Stablecoins 2026: Dari “Dollar Digital” hingga Infrastruktur Keuangan Inti

Pada awal tahun 2026, beberapa perkembangan di sektor stablecoin mengungkapkan pergeseran penting dalam peran stablecoin dalam sistem keuangan global. Apa yang dulunya berfungsi terutama sebagai aset jembatan untuk perdagangan kripto semakin berkembang menjadi infrastruktur keuangan independen yang digunakan oleh jutaan orang dan bisnis di seluruh dunia.

Salah satu sinyal terkuat datang dari Tether. CEO Paolo Ardoino mengungkapkan bahwa USDT melayani lebih dari 550 juta pengguna di pasar berkembang selama 12 bulan terakhir. Angka ini menyoroti permintaan nyata terhadap stablecoin di wilayah yang mengalami inflasi tinggi, akses perbankan terbatas, dan sistem pembayaran lintas batas yang tidak efisien. Di negara-negara seperti Argentina dan Turki, stablecoin yang dipatok dolar secara efektif telah menjadi bentuk tabungan dan alat pembayaran “dolar digital”.

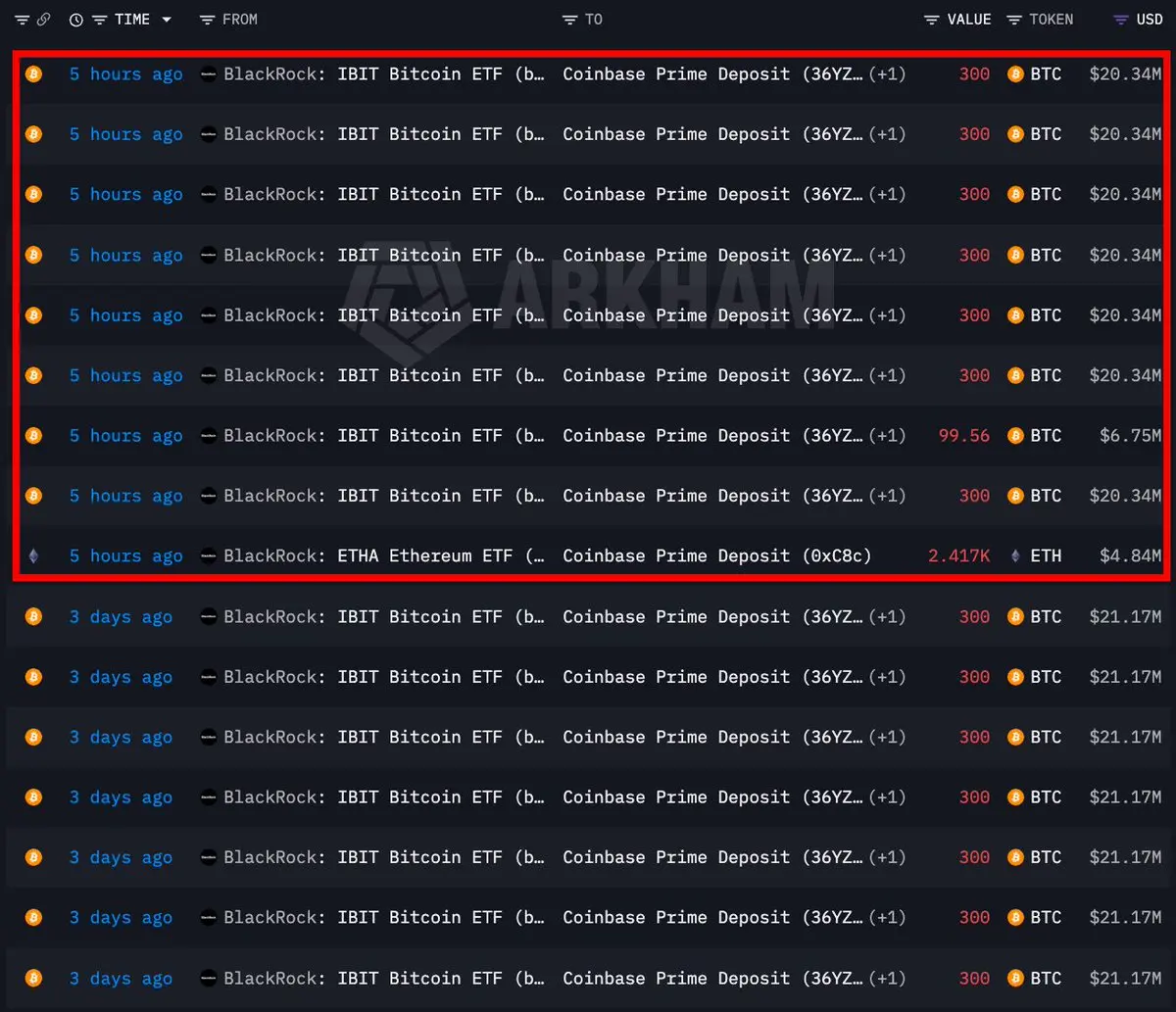

Data on-chain semakin memperkuat narasi ini. Menurut analisis dari Chainalysis dan Artemis, pengirim tunggal terbesar hanya bertanggung jawab atas 4,97% volume transaksi USDT, dibandingkan dengan 23,34% untuk stablecoin lainnya. Konsentrasi yang lebih rendah menunjukkan bahwa penggunaan stablecoin tersebar luas di antara pengguna sehari-hari daripada didominasi oleh sejumlah kecil institusi besar. Ini mencerminkan aktivitas dunia nyata seperti remitansi, pembayaran usaha kecil, dan transfer peer-to-peer.

Pada saat yang sama, komunitas investasi sedang menyempurnakan cara pandangnya terhadap stablecoin. mitra investasi a16z Noah Levine berpendapat bahwa narasi umum yang mengklaim stablecoin akan menggantikan jaringan kartu seperti Visa atau Mastercard terlalu sederhana. Sistem kartu tradisional menyediakan jauh lebih dari sekadar pembayaran — termasuk kredit, perlindungan terhadap penipuan, chargeback, dan sistem otorisasi. Stablecoin saat ini tidak dapat meniru semua fungsi ini.

Sebaliknya, Levine menyarankan bahwa peluang nyata terletak pada melayani pasar yang tidak dapat dijangkau oleh sistem pembayaran tradisional. Banyak pedagang — terutama pengembang independen, penjual online kecil, atau peserta ekonomi AI yang sedang berkembang — sering kekurangan struktur hukum, catatan keuangan, atau riwayat kredit yang diperlukan untuk mengakses infrastruktur pembayaran konvensional. Bagi pengguna ini, stablecoin berfungsi seperti uang tunai untuk perdagangan digital, menawarkan cara sederhana untuk menerima pembayaran tanpa bergantung pada bank.

Aliran modal di awal 2026 mendukung narasi infrastruktur ini. Mesh, jaringan pembayaran kripto yang bertujuan menghubungkan pasar kripto global ke dalam satu sistem pembayaran terpadu, mengumpulkan $75 juta dalam pendanaan Seri C, mencapai valuasi $1 miliar. Putaran ini melibatkan investor utama seperti Dragonfly Capital, Paradigm, Coinbase Ventures, dan SBI Investment. Tujuan Mesh adalah memungkinkan pembayaran yang mulus di berbagai platform kripto dan ekonomi tokenisasi.

Pemain besar lainnya, Rain, juga mendapatkan $250 juta dalam pendanaan Seri C, dipimpin oleh ICONIQ, dengan valuasi $1,95 miliar. Rain sudah memproses lebih dari $3 miliar dalam volume transaksi tahunan dan bekerja sama dengan lebih dari 200 mitra, termasuk perusahaan seperti Western Union dan Nuvei. Sebagai anggota jaringan Visa, kartu yang diterbitkan Rain dapat digunakan secara global, menunjukkan bagaimana infrastruktur stablecoin dapat terintegrasi dengan sistem keuangan tradisional daripada sekadar menggantinya.

Melihat ke depan, 12–24 bulan ke depan dapat menentukan trajektori ekosistem stablecoin melalui tiga perkembangan yang mungkin.

Pertama, kejelasan regulasi mungkin akan memimpin pasar stablecoin berlapis. Stablecoin yang sangat diatur seperti USDC dapat mendominasi penyelesaian institusional dan pembayaran lintas batas yang sesuai regulasi, sementara stablecoin offshore seperti USDT terus memimpin penggunaan ritel di pasar berkembang karena hambatan yang lebih rendah dan akses yang lebih luas.

Kedua, pertumbuhan pesat ekonomi agen AI mungkin menciptakan permintaan baru terhadap stablecoin. Sistem AI otonom yang melakukan tugas seperti kueri data atau inferensi model mungkin memerlukan mikro-pembayaran yang tidak dapat diproses secara ekonomis oleh jalur pembayaran tradisional. Stablecoin, yang mampu menyelesaikan transaksi sangat kecil, dapat menjadi lapisan pembayaran alami untuk ekonomi mesin-ke-mesin yang baru ini.

Ketiga, penggunaan stablecoin yang semakin meluas di ekonomi berinflasi tinggi dapat mempercepat bentuk dolar digital. Ketika individu semakin bergantung pada stablecoin yang dipatok dolar daripada mata uang lokal untuk tabungan dan transaksi, pengaruh kebijakan moneter domestik mungkin melemah, yang berpotensi memicu respons regulasi yang lebih kuat dari pemerintah.

Secara keseluruhan, sektor stablecoin sedang mengalami transformasi yang jelas. Apa yang dimulai sebagai alat perdagangan sederhana dalam ekosistem kripto secara bertahap menjadi jembatan keuangan antara ekonomi kripto dan dunia nyata. Data dari Tether menunjukkan adopsi akar rumput yang kuat, investasi modal ventura mempercepat pengembangan infrastruktur, dan tren teknologi baru seperti AI membuka kasus penggunaan tambahan.

Dalam konteks ini, kompetisi utama untuk stablecoin di tahun-tahun mendatang tidak akan berkisar pada ideologi tetapi pada desain produk, strategi regulasi, dan adopsi dunia nyata. Apakah melayani kebutuhan “dolar digital” pasar berkembang atau memungkinkan mikro-transaksi dalam ekonomi AI, stablecoin semakin diposisikan sebagai salah satu antarmuka paling praktis yang menghubungkan keuangan terdesentralisasi dengan aktivitas ekonomi sehari-hari.

Pada awal tahun 2026, beberapa perkembangan di sektor stablecoin mengungkapkan pergeseran penting dalam peran stablecoin dalam sistem keuangan global. Apa yang dulunya berfungsi terutama sebagai aset jembatan untuk perdagangan kripto semakin berkembang menjadi infrastruktur keuangan independen yang digunakan oleh jutaan orang dan bisnis di seluruh dunia.

Salah satu sinyal terkuat datang dari Tether. CEO Paolo Ardoino mengungkapkan bahwa USDT melayani lebih dari 550 juta pengguna di pasar berkembang selama 12 bulan terakhir. Angka ini menyoroti permintaan nyata terhadap stablecoin di wilayah yang mengalami inflasi tinggi, akses perbankan terbatas, dan sistem pembayaran lintas batas yang tidak efisien. Di negara-negara seperti Argentina dan Turki, stablecoin yang dipatok dolar secara efektif telah menjadi bentuk tabungan dan alat pembayaran “dolar digital”.

Data on-chain semakin memperkuat narasi ini. Menurut analisis dari Chainalysis dan Artemis, pengirim tunggal terbesar hanya bertanggung jawab atas 4,97% volume transaksi USDT, dibandingkan dengan 23,34% untuk stablecoin lainnya. Konsentrasi yang lebih rendah menunjukkan bahwa penggunaan stablecoin tersebar luas di antara pengguna sehari-hari daripada didominasi oleh sejumlah kecil institusi besar. Ini mencerminkan aktivitas dunia nyata seperti remitansi, pembayaran usaha kecil, dan transfer peer-to-peer.

Pada saat yang sama, komunitas investasi sedang menyempurnakan cara pandangnya terhadap stablecoin. mitra investasi a16z Noah Levine berpendapat bahwa narasi umum yang mengklaim stablecoin akan menggantikan jaringan kartu seperti Visa atau Mastercard terlalu sederhana. Sistem kartu tradisional menyediakan jauh lebih dari sekadar pembayaran — termasuk kredit, perlindungan terhadap penipuan, chargeback, dan sistem otorisasi. Stablecoin saat ini tidak dapat meniru semua fungsi ini.

Sebaliknya, Levine menyarankan bahwa peluang nyata terletak pada melayani pasar yang tidak dapat dijangkau oleh sistem pembayaran tradisional. Banyak pedagang — terutama pengembang independen, penjual online kecil, atau peserta ekonomi AI yang sedang berkembang — sering kekurangan struktur hukum, catatan keuangan, atau riwayat kredit yang diperlukan untuk mengakses infrastruktur pembayaran konvensional. Bagi pengguna ini, stablecoin berfungsi seperti uang tunai untuk perdagangan digital, menawarkan cara sederhana untuk menerima pembayaran tanpa bergantung pada bank.

Aliran modal di awal 2026 mendukung narasi infrastruktur ini. Mesh, jaringan pembayaran kripto yang bertujuan menghubungkan pasar kripto global ke dalam satu sistem pembayaran terpadu, mengumpulkan $75 juta dalam pendanaan Seri C, mencapai valuasi $1 miliar. Putaran ini melibatkan investor utama seperti Dragonfly Capital, Paradigm, Coinbase Ventures, dan SBI Investment. Tujuan Mesh adalah memungkinkan pembayaran yang mulus di berbagai platform kripto dan ekonomi tokenisasi.

Pemain besar lainnya, Rain, juga mendapatkan $250 juta dalam pendanaan Seri C, dipimpin oleh ICONIQ, dengan valuasi $1,95 miliar. Rain sudah memproses lebih dari $3 miliar dalam volume transaksi tahunan dan bekerja sama dengan lebih dari 200 mitra, termasuk perusahaan seperti Western Union dan Nuvei. Sebagai anggota jaringan Visa, kartu yang diterbitkan Rain dapat digunakan secara global, menunjukkan bagaimana infrastruktur stablecoin dapat terintegrasi dengan sistem keuangan tradisional daripada sekadar menggantinya.

Melihat ke depan, 12–24 bulan ke depan dapat menentukan trajektori ekosistem stablecoin melalui tiga perkembangan yang mungkin.

Pertama, kejelasan regulasi mungkin akan memimpin pasar stablecoin berlapis. Stablecoin yang sangat diatur seperti USDC dapat mendominasi penyelesaian institusional dan pembayaran lintas batas yang sesuai regulasi, sementara stablecoin offshore seperti USDT terus memimpin penggunaan ritel di pasar berkembang karena hambatan yang lebih rendah dan akses yang lebih luas.

Kedua, pertumbuhan pesat ekonomi agen AI mungkin menciptakan permintaan baru terhadap stablecoin. Sistem AI otonom yang melakukan tugas seperti kueri data atau inferensi model mungkin memerlukan mikro-pembayaran yang tidak dapat diproses secara ekonomis oleh jalur pembayaran tradisional. Stablecoin, yang mampu menyelesaikan transaksi sangat kecil, dapat menjadi lapisan pembayaran alami untuk ekonomi mesin-ke-mesin yang baru ini.

Ketiga, penggunaan stablecoin yang semakin meluas di ekonomi berinflasi tinggi dapat mempercepat bentuk dolar digital. Ketika individu semakin bergantung pada stablecoin yang dipatok dolar daripada mata uang lokal untuk tabungan dan transaksi, pengaruh kebijakan moneter domestik mungkin melemah, yang berpotensi memicu respons regulasi yang lebih kuat dari pemerintah.

Secara keseluruhan, sektor stablecoin sedang mengalami transformasi yang jelas. Apa yang dimulai sebagai alat perdagangan sederhana dalam ekosistem kripto secara bertahap menjadi jembatan keuangan antara ekonomi kripto dan dunia nyata. Data dari Tether menunjukkan adopsi akar rumput yang kuat, investasi modal ventura mempercepat pengembangan infrastruktur, dan tren teknologi baru seperti AI membuka kasus penggunaan tambahan.

Dalam konteks ini, kompetisi utama untuk stablecoin di tahun-tahun mendatang tidak akan berkisar pada ideologi tetapi pada desain produk, strategi regulasi, dan adopsi dunia nyata. Apakah melayani kebutuhan “dolar digital” pasar berkembang atau memungkinkan mikro-transaksi dalam ekonomi AI, stablecoin semakin diposisikan sebagai salah satu antarmuka paling praktis yang menghubungkan keuangan terdesentralisasi dengan aktivitas ekonomi sehari-hari.