HuntingGoldBaby

Evening Analysis and Trading Suggestions for Bitcoin and Ethereum on December 4

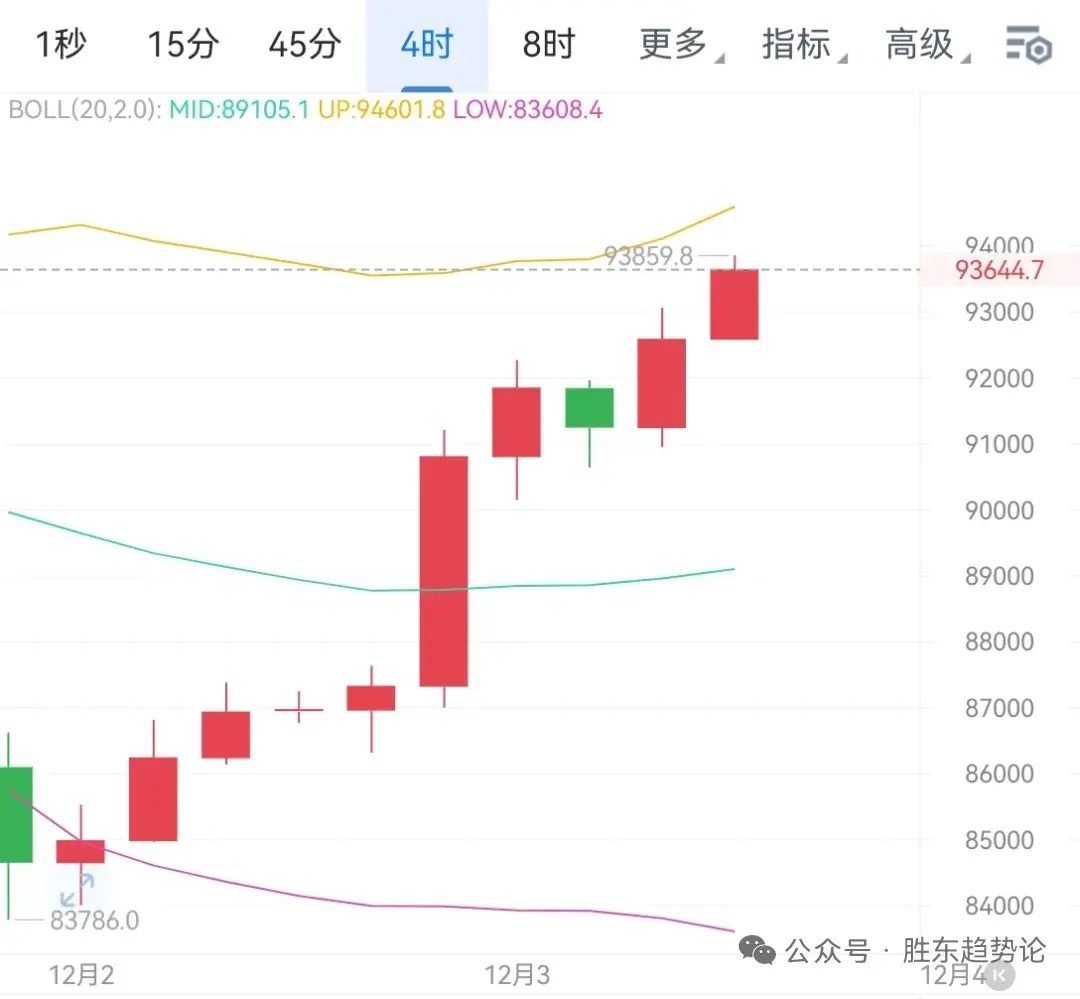

The current market shows strong upward momentum. On the 4-hour chart, after a period of consolidation, there has been a successful breakout to the upside. The price action has formed a clear double-bottom support structure below, with higher lows gradually established through multiple rounds of bottom building. This has solidified the market’s base and provided a strong foundation for further rebounds.

At present, the price continues to rise and has effectively reclaimed the middle band of the Bollinger Bands. The

View OriginalThe current market shows strong upward momentum. On the 4-hour chart, after a period of consolidation, there has been a successful breakout to the upside. The price action has formed a clear double-bottom support structure below, with higher lows gradually established through multiple rounds of bottom building. This has solidified the market’s base and provided a strong foundation for further rebounds.

At present, the price continues to rise and has effectively reclaimed the middle band of the Bollinger Bands. The