# InflationHedge

1.82K

MoonGirl

#BitcoinGoldBattle ✨

2026 Outlook: Why I’m Favoring Bitcoin Over Gold & Silver

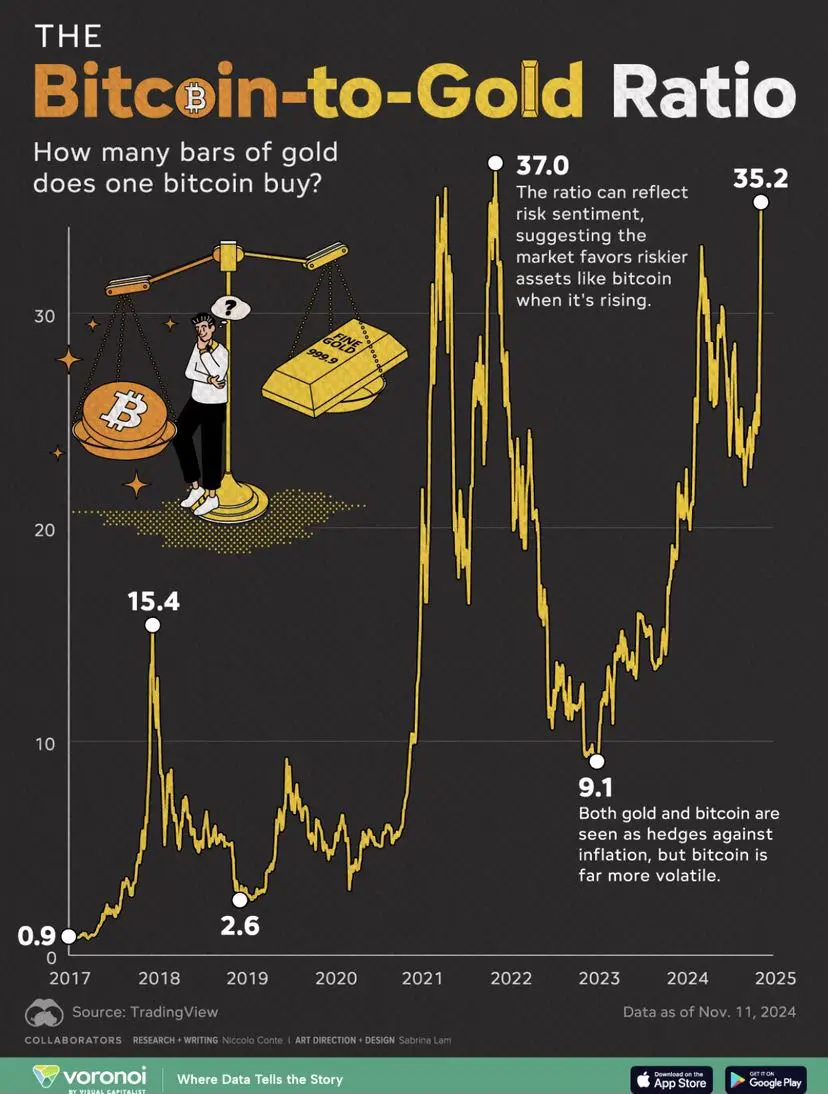

2025 was a dramatic year for investors looking to hedge against inflation. Gold and silver stole the spotlight — breaking records and delivering huge gains — while Bitcoin spent much of the year consolidating after a volatile correction.

As we step into 2026, the key question is clear: should your hedge be traditional metals, or is it time to give Bitcoin the spotlight? Here’s my take.

📈 Gold & Silver: Strong, but Limited

Gold and silver had incredible runs in 2025:

Gold surged on a weaker dollar, central bank dema

2026 Outlook: Why I’m Favoring Bitcoin Over Gold & Silver

2025 was a dramatic year for investors looking to hedge against inflation. Gold and silver stole the spotlight — breaking records and delivering huge gains — while Bitcoin spent much of the year consolidating after a volatile correction.

As we step into 2026, the key question is clear: should your hedge be traditional metals, or is it time to give Bitcoin the spotlight? Here’s my take.

📈 Gold & Silver: Strong, but Limited

Gold and silver had incredible runs in 2025:

Gold surged on a weaker dollar, central bank dema

BTC0,56%

- Reward

- 10

- 11

- Repost

- Share

natadoz :

:

Paying Close Attention🔍View More

#BitcoinGoldBattle ✨

2026 Outlook: Why I’m Favoring Bitcoin Over Gold & Silver

2025 was a dramatic year for investors looking to hedge against inflation. Gold and silver stole the spotlight — breaking records and delivering huge gains — while Bitcoin spent much of the year consolidating after a volatile correction.

As we step into 2026, the key question is clear: should your hedge be traditional metals, or is it time to give Bitcoin the spotlight? Here’s my take.

📈 Gold & Silver: Strong, but Limited

Gold and silver had incredible runs in 2025:

Gold surged on a weaker dollar, central bank dema

2026 Outlook: Why I’m Favoring Bitcoin Over Gold & Silver

2025 was a dramatic year for investors looking to hedge against inflation. Gold and silver stole the spotlight — breaking records and delivering huge gains — while Bitcoin spent much of the year consolidating after a volatile correction.

As we step into 2026, the key question is clear: should your hedge be traditional metals, or is it time to give Bitcoin the spotlight? Here’s my take.

📈 Gold & Silver: Strong, but Limited

Gold and silver had incredible runs in 2025:

Gold surged on a weaker dollar, central bank dema

BTC0,56%

- Reward

- 7

- 5

- Repost

- Share

Crypto_Teacher :

:

HODL Tight 💪View More

#BitcoinGoldBattle 🎊

Why I’m Betting on Bitcoin Over Gold & Silver in 2026

2025 handed us one of the most dramatic inflation hedge battles in modern history. Gold and silver soared — breaking records and outperforming almost every major asset class — while Bitcoin consolidated after heavy leverage liquidations and a sharp correction from all-time highs.

So, as we move into 2026, the big question is: Precious metals or Bitcoin — where do you place your bets? Here’s my perspective.

📈 Gold & Silver: Strong, But Not Invincible

There’s no denying it — gold and silver had a phenomenal 2025:

Gold h

Why I’m Betting on Bitcoin Over Gold & Silver in 2026

2025 handed us one of the most dramatic inflation hedge battles in modern history. Gold and silver soared — breaking records and outperforming almost every major asset class — while Bitcoin consolidated after heavy leverage liquidations and a sharp correction from all-time highs.

So, as we move into 2026, the big question is: Precious metals or Bitcoin — where do you place your bets? Here’s my perspective.

📈 Gold & Silver: Strong, But Not Invincible

There’s no denying it — gold and silver had a phenomenal 2025:

Gold h

BTC0,56%

- Reward

- 12

- 23

- Repost

- Share

EagleEye :

:

Thanks for sharing this very good streamView More

#BitcoinGoldBattle #BitcoinGoldBattle | Legacy Stability vs Digital Scarcity

As we look toward 2026, the global debate around inflation hedging is intensifying. A weakening US dollar, shifting liquidity cycles, and evolving investor behavior are forcing capital to choose between proven legacy hedges and emerging digital alternatives. Gold and silver are surging as traditional safe havens, while Bitcoin cools after leverage-driven excess — setting the stage for a defining battle of store-of-value narratives.

🪙 Gold & Silver — Timeless Stability

Precious metals have protected wealth for centuri

As we look toward 2026, the global debate around inflation hedging is intensifying. A weakening US dollar, shifting liquidity cycles, and evolving investor behavior are forcing capital to choose between proven legacy hedges and emerging digital alternatives. Gold and silver are surging as traditional safe havens, while Bitcoin cools after leverage-driven excess — setting the stage for a defining battle of store-of-value narratives.

🪙 Gold & Silver — Timeless Stability

Precious metals have protected wealth for centuri

BTC0,56%

- Reward

- 7

- 4

- Repost

- Share

Crypto_Buzz_with_Alex :

:

📊 “Nice breakdown! It’s rare to see this level of clarity in crypto posts.”View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

162.8K Popularity

32.43K Popularity

28.93K Popularity

74.49K Popularity

13.99K Popularity

275.34K Popularity

366.22K Popularity

26.05K Popularity

15.53K Popularity

14.05K Popularity

13.97K Popularity

13.12K Popularity

13.23K Popularity

40.5K Popularity

News

View MoreData: Over $2 billion in ETH short positions are concentrated above $2200

7 m

Philippine digital bank Maya is exploring an IPO in the United States, planning to raise up to $1 billion.

12 m

Wang Yongli: Using Bitcoin and other cryptocurrencies to re-anchor currency is a misunderstanding of the laws of currency development

14 m

RootData: REZ will unlock tokens worth approximately $1.26 million in one week

34 m

Overview of popular cryptocurrencies on February 17, 2026, with the top three in popularity being: Rocket Pool, Spacecoin, Power Protocol

34 m

Pin