Post content & earn content mining yield

placeholder

十一

【$PTB Signal】Long | Healthy Pullback After Explosive Breakout

After completing an explosive breakout on the 4-hour chart, $PTB is undergoing a healthy pullback and chip exchange below the previous high resistance zone (0.0018).

🎯 Direction: Long

🎯 Entry: 0.00158 - 0.00162

🛑 Stop Loss: 0.00151 ( Rigid Stop Loss )

🚀 Target 1: 0.00180

🚀 Target 2: 0.00200

Hardcore Logic: The third 4-hour candle shows a massive surge (36B), with buy/sell ratio stable at 0.51, indicating active buying pressure rather than a short squeeze. The following two candles show a volume contraction during the pullback

View OriginalAfter completing an explosive breakout on the 4-hour chart, $PTB is undergoing a healthy pullback and chip exchange below the previous high resistance zone (0.0018).

🎯 Direction: Long

🎯 Entry: 0.00158 - 0.00162

🛑 Stop Loss: 0.00151 ( Rigid Stop Loss )

🚀 Target 1: 0.00180

🚀 Target 2: 0.00200

Hardcore Logic: The third 4-hour candle shows a massive surge (36B), with buy/sell ratio stable at 0.51, indicating active buying pressure rather than a short squeeze. The following two candles show a volume contraction during the pullback

- Reward

- like

- Comment

- Repost

- Share

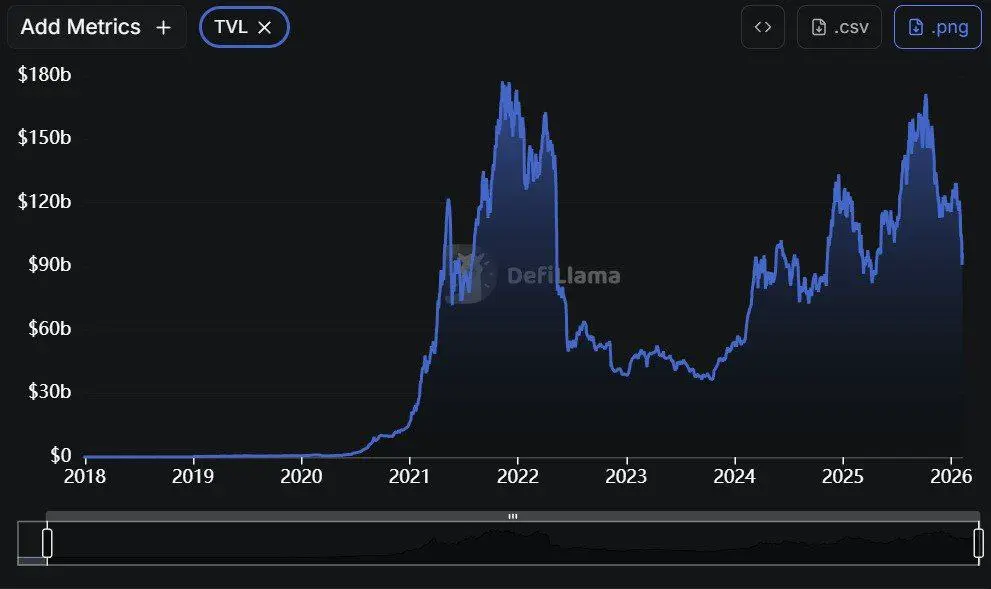

📊 MARKET: Total TVL has dropped $73B since the 10/10 liquidation event. #crypto

- Reward

- 1

- Comment

- Repost

- Share

Why am I always very optimistic about Bitcoin, God willing?

Decentralized

Non-inflationary

Permissionless

Popular

Divisible

Portable

Self-custody and inheritance

Crazy liquidity and easy liquidation

- Let me explain it to you more:

- Decentralized: Allows you to store and transfer value across time and space without third-party intervention. No entity controls it—neither a central bank nor anyone can stop the Bitcoin network or print it at will. The network operates 24/7 regardless of what happens.

- Non-inflationary: The supply is known and limited. Every four years, there’s a halving that re

View OriginalDecentralized

Non-inflationary

Permissionless

Popular

Divisible

Portable

Self-custody and inheritance

Crazy liquidity and easy liquidation

- Let me explain it to you more:

- Decentralized: Allows you to store and transfer value across time and space without third-party intervention. No entity controls it—neither a central bank nor anyone can stop the Bitcoin network or print it at will. The network operates 24/7 regardless of what happens.

- Non-inflationary: The supply is known and limited. Every four years, there’s a halving that re

MC:$2.48KHolders:2

0.01%

- Reward

- like

- Comment

- Repost

- Share

YZE

扬子鳄

Created By@FortunateTreasureBrother

Listing Progress

0.00%

MC:

$0.1

Create My Token

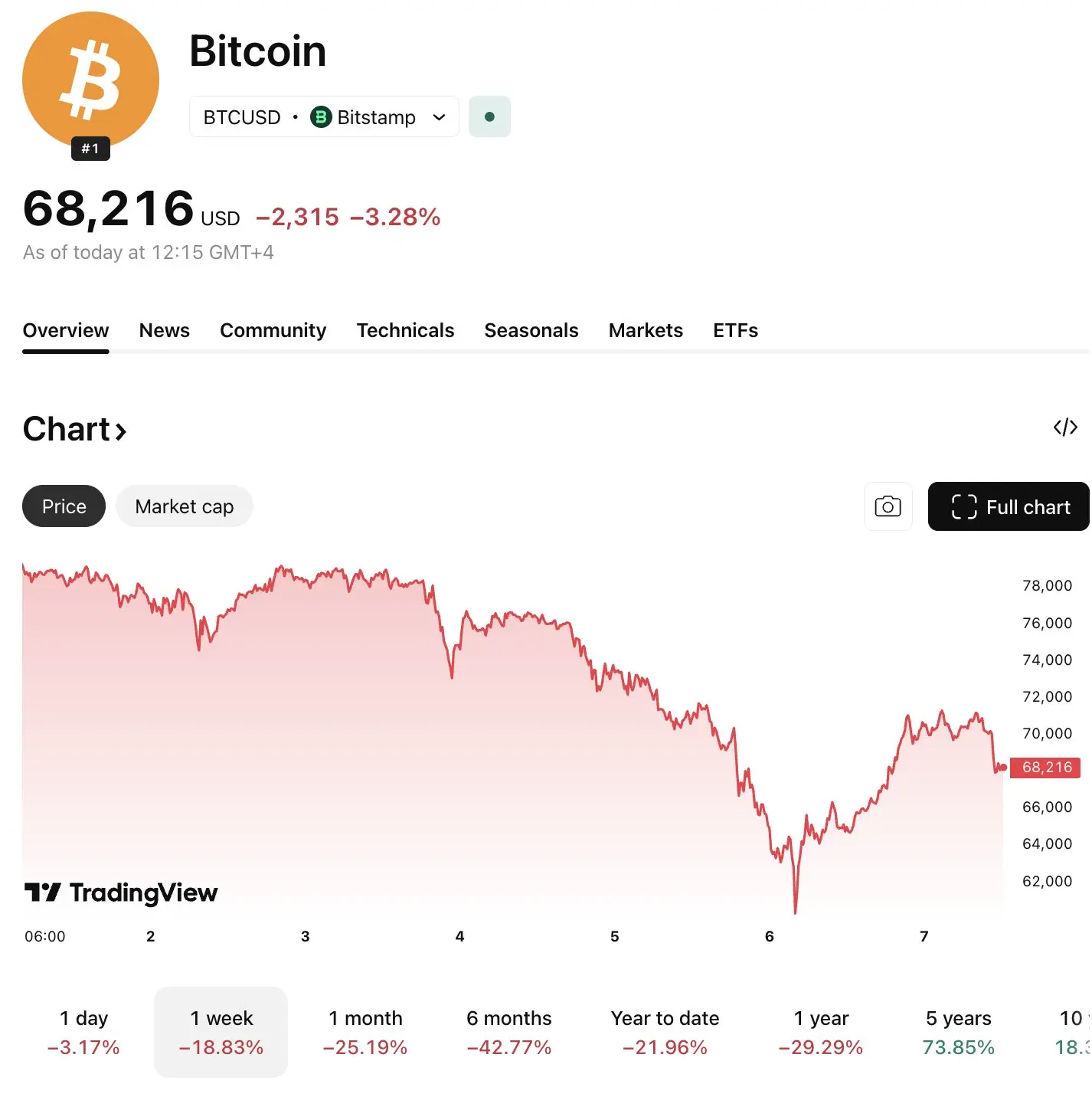

#BuyTheDipOrWaitNow? Buy the Dip or Wait? — Bitcoin Deep Dive (Feb 2026)

Bitcoin is at a crossroads. After a sharp correction in early February, the market has stabilized—but stability doesn’t mean certainty. This isn’t a simple “buy now or miss out” moment. Traders and investors face a decision zone, not a comfort zone. Understanding the context, risks, and technical cues is key to making informed moves.

The current dip is driven by several structural factors. ETF-related selling pressure has been unusually strong, liquidating leveraged long positions and creating temporary market imbalances.

Bitcoin is at a crossroads. After a sharp correction in early February, the market has stabilized—but stability doesn’t mean certainty. This isn’t a simple “buy now or miss out” moment. Traders and investors face a decision zone, not a comfort zone. Understanding the context, risks, and technical cues is key to making informed moves.

The current dip is driven by several structural factors. ETF-related selling pressure has been unusually strong, liquidating leveraged long positions and creating temporary market imbalances.

BTC-1,62%

- Reward

- 3

- 8

- Repost

- Share

Peacefulheart :

:

DYOR 🤓View More

【$CRV Signal】Short Position Price drops with stable open interest, beware of main players distributing

$CRV Price drops but open interest remains stable. Combined with persistent negative Taker buy volume and order book sell-side accumulation, this is not simply a long squeeze but more likely an orderly distribution by the main players before a key resistance.

🎯 Direction: Short

Market logic: Price retraced from the high of 0.264, but open interest stayed steady, with no sudden drop caused by a squeeze. The key indicator is the continuous negative Taker buy volume, and the 4H K-line buy/sel

View Original$CRV Price drops but open interest remains stable. Combined with persistent negative Taker buy volume and order book sell-side accumulation, this is not simply a long squeeze but more likely an orderly distribution by the main players before a key resistance.

🎯 Direction: Short

Market logic: Price retraced from the high of 0.264, but open interest stayed steady, with no sudden drop caused by a squeeze. The key indicator is the continuous negative Taker buy volume, and the 4H K-line buy/sel

- Reward

- like

- Comment

- Repost

- Share

🔹 Whales are still buying: BitMine-linked addresses scoop up another 20,000 ETH, worth over $40 million

- Reward

- like

- Comment

- Repost

- Share

Bitcoin gains approximately 10,000

Rising from levels of 62,000 to around 72,000

Before dropping again to 68,000

$BTC $XRP

#GateJanTransparencyReport #BitcoinDropsBelow$65K #TopCoinsRisingAgainsttheTrend

View OriginalRising from levels of 62,000 to around 72,000

Before dropping again to 68,000

$BTC $XRP

#GateJanTransparencyReport #BitcoinDropsBelow$65K #TopCoinsRisingAgainsttheTrend

MC:$2.48KHolders:2

0.01%

- Reward

- like

- Comment

- Repost

- Share

#btc$btc As narrative fades, value emerges: the market is completing a critical “stress test”

Key dynamic insights:

1. Is the “digital gold” narrative collapsing? No, it’s the “speculative bubble” being squeezed out.

◦ Increased correlation indicates that crypto assets are being officially priced by global capital markets, a necessary step toward maturity. Each reconfiguration of correlation is a process of long-term value anchoring.

2. Is there a massive withdrawal of institutional funds? No, it’s a “liquidity pressure release” in the short term.

◦ The phased outflow from ETFs is a normal

Key dynamic insights:

1. Is the “digital gold” narrative collapsing? No, it’s the “speculative bubble” being squeezed out.

◦ Increased correlation indicates that crypto assets are being officially priced by global capital markets, a necessary step toward maturity. Each reconfiguration of correlation is a process of long-term value anchoring.

2. Is there a massive withdrawal of institutional funds? No, it’s a “liquidity pressure release” in the short term.

◦ The phased outflow from ETFs is a normal

BTC-1,62%

- Reward

- 4

- 6

- Repost

- Share

HighAmbition :

:

thnxx for sharing informationView More

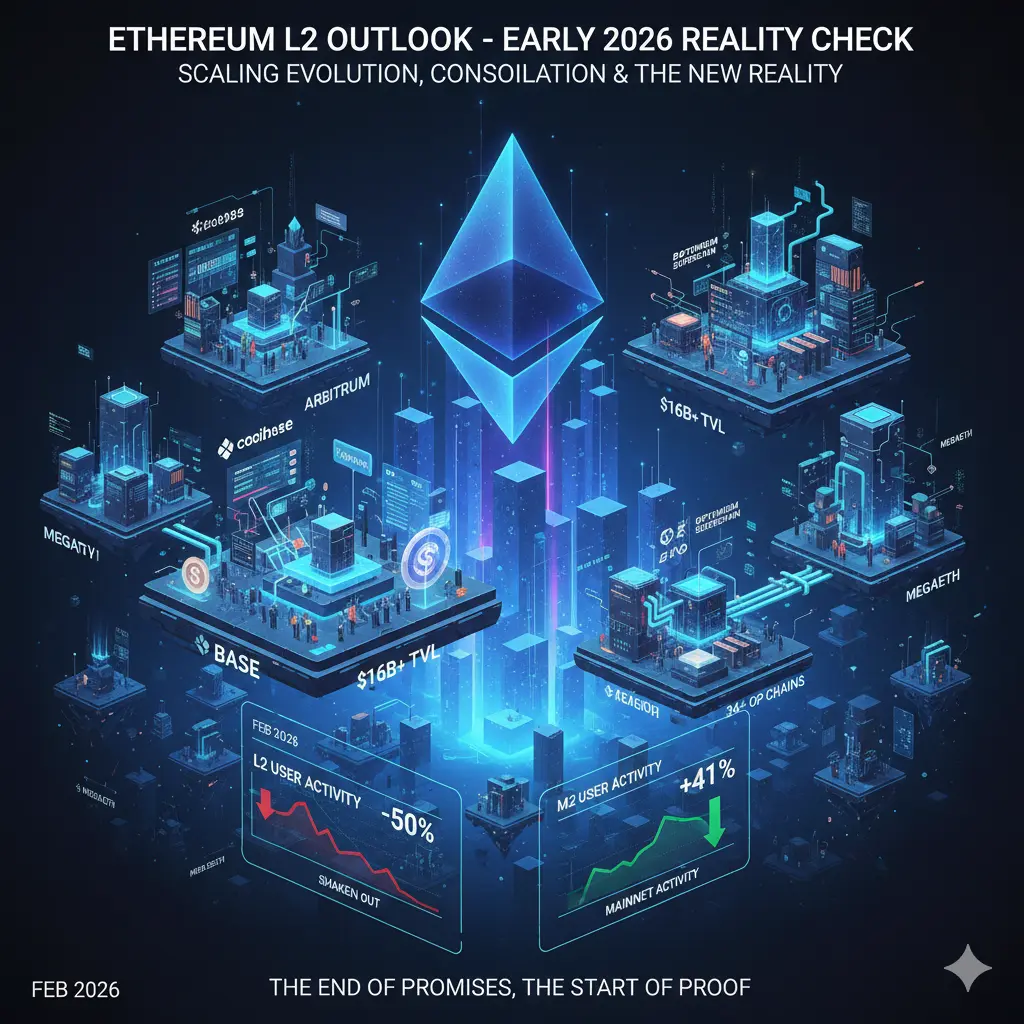

#EthereumL2Outlook

🔥 #EthereumL2Outlook – Early 2026 Reality Check: Scaling Evolution, Consolidation & The New Reality 🔥

Ethereum's Layer 2 ecosystem in February 2026 is undergoing a major pivot. Vitalik Buterin's recent comments sparked debate: the original "rollup-centric" roadmap "no longer makes sense" as L1 scales directly (low fees near-zero, gas limits set to surge in 2026), L2 user activity dropped ~50% from mid-2025 peaks (monthly addresses from 58M to ~30M), while mainnet active addresses jumped 41%+. L2s now handle 95-99% of tx volume but face an identity crisis—pure scaling isn'

🔥 #EthereumL2Outlook – Early 2026 Reality Check: Scaling Evolution, Consolidation & The New Reality 🔥

Ethereum's Layer 2 ecosystem in February 2026 is undergoing a major pivot. Vitalik Buterin's recent comments sparked debate: the original "rollup-centric" roadmap "no longer makes sense" as L1 scales directly (low fees near-zero, gas limits set to surge in 2026), L2 user activity dropped ~50% from mid-2025 peaks (monthly addresses from 58M to ~30M), while mainnet active addresses jumped 41%+. L2s now handle 95-99% of tx volume but face an identity crisis—pure scaling isn'

- Reward

- 5

- 7

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

🌈 #GateLiveStreamingInspiration - Feb.8

Today's Topic Recommendations:

🔹 Whales are still buying: BitMine-linked addresses scoop up another 20,000 #ETH, worth over $40 million

🔹 Exclusive insight from Bitwise’s Chief Advisor: This sell-off was driven by “paper capital”, while long-term capital has not exited the market

🔹 New cross-chain breakthrough: SushiSwap officially integrates Solana, enabling seamless swaps between SOL and EVM assets

🔹 A macro storm is approaching: Nonfarm payrolls, #CPI, Middle East negotiations, and Japan’s election set the stage for a critical week of bull–bear

Today's Topic Recommendations:

🔹 Whales are still buying: BitMine-linked addresses scoop up another 20,000 #ETH, worth over $40 million

🔹 Exclusive insight from Bitwise’s Chief Advisor: This sell-off was driven by “paper capital”, while long-term capital has not exited the market

🔹 New cross-chain breakthrough: SushiSwap officially integrates Solana, enabling seamless swaps between SOL and EVM assets

🔹 A macro storm is approaching: Nonfarm payrolls, #CPI, Middle East negotiations, and Japan’s election set the stage for a critical week of bull–bear

- Reward

- 1

- 2

- Repost

- Share

Erikid54 :

:

Buy To Earn 💎View More

The pandemic in 2020 was beyond me

- Reward

- like

- Comment

- Repost

- Share

p小将

p小将

Created By@DreamJourney

Listing Progress

100.00%

MC:

$1.76K

Create My Token

【$IOTA Signal】No Position + Weak Consolidation Awaiting Breakout

$IOTA is showing weak consolidation on the 4H timeframe, with the price being suppressed below 0.0727. Buying pressure is insufficient to trigger a meaningful rebound.

🎯 Direction: No Position

Market Logic: Price declines while open interest remains stable, indicating no long liquidation. This suggests either main players are offloading or there is a lack of buying interest. The 4H candlestick buy/sell ratio hovers around 0.5, showing a balanced battle between bulls and bears but with a downward shift in the price center of gr

View Original$IOTA is showing weak consolidation on the 4H timeframe, with the price being suppressed below 0.0727. Buying pressure is insufficient to trigger a meaningful rebound.

🎯 Direction: No Position

Market Logic: Price declines while open interest remains stable, indicating no long liquidation. This suggests either main players are offloading or there is a lack of buying interest. The 4H candlestick buy/sell ratio hovers around 0.5, showing a balanced battle between bulls and bears but with a downward shift in the price center of gr

- Reward

- 1

- 1

- Repost

- Share

LivermoreJesse :

:

【$IOTA Signal】Short Position + Weak Consolidation Awaiting Breakout $IOTA is showing a weak consolidation on the 4H timeframe, with the price suppressed below 0.0727, and buying pressure unable to trigger an effective rebound.

🎯Direction: Short

Market Logic: Price declines accompanied by stable open interest, indicating no long liquidation, suggesting main players are offloading or lacking bullish interest. The 4H K-line buy/sell ratio hovers around 0.5, showing a balanced battle between bulls and bears but with a downward shift in the price center of gravity, slightly favoring the bears. Taker Volume indicates active selling dominance, with heavy sell walls above (0.0706-0.0707). The current structure leans toward weak oscillation within the 0.070-0.073 range, awaiting a directional move, but the probability of a downward break is increasing.

Trade here 👇 $IOTA

---

Follow me: Get more real-time analysis and insights on the crypto market!

#Gate广场创作者新春激励 #Is the current market a bottoming out or just watching? $BTC $ETH $SOL

$USD1 $USDG $USDC

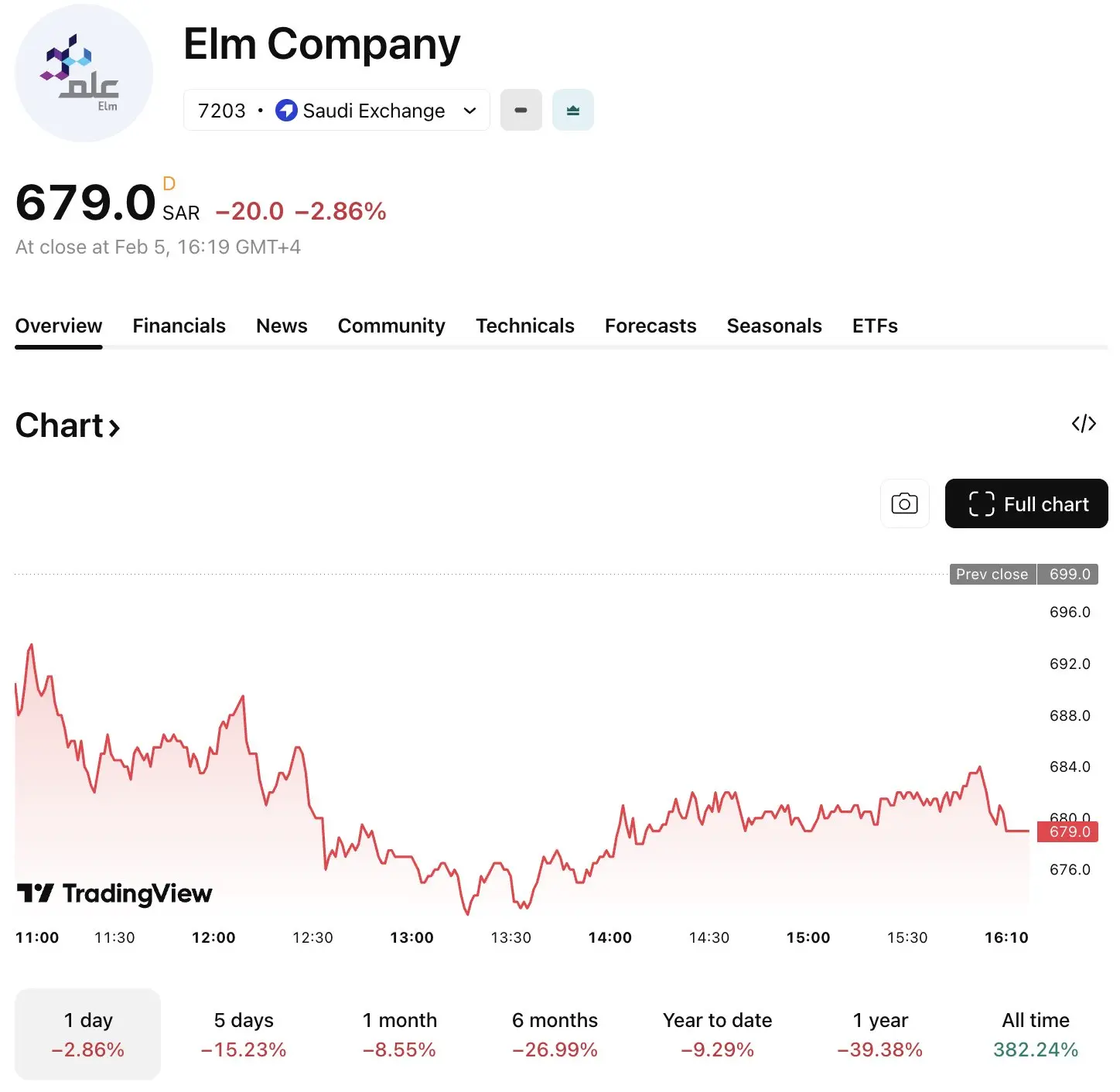

"Knowledge" and the search for value... A reading beyond the dust of numbers

In financial markets,

Price is what you pay,

Value is what you get.

What is currently happening to "علم 7203" in "TASI" is a real test of this rule.

When we look deeply into the numbers,

We discover that we are dealing with a company that is ahead of the market by steps,

But now paying the price of "excessive expectations."

1. Revenue Boom vs. Margin Pressures

The financial statements show that the company achieved tremendous revenue growth,

Jumping from 1.69 billion SAR in Q4 2023

to 2.53 billion SA

View Original"Knowledge" and the search for value... A reading beyond the dust of numbers

In financial markets,

Price is what you pay,

Value is what you get.

What is currently happening to "علم 7203" in "TASI" is a real test of this rule.

When we look deeply into the numbers,

We discover that we are dealing with a company that is ahead of the market by steps,

But now paying the price of "excessive expectations."

1. Revenue Boom vs. Margin Pressures

The financial statements show that the company achieved tremendous revenue growth,

Jumping from 1.69 billion SAR in Q4 2023

to 2.53 billion SA

- Reward

- like

- Comment

- Repost

- Share

#GateLunarNewYearOn-ChainGala

Event Overview

Gate.io hosted an on-chain gala to celebrate the Lunar New Year 2026.

The event was designed to engage the community, showcase Gate.io’s platform capabilities, and reward users.

Unlike typical centralized celebrations, this gala leveraged blockchain transparency and on-chain mechanics.

On-Chain Mechanics

Participants interacted directly on-chain via smart contracts.

Rewards and prizes were distributed transparently, ensuring no hidden allocation.

On-chain games, raffles, and staking competitions were part of the gala, highlighting Gate.io’s DeFi a

Event Overview

Gate.io hosted an on-chain gala to celebrate the Lunar New Year 2026.

The event was designed to engage the community, showcase Gate.io’s platform capabilities, and reward users.

Unlike typical centralized celebrations, this gala leveraged blockchain transparency and on-chain mechanics.

On-Chain Mechanics

Participants interacted directly on-chain via smart contracts.

Rewards and prizes were distributed transparently, ensuring no hidden allocation.

On-chain games, raffles, and staking competitions were part of the gala, highlighting Gate.io’s DeFi a

GT-3,62%

- Reward

- 8

- 9

- Repost

- Share

Galaaxs :

:

In terms of asset and incentive systems, products such as Launchpool, Launchpad, HODLer Airdrop, and CandyDrop maintain high-frequency operations, balancing user engagement and trading conversion efficiency; ETF business trading volume increased by 32.6% month-on-month to over 6.7 billion USDT, with the product matrix expanded to over 332 long and short leverage ETF trading pairs; YuBiBao maintains a large-scale fund pool position, continuously supporting users' liquidity management and stable allocation needs. The on-chain infrastructure Gate Layer's activity further increased, with the number of addresses surpassing 100 million and trading volume growing by over 22% month-on-month, providing underlying support for multi-chain asset circulation and application deployment.View More

#WhyAreGoldStocksandBTCFallingTogether?

🚨 MAJOR RISK-OFF FLUSH: BTC, GOLD & GDX ALL HIT IN TANDEM – MACRO LIQUIDITY CRUNCH IN EARLY FEB 2026 🚨

This isn't just a crypto crash — it's a broad liquidity/risk-off event slamming even classic safe havens like gold temporarily. High-volume cascades, leverage unwinds, USD strength, and hawkish Fed echoes are forcing correlated selling across assets. Weak hands flushed, but this sets up the classic "fear peak → strong rebound" playbook.

1. CURRENT PRICE & DRAWDOWN SNAPSHOT (as of ~Feb 8, 2026)

Bitcoin (BTC): Trading ~$69,000–$70,000 (bounced hard fro

🚨 MAJOR RISK-OFF FLUSH: BTC, GOLD & GDX ALL HIT IN TANDEM – MACRO LIQUIDITY CRUNCH IN EARLY FEB 2026 🚨

This isn't just a crypto crash — it's a broad liquidity/risk-off event slamming even classic safe havens like gold temporarily. High-volume cascades, leverage unwinds, USD strength, and hawkish Fed echoes are forcing correlated selling across assets. Weak hands flushed, but this sets up the classic "fear peak → strong rebound" playbook.

1. CURRENT PRICE & DRAWDOWN SNAPSHOT (as of ~Feb 8, 2026)

Bitcoin (BTC): Trading ~$69,000–$70,000 (bounced hard fro

BTC-1,62%

- Reward

- 8

- 7

- Repost

- Share

ybaser :

:

Thank you for sharing 🙏View More

Check out Gate and join me in the hottest event! https://www.gate.com/id/campaigns/3959?ref_type=132

- Reward

- 1

- Comment

- Repost

- Share

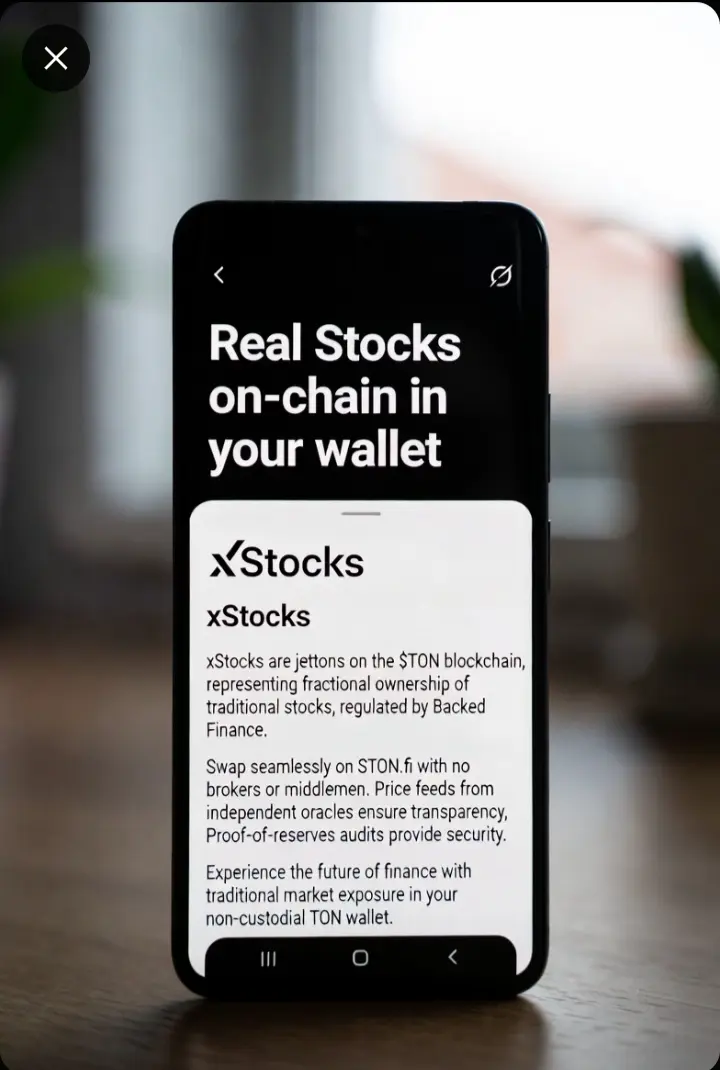

Real Stocks → On‑Chain in Your Wallet: How xStocks Actually Work 💥

For the first time ever, familiar traditional market assets are being brought fully onto the $TON blockchain as xStocks real stock exposure you can hold, trade, and use right alongside your crypto. But how does something like Apple or Tesla become a jetton you see in your wallet? Let’s break it down simply. �

When you swap for an xStock on STONfi, what you’re really doing is accessing an on‑chain representation of a real asset that’s been created through a regulated process. Behind the scenes, a licensed provider like Backed F

For the first time ever, familiar traditional market assets are being brought fully onto the $TON blockchain as xStocks real stock exposure you can hold, trade, and use right alongside your crypto. But how does something like Apple or Tesla become a jetton you see in your wallet? Let’s break it down simply. �

When you swap for an xStock on STONfi, what you’re really doing is accessing an on‑chain representation of a real asset that’s been created through a regulated process. Behind the scenes, a licensed provider like Backed F

TON0,07%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 2

- 1

- Repost

- Share

HighAmbition :

:

thank you for informationLoad More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More145.98K Popularity

34.3K Popularity

393.1K Popularity

14.92K Popularity

13.87K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$2.38KHolders:10.00%

- MC:$2.37KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

News

View MoreTrend Research Sells Additional 20,770 ETH Worth $43.57M, Retains Only 10,303 ETH

8 m

Market Report: Top 5 Cryptocurrency Gainers on February 8, 2026, led by MemeCore

44 m

Browser cache issues cause abnormal display of Arweave network block data.

51 m

Illinois proposes bill to establish state-level Bitcoin reserve

1 h

Multiple traditional financial assets experience price fluctuations, with gold, silver, and crude oil strengthening.

1 h

Pin