Trade

Trading Type

Spot

Trade crypto freely

Alpha

Points

Get promising tokens in streamlined on-chain trading

Pre-Market

Trade new tokens before they are officially listed

Margin

Magnify your profit with leverage

Convert & Block Trading

0 Fees

Trade any size with no fees and no slippage

Leveraged Tokens

Get exposure to leveraged positions simply

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

BTC Staking

HOT

Stake BTC and earn 10% APR

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

- Trending TopicsView More

275.98K Popularity

72.88K Popularity

10.78K Popularity

11.59K Popularity

12.3K Popularity

- Hot Gate FunView More

- MC:$3.81KHolders:31.69%

- MC:$3.6KHolders:10.81%

- MC:$3.52KHolders:10.00%

- MC:$3.53KHolders:10.00%

- MC:$3.64KHolders:20.21%

- Pin

Despite Nvidia's strong performance, Bitcoin falls on weakened expectations for interest rate cuts.

Source: DecenterKorea Original Title: Despite NVIDIA's strong performance… Bitcoin falls on weakened expectations for interest rate cuts [Decenter Market Trends] Original Link: https://www.decenter.kr/NewsView/2H0IZYZEBM/GZ03

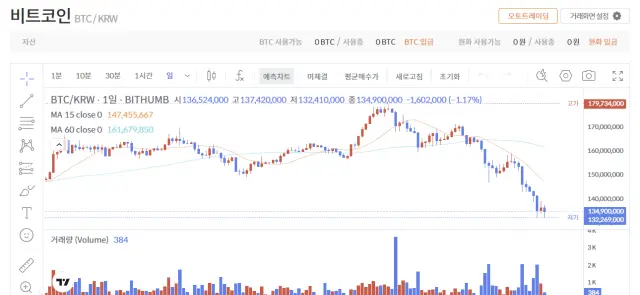

As of 8 AM on the 20th, the price of Bitcoin (BTC ) on Bithumb has recorded a decrease of 1.15% compared to the previous day, reaching 134.9 million won.

Bitcoin ( BTC ) has come under downward pressure again due to weakened expectations for interest rate cuts from the Federal Reserve ( Fed · FOMC ). NVIDIA's third-quarter performance significantly exceeded expectations, temporarily calming the anxiety surrounding risk assets, but market attention has shifted back to monetary policy variables, limiting upward momentum.

According to CoinMarketCap, a global cryptocurrency market tracking site, as of 8 AM on the 20th, Bitcoin(BTC) traded at $93,324.97, down 3.02% from 24 hours ago. Ethereum(ETH) traded at $2,979.53, down 4.62%. XRP( traded at $2.092, down 6.01%, while BNB) recorded a decline of 4.52% to $891.66. Solana(SOL) is trading at $135.41, down 4.21%.

The domestic market is also on a downward trend. At the domestic cryptocurrency exchange Bithumb, BTC recorded a drop of 1.15% from the previous day, priced at 134.9 million won. ETH fell 2.35% to 4.448 million won, XRP decreased by 1.42% to 3,117 won, and SOL is trading at 201,700 won, down 1.22%.

NVIDIA announced on the 19th that its third-quarter revenue reached $57.01 billion, marking a 62% increase compared to the previous year. Data center revenue was reported at $51.2 billion, and the revenue guidance for the fourth quarter was presented as $63.7 billion to $66.3 billion. After the market closed, the stock rose by over 4% in after-hours trading, reaffirming strong demand for artificial intelligence AI. As a result, BTC, which had fallen to $88,000 earlier that morning, recovered back to $90,000.

However, the minutes of the Federal Open Market Committee meeting released on this day in October indicated that the prevailing opinion was to keep the benchmark interest rate unchanged in December, leading to a drop in BTC prices. The minutes stated, “Many participants expressed the view that maintaining the benchmark interest rate for the remainder of the year would be appropriate in light of their respective economic outlooks.” On the other hand, some participants suggested that a rate cut in December would be appropriate if the economic situation changes in line with their expectations, according to the minutes. The minutes specified that participants' forecasts for the December decision were highly divergent.

The prices of major cryptocurrencies, including BTC, are once again on the decline due to weakened expectations for interest rate cuts. The market anticipates that uncertainty in monetary policy will act as a key variable for short-term price fluctuations.

The investment sentiment in cryptocurrencies is still in a state of 'extreme fear'. The Fear and Greed Index from the cryptocurrency data analysis company Alternative.me has risen by 4 points to 15 points compared to the previous day. This index indicates that the closer it is to 0, the more the investment sentiment is retracted, while the closer it is to 100, the more it indicates market overheating.