#BitcoinFallsBehindGold “Vàng Kỹ Thuật Số” Đang Mất Dần Ưu Thế Trước Trái Tim Tin Cậy Truyền Thống

Trong nhiều năm, Bitcoin đã được xem như một đối thủ của vàng — một kho lưu trữ giá trị hiện đại cho kỷ nguyên số. Tuy nhiên, đầu năm 2026 kể một câu chuyện khác. Vàng giao ngay đã vượt qua mức 5.200 USD/oz, tăng mạnh trong bối cảnh bất ổn toàn cầu gia tăng, trong khi Bitcoin vẫn dao động trong phạm vi từ 86.000 USD đến 89.000 USD, gặp khó khăn trong việc lấy lại đà quyết định. Trong thị trường biến động, vốn thường ưu tiên các tài sản được hỗ trợ bởi sự chắc chắn vật lý và niềm tin kéo dài hàng thế kỷ.

Cốt lõi của sự phân kỳ này là sự ưu tiên toàn cầu mới dành cho các nơi trú ẩn an toàn thuần túy. Các nhà đầu tư đang ưu tiên bảo vệ hơn là tăng trưởng, phản ứng trước các rủi ro như khả năng chính phủ Mỹ đóng cửa, căng thẳng địa chính trị quanh Greenland, và các vấn đề thương mại cùng thuế quan chưa được giải quyết. Phân tích của các tổ chức cho thấy tỷ lệ Bitcoin so với vàng giảm xuống mức thấp nhiều năm, báo hiệu sự chuyển hướng trở lại các kho lưu trữ giá trị truyền thống. Trong những thời kỳ căng thẳng, độ tin cậy luôn vượt trội so với khả năng lựa chọn.

Ngân hàng trung ương đã thúc đẩy nhanh quá trình tăng giá của vàng. Các tổ chức chủ quyền tiếp tục đa dạng hóa dự trữ khỏi tiền tệ fiat và hướng tới các tài sản cứng. Ước tính đầu năm 2026 cho thấy đã tích lũy hàng trăm tấn vàng, củng cố nhu cầu cấu trúc. Ngược lại, Bitcoin vẫn chủ yếu vắng mặt trong dự trữ chính thức, hạn chế khả năng thu hút dòng vốn chảy vào như trong các cuộc khủng hoảng vĩ mô trước đây, vốn thường thúc đẩy giá vàng.

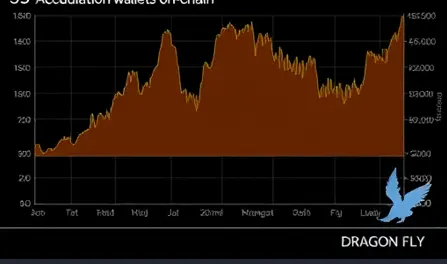

Động thái thanh khoản trong thị trường crypto còn giải thích rõ hơn về hiệu suất kém của Bitcoin. Chuỗi thanh lý trị giá $19 tỷ USD vào giữa tháng 1 đã làm nổi bật cách BTC vẫn được xem như một công cụ rủi ro trong giai đoạn căng thẳng đòn bẩy. Trong khi vàng hấp thụ cú sốc với áp lực tăng giá, Bitcoin vẫn dễ bị tổn thương bởi việc giảm đòn bẩy bắt buộc — một đặc điểm tiếp tục thách thức câu chuyện “vàng kỹ thuật số”.

Xét về mặt kỹ thuật, sự đối lập rõ rệt. Bitcoin vẫn bị giới hạn dưới mức kháng cự tâm lý 100.000 USD, nơi áp lực bán kéo dài hạn chế đà tăng. Trong khi đó, vàng đã bước vào vùng mở rộng có độ kháng cự thấp, giao dịch trên mức 5.200 USD với nguồn cung hạn chế phía trên. Sự bứt phá mà nhiều người mong đợi cho Bitcoin vào cuối năm 2025 vẫn chưa thành hiện thực, trong khi các kim loại quý tiếp tục xu hướng rõ ràng giữa bối cảnh bất ổn.

Về chiến lược, sự phân kỳ này báo hiệu việc làm rõ vai trò, chứ không phải thất bại. Vàng khẳng định lại vị thế như một công cụ phòng ngừa địa chính trị và tài sản bảo toàn vốn. Bitcoin giữ vai trò hỗn hợp: một kho lưu trữ giá trị công nghệ dài hạn và một công cụ tăng trưởng dựa trên thanh khoản. Mỗi loại phản ứng khác nhau với các điều kiện vĩ mô, và việc nhầm lẫn giữa chúng dẫn đến kỳ vọng sai lệch.

Đối với xây dựng danh mục, sự sụt giảm trong mối tương quan là một tín hiệu quan trọng. Điều kiện đầu năm 2026 đòi hỏi phải đánh giá lại vai trò của các tài sản dựa trên tâm lý rủi ro, hoạt động của ngân hàng trung ương và chu kỳ thanh khoản. Các nhà đầu tư nhận biết khi nào nên ưu tiên khả năng chống chịu so với việc theo đuổi sự bất đối xứng có thể điều hướng biến động trong khi vẫn giữ được tiềm năng tăng trưởng.

Cuối cùng, thông điệp rõ ràng: trong những giai đoạn bất ổn toàn cầu, vốn vẫn hướng về các tài sản được hỗ trợ bởi niềm tin kéo dài hàng thế kỷ. Bitcoin vẫn là một đổi mới mang tính chuyển đổi, nhưng giai đoạn hiện tại nhấn mạnh rằng “vàng kỹ thuật số” phải tồn tại song song — và cạnh tranh — với các khoản phòng hộ vật lý đã ăn sâu vào nền tảng.

Đây không phải là thất bại của Bitcoin — đó là bài học thị trường nhấn mạnh sự thận trọng, phân bổ chiến lược và sự cân bằng ngày càng phát triển giữa các kho lưu trữ giá trị truyền thống và kỹ thuật số.

Trong nhiều năm, Bitcoin đã được xem như một đối thủ của vàng — một kho lưu trữ giá trị hiện đại cho kỷ nguyên số. Tuy nhiên, đầu năm 2026 kể một câu chuyện khác. Vàng giao ngay đã vượt qua mức 5.200 USD/oz, tăng mạnh trong bối cảnh bất ổn toàn cầu gia tăng, trong khi Bitcoin vẫn dao động trong phạm vi từ 86.000 USD đến 89.000 USD, gặp khó khăn trong việc lấy lại đà quyết định. Trong thị trường biến động, vốn thường ưu tiên các tài sản được hỗ trợ bởi sự chắc chắn vật lý và niềm tin kéo dài hàng thế kỷ.

Cốt lõi của sự phân kỳ này là sự ưu tiên toàn cầu mới dành cho các nơi trú ẩn an toàn thuần túy. Các nhà đầu tư đang ưu tiên bảo vệ hơn là tăng trưởng, phản ứng trước các rủi ro như khả năng chính phủ Mỹ đóng cửa, căng thẳng địa chính trị quanh Greenland, và các vấn đề thương mại cùng thuế quan chưa được giải quyết. Phân tích của các tổ chức cho thấy tỷ lệ Bitcoin so với vàng giảm xuống mức thấp nhiều năm, báo hiệu sự chuyển hướng trở lại các kho lưu trữ giá trị truyền thống. Trong những thời kỳ căng thẳng, độ tin cậy luôn vượt trội so với khả năng lựa chọn.

Ngân hàng trung ương đã thúc đẩy nhanh quá trình tăng giá của vàng. Các tổ chức chủ quyền tiếp tục đa dạng hóa dự trữ khỏi tiền tệ fiat và hướng tới các tài sản cứng. Ước tính đầu năm 2026 cho thấy đã tích lũy hàng trăm tấn vàng, củng cố nhu cầu cấu trúc. Ngược lại, Bitcoin vẫn chủ yếu vắng mặt trong dự trữ chính thức, hạn chế khả năng thu hút dòng vốn chảy vào như trong các cuộc khủng hoảng vĩ mô trước đây, vốn thường thúc đẩy giá vàng.

Động thái thanh khoản trong thị trường crypto còn giải thích rõ hơn về hiệu suất kém của Bitcoin. Chuỗi thanh lý trị giá $19 tỷ USD vào giữa tháng 1 đã làm nổi bật cách BTC vẫn được xem như một công cụ rủi ro trong giai đoạn căng thẳng đòn bẩy. Trong khi vàng hấp thụ cú sốc với áp lực tăng giá, Bitcoin vẫn dễ bị tổn thương bởi việc giảm đòn bẩy bắt buộc — một đặc điểm tiếp tục thách thức câu chuyện “vàng kỹ thuật số”.

Xét về mặt kỹ thuật, sự đối lập rõ rệt. Bitcoin vẫn bị giới hạn dưới mức kháng cự tâm lý 100.000 USD, nơi áp lực bán kéo dài hạn chế đà tăng. Trong khi đó, vàng đã bước vào vùng mở rộng có độ kháng cự thấp, giao dịch trên mức 5.200 USD với nguồn cung hạn chế phía trên. Sự bứt phá mà nhiều người mong đợi cho Bitcoin vào cuối năm 2025 vẫn chưa thành hiện thực, trong khi các kim loại quý tiếp tục xu hướng rõ ràng giữa bối cảnh bất ổn.

Về chiến lược, sự phân kỳ này báo hiệu việc làm rõ vai trò, chứ không phải thất bại. Vàng khẳng định lại vị thế như một công cụ phòng ngừa địa chính trị và tài sản bảo toàn vốn. Bitcoin giữ vai trò hỗn hợp: một kho lưu trữ giá trị công nghệ dài hạn và một công cụ tăng trưởng dựa trên thanh khoản. Mỗi loại phản ứng khác nhau với các điều kiện vĩ mô, và việc nhầm lẫn giữa chúng dẫn đến kỳ vọng sai lệch.

Đối với xây dựng danh mục, sự sụt giảm trong mối tương quan là một tín hiệu quan trọng. Điều kiện đầu năm 2026 đòi hỏi phải đánh giá lại vai trò của các tài sản dựa trên tâm lý rủi ro, hoạt động của ngân hàng trung ương và chu kỳ thanh khoản. Các nhà đầu tư nhận biết khi nào nên ưu tiên khả năng chống chịu so với việc theo đuổi sự bất đối xứng có thể điều hướng biến động trong khi vẫn giữ được tiềm năng tăng trưởng.

Cuối cùng, thông điệp rõ ràng: trong những giai đoạn bất ổn toàn cầu, vốn vẫn hướng về các tài sản được hỗ trợ bởi niềm tin kéo dài hàng thế kỷ. Bitcoin vẫn là một đổi mới mang tính chuyển đổi, nhưng giai đoạn hiện tại nhấn mạnh rằng “vàng kỹ thuật số” phải tồn tại song song — và cạnh tranh — với các khoản phòng hộ vật lý đã ăn sâu vào nền tảng.

Đây không phải là thất bại của Bitcoin — đó là bài học thị trường nhấn mạnh sự thận trọng, phân bổ chiến lược và sự cân bằng ngày càng phát triển giữa các kho lưu trữ giá trị truyền thống và kỹ thuật số.