# BItcoin

6.64M

TopCryptoNews

📊 Bitcoin risk-reward has shifted after recent selloff: on-chain analyst

Bitcoin’s recent price decline has prompted market analysts to assess whether a price floor is forming, with one prominent on-chain researcher stating the risk-reward profile has shifted following the selloff.

James “Checkmate” Check, a former lead researcher at Glassnode and author of Check On Chain, told What Bitcoin Did host Danny Knowles that Bitcoin entered “deep value” territory across multiple mean-reversion frameworks when it dropped into recent price zones, according to statements made on the podcast. Check note

Bitcoin’s recent price decline has prompted market analysts to assess whether a price floor is forming, with one prominent on-chain researcher stating the risk-reward profile has shifted following the selloff.

James “Checkmate” Check, a former lead researcher at Glassnode and author of Check On Chain, told What Bitcoin Did host Danny Knowles that Bitcoin entered “deep value” territory across multiple mean-reversion frameworks when it dropped into recent price zones, according to statements made on the podcast. Check note

BTC-1,62%

- Reward

- like

- Comment

- Repost

- Share

BTC – BREAKOUT IMMINENT: BUYERS REGROUPING

Entry: 66,900 – 67,400

Target 1: 68,300 🎯

Target 2: 69,200 🎯

Target 3: 70,500 🎯

Stop Loss: 65,800 🛑

Analysis: $BTC is carving higher lows on lower timeframes. Accumulation is visible near support. A break above 68.3K unlocks strong momentum. Lose 65.8K and volatility expands.

#Crypto #Bitcoin $BTC

Entry: 66,900 – 67,400

Target 1: 68,300 🎯

Target 2: 69,200 🎯

Target 3: 70,500 🎯

Stop Loss: 65,800 🛑

Analysis: $BTC is carving higher lows on lower timeframes. Accumulation is visible near support. A break above 68.3K unlocks strong momentum. Lose 65.8K and volatility expands.

#Crypto #Bitcoin $BTC

BTC-1,62%

- Reward

- 1

- Comment

- Repost

- Share

BTC – BREAKOUT IMMINENT: BUYERS REGROUPING

Entry: 66,900 – 67,400

Target 1: 68,300 🎯

Target 2: 69,200 🎯

Target 3: 70,500 🎯

Stop Loss: 65,800 🛑

Analysis: $BTC is carving higher lows on lower timeframes. Accumulation is visible near support. A break above 68.3K unlocks strong momentum. Lose 65.8K and volatility expands.

#Crypto #Bitcoin $BTC

Entry: 66,900 – 67,400

Target 1: 68,300 🎯

Target 2: 69,200 🎯

Target 3: 70,500 🎯

Stop Loss: 65,800 🛑

Analysis: $BTC is carving higher lows on lower timeframes. Accumulation is visible near support. A break above 68.3K unlocks strong momentum. Lose 65.8K and volatility expands.

#Crypto #Bitcoin $BTC

BTC-1,62%

- Reward

- 1

- Comment

- Repost

- Share

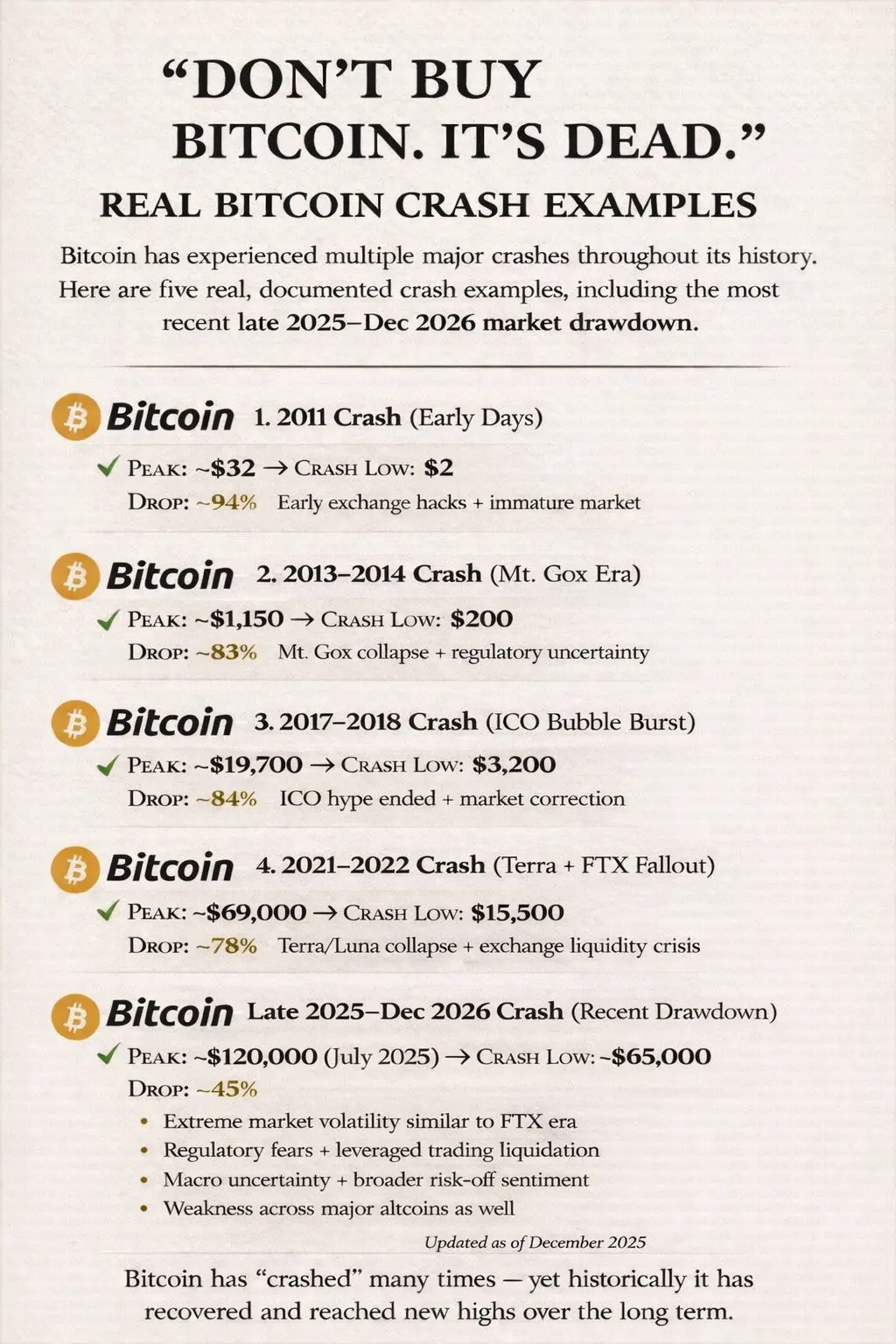

Bitcoin $BTC has crashed.

Not once.

Not twice.

But every cycle.

And each time, the same story repeats:

“It's over.”

“This time is different.”

“Crypto is dead.”

Yet history keeps leaving receipts.

📉 2011: $32 → $2

📉 2013–14: $1,150 → $200

📉 2017–18: $19,700 → $3,200

📉 2021–22: $69,000 → $15,500

📉 2025: ~$120,000 → ~$65,000

Here’s what I’ve learned:

Bitcoin doesn’t reward certainty. It rewards resilience.

Crashes aren’t anomalies, they are part of the design of an emerging asset class.

The real divide in crypto is simple:

* Some people react to volatility

* Others recogn

Not once.

Not twice.

But every cycle.

And each time, the same story repeats:

“It's over.”

“This time is different.”

“Crypto is dead.”

Yet history keeps leaving receipts.

📉 2011: $32 → $2

📉 2013–14: $1,150 → $200

📉 2017–18: $19,700 → $3,200

📉 2021–22: $69,000 → $15,500

📉 2025: ~$120,000 → ~$65,000

Here’s what I’ve learned:

Bitcoin doesn’t reward certainty. It rewards resilience.

Crashes aren’t anomalies, they are part of the design of an emerging asset class.

The real divide in crypto is simple:

* Some people react to volatility

* Others recogn

BTC-1,62%

- Reward

- like

- Comment

- Repost

- Share

📈💼 #NFPBeatsExpectations

The latest Non-Farm Payroll (NFP) report has beat expectations, showing stronger-than-anticipated job growth in the U.S. economy.

🔎 Market Implications:

• Strong employment → potential for higher interest rates

• Risk assets like crypto and stocks may face short-term pressure

• USD strength could increase, impacting BTC and altcoin liquidity

📊 Key Levels to Watch:

• BTC Support: $67K – $68K

• BTC Resistance: $70K – $71K

• Altcoins: Watch for correlated volatility

💡 Trading Tip:

NFP surprises often trigger sharp price swings. Keep positions sized properly and watch

The latest Non-Farm Payroll (NFP) report has beat expectations, showing stronger-than-anticipated job growth in the U.S. economy.

🔎 Market Implications:

• Strong employment → potential for higher interest rates

• Risk assets like crypto and stocks may face short-term pressure

• USD strength could increase, impacting BTC and altcoin liquidity

📊 Key Levels to Watch:

• BTC Support: $67K – $68K

• BTC Resistance: $70K – $71K

• Altcoins: Watch for correlated volatility

💡 Trading Tip:

NFP surprises often trigger sharp price swings. Keep positions sized properly and watch

BTC-1,62%

- Reward

- 3

- 4

- Repost

- Share

HighAmbition :

:

thank you for information about cryptoView More

Bitcoin’s cycle structure is repeating with almost mechanical precision.

Every bear market has lasted roughly 12–13 monthly candles, wiping out excess and resetting sentiment. Every bull phase has stretched close to 35 monthly candles, rebuilding momentum and pushing price into new discovery zones.

The rhythm is clear: one year of pain, nearly three years of expansion.

Now the chart points toward another potential inflection around late 2026. If history continues to rhyme, we are not witnessing randomness — we are watching a structured macro cycle play out in real time.

Volatility shakes out t

Every bear market has lasted roughly 12–13 monthly candles, wiping out excess and resetting sentiment. Every bull phase has stretched close to 35 monthly candles, rebuilding momentum and pushing price into new discovery zones.

The rhythm is clear: one year of pain, nearly three years of expansion.

Now the chart points toward another potential inflection around late 2026. If history continues to rhyme, we are not witnessing randomness — we are watching a structured macro cycle play out in real time.

Volatility shakes out t

BTC-1,62%

- Reward

- like

- Comment

- Repost

- Share

📈💼 #NFPBeatsExpectations

The latest Non-Farm Payroll (NFP) report has beat expectations, showing stronger-than-anticipated job growth in the U.S. economy.

🔎 Market Implications:

• Strong employment → potential for higher interest rates

• Risk assets like crypto and stocks may face short-term pressure

• USD strength could increase, impacting BTC and altcoin liquidity

📊 Key Levels to Watch:

• BTC Support: $67K – $68K

• BTC Resistance: $70K – $71K

• Altcoins: Watch for correlated volatility

💡 Trading Tip:

NFP surprises often trigger sharp price swings. Keep positions sized properly and watch

The latest Non-Farm Payroll (NFP) report has beat expectations, showing stronger-than-anticipated job growth in the U.S. economy.

🔎 Market Implications:

• Strong employment → potential for higher interest rates

• Risk assets like crypto and stocks may face short-term pressure

• USD strength could increase, impacting BTC and altcoin liquidity

📊 Key Levels to Watch:

• BTC Support: $67K – $68K

• BTC Resistance: $70K – $71K

• Altcoins: Watch for correlated volatility

💡 Trading Tip:

NFP surprises often trigger sharp price swings. Keep positions sized properly and watch

BTC-1,62%

- Reward

- 7

- 11

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Good luck and prosperity 🧧View More

$BTC on the 1Hr is now tightening inside a descending triangle, with clear lower highs pressing against a flat-to-rising base around 66k–67k. This is classic compression after a heavy selloff — volatility contracts before expansion.

Right now, price is sitting at the apex zone, meaning the breakout window is near.

What matters here:

The upper trendline from ~85k continues to cap every rally.

The base around 66k has been defended multiple times.

• If #BTC breaks above 69k–70k and holds, this descending pressure releases and we likely see a squeeze toward 73k–75k first.

• If #BITCOIN loses 66k w

Right now, price is sitting at the apex zone, meaning the breakout window is near.

What matters here:

The upper trendline from ~85k continues to cap every rally.

The base around 66k has been defended multiple times.

• If #BTC breaks above 69k–70k and holds, this descending pressure releases and we likely see a squeeze toward 73k–75k first.

• If #BITCOIN loses 66k w

BTC-1,62%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin continues to fall, while altcoins are aiming for a rise. There's a concentration of LONG positions below $65,000 in $BTC futures. $BTC may want to absorb this liquidity, after which it will likely be on the bullish side. In altcoins, there are no LONG players left. The expected rises should begin now...

#BTC #Bitcoin #Crypto #BuyTheDipOrWaitNow?

#BTC #Bitcoin #Crypto #BuyTheDipOrWaitNow?

BTC-1,62%

MC:$81.35KHolders:175

100.00%

- Reward

- 1

- Comment

- Repost

- Share

📊 #BitcoinMarketAnalysis — Feb 12, 2026

Bitcoin is showing short-term volatility after slipping below $67K, with support likely near $64K–$66K.

🔹 Key Points:

Short-term pressure as crypto sentiment tilts toward fear.

Resistance around $70K, sideways trading expected in the near term.

Medium-term potential: Institutional demand and liquidity could push BTC toward $100K+ later this year.

Key drivers: Macro factors, ETF flows, and market sentiment will guide price action.

💡 Despite the dips, fundamentals remain strong — Bitcoin continues to attract institutional attention and long-term investo

Bitcoin is showing short-term volatility after slipping below $67K, with support likely near $64K–$66K.

🔹 Key Points:

Short-term pressure as crypto sentiment tilts toward fear.

Resistance around $70K, sideways trading expected in the near term.

Medium-term potential: Institutional demand and liquidity could push BTC toward $100K+ later this year.

Key drivers: Macro factors, ETF flows, and market sentiment will guide price action.

💡 Despite the dips, fundamentals remain strong — Bitcoin continues to attract institutional attention and long-term investo

BTC-1,62%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

25.5K Popularity

12.33K Popularity

6.55K Popularity

38.56K Popularity

252.53K Popularity

170.39K Popularity

7.03K Popularity

5.93K Popularity

4.41K Popularity

5.84K Popularity

121.4K Popularity

26.67K Popularity

22.74K Popularity

20.15K Popularity

4.32K Popularity

News

View MorePrices of multiple traditional financial assets decline, with silver and crude oil weakening

1 m

The Bitcoin codebase adds the proposed improvement BIP-360 aimed at enhancing resistance to quantum threats through soft forks.

3 m

AZTEC (Aztec) 24-hour increase of 19.26%

4 m

Market Report: Top 5 Cryptocurrency Declines on February 13, 2026, with the Largest Drop in LayerZero

7 m

PartyDAO team will join Stripe to jointly develop a new generation of crypto products

7 m

Pin