Trade

Basic

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

Smart Leverage

NEW

No forced liquidation before maturity, worry-free leveraged gains

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

December 29 | ETH Trend Analysis

Core Viewpoints

Current Price: $3,006.15 (as of December 29, 10:12)

Short-term Outlook: The short-term trend shows oscillating upward movement, with technical indicators on the 1-hour and 4-hour charts indicating bullish momentum. However, RSI has entered overbought territory, posing a risk of a pullback. If the $2,950 support level holds, there is a 70% probability of continuing upward to the $3,050-$3,100 range; a break below $2,900 could trigger a chain liquidation.

Key Support Levels:

Key Resistance Levels:

Technical Analysis

Multi-timeframe Price Trends

1-Hour Level: Strong upward momentum but entering overbought warning zone

4-Hour Level: Medium-term trend confirmed upward

Daily Level: Long-term structure still appears weak

Derivatives Market

Futures Positions and Funding Rates

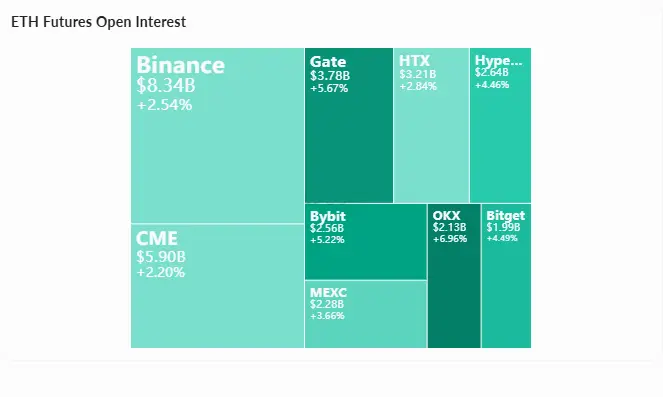

Total open interest reaches $38.4 billion (+4.48% in 24 hours), increasing with price rise, indicating growing market confidence.

Funding rate on Binance is +0.0097% (longs pay), showing a mild long bias across exchanges. 24-hour liquidation data shows short positions liquidated at $22.6 million versus $5.5 million for longs, confirming a short squeeze scenario.

Options Market and Liquidation Risks

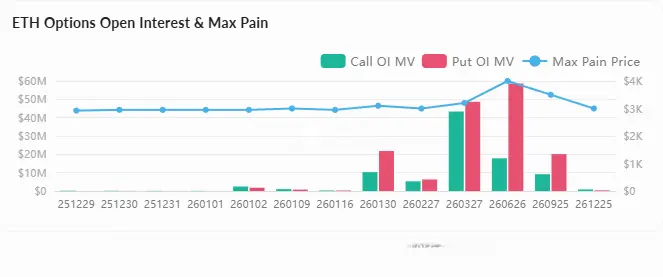

Total options open interest is $6.12 billion (+0.87% in 24 hours), with maximum pain concentrated in the $2,950-$3,000 range, exerting a magnetic effect on current price.

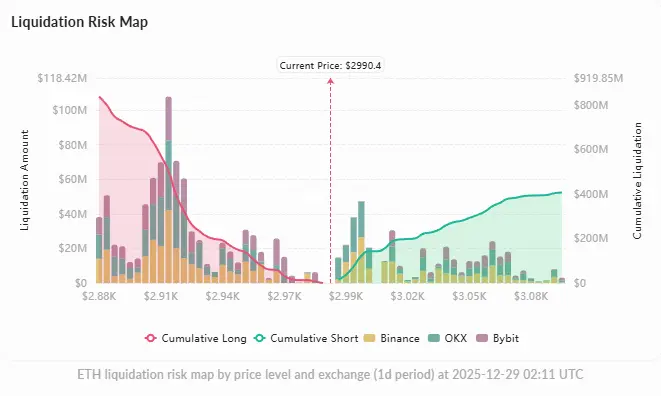

Asymmetric liquidation risk distribution:

This distribution suggests that a downward break could trigger more intense chain reactions.

Exchange Capital Flows

7-day net inflow data shows daily net inflows between +11,500 and +154,000 ETH, indicating overall inflow trend. Exchange reserves have increased from 16.3 million ETH to 16.7 million ETH (+2.1%), with increased liquidity potentially exerting downward pressure on price.

Recent whale activity: Address 0xA339d279 sold an average of 24,700 ETH (worth $73 million USDC) over the past week at an average price of $2,954.

Market Sentiment

Bullish Narrative

Bearish Narrative

Overall Sentiment

Market sentiment is generally neutral with a cautious optimism. Analyst Tom Lee forecasts ETH reaching $7,000-$9,000 this year, with long-term potential of $20,000. Community discussions focus on breaking the $3,000 key resistance, but widespread panic or FOMO has yet to emerge.

Summary

ETH is currently in a short-term bullish phase but with a long-term structural repair needed. The 1-hour and 4-hour technicals are strong, with increasing open interest and short liquidations confirming upward momentum. However, overbought RSI, daily moving average resistance, and rising exchange reserves pose risks of a correction.

The key in the next 24-48 hours is whether $2,950 support can hold. Holding this level could lead to a push toward the $3,050-$3,100 short liquidation zone; breaking below $2,900 risks a bearish cascade. Close attention should be paid to price action around the $2,950-$3,000 maximum pain options zone and derivatives funding rate changes.