Post content & earn content mining yield

placeholder

InternetBeggarIWishYouPeaceAnd

$RIVER Strange, I can't send the picture, and the chart on the webpage has already reached 59.763...

View Original

- Reward

- like

- Comment

- Repost

- Share

https://www.gate.com/activities/pointprize/?now_period=16&refUid=45456177 This event is very awesome, let's go!

View Original

MC:$3.29KHolders:207

100.00%

- Reward

- like

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3902?ref=XgRFBg1c&ref_type=132

- Reward

- like

- Comment

- Repost

- Share

鲁班2号

鲁班2号

Created By@DoYouLikeSummer?Test

Subscription Progress

0.00%

MC:

$0

Create My Token

A prediction market platform offers a $6M airdrop, requiring only $200 in volume for eligibility without complex farming or extensive effort, emphasizing straightforward participation.\n\nThis aspect draws attention to @trylimitless \n\nSuch setups represent low-effort, high-potential opportunities often recognized retrospectively. For those engaged in market predictions, it serves as an additional incentive.\n\nOptimal strategies sometimes involve identifying and pursuing simple prospects early, ahead of widespread adoption.

- Reward

- like

- Comment

- Repost

- Share

Davos 2026: The Turning Point for Cryptocurrency to Become a Global Financial Hub

The 2026 World Economic Forum (Davos) marks a historic turning point for the cryptocurrency industry. This year's conference has shifted its tone entirely, no longer discussing the survival of crypto assets, but instead focusing on how to integrate them on a large scale into the global financial system. From aggressive efforts by sovereign nations to substantial moves by Wall Street giants, the forum has sent unprecedented positive signals for the industry.

The most milestone news comes from the Bermuda governmen

The 2026 World Economic Forum (Davos) marks a historic turning point for the cryptocurrency industry. This year's conference has shifted its tone entirely, no longer discussing the survival of crypto assets, but instead focusing on how to integrate them on a large scale into the global financial system. From aggressive efforts by sovereign nations to substantial moves by Wall Street giants, the forum has sent unprecedented positive signals for the industry.

The most milestone news comes from the Bermuda governmen

RWA1,35%

- Reward

- 1

- 1

- Repost

- Share

Web3摸鱼大神 :

:

@Gate AI verify the informationThree days of live streaming, summary:

1. The live streaming status needs adjustment; trading is a focused activity.

2. Currently learning short-term trading; previous trading strategies need to be adjusted.

3. Three days of floating loss -0.56%; strict stop-loss was implemented, but profits cannot be held, so further adjustments are needed.

4. Need to organize the daily live streaming process.

Rest today~ Keep going tomorrow!

A journey of a thousand miles begins with a single step.

View Original1. The live streaming status needs adjustment; trading is a focused activity.

2. Currently learning short-term trading; previous trading strategies need to be adjusted.

3. Three days of floating loss -0.56%; strict stop-loss was implemented, but profits cannot be held, so further adjustments are needed.

4. Need to organize the daily live streaming process.

Rest today~ Keep going tomorrow!

A journey of a thousand miles begins with a single step.

- Reward

- like

- Comment

- Repost

- Share

i look at this chart and see the veil of human optimism lifted\n\nthe top 5 holders went to bed with a 1 million dollar+ balances\n\nwoke up with $40k, $50k, $60k, and dropping\n\nso much hope, euphoria, tragedy in those green and red lines\n\nmaybe they\'re still live in a moment of bliss or quiet before checking their portfolio this morning

- Reward

- like

- Comment

- Repost

- Share

$RIVER Trade Setup

Current Price: 55.78

Entry: 54.80 – 55.40 zone

Target 1: 60.20

Target 2: 66.50

Stop Loss: 51.90

Analysis

RIVER is sitting just above a strong demand area after a healthy pullback from recent highs. The 54–55 zone has acted as a reaction level multiple times, which makes it a good place for a controlled long entry rather than chasing at the top. Price is still holding above the rising trendline on the higher time frame, meaning the overall structure remains bullish. Volume has also started to stabilize after the sell-off, which usually hints that sellers are losing momentum.

Current Price: 55.78

Entry: 54.80 – 55.40 zone

Target 1: 60.20

Target 2: 66.50

Stop Loss: 51.90

Analysis

RIVER is sitting just above a strong demand area after a healthy pullback from recent highs. The 54–55 zone has acted as a reaction level multiple times, which makes it a good place for a controlled long entry rather than chasing at the top. Price is still holding above the rising trendline on the higher time frame, meaning the overall structure remains bullish. Volume has also started to stabilize after the sell-off, which usually hints that sellers are losing momentum.

- Reward

- like

- Comment

- Repost

- Share

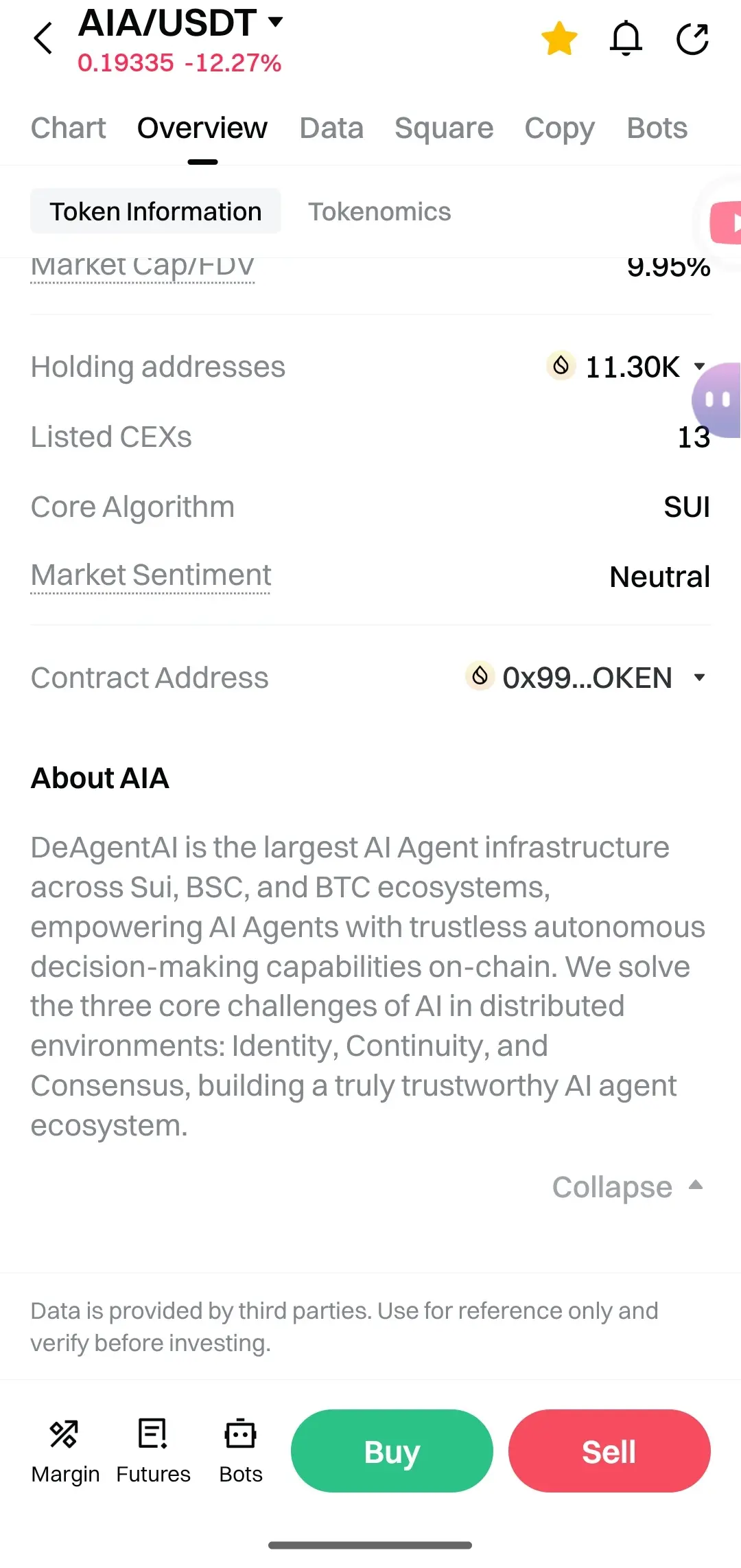

Friends, I would like to know your opinion about the $AIA token. With such a high ATH compared to the current price, will the case be the same as the $ZEC token in the years to come?

please,tell me with data..

$AIA

#A59 #GateTradFi1gGoldGiveaway #SpotGoldHitsaNewHigh #GrowthPointsDrawRound16 #TariffTensionsHitCryptoMarket

please,tell me with data..

$AIA

#A59 #GateTradFi1gGoldGiveaway #SpotGoldHitsaNewHigh #GrowthPointsDrawRound16 #TariffTensionsHitCryptoMarket

AIA-2,67%

- Reward

- 1

- 1

- Repost

- Share

DragonFlyOfficial :

:

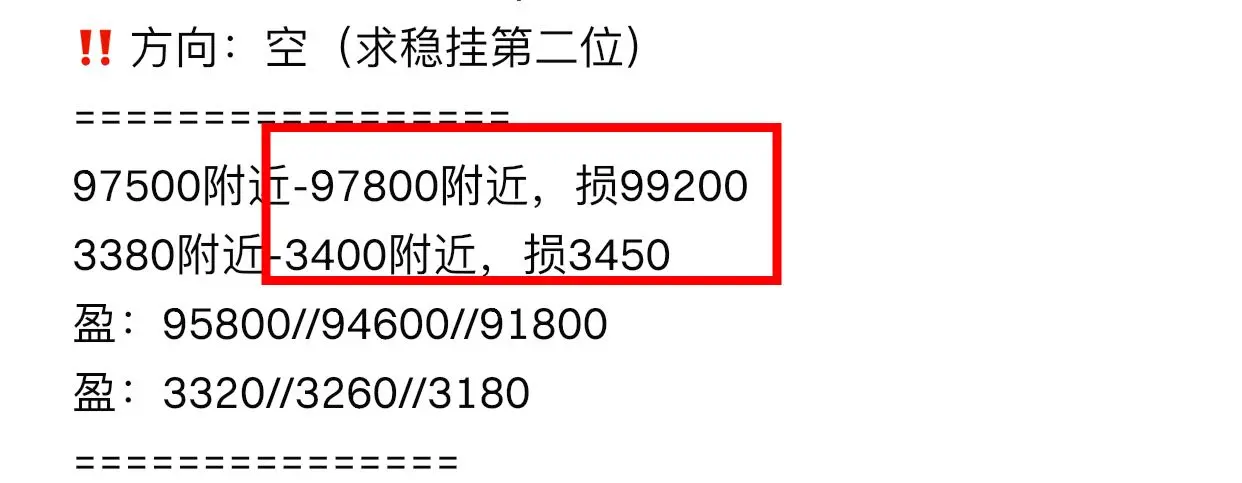

2026 GOGOGO 👊‼️ Guan He Ping Wheel Old Iron Friends, Give U‼️ The contract/spot order for the night of the 22nd has been updated 👇 In the crypto world, only follow the right people. Thank you all for your support. The New Year 3.5gt half-price discount has already surpassed 140 people. The last person to reach full recovery will get 7gt‼️ Apple click 👇

https://www.gate.com/zh/profile/ Little Ghost Daily Contract

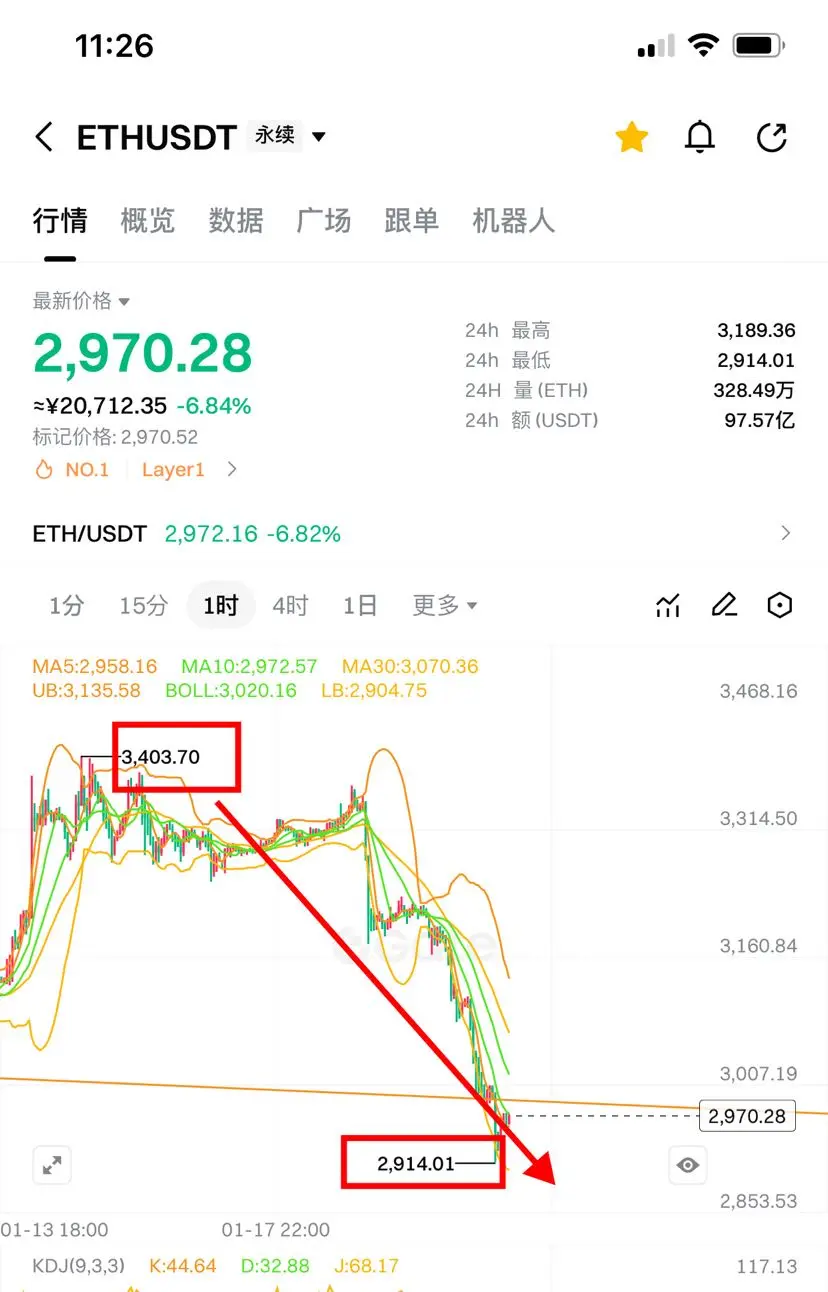

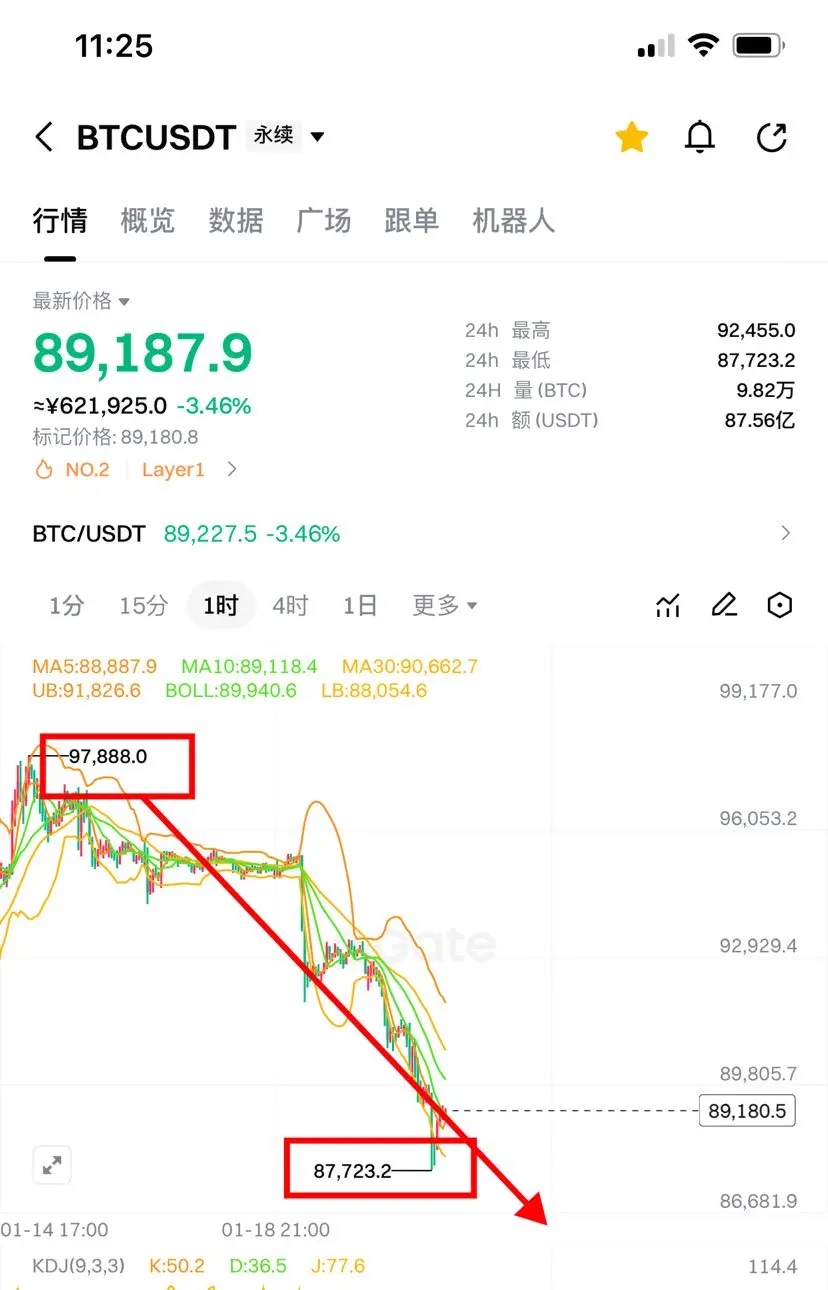

🔥 Recently ate over 2 million U in a row‼️ Last week 3400/97800 short, yesterday 2865/87250 eating big meat 📉 2900/87900 reverse long 3065/90500 eating more meat 📈 This morning 3060 short, now

https://www.gate.com/zh/profile/ Little Ghost Daily Contract

🔥 Recently ate over 2 million U in a row‼️ Last week 3400/97800 short, yesterday 2865/87250 eating big meat 📉 2900/87900 reverse long 3065/90500 eating more meat 📈 This morning 3060 short, now

PAXG1,54%

- Reward

- 10

- 10

- Repost

- Share

MyPigIsAmazing. :

:

Hold on tight, we're about to take off 🛫View More

On January 23, 2026, ETH is currently around 2930 USDT, with intra-day fluctuations leaning weak. Short-term trading should focus on range-bound strategies and risk control. Below are the specific strategies.

1. Core Trading Strategies

Bullish Strategy

Entry Point: 2900-2920 (correction stabilizes, combined with small-cycle MACD golden cross)

Stop Loss: 2870 (break below previous low support, higher risk)

Target Levels: First target 2980-3000, second target 3050-3080 (reduce positions at resistance)

Bearish Strategy

Entry Point: 3000-3020 (rebound losing momentum, combined with small-cycle MAC

1. Core Trading Strategies

Bullish Strategy

Entry Point: 2900-2920 (correction stabilizes, combined with small-cycle MACD golden cross)

Stop Loss: 2870 (break below previous low support, higher risk)

Target Levels: First target 2980-3000, second target 3050-3080 (reduce positions at resistance)

Bearish Strategy

Entry Point: 3000-3020 (rebound losing momentum, combined with small-cycle MAC

ETH1,93%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

BTC & ETH Correlation With Overall Market

- Reward

- like

- Comment

- Repost

- Share

qwertyuiop

巴菲特

Created By@GateUser-3ad7b067

Listing Progress

0.00%

MC:

$3.39K

Create My Token

🚨 JUST IN: Gold reaches another all-time high of $4,900\n\nWhen $5K?

- Reward

- like

- 1

- Repost

- Share

Himmatsingh :

:

good morning goodJUST IN: Trump sues JPMorgan and Jamie Dimon for @E0 billion USD, accusing politically motivated debanking after January 6, 2021. \n\nHe claims his account was closed and he was blacklisted financially. The lawsuit was filed in Florida with substantial damages and a jury trial.

View Original

- Reward

- like

- Comment

- Repost

- Share

The Mayer Multiple for bitcoin sits at 0.84, toward the historical lower bound.\n\nThe Mayer Multiple is an oscillator calculated as the ratio between price, and the 200-day moving average.

BTC1,68%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

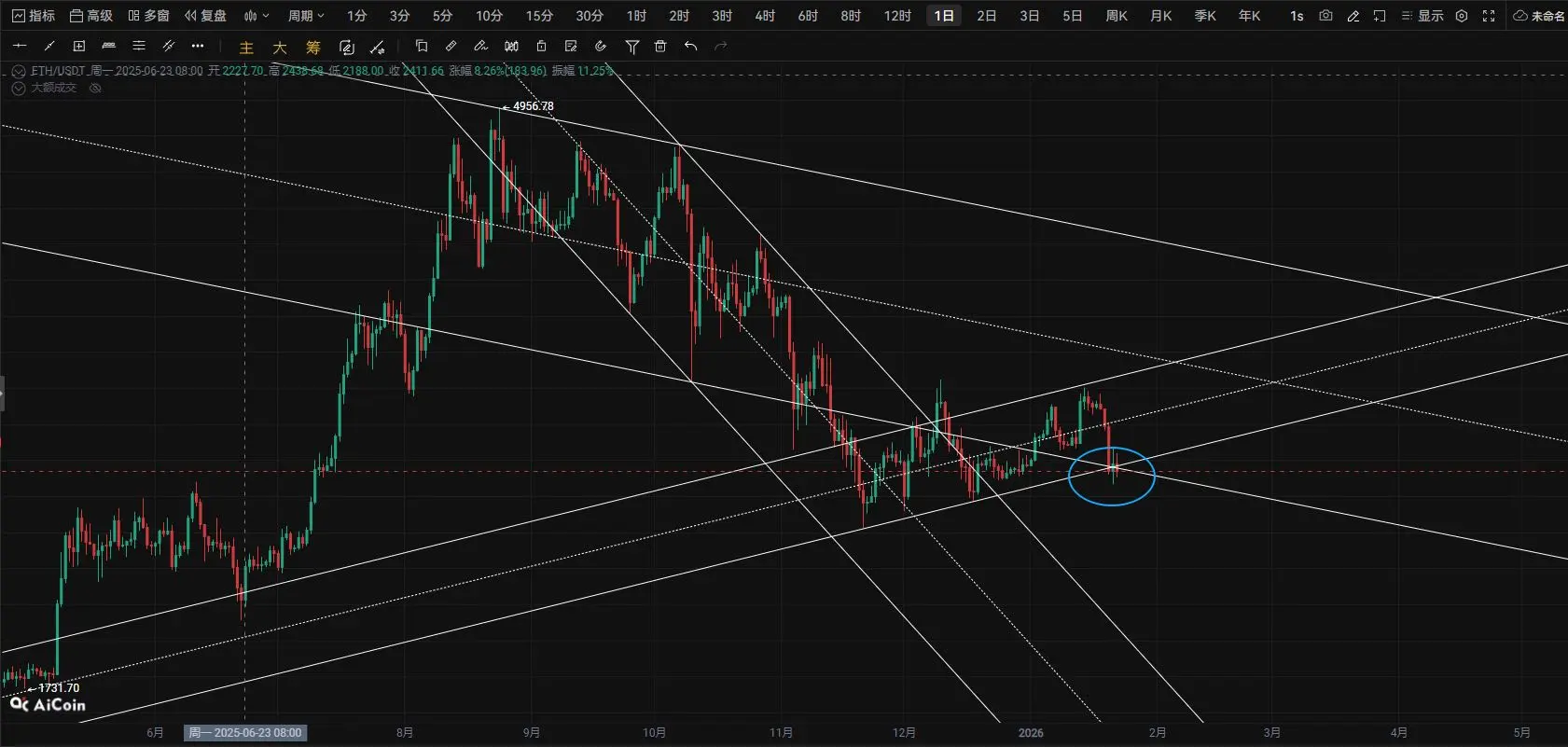

The second Bitcoin has dropped from the 4956 high of the M top. The major timeframes still show a bearish outlook: the monthly chart has a death cross, the weekly chart is trending downward, and the daily chart has a death cross with a 12-hour downtrend. Currently, it is in a mid-term correction after the M top, with a rebound following the decline. It is possibly undergoing a second bottom test, oscillating back and forth around this level, but there may be a daily-level rebound forming. The key levels show a fierce battle between bulls and bears. There is a potential head and shoulders botto

View Original

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More58.68K Popularity

37.91K Popularity

22.33K Popularity

64.84K Popularity

347.54K Popularity

News

View MoreData: 1.7 million PENDLE transferred from an anonymous address, worth approximately $3.6 million

55 m

Data: A total of 60,000 addresses have claimed SKR tokens, with an average airdrop amount of $1,400.

1 h

He Yi: Overly taking things out of context and misinterpretation are hard to prevent, and rumors, hatred, and conspiracy theories are more likely to sweep through public sentiment.

1 h

Russell 2000 Index rises 1.2%, reaching a new all-time high

1 h

CNN: No written agreement has been reached on the Greenland issue

1 h

Pin