Post content & earn content mining yield

placeholder

Happy_Bird

Gate.io TradFi Integration is LIVE! 🔥

Trade Gold, Indices & Commodities using USDx (1:1 USDT) — all on one platform!

📌 Why it’s a game-changer:

✅ Unified liquidity (no bank transfers)

✅ MT5 professional tools

✅ Hedge crypto with gold in volatile markets

✅ Leverage up to 500x

🚀 One platform. Crypto + TradFi. Unlimited potential.

#Gateio #TradFi

Trade Gold, Indices & Commodities using USDx (1:1 USDT) — all on one platform!

📌 Why it’s a game-changer:

✅ Unified liquidity (no bank transfers)

✅ MT5 professional tools

✅ Hedge crypto with gold in volatile markets

✅ Leverage up to 500x

🚀 One platform. Crypto + TradFi. Unlimited potential.

#Gateio #TradFi

- Reward

- 2

- 1

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊He has survived until today; it's already a miracle.

View Original

- Reward

- like

- Comment

- Repost

- Share

Crypto aggregator platform consolidates over 200 top-tier KOLs across the entire network, with paid memberships and free trial real-time synchronization of signals and trading calls. My belief is that all crypto enthusiasts in the world should not be taken advantage of as mere retail investors, nor should they be exploited by KOLs. Let's make the first move!!! Let's encourage each other!!

View Original

- Reward

- like

- Comment

- Repost

- Share

LAYA

Laya

Created By@therestorerx

Subscription Progress

0.00%

MC:

$0

Create My Token

SOL/USDT 4-Hour K-Line Analysis: Rebound Meets Resistance and Falls Back, Medium-Term Downtrend Unchanged

Key Support and Resistance Levels

• Resistance Levels

1. First Resistance: 129.19 (MA10), is the immediate barrier to short-term rebound. Breaking through could target the 130 integer level.

2. Second Resistance: 128.92 (MA20), this medium-term moving average is an important dividing line between bulls and bears.

3. Third Resistance: 131.51 (MA30), only after breaking can the medium-term downward pressure be alleviated.

• Support Levels

1. First Support: 125 integer level, is the current s

Key Support and Resistance Levels

• Resistance Levels

1. First Resistance: 129.19 (MA10), is the immediate barrier to short-term rebound. Breaking through could target the 130 integer level.

2. Second Resistance: 128.92 (MA20), this medium-term moving average is an important dividing line between bulls and bears.

3. Third Resistance: 131.51 (MA30), only after breaking can the medium-term downward pressure be alleviated.

• Support Levels

1. First Support: 125 integer level, is the current s

SOL-1,64%

- Reward

- like

- Comment

- Repost

- Share

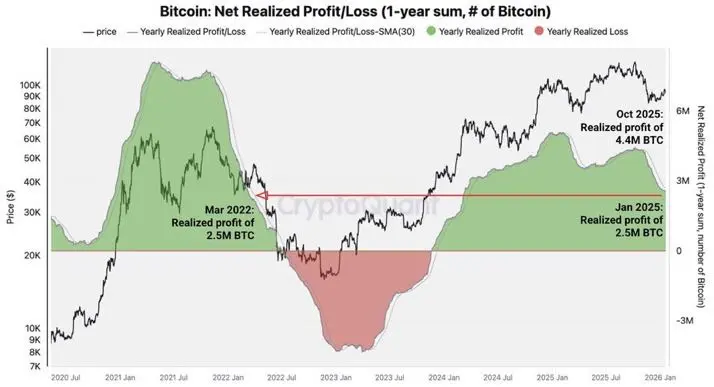

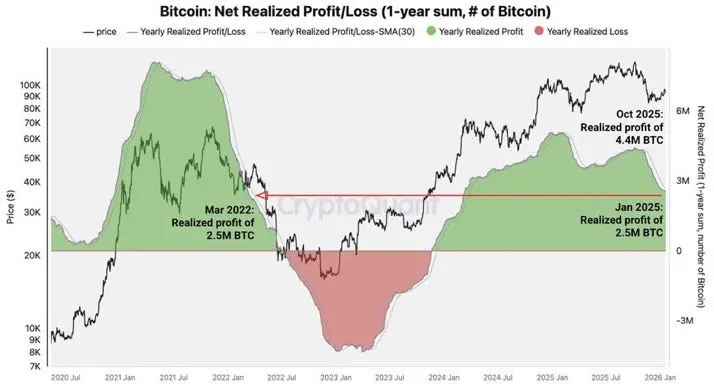

🚨 LATEST: Bitcoin's annual net realized profits drop to 2.5M $BTC, matching March 2022 bear market levels, signaling weakening price strength, per CryptoQuant.

BTC-0,45%

- Reward

- 1

- Comment

- Repost

- Share

Help:

Elon Musk's salary was supposed to be credited today.

Just now, the bank in Hong Kong called me and said

the sender might have entered an extra digit, causing the money not to arrive.

They asked me to contact the sender.

I said, how can I contact the sender? 😭

X's help center has no customer service at all.

The key point is that they have already canceled the customer service email.

Emails sent are also bounced back.

No matter how I try, I can't find X's email address.

There is simply none at all.

Netizens, please help with some ideas 🥹 @elonmusk

View OriginalElon Musk's salary was supposed to be credited today.

Just now, the bank in Hong Kong called me and said

the sender might have entered an extra digit, causing the money not to arrive.

They asked me to contact the sender.

I said, how can I contact the sender? 😭

X's help center has no customer service at all.

The key point is that they have already canceled the customer service email.

Emails sent are also bounced back.

No matter how I try, I can't find X's email address.

There is simply none at all.

Netizens, please help with some ideas 🥹 @elonmusk

- Reward

- like

- Comment

- Repost

- Share

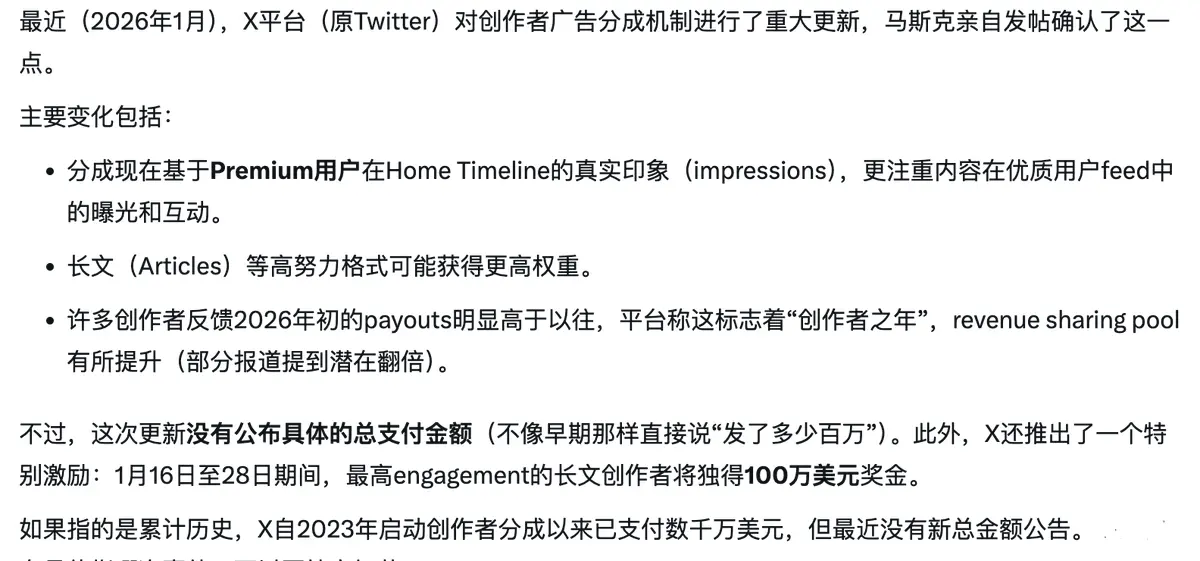

JUST IN: $1.7 Billion Wiped Out as Bitcoin Tests Sub-$90k Liquidity.

The leverage flush is finally here. In the last 24 hours, over $1.7 billion in positions has been liquidated across the market, dragging Bitcoin down to test the $89,400 support level. The primary trigger was a wave of "risk-off" selling driven by new geopolitical fears regarding U.S.-Greenland tariffs.

This matters because the market is misinterpreting the flows. While ETF investors panic-sold roughly $500 million this week, Strategy (MicroStrategy) used the volatility to execute a massive $2.1 billion Bitcoin purchase. The

The leverage flush is finally here. In the last 24 hours, over $1.7 billion in positions has been liquidated across the market, dragging Bitcoin down to test the $89,400 support level. The primary trigger was a wave of "risk-off" selling driven by new geopolitical fears regarding U.S.-Greenland tariffs.

This matters because the market is misinterpreting the flows. While ETF investors panic-sold roughly $500 million this week, Strategy (MicroStrategy) used the volatility to execute a massive $2.1 billion Bitcoin purchase. The

BTC-0,45%

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊BTC yesterday faced resistance below 90500, experienced a pullback, with a low around 88500, then rebounded. The overall pattern now shows a zone of oscillation and tug-of-war.

On the four-hour chart, the price is below the midline, and the MACD bullish momentum is starting to expand. However, the price has been stagnant for a long time, and more time is needed to convert space. If the price breaks above the midline and stabilizes, the bullish trend will continue.

Looking at the daily chart, after testing the lower band, it has continued to rise, and the four-hour price has room to move upward

View OriginalOn the four-hour chart, the price is below the midline, and the MACD bullish momentum is starting to expand. However, the price has been stagnant for a long time, and more time is needed to convert space. If the price breaks above the midline and stabilizes, the bullish trend will continue.

Looking at the daily chart, after testing the lower band, it has continued to rise, and the four-hour price has room to move upward

- Reward

- like

- Comment

- Repost

- Share

Russel 2000 is tearing it to the upside making new ATHs daily. You know the trend is super bullish when bear divergences don\'t play out.

- Reward

- like

- Comment

- Repost

- Share

#GoldandSilverHitNewHighs – A New Era for Safe-Haven Assets

Gold and silver have once again captured global attention as both metals surge to new highs, signaling a powerful shift in investor sentiment and global market dynamics. In times of uncertainty, history shows that capital always seeks safety — and today, precious metals are proving once again why they remain timeless stores of value. This latest rally is not just a short-term price spike; it reflects deeper economic, geopolitical, and financial forces reshaping the global economy.

One of the strongest drivers behind this rally is pers

Gold and silver have once again captured global attention as both metals surge to new highs, signaling a powerful shift in investor sentiment and global market dynamics. In times of uncertainty, history shows that capital always seeks safety — and today, precious metals are proving once again why they remain timeless stores of value. This latest rally is not just a short-term price spike; it reflects deeper economic, geopolitical, and financial forces reshaping the global economy.

One of the strongest drivers behind this rally is pers

BTC-0,45%

- Reward

- 1

- 1

- Repost

- Share

Crypto_Exper :

:

follow me brother I will follow back we should support each other 🥰✅2017 Bull Run

$NEO pumped $4.60 to $200 , 4200%

$ADA pumped $0.01 to $1.30, 6700%

$XVG pumped $0.000019 to $0.30 , 1,582,000%

2021 Bull Run

$Cake pumped $0.0002317 to $44

$SOL Pumped $0.59 to $263

$AXS pumped $0.12 to $164

2026

You think $wkc won't Pump to $0.0118?

You think $crepe won't pump to $1?

You think $foxinu won't pump to $2?

You think $ocicat won't pump to $0.0000828?

#GoldandSilverHitNewHighs

$NEO pumped $4.60 to $200 , 4200%

$ADA pumped $0.01 to $1.30, 6700%

$XVG pumped $0.000019 to $0.30 , 1,582,000%

2021 Bull Run

$Cake pumped $0.0002317 to $44

$SOL Pumped $0.59 to $263

$AXS pumped $0.12 to $164

2026

You think $wkc won't Pump to $0.0118?

You think $crepe won't pump to $1?

You think $foxinu won't pump to $2?

You think $ocicat won't pump to $0.0000828?

#GoldandSilverHitNewHighs

- Reward

- like

- Comment

- Repost

- Share

Crypto Trading Psychology & Risk Control

- Reward

- like

- Comment

- Repost

- Share

#IranTradeSanctions

1) What’s Happening Now

New US Tariff Threat Linked to Iran

The United States government has threatened a 25 % tariff on any country doing business with Iran, a broad measure aimed at isolating Tehran economically by forcing other nations to choose between trading with Iran or keeping full access to the US market. This threat has drawn strong criticism from China and Russia, which oppose interference and argue such measures harm global trade and stability.

European Union Moves Toward New Sanctions

The European Commission is planning additional sanctions on Iran’s exports

1) What’s Happening Now

New US Tariff Threat Linked to Iran

The United States government has threatened a 25 % tariff on any country doing business with Iran, a broad measure aimed at isolating Tehran economically by forcing other nations to choose between trading with Iran or keeping full access to the US market. This threat has drawn strong criticism from China and Russia, which oppose interference and argue such measures harm global trade and stability.

European Union Moves Toward New Sanctions

The European Commission is planning additional sanctions on Iran’s exports

- Reward

- 3

- 4

- Repost

- Share

CryptoVortex :

:

Happy New Year! 🤑View More

糖果币

糖果币

Created By@CandyCake

Subscription Progress

0.00%

MC:

$0

Create My Token

#DoubleRewardsWithGUSD 💰✨ Gate Star Trader Double Ranking Challenge – Week 2 Report

Congratulations to all VIP traders who made it to the top of the leaderboard in Week 2! Your steady strategies and active participation unlocked double rewards and multi-million-level traffic support.

🔹 Double Rewards Highlights:

1️⃣ Weekly Rankings:

Bonuses distributed weekly

Covers short-term & long-term strategies

Winning signals continuously updated

2️⃣ Monthly Rankings:

150,000+ USDT reward pool for top performers

Additional exclusive VIP benefits

3️⃣ Participation Tips for VIPs:

Keep trading consistent

Congratulations to all VIP traders who made it to the top of the leaderboard in Week 2! Your steady strategies and active participation unlocked double rewards and multi-million-level traffic support.

🔹 Double Rewards Highlights:

1️⃣ Weekly Rankings:

Bonuses distributed weekly

Covers short-term & long-term strategies

Winning signals continuously updated

2️⃣ Monthly Rankings:

150,000+ USDT reward pool for top performers

Additional exclusive VIP benefits

3️⃣ Participation Tips for VIPs:

Keep trading consistent

BTC-0,45%

- Reward

- 2

- 2

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

“We are so back” “this could 10x” and “buy the dip” looking at you right after you’ve received your minimum wage paycheck from a double shift

- Reward

- like

- Comment

- Repost

- Share

Gate Annual Report is out! Let's take a look at my yearly performance.

Click the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=BlFGUFBc&ref_type=126&shareUid=VlFAXFxcBwoO0O0O.

View OriginalClick the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=BlFGUFBc&ref_type=126&shareUid=VlFAXFxcBwoO0O0O.

- Reward

- like

- Comment

- Repost

- Share

#NextFedChairPredictions

Next Fed Chair Predictions: Who Will Lead, and How Could Markets React?

The question of who will become the next U.S. Federal Reserve Chair is drawing intense attention from investors, economists, and policymakers worldwide. The Fed Chair’s decisions shape monetary policy, interest rates, inflation expectations, and overall market sentiment, meaning that this appointment will have far-reaching consequences for equities, bonds, commodities, and even cryptocurrencies. Markets are already speculating on the potential candidates, weighing their policy philosophies, track

Next Fed Chair Predictions: Who Will Lead, and How Could Markets React?

The question of who will become the next U.S. Federal Reserve Chair is drawing intense attention from investors, economists, and policymakers worldwide. The Fed Chair’s decisions shape monetary policy, interest rates, inflation expectations, and overall market sentiment, meaning that this appointment will have far-reaching consequences for equities, bonds, commodities, and even cryptocurrencies. Markets are already speculating on the potential candidates, weighing their policy philosophies, track

BTC-0,45%

- Reward

- 1

- Comment

- Repost

- Share

Short-Term Market Trend Analysis (No Signals)

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More20.75K Popularity

3.35K Popularity

341 Popularity

1.31K Popularity

1.07K Popularity

News

View MoreGate Yubi Bao BTC 7-Day Fixed-term Financial Management Extra Reward Pool is now live, with a maximum comprehensive annualized return of up to 10.3%. A total of 250,000 ACU tokens are available on a first-come, first-served basis.

5 m

Analyst: Japan suspected of intervening in the yen exchange rate

7 m

Well-known KOL AB: The exchange listing department is very concerned about the completeness of project information on public data platforms.

8 m

CZ: Retail traders should pay attention to position control when participating in trading. You can start by using a small portion of your funds to try.

9 m

The USD/JPY short-term plummets sharply, breaking below 158

13 m

Pin