$ETH #GateSquare$50KRedPacketGiveaway

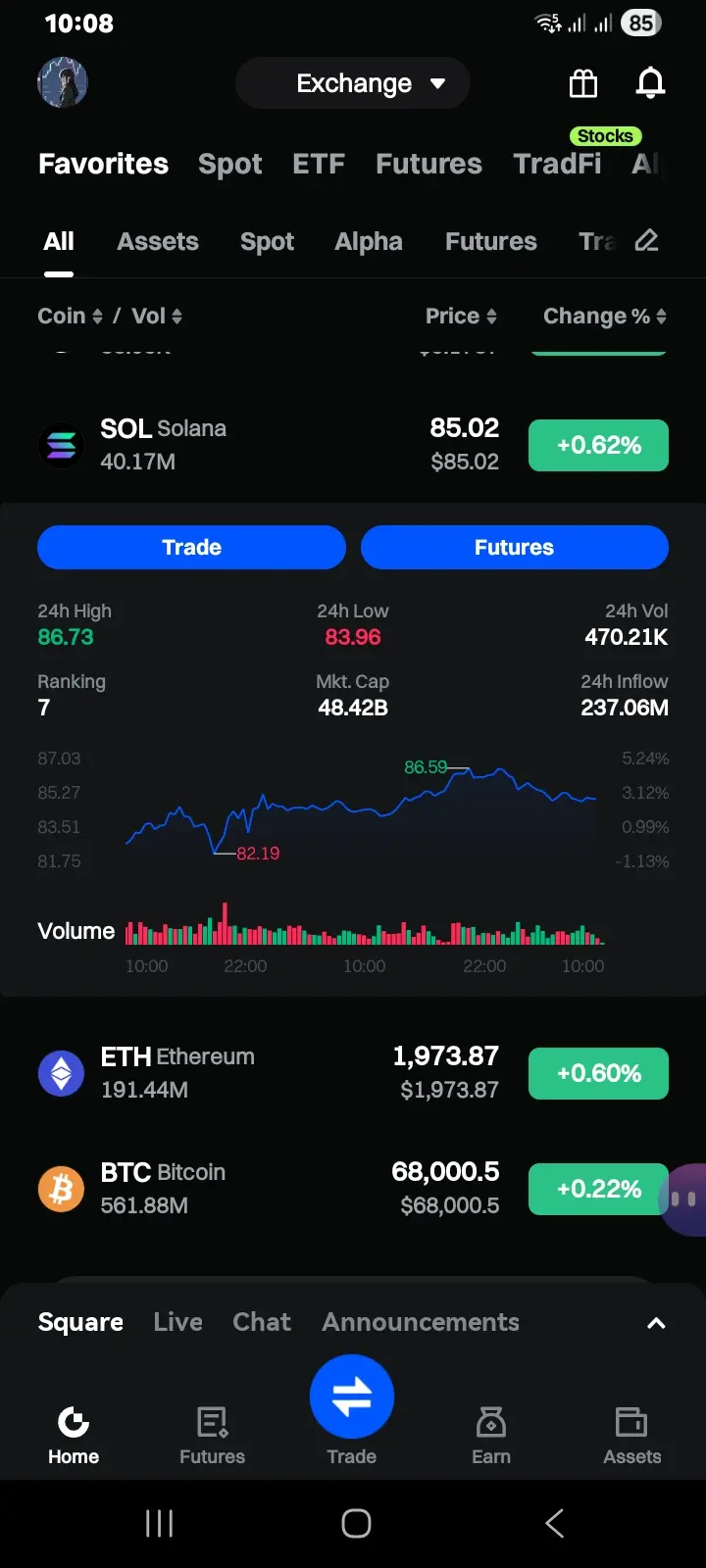

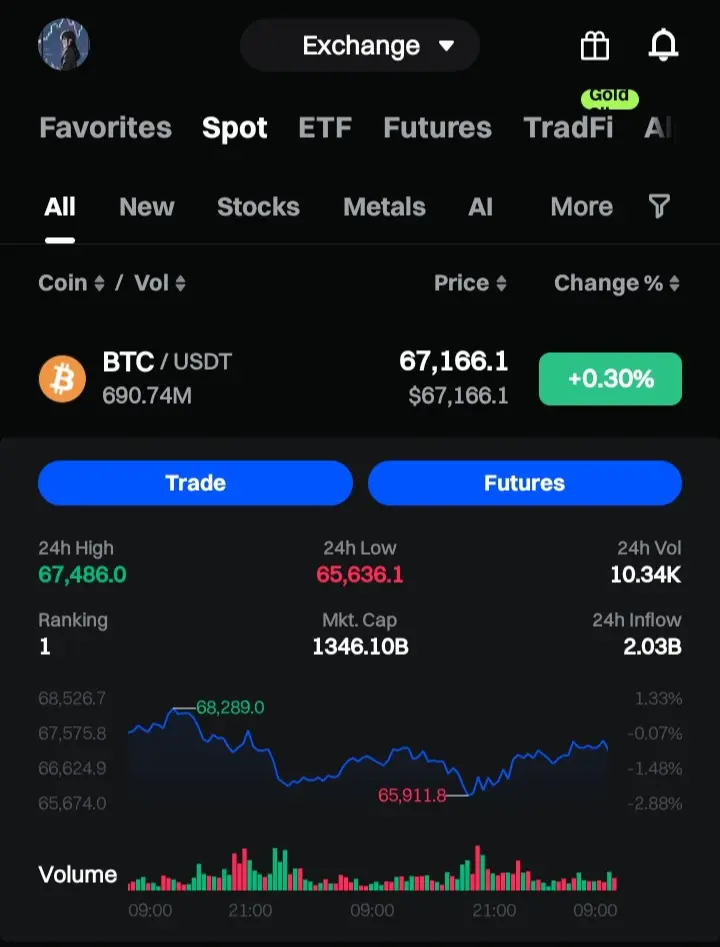

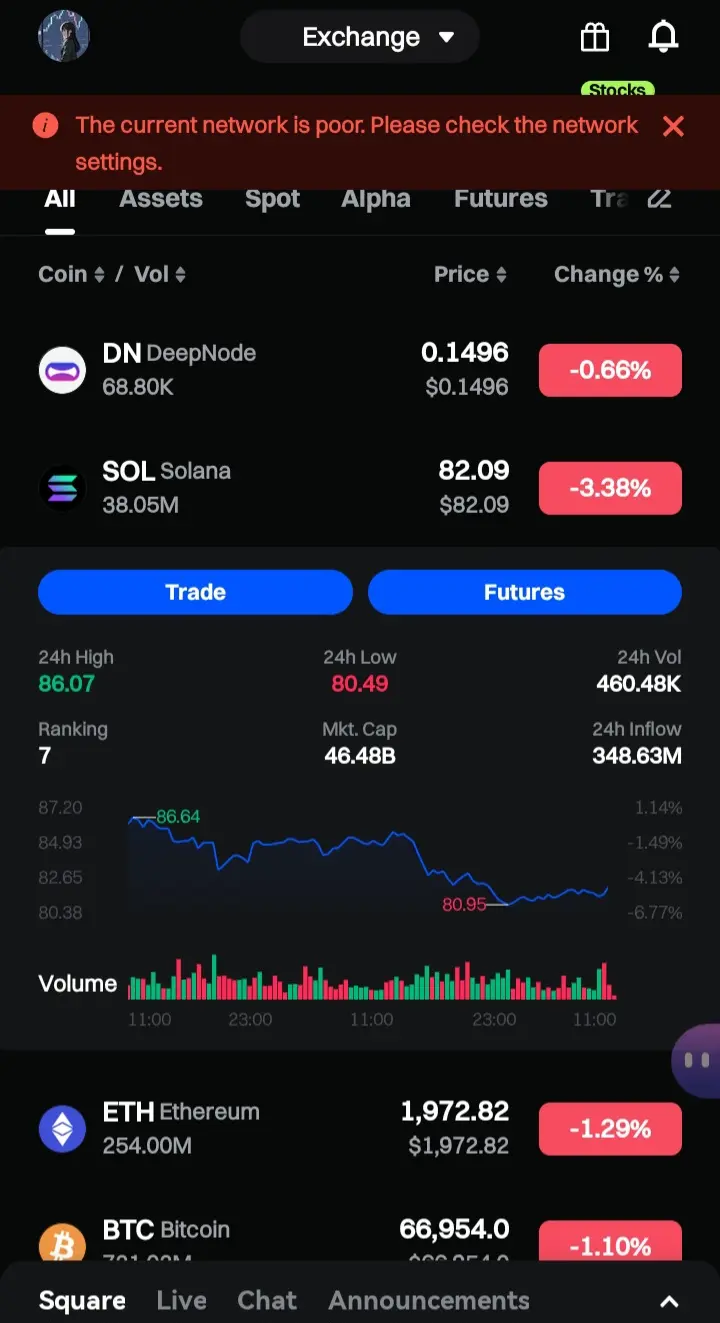

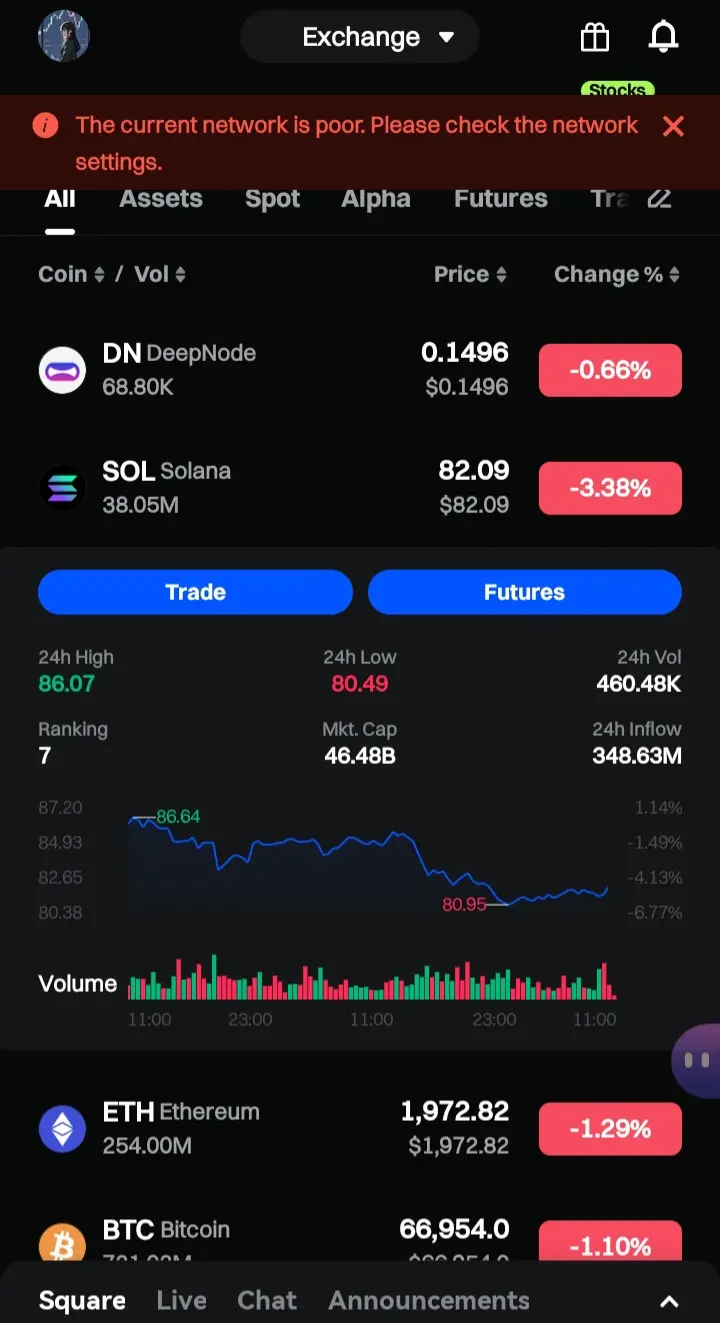

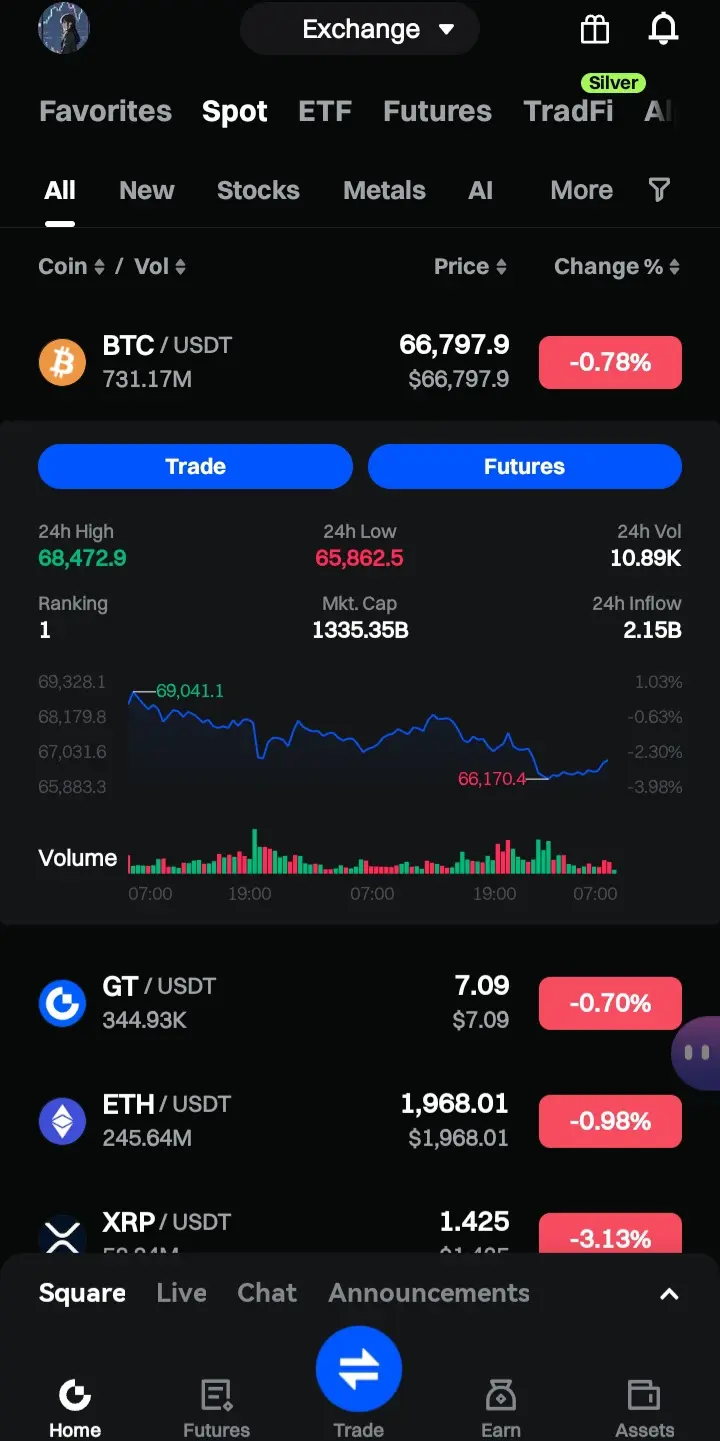

📊 السعر الحالي

$2,021

انخفاض حوالي -2.5%

شمعة هابطة قوية تم تشكيلها للتو

🔎 تحليل الاتجاه (1H)

✅ المتوسطات المتحركة

MA5: 2044

MA10: 2063

MA30: 2074

السعر أدنى من جميع المتوسطات الرئيسية → الاتجاه قصير المدى هابط

المتوسطات تبدأ أيضًا في الانحدار للأسفل → يؤكد زخم الهبوط.

📉 مؤشرات الزخم

🔴 MACD (12,26,9)

خط MACD أدنى من خط الإشارة

مخطط الأعمدة يتوسع في السلبي

زخم الهبوط يتزايد

يدعم استمرار الاتجاه نحو الأسفل إلا إذا ظهرت قوة شراء قوية.

📊 الحجم

شمعة حمراء كبيرة مؤخرًا مع حجم أعلى

→ يشير إلى ضغط بيع قوي

→ ليس مجرد انحراف ضعيف نحو الأسفل

🧱 المستويات الرئيسية

🔹 الدعم:

$2,010 – $2,000 (منطقة نفسية رئيسية)

إذا تم الاختراق → الدعم التالي حول $1,990 – $1,970

🔹 المقاومة:

$2,040

$2,060 – $2,075 (مقاومة تجمع المتوسطات)

📌 السيناريوهات المحتملة

🐻 سيناريو هابط (الأكثر احتمالًا الآن)

إذا ظل السعر أدنى من $2,040، الاستمرار نحو:

$2,000

ربما $1,980

🐂 سيناريو انعكاس صاعد

مطلوب:

استعادة قوية فوق $2,060

تقاطع MACD

تأكيد الحجم

🎯 فكرة التداول (تعليمي فقط)

إعداد قصير:

الدخول: تصحيح إلى $2,035–$2,050

وقف الخسارة: فوق $2,075

الأهداف: $2,000 / $1,980

أو

إعداد طويل (مهاجم):

فقط إذا كان هناك ارتداد قوي من $2,000

وقف ضيق أدنى من $1,990

الانحياز الآن = هبوط قصير المدى

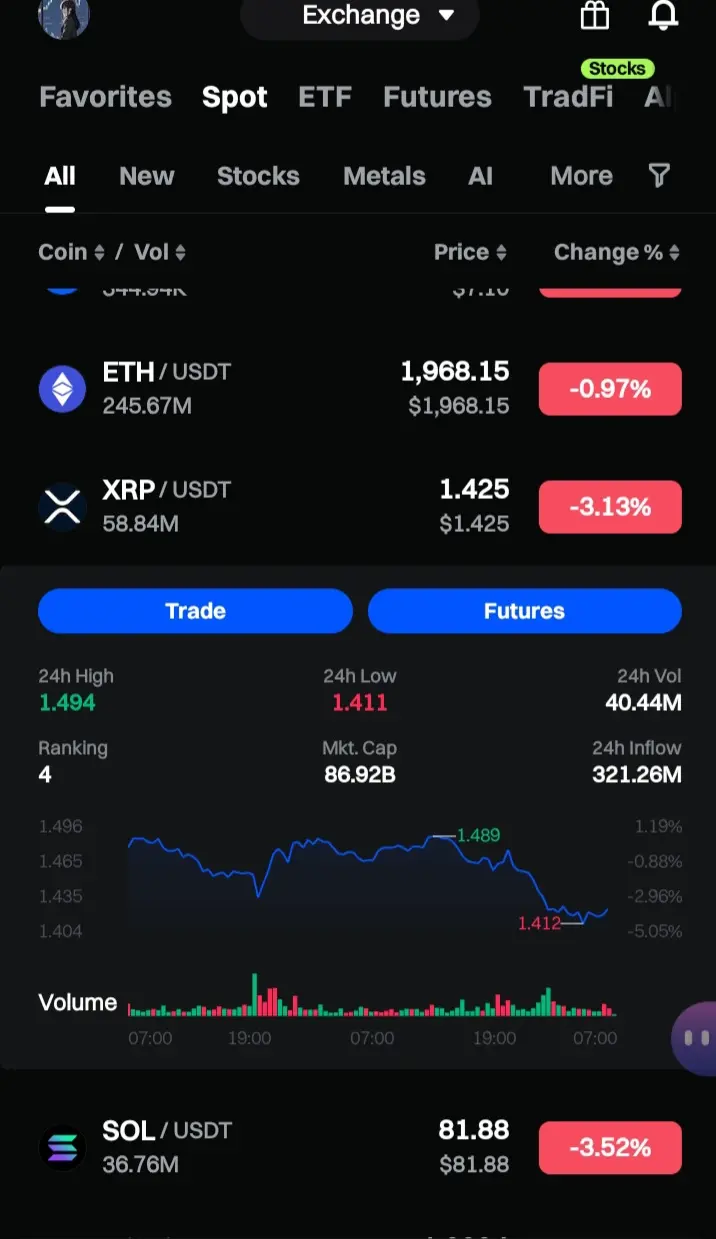

📊 السعر الحالي

$2,021

انخفاض حوالي -2.5%

شمعة هابطة قوية تم تشكيلها للتو

🔎 تحليل الاتجاه (1H)

✅ المتوسطات المتحركة

MA5: 2044

MA10: 2063

MA30: 2074

السعر أدنى من جميع المتوسطات الرئيسية → الاتجاه قصير المدى هابط

المتوسطات تبدأ أيضًا في الانحدار للأسفل → يؤكد زخم الهبوط.

📉 مؤشرات الزخم

🔴 MACD (12,26,9)

خط MACD أدنى من خط الإشارة

مخطط الأعمدة يتوسع في السلبي

زخم الهبوط يتزايد

يدعم استمرار الاتجاه نحو الأسفل إلا إذا ظهرت قوة شراء قوية.

📊 الحجم

شمعة حمراء كبيرة مؤخرًا مع حجم أعلى

→ يشير إلى ضغط بيع قوي

→ ليس مجرد انحراف ضعيف نحو الأسفل

🧱 المستويات الرئيسية

🔹 الدعم:

$2,010 – $2,000 (منطقة نفسية رئيسية)

إذا تم الاختراق → الدعم التالي حول $1,990 – $1,970

🔹 المقاومة:

$2,040

$2,060 – $2,075 (مقاومة تجمع المتوسطات)

📌 السيناريوهات المحتملة

🐻 سيناريو هابط (الأكثر احتمالًا الآن)

إذا ظل السعر أدنى من $2,040، الاستمرار نحو:

$2,000

ربما $1,980

🐂 سيناريو انعكاس صاعد

مطلوب:

استعادة قوية فوق $2,060

تقاطع MACD

تأكيد الحجم

🎯 فكرة التداول (تعليمي فقط)

إعداد قصير:

الدخول: تصحيح إلى $2,035–$2,050

وقف الخسارة: فوق $2,075

الأهداف: $2,000 / $1,980

أو

إعداد طويل (مهاجم):

فقط إذا كان هناك ارتداد قوي من $2,000

وقف ضيق أدنى من $1,990

الانحياز الآن = هبوط قصير المدى