Post content & earn content mining yield

placeholder

GateUser-ffe7b9de

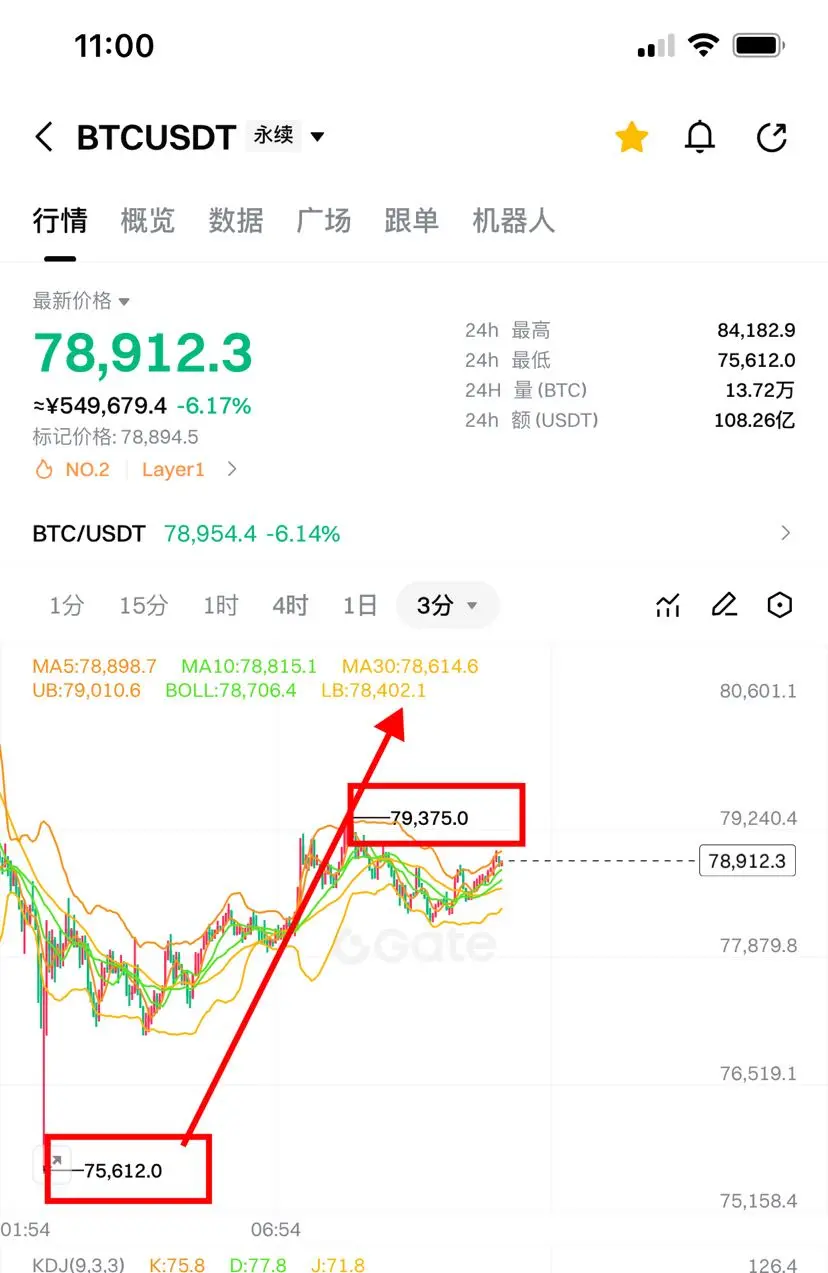

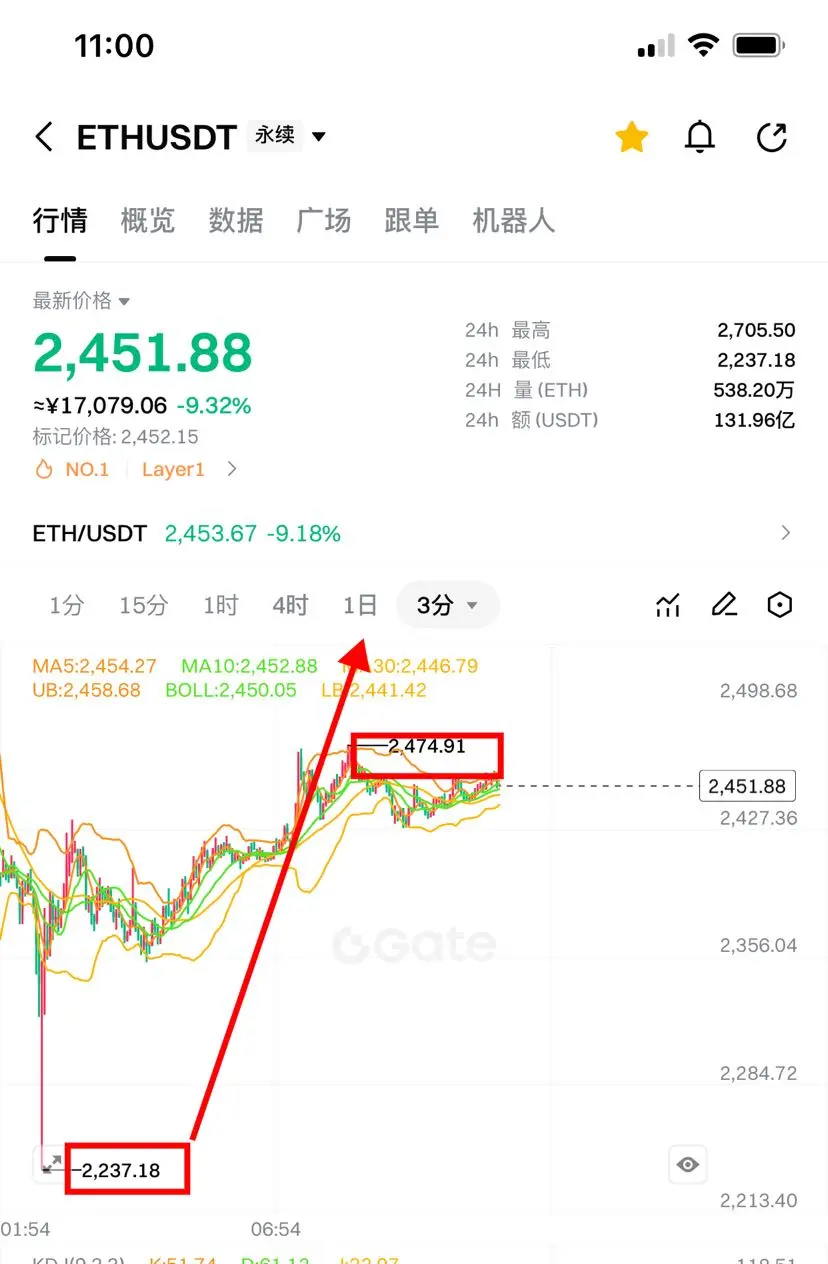

Good morning CT🌞Happy new month And a happy Sunday to everyone Still awaiting the green signals📉Market is bleeding badly 📈📈🩸🩸

- Reward

- like

- Comment

- Repost

- Share

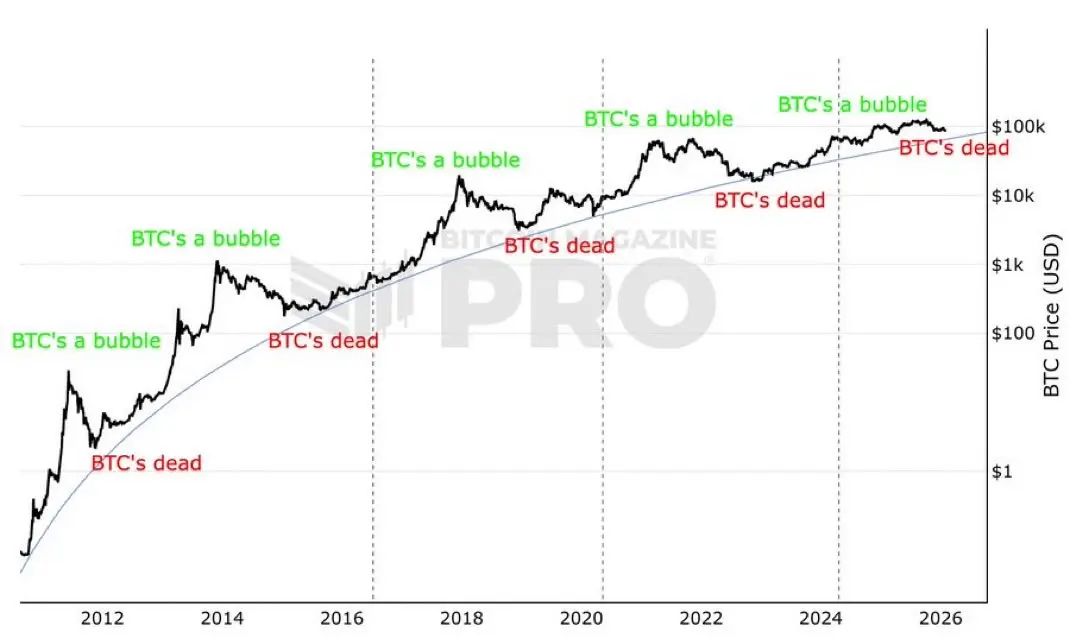

Every single time…Same old storyWe will go up as we have always done💹💹💹💹

- Reward

- like

- Comment

- Repost

- Share

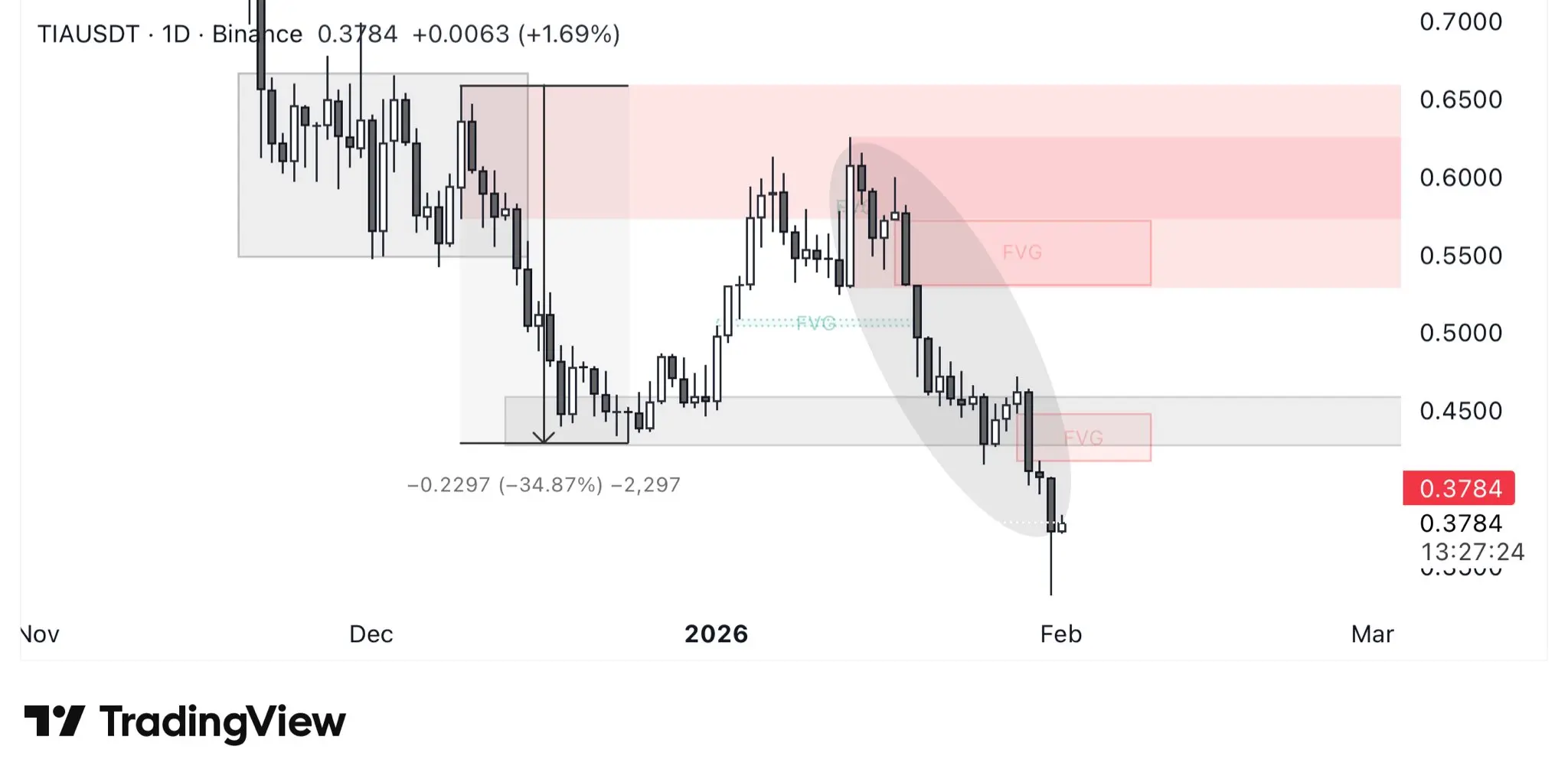

Waiting for the bounce that never came.#Crypto #NFT

- Reward

- like

- Comment

- Repost

- Share

马跃前程

神马都给力

Created By@FortuñoRich

Listing Progress

0.00%

MC:

$2.92K

Create My Token

- Reward

- 1

- Comment

- Repost

- Share

Lawmakers Push Crypto Rules Forward as ETF Money Dries Up - - #fed #nft #sec

- Reward

- like

- Comment

- Repost

- Share

❌ Bitcoin network activity has fallen to 2020 lows

The number of active Bitcoin addresses has decreased to 720,000, the lowest level since April 2020.

For comparison, in November 2024, the figure reached 1.126 million, representing a decrease of approximately 36%.

⬇️ The decline in network activity occurred against the backdrop of a more than 11% drop in BTC price over the week.

*Graph illustrating the decline in network activity*

This decrease indicates a significant reduction in user engagement and transaction volume on the Bitcoin ne

View OriginalThe number of active Bitcoin addresses has decreased to 720,000, the lowest level since April 2020.

For comparison, in November 2024, the figure reached 1.126 million, representing a decrease of approximately 36%.

⬇️ The decline in network activity occurred against the backdrop of a more than 11% drop in BTC price over the week.

*Graph illustrating the decline in network activity*

This decrease indicates a significant reduction in user engagement and transaction volume on the Bitcoin ne

- Reward

- 1

- Comment

- Repost

- Share

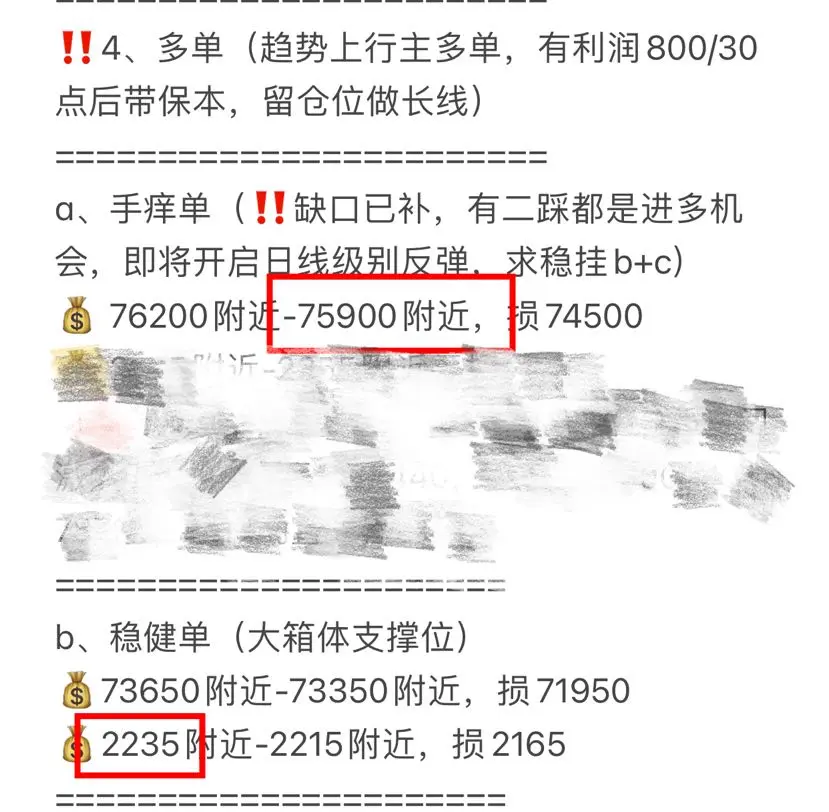

🌹Guan Peace, family members, give U‼️ Unknowingly, it has been 4 years since the subscription started, and the number of subscribers has exceeded 280🀄️ The 5.4gt discount is about to end and will revert to 8gt. Friends who subscribe are not fools; if you don’t earn, then you definitely 😄. You can click on 👇 on Apple or copy it to the web page to subscribe:

https://www.gate.com/zh/profile/When will the autumn rain end

🌹 Last week 3400/97800 empty 2865/87250 ate big meat

🌹 Last week late 3015/90800 empty Monday 2785/86000 ate more meat

🌹 Wednesday reverse 3045/90400 empty + yesterday 8440

View Originalhttps://www.gate.com/zh/profile/When will the autumn rain end

🌹 Last week 3400/97800 empty 2865/87250 ate big meat

🌹 Last week late 3015/90800 empty Monday 2785/86000 ate more meat

🌹 Wednesday reverse 3045/90400 empty + yesterday 8440

- Reward

- 10

- 10

- Repost

- Share

KeepUpWithTheRhythmOfTheTimes :

:

New Year Wealth Explosion 🤑View More

#MyWeekendTradingPlan

Take a glass of your drink, friend, so you don't think too much; the current situation is not very good for small traders.

View OriginalTake a glass of your drink, friend, so you don't think too much; the current situation is not very good for small traders.

- Reward

- like

- Comment

- Repost

- Share

#MyWeekendTradingPlan 1. The Rise of "Permitted" Assets

The ambiguity of "is it a security or a commodity?" is being resolved through structured frameworks like the GENIUS Act in the US and the full activation of MiCA in the EU.

Tokenized RWAs: Real-world assets (bonds, real estate, and private credit) now have clear legal pathways. This allows institutions to move these assets on-chain with the same legal protections as traditional certificates.

Stablecoins as "Tokenized Cash": Major jurisdictions (US, EU, UK, Singapore, Japan) now treat stablecoins as regulated payment instruments. Rules now

The ambiguity of "is it a security or a commodity?" is being resolved through structured frameworks like the GENIUS Act in the US and the full activation of MiCA in the EU.

Tokenized RWAs: Real-world assets (bonds, real estate, and private credit) now have clear legal pathways. This allows institutions to move these assets on-chain with the same legal protections as traditional certificates.

Stablecoins as "Tokenized Cash": Major jurisdictions (US, EU, UK, Singapore, Japan) now treat stablecoins as regulated payment instruments. Rules now

- Reward

- 2

- 2

- Repost

- Share

AylaShinex :

:

Buy To Earn 💎View More

Today, the best team in the world is gonna play football ⚽️

- Reward

- like

- Comment

- Repost

- Share

Gate Live 2026 Lunar New Year On-Chain Gala · Non-Stop Market Insights https://www.gate.com/campaigns/3937?ref_type=132

- Reward

- 2

- 2

- Repost

- Share

AylaShinex :

:

2026 GOGOGO 👊View More

【$ZK Signal】Long | Healthy Reset After Breakout with Volume

After a nearly 25% increase in 24 hours with volume, the price is cooling down and consolidating. This is a typical healthy reset after major players enter, rather than a top sell-off. The market shows buying interest absorbing short-term profit-taking, and the increasing open interest confirms bullish momentum.

🎯Direction: Long

🎯Entry: 0.0288 - 0.0290

🛑Stop Loss: 0.0275 $ZK Rigid stop loss, invalidates the structure if broken(

🚀Target 1: 0.0320

🚀Target 2: 0.0350

)Forms a flag pattern above a key resistance zone, with healthy vol

View OriginalAfter a nearly 25% increase in 24 hours with volume, the price is cooling down and consolidating. This is a typical healthy reset after major players enter, rather than a top sell-off. The market shows buying interest absorbing short-term profit-taking, and the increasing open interest confirms bullish momentum.

🎯Direction: Long

🎯Entry: 0.0288 - 0.0290

🛑Stop Loss: 0.0275 $ZK Rigid stop loss, invalidates the structure if broken(

🚀Target 1: 0.0320

🚀Target 2: 0.0350

)Forms a flag pattern above a key resistance zone, with healthy vol

- Reward

- like

- Comment

- Repost

- Share

芝麻传奇

芝麻传奇之路

Created By@gatefunuser_e111

Listing Progress

100.00%

MC:

$2.51K

Create My Token

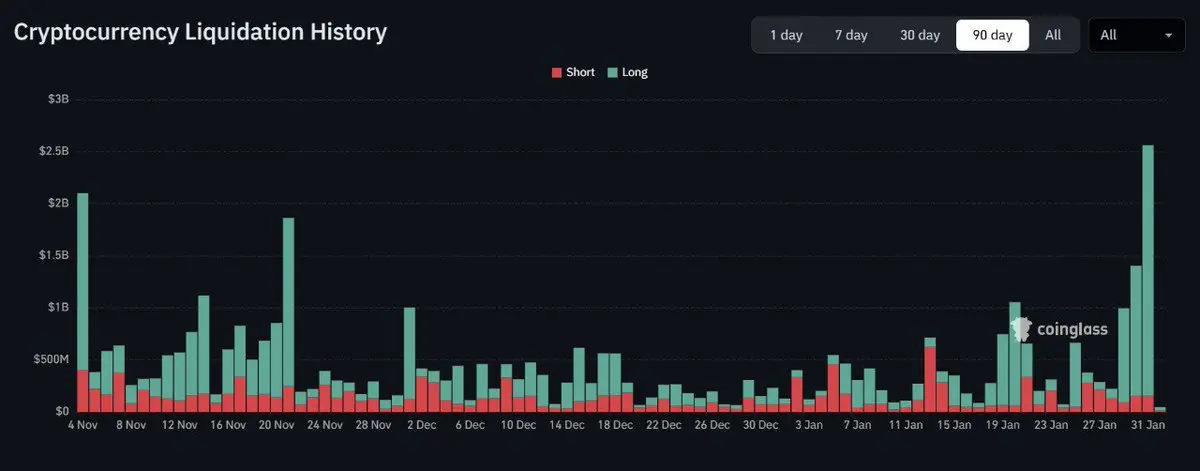

📊 MARKET: Yesterday saw the highest single-day liquidations since October 10th. #crypto

- Reward

- like

- Comment

- Repost

- Share

BTC Dominance & Its Impact on Altcoins

- Reward

- like

- Comment

- Repost

- Share

How can a cat just waking up be so sloppy and ugly🙃 Sigh, I spent 100,000 on U, saved every penny, and this year should be enough to get by. I won't go to activities that don't include charter flights, drinks, or meals. I'm out of money🌚 I'll save the rest for a bottom-fishing opportunity😭 I must endure this crypto winter😭

View Original

- Reward

- like

- 1

- Repost

- Share

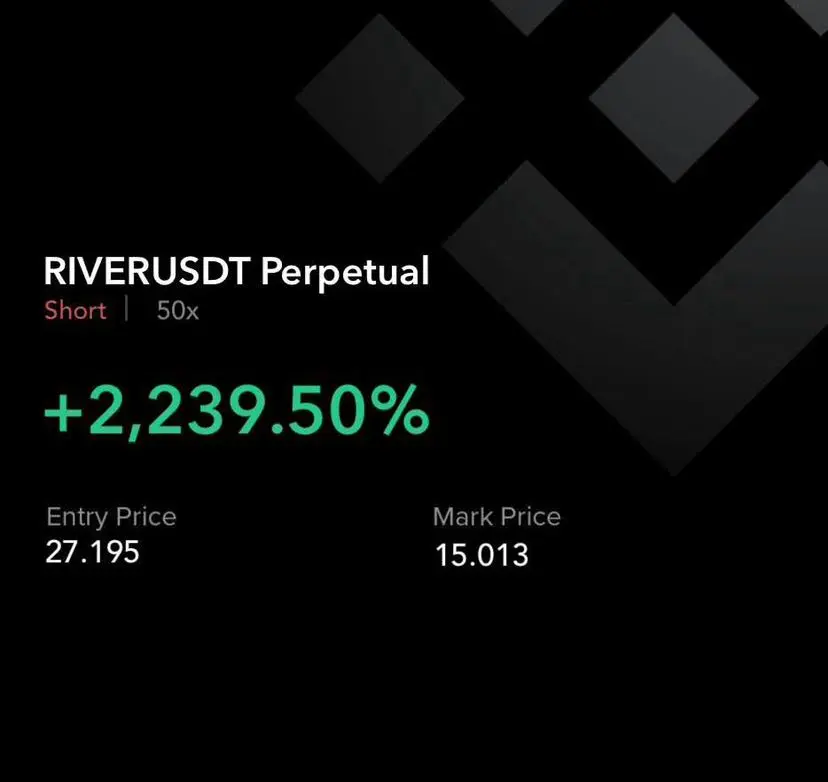

IAmHaifeng :

:

Seize this opportunity presented by the Federal Reserve's leadership transition to implement strategic adjustments, capitalize on market opportunities, and position yourself for future growth.SHORT

Leverage: 50x

Entry Target: 27.195

Take-profit Target:

25.051

22.689

21.002

18.885

17.145

Stop-loss: 28.335

#river

Leverage: 50x

Entry Target: 27.195

Take-profit Target:

25.051

22.689

21.002

18.885

17.145

Stop-loss: 28.335

#river

- Reward

- 3

- 2

- Repost

- Share

Chenxi :

:

Why don't you send it at night?View More

gm,is a good day to have a good day.🐸

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More27.58K Popularity

64K Popularity

368.25K Popularity

46.5K Popularity

65.85K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$2.91KHolders:10.00%

- MC:$2.91KHolders:10.00%

- MC:$2.91KHolders:10.00%

- MC:$2.91KHolders:10.00%

News

View MorePlanB: BTC enters the bear market zone or dips to $55,000–$58,000, but this cycle may be a shallow bear market

2 m

PeckShield: 16 hacking incidents occurred in the January crypto market, with total losses reaching $86.01 million

7 m

SOL现货ETF本周净流出245万美元 This week, the SOL spot ETF experienced a net outflow of $2.45 million.

26 m

Data: Bitcoin spot ETF net outflow of $1.49 billion this week, the second highest in history

26 m

Ethereum spot ETF experienced a net outflow of $327 million this week, with BlackRock's ETHA leading with a net outflow of $264 million.

28 m

Pin