Размещайте контент и зарабатывайте на создании контента

placeholder

Adrig_iv

- Награда

- лайк

- комментарий

- Репост

- Поделиться

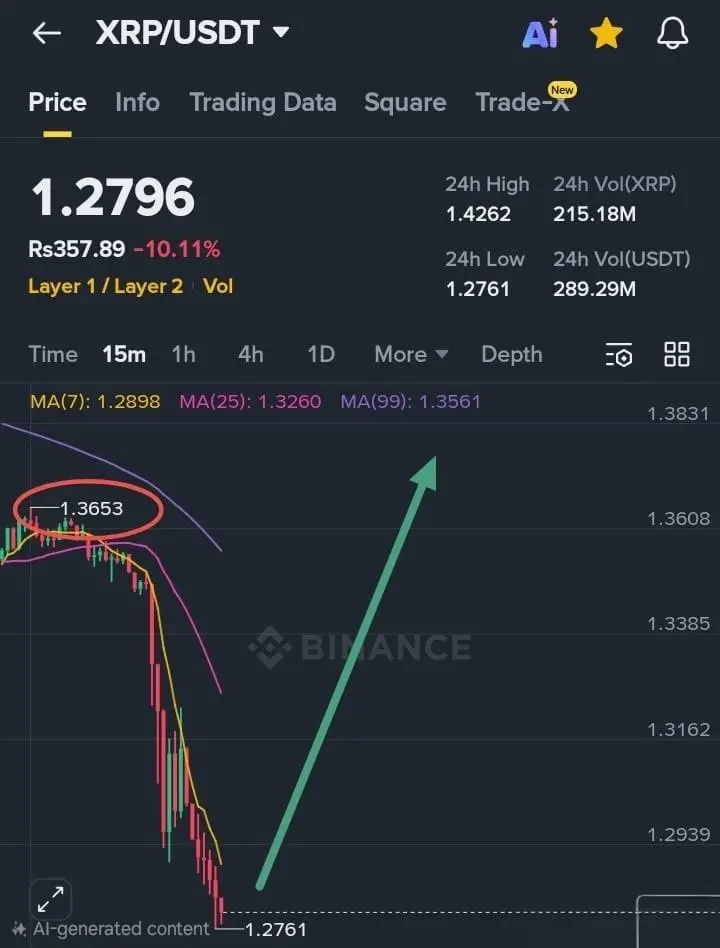

Движение за импульсом с пробоем, при этом бычий сценарий остается сильным

$PAXG ДЛИННАЯ

Торговый план

Вход: $5350 – $5450

Стоп-лосс: $5180

TP1: $5550

TP2: $5600

TP3: $5650

Уверенное продолжение бычьего тренда, подтверждение поддержки и пробоя

Покупка и торговля #Gate广场发帖领五万美金红包 $PAXG

$PAXG ДЛИННАЯ

Торговый план

Вход: $5350 – $5450

Стоп-лосс: $5180

TP1: $5550

TP2: $5600

TP3: $5650

Уверенное продолжение бычьего тренда, подтверждение поддержки и пробоя

Покупка и торговля #Gate广场发帖领五万美金红包 $PAXG

PAXG5,2%

- Награда

- лайк

- комментарий

- Репост

- Поделиться

Теперь каждый — военный аналитик.

Посмотреть Оригинал

- Награда

- 2

- комментарий

- Репост

- Поделиться

马勒戈币

马勒戈币

Создано@LittlePonyGogo

Прогресс листинга

100.00%

РК:

$63.17K

Больше токенов

Начинается война с Ираном, билет из Дамаска в Шанхай на завтра стоит 4 миллиона, данные можно найти на Цекэне.

Посмотреть Оригинал

- Награда

- лайк

- комментарий

- Репост

- Поделиться

- Награда

- 1

- комментарий

- Репост

- Поделиться

Говорят, что в храме, когда выигрываешь в лотерею, тебе везет.

Тогда я пойду перед Буддой покупать криптовалюту. Пусть Будда благословит, и я тоже смогу заработать🙏

Посмотреть ОригиналТогда я пойду перед Буддой покупать криптовалюту. Пусть Будда благословит, и я тоже смогу заработать🙏

- Награда

- лайк

- комментарий

- Репост

- Поделиться

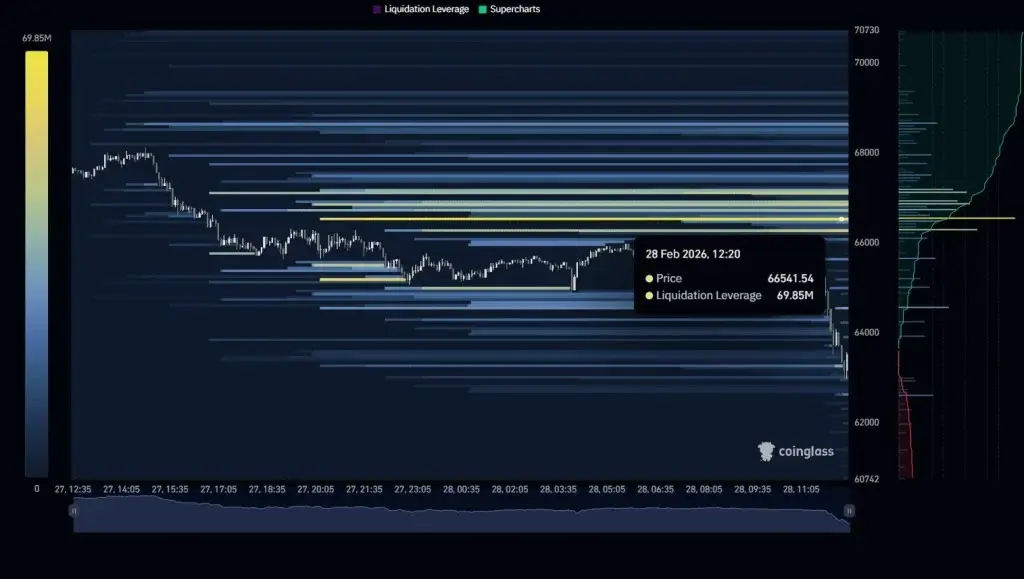

#IsraelStrikesIranBTCPlunges 🌍 Новости: США и Израиль наносят удары по Ирану — Биткойн падает на фоне глобального шока

В ходе крупной геополитической эскалации 28 февраля 2026 года Соединённые Штаты и Израиль провели скоординированные военные удары по целям внутри Ирана, что стало значительным сдвигом в напряжённости на Ближнем Востоке. Операция, описанная американскими чиновниками как превентивная, направленная на снижение воспринимаемых угроз безопасности, вызвала немедленную военную ответную реакцию Ирана, который запустил ракеты и дроны в сторону израильской территории. В Тегеране сообщаю

Посмотреть ОригиналВ ходе крупной геополитической эскалации 28 февраля 2026 года Соединённые Штаты и Израиль провели скоординированные военные удары по целям внутри Ирана, что стало значительным сдвигом в напряжённости на Ближнем Востоке. Операция, описанная американскими чиновниками как превентивная, направленная на снижение воспринимаемых угроз безопасности, вызвала немедленную военную ответную реакцию Ирана, который запустил ракеты и дроны в сторону израильской территории. В Тегеране сообщаю

- Награда

- 1

- 3

- Репост

- Поделиться

SheenCrypto :

:

LFG 🔥Подробнее

🪙FARTCOIN

Вход:

0.1491

🎯 Цели:

1) 0.1504

2) 0.1518

3) 0.1531

4) 0.1543

5) 0.1558

6) 0.1772

7) 0.1815

8) 0.1884

9) 0.2153

10) На Луну 🌖1 - 2 $

⛔️ Стоп:

0.1336

Вход:

0.1491

🎯 Цели:

1) 0.1504

2) 0.1518

3) 0.1531

4) 0.1543

5) 0.1558

6) 0.1772

7) 0.1815

8) 0.1884

9) 0.2153

10) На Луну 🌖1 - 2 $

⛔️ Стоп:

0.1336

FARTCOIN-7,23%

- Награда

- лайк

- комментарий

- Репост

- Поделиться

СРОЧНО: 🇮🇱 Израиль подтверждает, что командир IRGC Мохаммад Пакпур был убит.

Посмотреть Оригинал

- Награда

- лайк

- комментарий

- Репост

- Поделиться

У каждого есть своя история, своя молодость, просто все они зарыты в сердце, и никто не хочет их рассказывать.

Посмотреть Оригинал

- Награда

- лайк

- комментарий

- Репост

- Поделиться

#GateSquare$50KRedEnvelopeRain 🎁🔥

🚀 Огромные новости! Gate Square официально запустил безумную раздачу "Дождь из красных конвертов" на сумму 50 000 долларов!

Теперь каждый может выиграть — будь вы новым пользователем или опытным трейдером! 💯

💰 Зарабатывайте до 28 USDT за пост!

📈 Без ограничений — чем больше вы публикуете, тем больше собираете красных конвертов!

✅ Просто обновите ваше приложение до версии 8.8.0.

✅ Публикуйте в Square, и ваши награды будут автоматически зачислены.

Не пропустите свою долю призового фонда! Начинайте публиковать сегодня и получайте свои награды. 🎉

�

Посмотреть Оригинал🚀 Огромные новости! Gate Square официально запустил безумную раздачу "Дождь из красных конвертов" на сумму 50 000 долларов!

Теперь каждый может выиграть — будь вы новым пользователем или опытным трейдером! 💯

💰 Зарабатывайте до 28 USDT за пост!

📈 Без ограничений — чем больше вы публикуете, тем больше собираете красных конвертов!

✅ Просто обновите ваше приложение до версии 8.8.0.

✅ Публикуйте в Square, и ваши награды будут автоматически зачислены.

Не пропустите свою долю призового фонда! Начинайте публиковать сегодня и получайте свои награды. 🎉

�

- Награда

- 8

- 9

- Репост

- Поделиться

Yusfirah :

:

На Луну 🌕Подробнее

TMZ

Tamizhan

Создано@NLSTrading

Прогресс листинга

0.00%

РК:

$0.1

Больше токенов

Самый главный секрет торговли криптовалютой — сохранять запас, сначала заманить цену вниз с помощью приманки, а затем крупной позицией покупать по низкой цене

Посмотреть Оригинал

- Награда

- лайк

- 13

- Репост

- Поделиться

囤主流享自由 :

:

Год Коня — большой доход 🐴Подробнее

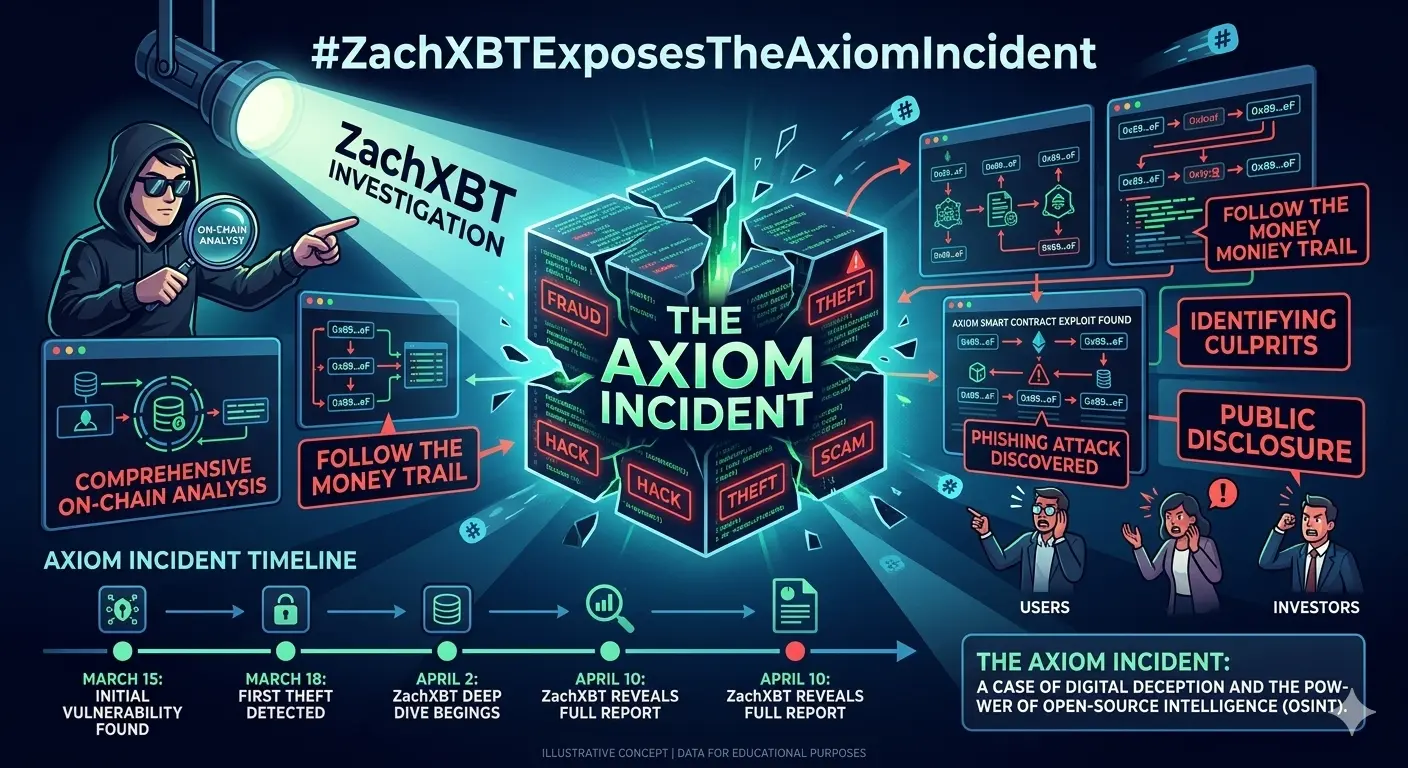

#ZachXBTExposesTheAxiomIncident

В криптовалюте прозрачность — это не опция, а неизбежность. Когда исследователь ZachXBT обращает внимание на инцидент с Axiom, его влияние выходит за рамки одного проекта. Это подрывает доверие, проверяет нарративы и напоминает всей экосистеме, что блокчейн оставляет следы.

Вот что делает такие моменты мощными: они возвращают власть к данным.

В традиционных финансах расследования могут занимать годы и оставаться скрытыми. В Web3 кошельки публичны. Транзакции отслеживаемы. Модели можно анализировать. Когда возникают irregularities, они не полагаются на слухи — о

Посмотреть ОригиналВ криптовалюте прозрачность — это не опция, а неизбежность. Когда исследователь ZachXBT обращает внимание на инцидент с Axiom, его влияние выходит за рамки одного проекта. Это подрывает доверие, проверяет нарративы и напоминает всей экосистеме, что блокчейн оставляет следы.

Вот что делает такие моменты мощными: они возвращают власть к данным.

В традиционных финансах расследования могут занимать годы и оставаться скрытыми. В Web3 кошельки публичны. Транзакции отслеживаемы. Модели можно анализировать. Когда возникают irregularities, они не полагаются на слухи — о

- Награда

- 2

- комментарий

- Репост

- Поделиться

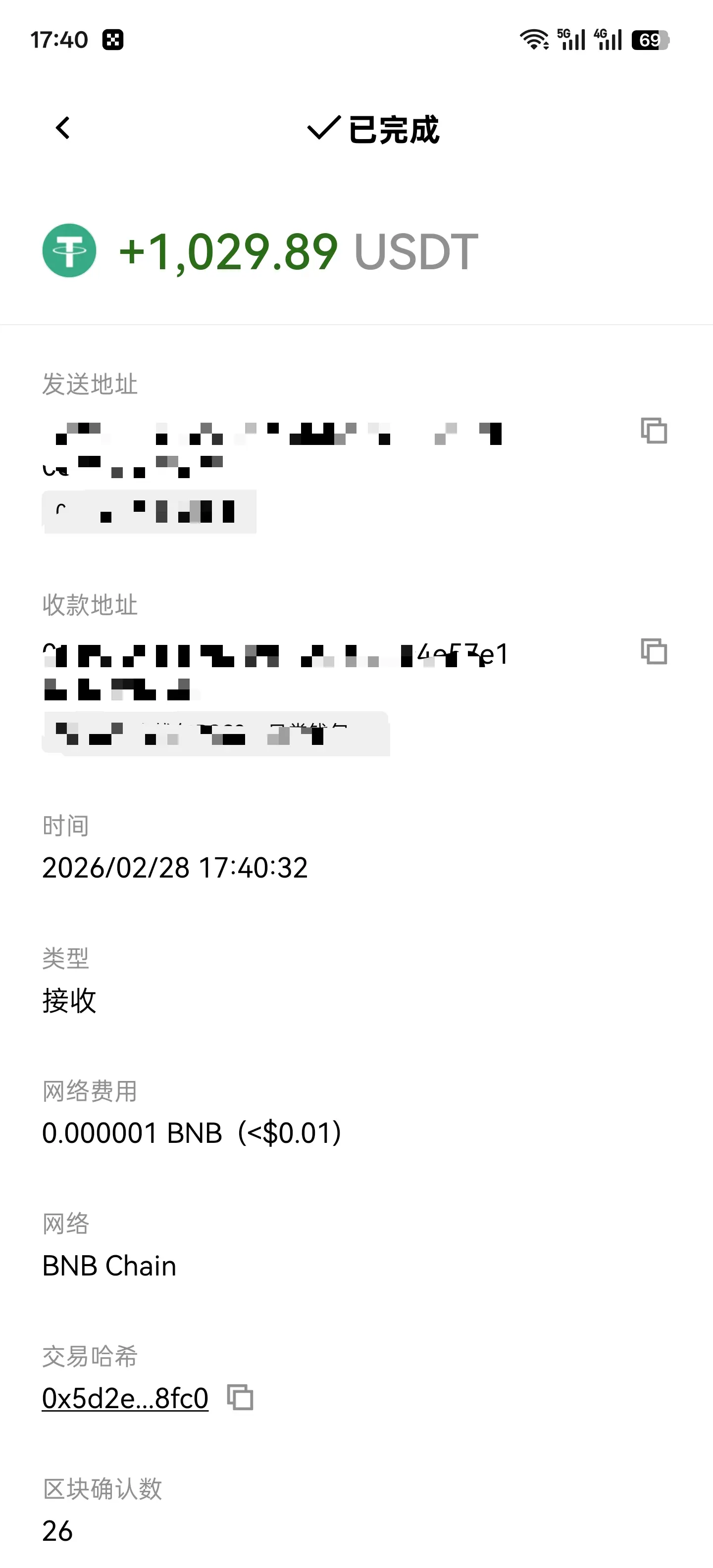

Доход 1029u

Какая самая уважаемая обвинение в тюрьме? Сегодня я общался с руководителем команды, он сам юрист. Забавно, что недавно он спрашивал у своего клиента, который отсидел 3,5 года и только что вышел.

Во-первых, какая бы ни была причина, все попадают одинаково. Если уж говорить о уважаемых, то преступления в сфере должностных полномочий — одно из них.

В камере у клиента сосед по комнате — человек, которому дали 10 лет, он даже посещал этот же тюрьму, хорошо знаком с руководством, так как все они работали в одной системе.

Все они — люди из власти, опустились, но система их не наказывает,

Какая самая уважаемая обвинение в тюрьме? Сегодня я общался с руководителем команды, он сам юрист. Забавно, что недавно он спрашивал у своего клиента, который отсидел 3,5 года и только что вышел.

Во-первых, какая бы ни была причина, все попадают одинаково. Если уж говорить о уважаемых, то преступления в сфере должностных полномочий — одно из них.

В камере у клиента сосед по комнате — человек, которому дали 10 лет, он даже посещал этот же тюрьму, хорошо знаком с руководством, так как все они работали в одной системе.

Все они — люди из власти, опустились, но система их не наказывает,

ARK-6,4%

- Награда

- лайк

- комментарий

- Репост

- Поделиться

$ESP ESP снизился на 35%, но это не остановит его — он может продолжить падение. Продажа $ESP

Финальная целевая цена: $0.1

#Gate广场发帖领五万美金红包 $ESP

Финальная целевая цена: $0.1

#Gate广场发帖领五万美金红包 $ESP

ESP-10,8%

- Награда

- 1

- комментарий

- Репост

- Поделиться

🚨 Эксклюзивные сделки подписчиков уже в эфире! 🚨

Не пропустите — присоединяйтесь сейчас и следуйте за движениями вместе с нами.

Высоковероятные сценарии. Точные входы. Серьезные прибыли. 💰

Давайте зарабатывать реальные деньги вместе.

Посмотреть ОригиналНе пропустите — присоединяйтесь сейчас и следуйте за движениями вместе с нами.

Высоковероятные сценарии. Точные входы. Серьезные прибыли. 💰

Давайте зарабатывать реальные деньги вместе.

- Награда

- лайк

- комментарий

- Репост

- Поделиться

Заработал

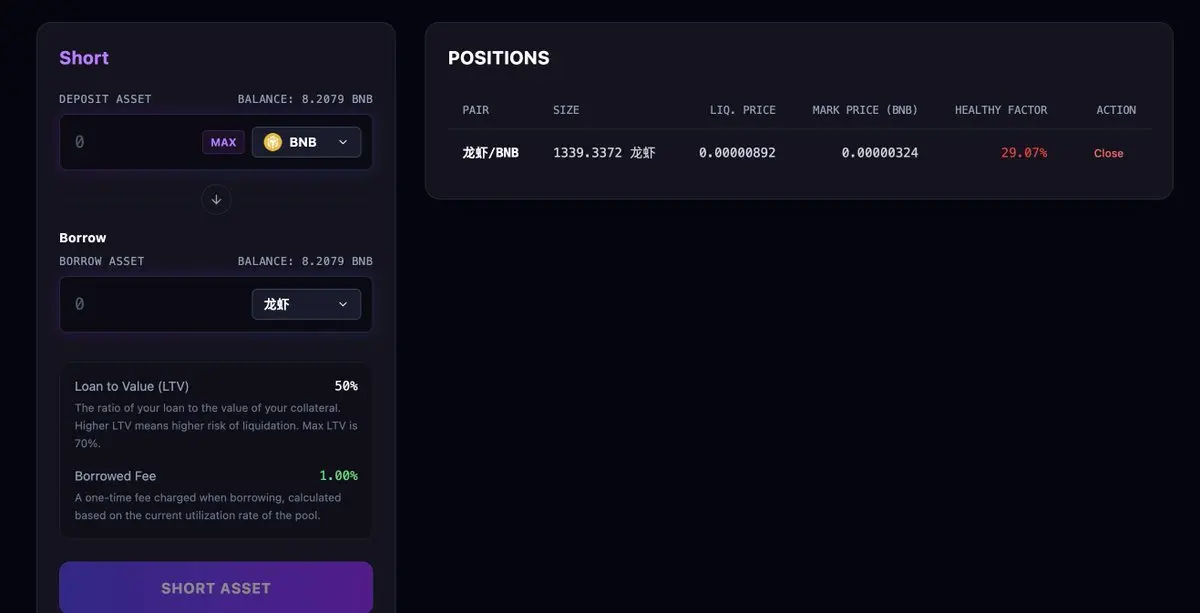

Я посмотрел ситуацию с хранилищем

Порядка 5% было взято взаймы

Это означает, что есть игроки, которые тоже участвуют

На данный момент при нажатии close не забудьте купить токен, соответствующий вашей позиции, чтобы закрыть позицию

Если возникнут проблемы при использовании продукта, можете написать мне в личные сообщения

Посмотреть ОригиналЯ посмотрел ситуацию с хранилищем

Порядка 5% было взято взаймы

Это означает, что есть игроки, которые тоже участвуют

На данный момент при нажатии close не забудьте купить токен, соответствующий вашей позиции, чтобы закрыть позицию

Если возникнут проблемы при использовании продукта, можете написать мне в личные сообщения

- Награда

- 2

- комментарий

- Репост

- Поделиться

#DeepCreationCamp

Израиль наносит удар по Ирану, крах крипторынка — живой разбор рынка (28 февраля 2026)

Криптовалютный рынок реагирует в реальном времени на одну из самых серьезных геополитических эскалаций за последние годы. В то время как Израиль начал то, что официальные лица описали как превентивный удар по Ирану, а Соединенные Штаты объявили о масштабных боевых операциях, мировые рынки немедленно перешли в режим избегания рисков. Как и ожидалось, криптовалюта почти мгновенно восприняла удар.

Геополитическая эскалация потрясает мировые рынки

По сообщениям, министр обороны Израиля Израиль

Израиль наносит удар по Ирану, крах крипторынка — живой разбор рынка (28 февраля 2026)

Криптовалютный рынок реагирует в реальном времени на одну из самых серьезных геополитических эскалаций за последние годы. В то время как Израиль начал то, что официальные лица описали как превентивный удар по Ирану, а Соединенные Штаты объявили о масштабных боевых операциях, мировые рынки немедленно перешли в режим избегания рисков. Как и ожидалось, криптовалюта почти мгновенно восприняла удар.

Геополитическая эскалация потрясает мировые рынки

По сообщениям, министр обороны Израиля Израиль

BTC-3,44%

- Награда

- 1

- комментарий

- Репост

- Поделиться

Загрузить больше

Присоединяйтесь к 40M пользователям в нашем растущем сообществе

⚡️ Присоединяйтесь к 40M пользователям в обсуждении криптовалют

💬 Общайтесь с любимыми авторами

👍 Посмотрите, что вас интересует

Популярные темы

Подробнее42.46M Популярность

150.27K Популярность

93.21K Популярность

1.66M Популярность

491.75K Популярность

Горячее на Gate Fun

Подробнее- РК:$2.34KДержатели:20.00%

- РК:$2.29KДержатели:10.00%

- РК:$0.1Держатели:10.00%

- РК:$2.34KДержатели:20.14%

- РК:$2.33KДержатели:20.07%

Новости

ПодробнееРаздача второго этапа Bitlayer уже открыта для получения

16 м

Анализ: ставка финансирования по биткоину снизилась до -6%, что может вызвать потенциальную ликвидацию коротких позиций

20 м

С октября прошлого года крупный кит, постепенно накапливающий цифровое золото на сумму 12,4 миллиона долларов, уже получил прибыль в 352,1 тысячи долларов

42 м

Американский высокопоставленный чиновник: у США пока нет пострадавших.

54 м

Данные: если ETH преодолеет уровень 1 947 долларов, совокупная сила ликвидации коротких позиций на основных централизованных биржах достигнет 7,87 миллиарда долларов

1 ч

Закрепить