# GlobalMarkets

5.84K

MissCrypto

🇯🇵 Pemilihan Jepang 2026: Kemenangan Telak Sejarah, Mandat Kuat & Gelombang Kejut Pasar

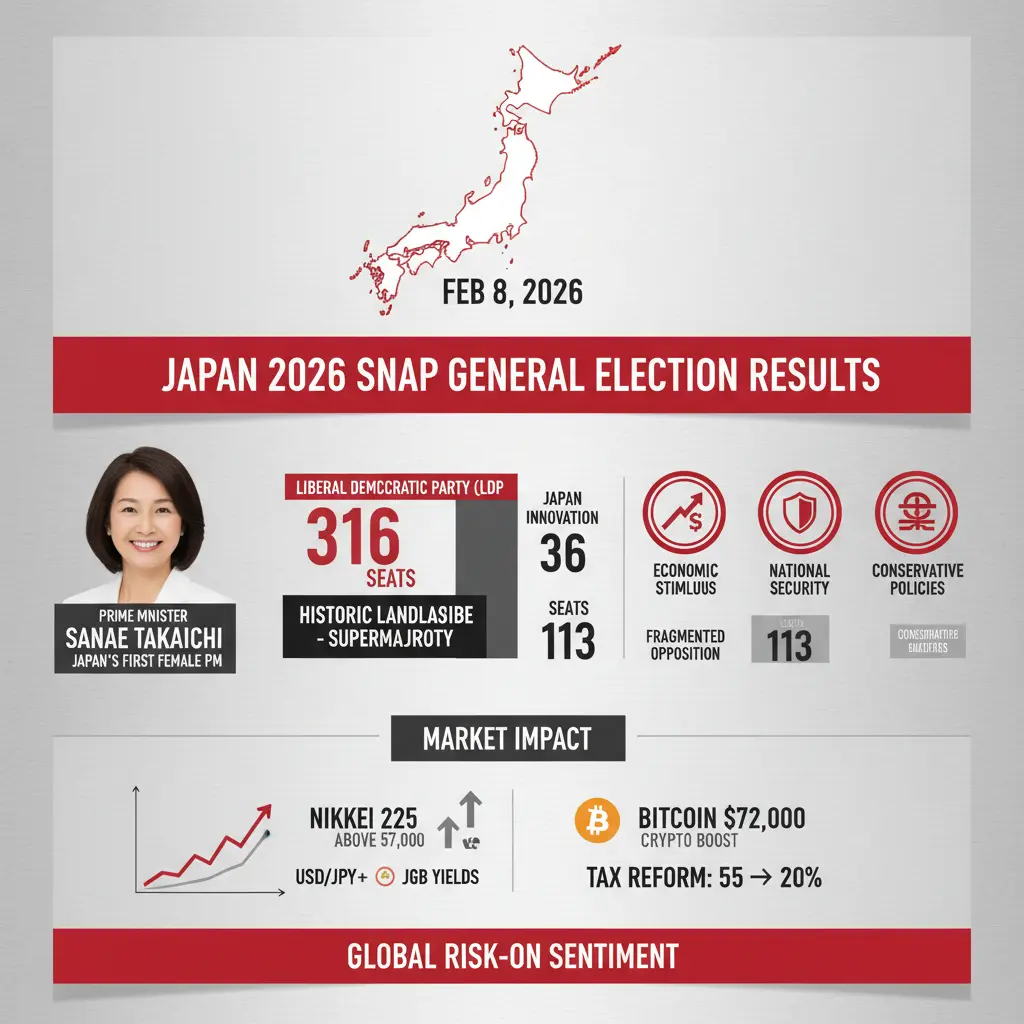

Pemilihan umum mendadak Jepang pada 8 Februari 2026 telah menghasilkan salah satu hasil paling menentukan dalam sejarah pasca perang negara tersebut. Perdana Menteri Sanae Takaichi, perdana menteri wanita pertama Jepang, mendapatkan mandat yang luar biasa hanya beberapa bulan setelah menjabat—mengubah lanskap politik dan pasar Jepang dalam satu langkah.

🗳️ Hasil Pemilihan Secara Singkat

Meskipun terjadi hujan salju lebat dan tingkat partisipasi sekitar 55,7%, pemilih memberikan Partai Demokrat Liberal (L

Pemilihan umum mendadak Jepang pada 8 Februari 2026 telah menghasilkan salah satu hasil paling menentukan dalam sejarah pasca perang negara tersebut. Perdana Menteri Sanae Takaichi, perdana menteri wanita pertama Jepang, mendapatkan mandat yang luar biasa hanya beberapa bulan setelah menjabat—mengubah lanskap politik dan pasar Jepang dalam satu langkah.

🗳️ Hasil Pemilihan Secara Singkat

Meskipun terjadi hujan salju lebat dan tingkat partisipasi sekitar 55,7%, pemilih memberikan Partai Demokrat Liberal (L

BTC-1,74%

- Hadiah

- 7

- 9

- Posting ulang

- Bagikan

CryptoFiler :

:

Selamat Tahun Baru! 🤑Lihat Lebih Banyak

Penjualan Teknologi Global Mengguncang Aset Risiko: Apa yang Perlu Diketahui Investor

Pasar keuangan global menghadapi tekanan yang meningkat karena penjualan besar-besaran saham teknologi menyebar ke seluruh aset risiko. Dimulai sebagai penarikan kembali saham teknologi dengan pertumbuhan tinggi telah berkembang menjadi recalibrasi pasar yang lebih luas, menyoroti betapa saling terkaitnya ekuitas, kripto, dan pasar berkembang.

Inti dari pergerakan ini adalah perubahan dalam ekspektasi makro. Inflasi yang persistens, prospek suku bunga yang lebih tinggi untuk jangka panjang, dan kondisi keuang

Pasar keuangan global menghadapi tekanan yang meningkat karena penjualan besar-besaran saham teknologi menyebar ke seluruh aset risiko. Dimulai sebagai penarikan kembali saham teknologi dengan pertumbuhan tinggi telah berkembang menjadi recalibrasi pasar yang lebih luas, menyoroti betapa saling terkaitnya ekuitas, kripto, dan pasar berkembang.

Inti dari pergerakan ini adalah perubahan dalam ekspektasi makro. Inflasi yang persistens, prospek suku bunga yang lebih tinggi untuk jangka panjang, dan kondisi keuang

BTC-1,74%

- Hadiah

- 1

- 1

- Posting ulang

- Bagikan

Lock_433 :

:

Beli Untuk Mendapatkan 💎Berikut adalah posting profesional untuk Gate.io di #USIranNuclearTalksTurmoil:🌍📉 #USIranNuclearTalksTurmoil – Pasar Global dalam WaspadaKetidakpastian di pasar global sedang meningkat akibat gejolak dalam pembicaraan nuklir AS–Iran, mempengaruhi sentimen risiko dan volatilitas aset. ⚠️✨ Apa yang Harus Diperhatikan Trader:Rising ketegangan geopolitik dapat mempengaruhi stabilitas pasar global 🌐Meningkatkan volatilitas di seluruh pasar energi, komoditas, dan crypto 📊Perubahan sentimen investor terhadap aset safe-haven dan alternatif 🛡️💡 Wawasan Gate.io:Tetap terinformasi tentang perkemban

Lihat Asli- Hadiah

- 2

- Komentar

- Posting ulang

- Bagikan

🚨 BERITA TERKINI 🚨

📉 Saham Campur

Pasar global berfluktuasi dengan perbedaan sektor dan wilayah. Saham teknologi & pertumbuhan sangat fluktuatif, sementara energi & komoditas kadang mengungguli.

🪙 Bitcoin & Altcoin Fluktuatif

BTC, ETH, XRP berayun tajam karena ketidakpastian makro dan sentimen risiko. Pedagang melihat peluang; pemegang jangka panjang tetap berhati-hati.

⚠️ Investor Hati-hati

Berita Fed, ekspektasi suku bunga, dan ketegangan geopolitik menciptakan suasana risiko rendah. Aset safe-haven seperti emas menarik perhatian.

#BreakingNews

#GlobalMarkets

Lihat Asli📉 Saham Campur

Pasar global berfluktuasi dengan perbedaan sektor dan wilayah. Saham teknologi & pertumbuhan sangat fluktuatif, sementara energi & komoditas kadang mengungguli.

🪙 Bitcoin & Altcoin Fluktuatif

BTC, ETH, XRP berayun tajam karena ketidakpastian makro dan sentimen risiko. Pedagang melihat peluang; pemegang jangka panjang tetap berhati-hati.

⚠️ Investor Hati-hati

Berita Fed, ekspektasi suku bunga, dan ketegangan geopolitik menciptakan suasana risiko rendah. Aset safe-haven seperti emas menarik perhatian.

#BreakingNews

#GlobalMarkets

- Hadiah

- 3

- 2

- Posting ulang

- Bagikan

DragonFlyOfficial :

:

GOGOGO 2026 👊Lihat Lebih Banyak

#MiddleEastTensionsEscalate 🌍

Risiko geopolitik kembali menjadi fokus, dan pasar sedang menilai kembali ketidakpastian secara real-time. Pasar energi memanas, volatilitas menyebar, dan modal beralih ke perlindungan daripada spekulasi.

Apa yang kita lihat: • Minyak bereaksi terhadap risiko pasokan dan ketidakstabilan regional

• Saham menjadi berhati-hati seiring kenaikan premi risiko

• Emas menarik aliran defensif

• Kripto menghadapi tekanan jangka pendek saat likuiditas mengencang

Fase ini bukan tentang memprediksi berita utama. Ini tentang membaca perilaku modal.

Selama ketegangan geopolitik

Risiko geopolitik kembali menjadi fokus, dan pasar sedang menilai kembali ketidakpastian secara real-time. Pasar energi memanas, volatilitas menyebar, dan modal beralih ke perlindungan daripada spekulasi.

Apa yang kita lihat: • Minyak bereaksi terhadap risiko pasokan dan ketidakstabilan regional

• Saham menjadi berhati-hati seiring kenaikan premi risiko

• Emas menarik aliran defensif

• Kripto menghadapi tekanan jangka pendek saat likuiditas mengencang

Fase ini bukan tentang memprediksi berita utama. Ini tentang membaca perilaku modal.

Selama ketegangan geopolitik

Lihat Asli

- Hadiah

- 12

- 12

- Posting ulang

- Bagikan

Crypto_Buzz_with_Alex :

:

Sangat menghargai kejelasan dan usaha yang Anda berikan dalam posting ini — jarang sekali melihat konten kripto yang sekaligus penuh wawasan dan mudah dipahami. Perspektif Anda menambah nilai nyata bagi komunitas. Terus bagikan karya berharga seperti ini! 🚀📊Lihat Lebih Banyak

#MiddleEastTensionsEscalate 🌍

Tekanan geopolitik meningkat, dan pasar bereaksi dengan cepat. Volatilitas minyak naik, aset risiko bergoyang, tempat aman mendapatkan perhatian.

Trader pintar tetap tenang, kelola risiko, dan perhatikan zona likuiditas dengan hati-hati.

Dalam masa yang tidak pasti, disiplin > emosi.

#GlobalMarkets #Crypto #Gold #Oil

Lihat AsliTekanan geopolitik meningkat, dan pasar bereaksi dengan cepat. Volatilitas minyak naik, aset risiko bergoyang, tempat aman mendapatkan perhatian.

Trader pintar tetap tenang, kelola risiko, dan perhatikan zona likuiditas dengan hati-hati.

Dalam masa yang tidak pasti, disiplin > emosi.

#GlobalMarkets #Crypto #Gold #Oil

- Hadiah

- 14

- 14

- Posting ulang

- Bagikan

Crypto_Buzz_with_Alex :

:

Sangat menghargai kejelasan dan usaha yang Anda berikan dalam posting ini — jarang sekali melihat konten kripto yang sekaligus penuh wawasan dan mudah dipahami. Perspektif Anda menambah nilai nyata bagi komunitas. Terus bagikan karya berharga seperti ini! 🚀📊Lihat Lebih Banyak

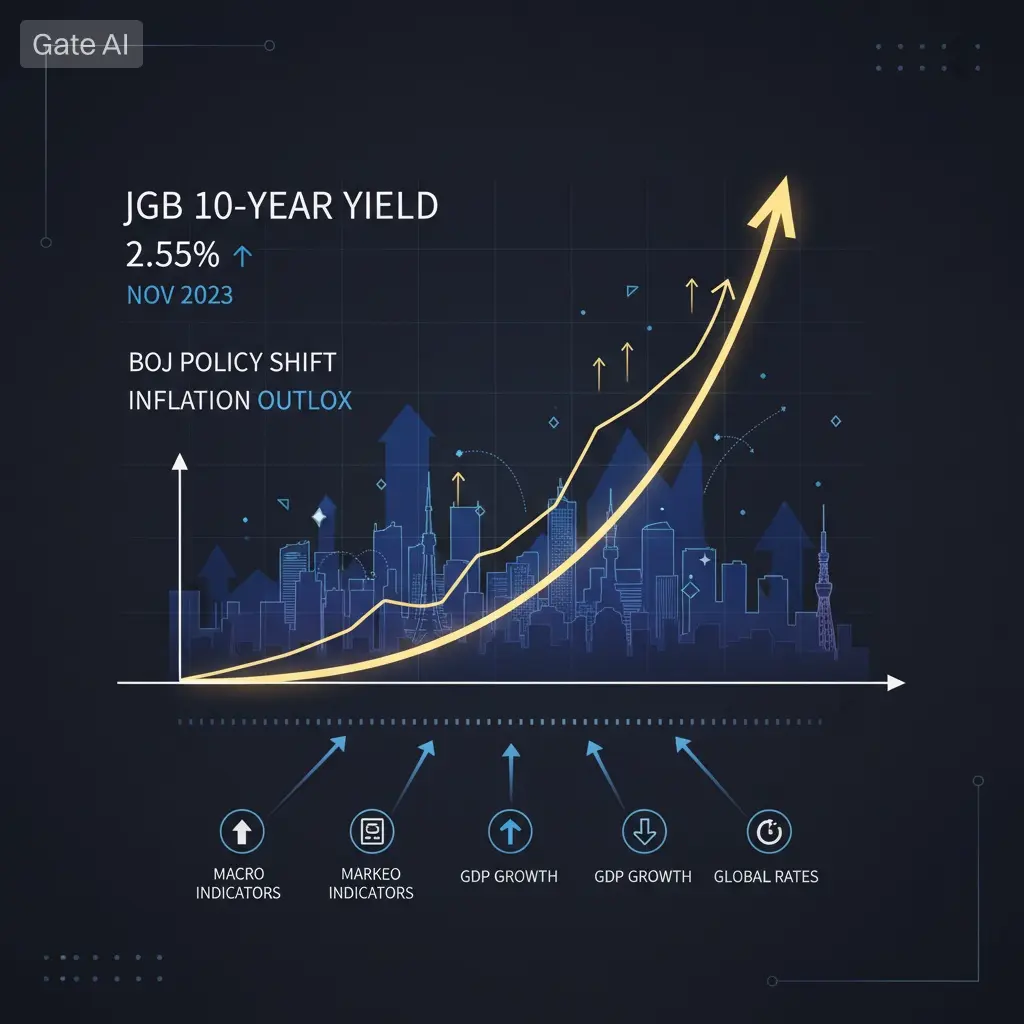

⚠️ #JapanBondMarketSell-Off — Langkah Makro yang Bisa Menggeser Pasar Global

Hasil obligasi 30Y & 40Y Jepang melonjak lebih dari 25 bps, menandakan potensi pergeseran setelah rencana untuk melonggarkan pengetatan fiskal dan meningkatkan pengeluaran.

Secara tradisional dikaitkan dengan hasil yang sangat rendah, langkah Jepang ini bisa mempengaruhi aliran modal global dan ekspektasi suku bunga.

📊 Mengapa Ini Penting

Hasil yang lebih tinggi di Jepang dapat memberi tekanan pada aset berisiko di seluruh dunia, termasuk kripto

Bisa memicu penyesuaian harga yang lebih luas di pasar obligasi dan saha

Lihat AsliHasil obligasi 30Y & 40Y Jepang melonjak lebih dari 25 bps, menandakan potensi pergeseran setelah rencana untuk melonggarkan pengetatan fiskal dan meningkatkan pengeluaran.

Secara tradisional dikaitkan dengan hasil yang sangat rendah, langkah Jepang ini bisa mempengaruhi aliran modal global dan ekspektasi suku bunga.

📊 Mengapa Ini Penting

Hasil yang lebih tinggi di Jepang dapat memberi tekanan pada aset berisiko di seluruh dunia, termasuk kripto

Bisa memicu penyesuaian harga yang lebih luas di pasar obligasi dan saha

- Hadiah

- 1

- Komentar

- Posting ulang

- Bagikan

#JapanBondMarketSell-Off 🇯🇵

Pasar obligasi Jepang baru saja mengirim sinyal kuat ke pasar global.

📉

Hasil obligasi JGB 30Y dan 40Y melonjak lebih dari 25 bps setelah rencana untuk mengakhiri pengetatan fiskal dan meningkatkan pengeluaran pemerintah.

Lalu mengapa ini penting di luar Jepang?

🌍 Mengapa pasar global memperhatikan

·

Hasil Jepang yang lebih tinggi mengurangi kebutuhan investor Jepang untuk mencari imbal hasil di luar negeri

·

Ini bisa berarti aliran modal yang lebih sedikit ke obligasi AS dan obligasi global

·

Hasil yang meningkat di Jepang dapat secara

Lihat AsliPasar obligasi Jepang baru saja mengirim sinyal kuat ke pasar global.

📉

Hasil obligasi JGB 30Y dan 40Y melonjak lebih dari 25 bps setelah rencana untuk mengakhiri pengetatan fiskal dan meningkatkan pengeluaran pemerintah.

Lalu mengapa ini penting di luar Jepang?

🌍 Mengapa pasar global memperhatikan

·

Hasil Jepang yang lebih tinggi mengurangi kebutuhan investor Jepang untuk mencari imbal hasil di luar negeri

·

Ini bisa berarti aliran modal yang lebih sedikit ke obligasi AS dan obligasi global

·

Hasil yang meningkat di Jepang dapat secara

- Hadiah

- 2

- Komentar

- Posting ulang

- Bagikan

📉🌍 #MajorStockIndexesPlunge | Pasar Global Di Bawah Tekanan ⚠️

Indeks saham utama telah jatuh tajam, mencerminkan meningkatnya risiko aversi di seluruh pasar global. Ketidakpastian makro yang meningkat, kekhawatiran kebijakan, dan perkembangan geopolitik mendorong investor untuk menilai kembali paparan terhadap aset berisiko. 📊💥

🔍 Apa yang Mempengaruhi Pasar:

💵 Perubahan dalam ekspektasi suku bunga dan likuiditas

🌐 Ketidakpastian ekonomi dan geopolitik global

🔄 Rotasi ke aset defensif dan safe-haven

💡 Tekanan pasar saham sering kali merembet ke kripto dan komoditas, meningkatkan volat

Lihat AsliIndeks saham utama telah jatuh tajam, mencerminkan meningkatnya risiko aversi di seluruh pasar global. Ketidakpastian makro yang meningkat, kekhawatiran kebijakan, dan perkembangan geopolitik mendorong investor untuk menilai kembali paparan terhadap aset berisiko. 📊💥

🔍 Apa yang Mempengaruhi Pasar:

💵 Perubahan dalam ekspektasi suku bunga dan likuiditas

🌐 Ketidakpastian ekonomi dan geopolitik global

🔄 Rotasi ke aset defensif dan safe-haven

💡 Tekanan pasar saham sering kali merembet ke kripto dan komoditas, meningkatkan volat

- Hadiah

- 2

- Komentar

- Posting ulang

- Bagikan

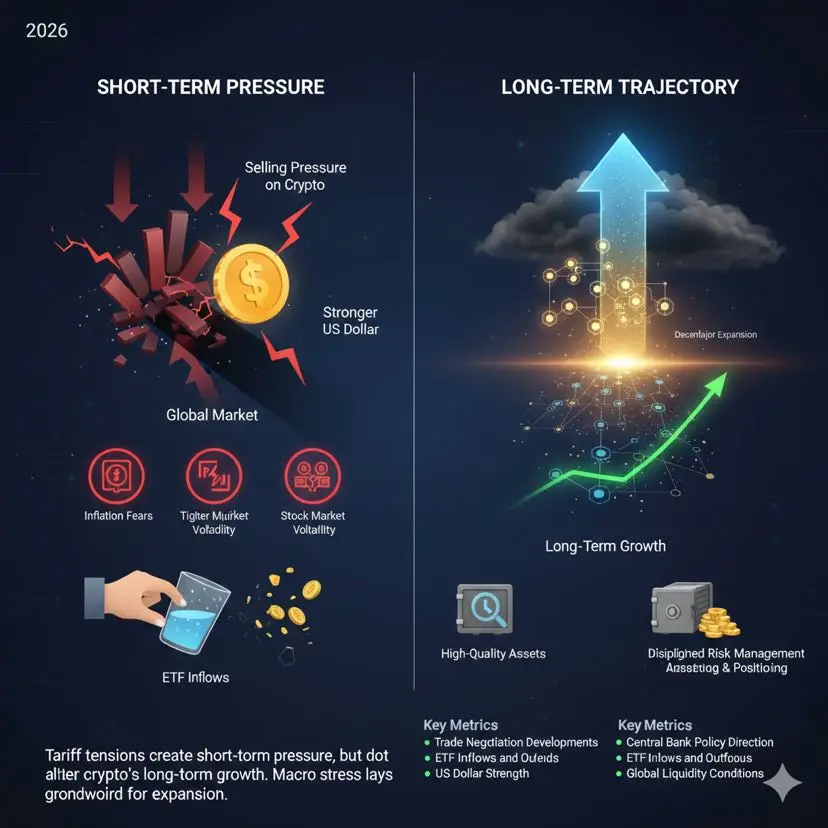

#FutureOutlook2026

Prospek Masa Depan & Dampak Pasar (2026)

Ketegangan tarif global yang meningkat dan pembatasan perdagangan yang diperbarui telah menjadi kekuatan makro yang kuat membentuk pasar keuangan di tahun 2026. Seiring meningkatnya tekanan geopolitik, cryptocurrency—yang sangat sensitif terhadap kondisi likuiditas dan psikologi investor—sekali lagi merespons ketidakpastian di skala global.

Ketika konflik tarif meningkat, pasar biasanya beralih ke lingkungan risiko rendah. Investor mengurangi eksposur terhadap aset yang volatil dan mengalihkan modal ke arah yang dianggap aman. Transis

Prospek Masa Depan & Dampak Pasar (2026)

Ketegangan tarif global yang meningkat dan pembatasan perdagangan yang diperbarui telah menjadi kekuatan makro yang kuat membentuk pasar keuangan di tahun 2026. Seiring meningkatnya tekanan geopolitik, cryptocurrency—yang sangat sensitif terhadap kondisi likuiditas dan psikologi investor—sekali lagi merespons ketidakpastian di skala global.

Ketika konflik tarif meningkat, pasar biasanya beralih ke lingkungan risiko rendah. Investor mengurangi eksposur terhadap aset yang volatil dan mengalihkan modal ke arah yang dianggap aman. Transis

BTC-1,74%

- Hadiah

- 4

- 3

- Posting ulang

- Bagikan

ybaser :

:

GOGOGO 2026 👊Lihat Lebih Banyak

Muat Lebih Banyak

Bergabung dengan 40M pengguna dalam komunitas yang terus berkembang

⚡️ Bergabung dengan 40M pengguna dalam diskusi tren kripto yang sedang ramai

💬 Berinteraksi dengan kreator top favorit Anda

👍 Lihat apa yang menarik minat Anda

Topik Trending

242.3K Popularitas

55.53K Popularitas

29.03K Popularitas

22.55K Popularitas

19.94K Popularitas

121.32K Popularitas

7.72K Popularitas

13.2K Popularitas

6.77K Popularitas

5.67K Popularitas

6.94K Popularitas

17.68K Popularitas

4.21K Popularitas

23.5K Popularitas

15.61K Popularitas

Berita

Lihat Lebih BanyakLINEA(Linea)24 jam naik 31.44%

10 men

Dompet baru menyetor 5.1 juta USDC ke Hyperliquid dan membuka posisi short GOLD melalui trade.xyz

15 men

BERA(Berachain)24 jam naik 75.53%

18 men

Elon Musk: Versi pengujian eksternal X Money akan diluncurkan dalam 1-2 bulan ke depan

32 men

Pergerakan harga berbagai aset keuangan tradisional, emas, perak, dan minyak mentah semuanya mengalami kenaikan secara menyeluruh

34 men

Sematkan