# BitcoinDropsBelowKeyPriceLevel

6.04K

BeautifulDay

#BitcoinDropsBelowKeyPriceLevel

Bitcoin (BTC) đã giảm xuống dưới một mức giá quan trọng, báo hiệu áp lực ngắn hạn gia tăng và sự thận trọng trên toàn thị trường tiền điện tử.

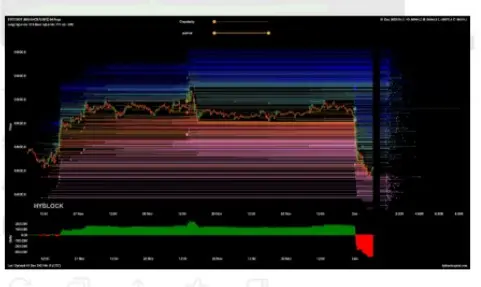

🔍 Tổng quan thị trường

BTC không giữ được trên vùng hỗ trợ quan trọng, biến nó thành kháng cự ngay lập tức

Áp lực bán đã tăng lên, với khối lượng mua yếu

Chỉ số động lượng ngắn hạn cho thấy xu hướng giảm

🟢 Các mức hỗ trợ chính cần theo dõi

Hỗ trợ ngay lập tức: $— (vùng hỗ trợ địa phương gần đây)

Vùng giảm tiếp theo: $— đến $— nếu đà giảm tiếp tục

🔴 Các mức kháng cự chính

Hỗ trợ trước đó biến thành kháng cự: $—

Kháng c

Bitcoin (BTC) đã giảm xuống dưới một mức giá quan trọng, báo hiệu áp lực ngắn hạn gia tăng và sự thận trọng trên toàn thị trường tiền điện tử.

🔍 Tổng quan thị trường

BTC không giữ được trên vùng hỗ trợ quan trọng, biến nó thành kháng cự ngay lập tức

Áp lực bán đã tăng lên, với khối lượng mua yếu

Chỉ số động lượng ngắn hạn cho thấy xu hướng giảm

🟢 Các mức hỗ trợ chính cần theo dõi

Hỗ trợ ngay lập tức: $— (vùng hỗ trợ địa phương gần đây)

Vùng giảm tiếp theo: $— đến $— nếu đà giảm tiếp tục

🔴 Các mức kháng cự chính

Hỗ trợ trước đó biến thành kháng cự: $—

Kháng c

BTC-6,58%

- Phần thưởng

- 8

- 4

- Đăng lại

- Retweed

EagleEye :

:

theo dõi sát saoXem thêm

📉 #BitcoinDropsBelowKeyPriceLevel | Cập nhật Thị trường BTC

Bitcoin (BTC) đã giảm xuống dưới một mức giá quan trọng, gia tăng áp lực giảm ngắn hạn và khiến thị trường cảnh báo.

🔍 Tổng quan Thị trường

BTC không giữ được vùng hỗ trợ quan trọng, hiện đã trở thành kháng cự ngay lập tức

Áp lực bán đã tăng lên, trong khi khối lượng mua vẫn yếu

Chỉ số động lượng ngắn hạn cho thấy tâm lý giảm giá hoặc thận trọng

🟢 Các mức hỗ trợ chính

Hỗ trợ ngay lập tức: $— (vùng hỗ trợ địa phương)

Khu vực giảm tiếp theo: $— đến $— nếu áp lực tiếp tục

🔴 Các mức kháng cự chính

Hỗ trợ bị phá vỡ chuyển thành kháng c

Bitcoin (BTC) đã giảm xuống dưới một mức giá quan trọng, gia tăng áp lực giảm ngắn hạn và khiến thị trường cảnh báo.

🔍 Tổng quan Thị trường

BTC không giữ được vùng hỗ trợ quan trọng, hiện đã trở thành kháng cự ngay lập tức

Áp lực bán đã tăng lên, trong khi khối lượng mua vẫn yếu

Chỉ số động lượng ngắn hạn cho thấy tâm lý giảm giá hoặc thận trọng

🟢 Các mức hỗ trợ chính

Hỗ trợ ngay lập tức: $— (vùng hỗ trợ địa phương)

Khu vực giảm tiếp theo: $— đến $— nếu áp lực tiếp tục

🔴 Các mức kháng cự chính

Hỗ trợ bị phá vỡ chuyển thành kháng c

BTC-6,58%

- Phần thưởng

- 1

- 1

- Đăng lại

- Retweed

Discovery :

:

Chúc mừng Giáng sinh ⛄#BitcoinDropsBelowKeyPriceLevel Cảnh báo ngắn hạn trong bối cảnh thị trường rộng lớn hơn

Bitcoin gần đây đã giảm xuống dưới một mức độ tâm lý và kỹ thuật quan trọng, chuyển đổi tâm lý ngắn hạn từ sự tự tin sang sự thận trọng. Điều này không chỉ liên quan đến một con số trên biểu đồ—nó phản ánh sự tương tác của thanh khoản, vị trí của các nhà giao dịch, và sự không chắc chắn vĩ mô đang ảnh hưởng đến cấu trúc thị trường.

Ý nghĩa Kỹ thuật

Phá vỡ một mức lớn thường kích hoạt các phản ứng thị trường cơ học:

Nhà giao dịch ngắn hạn giảm bớt rủi ro.

Các lệnh dừng lỗ được kích hoạt.

Các vị thế đòn bẩy

Bitcoin gần đây đã giảm xuống dưới một mức độ tâm lý và kỹ thuật quan trọng, chuyển đổi tâm lý ngắn hạn từ sự tự tin sang sự thận trọng. Điều này không chỉ liên quan đến một con số trên biểu đồ—nó phản ánh sự tương tác của thanh khoản, vị trí của các nhà giao dịch, và sự không chắc chắn vĩ mô đang ảnh hưởng đến cấu trúc thị trường.

Ý nghĩa Kỹ thuật

Phá vỡ một mức lớn thường kích hoạt các phản ứng thị trường cơ học:

Nhà giao dịch ngắn hạn giảm bớt rủi ro.

Các lệnh dừng lỗ được kích hoạt.

Các vị thế đòn bẩy

BTC-6,58%

- Phần thưởng

- 6

- 1

- Đăng lại

- Retweed

Discovery :

:

Theo dõi chặt chẽ 🔍#BitcoinDropsBelowKeyPriceLevel

Bitcoin một lần nữa thu hút sự chú ý của nhà đầu tư khi giảm xuống dưới các mức quan trọng. Những biến động mạnh trong những ngày gần đây đang định hình lại tâm lý và chiến lược thị trường.

Bitcoin đã có một khởi đầu yếu ớt vào tháng 12. Các nhà phân tích của Grayscale nhận định rằng giá đã giảm xuống mức 86.000, cho thấy thị trường đang trong giai đoạn dài của sự sợ hãi. Tuy nhiên, cùng trong báo cáo này nhấn mạnh rằng các mức cao mới có thể xảy ra trong trung hạn đến dài hạn với nhu cầu tăng từ các tổ chức và sự rõ ràng về quy định được củng cố. JPMorgan cho

Xem bản gốcBitcoin một lần nữa thu hút sự chú ý của nhà đầu tư khi giảm xuống dưới các mức quan trọng. Những biến động mạnh trong những ngày gần đây đang định hình lại tâm lý và chiến lược thị trường.

Bitcoin đã có một khởi đầu yếu ớt vào tháng 12. Các nhà phân tích của Grayscale nhận định rằng giá đã giảm xuống mức 86.000, cho thấy thị trường đang trong giai đoạn dài của sự sợ hãi. Tuy nhiên, cùng trong báo cáo này nhấn mạnh rằng các mức cao mới có thể xảy ra trong trung hạn đến dài hạn với nhu cầu tăng từ các tổ chức và sự rõ ràng về quy định được củng cố. JPMorgan cho

Vốn hóa:$3.61KNgười nắm giữ:2

0.01%

- Phần thưởng

- 71

- 42

- Đăng lại

- Retweed

MrSTAR :

:

Theo dõi chặt chẽ 🔍️Xem thêm

#BitcoinDropsBelowKeyPriceLevel

Bitcoin một lần nữa thu hút sự chú ý của nhà đầu tư khi giảm xuống dưới các mức quan trọng. Những biến động mạnh trong những ngày gần đây đang định hình lại tâm lý và chiến lược thị trường.

Bitcoin đã có một khởi đầu yếu ớt vào tháng 12. Các nhà phân tích của Grayscale nhận định rằng giá đã giảm xuống mức 86.000, cho thấy thị trường đang trong giai đoạn dài của sự sợ hãi. Tuy nhiên, cùng trong báo cáo này nhấn mạnh rằng các mức cao mới có thể xảy ra trong trung hạn đến dài hạn với nhu cầu tăng từ các tổ chức và sự rõ ràng về quy định được củng cố. JPMorgan cho

Xem bản gốcBitcoin một lần nữa thu hút sự chú ý của nhà đầu tư khi giảm xuống dưới các mức quan trọng. Những biến động mạnh trong những ngày gần đây đang định hình lại tâm lý và chiến lược thị trường.

Bitcoin đã có một khởi đầu yếu ớt vào tháng 12. Các nhà phân tích của Grayscale nhận định rằng giá đã giảm xuống mức 86.000, cho thấy thị trường đang trong giai đoạn dài của sự sợ hãi. Tuy nhiên, cùng trong báo cáo này nhấn mạnh rằng các mức cao mới có thể xảy ra trong trung hạn đến dài hạn với nhu cầu tăng từ các tổ chức và sự rõ ràng về quy định được củng cố. JPMorgan cho

- Phần thưởng

- 2

- 2

- Đăng lại

- Retweed

Discovery :

:

Quan sát chặt chẽ 🔍Xem thêm

#BitcoinDropsBelowKeyPriceLevel

Bitcoin giảm xuống dưới một mức giá quan trọng là khoảnh khắc ngay lập tức thu hút sự chú ý, nhưng hành động này cần được hiểu trong bối cảnh, không phải cảm xúc. Thị trường không thay đổi chỉ dựa trên một cây nến đơn lẻ. Chúng phát triển qua áp lực, hấp thụ, và tâm lý thay đổi, và đợt giảm này là một phần của quá trình đó.

“Dưới mức quan trọng” thực sự có nghĩa là gì?

Các mức quan trọng không phải là những đường ma thuật. Chúng là các vùng nơi kỳ vọng va chạm:

Các nhà giao dịch mong đợi hỗ trợ và đặt lệnh mua

Người khác đặt lệnh dừng lỗ ngay dưới đó

Các nhà bá

Bitcoin giảm xuống dưới một mức giá quan trọng là khoảnh khắc ngay lập tức thu hút sự chú ý, nhưng hành động này cần được hiểu trong bối cảnh, không phải cảm xúc. Thị trường không thay đổi chỉ dựa trên một cây nến đơn lẻ. Chúng phát triển qua áp lực, hấp thụ, và tâm lý thay đổi, và đợt giảm này là một phần của quá trình đó.

“Dưới mức quan trọng” thực sự có nghĩa là gì?

Các mức quan trọng không phải là những đường ma thuật. Chúng là các vùng nơi kỳ vọng va chạm:

Các nhà giao dịch mong đợi hỗ trợ và đặt lệnh mua

Người khác đặt lệnh dừng lỗ ngay dưới đó

Các nhà bá

BTC-6,58%

- Phần thưởng

- 5

- 4

- Đăng lại

- Retweed

BabaJi :

:

HODL chặt 💪Xem thêm

#BitcoinDropsBelowKeyPriceLevel

Giảm gần đây của Bitcoin xuống dưới $89K: Phân tích sự chuyển đổi thị trường và xu hướng giảm tiềm năng

Đây đã là một tuần khó khăn đối với Bitcoin và thị trường crypto rộng lớn hơn, khi Bitcoin giảm xuống dưới mốc $89K và tổng vốn hóa thị trường crypto giảm 1,5%, phá vỡ mức hỗ trợ quan trọng tại $2.95 nghìn tỷ. Động thái này báo hiệu sự chuyển đổi trong tâm lý thị trường và khiến các nhà giao dịch, nhà đầu tư và nhà phân tích tự hỏi liệu chúng ta có đang đối mặt với nhiều đợt giảm hơn nữa hay không. Trong quá khứ, Bitcoin hiếm khi kết thúc năm trong cây nến

Xem bản gốcGiảm gần đây của Bitcoin xuống dưới $89K: Phân tích sự chuyển đổi thị trường và xu hướng giảm tiềm năng

Đây đã là một tuần khó khăn đối với Bitcoin và thị trường crypto rộng lớn hơn, khi Bitcoin giảm xuống dưới mốc $89K và tổng vốn hóa thị trường crypto giảm 1,5%, phá vỡ mức hỗ trợ quan trọng tại $2.95 nghìn tỷ. Động thái này báo hiệu sự chuyển đổi trong tâm lý thị trường và khiến các nhà giao dịch, nhà đầu tư và nhà phân tích tự hỏi liệu chúng ta có đang đối mặt với nhiều đợt giảm hơn nữa hay không. Trong quá khứ, Bitcoin hiếm khi kết thúc năm trong cây nến

- Phần thưởng

- 15

- 11

- Đăng lại

- Retweed

BabaJi :

:

HODL chặt 💪Xem thêm

Bitcoin đối mặt với sự giảm mạnh: Những nguyên nhân đằng sau con số?

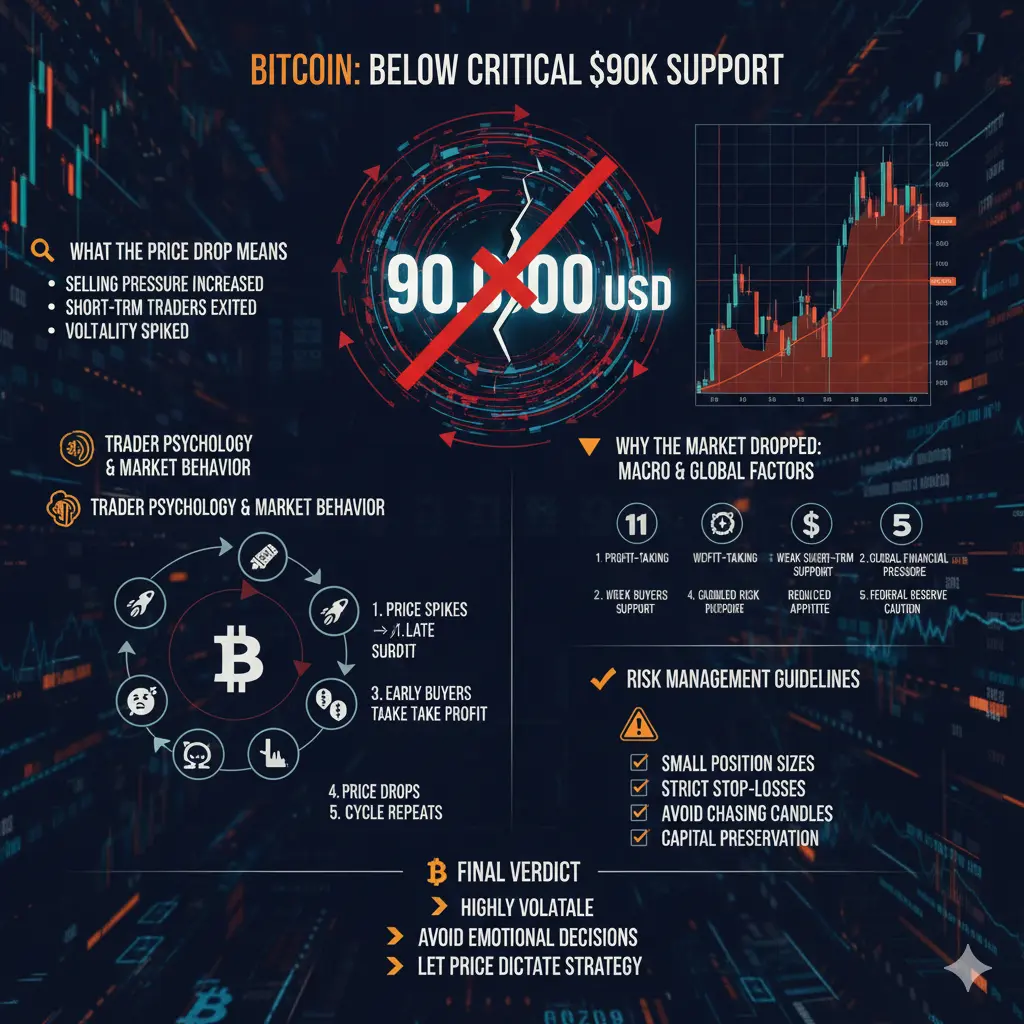

Bitcoin ( $BTC ) bắt đầu tuần trên 90.000 USD, nhưng xu hướng giảm đã đưa giá xuống còn 86.674 USD. Tuần này được đánh dấu là giai đoạn “rủi ro thấp” vì nhiều lý do, ảnh hưởng tiêu cực đến các nhà đầu cơ tăng giá. Chúng ta sẽ xem xét lại những lý do này, cũng như các tuyên bố gần đây của ông Williams thuộc Fed.

Nguyên nhân giảm giá của Bitcoin

Bộ trưởng Ngoại giao Liên minh Châu Âu gần đây đã bình luận rằng Trung Quốc sử dụng các mối quan hệ kinh tế như một vũ khí để đạt lợi ích chính trị. Williams đã ủng hộ việc nới lỏng tiề

Bitcoin ( $BTC ) bắt đầu tuần trên 90.000 USD, nhưng xu hướng giảm đã đưa giá xuống còn 86.674 USD. Tuần này được đánh dấu là giai đoạn “rủi ro thấp” vì nhiều lý do, ảnh hưởng tiêu cực đến các nhà đầu cơ tăng giá. Chúng ta sẽ xem xét lại những lý do này, cũng như các tuyên bố gần đây của ông Williams thuộc Fed.

Nguyên nhân giảm giá của Bitcoin

Bộ trưởng Ngoại giao Liên minh Châu Âu gần đây đã bình luận rằng Trung Quốc sử dụng các mối quan hệ kinh tế như một vũ khí để đạt lợi ích chính trị. Williams đã ủng hộ việc nới lỏng tiề

BTC-6,58%

- Phần thưởng

- 4

- Bình luận

- Đăng lại

- Retweed

#BitcoinDropsBelowKeyPriceLevel

5 Lý do Bitcoin rớt về mức $85,000 và tại sao còn có thể giảm tiếp

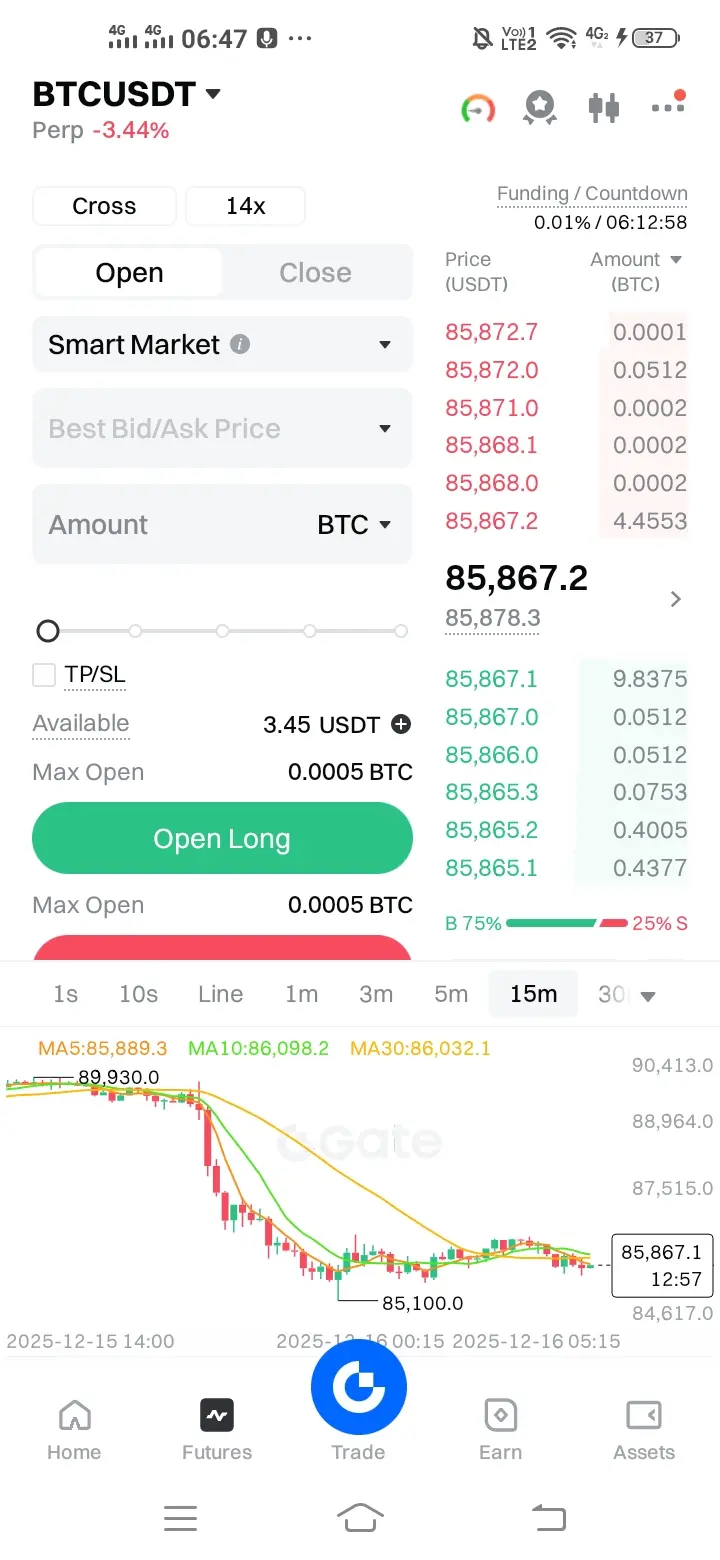

Bitcoin giảm xuống mức $85,000 vào ngày 15 tháng 12, mở rộng đợt giảm giá gần đây khi các rủi ro vĩ mô toàn cầu, việc tháo gỡ đòn bẩy và thanh khoản mỏng manh đan xen nhau. Sự sụt giảm đã xóa hơn $100 tỷ đô khỏi tổng vốn hóa thị trường tiền điện tử chỉ trong vài ngày, đặt ra câu hỏi liệu đợt bán tháo đã kết thúc chưa.

Mặc dù không có một yếu tố nào gây ra cú giảm này, nhưng có năm lực lượng chồng chéo đẩy Bitcoin đi xuống và có thể duy trì áp lực lên giá trong ngắn hạn.

Nỗi sợ tăng lãi suất của

5 Lý do Bitcoin rớt về mức $85,000 và tại sao còn có thể giảm tiếp

Bitcoin giảm xuống mức $85,000 vào ngày 15 tháng 12, mở rộng đợt giảm giá gần đây khi các rủi ro vĩ mô toàn cầu, việc tháo gỡ đòn bẩy và thanh khoản mỏng manh đan xen nhau. Sự sụt giảm đã xóa hơn $100 tỷ đô khỏi tổng vốn hóa thị trường tiền điện tử chỉ trong vài ngày, đặt ra câu hỏi liệu đợt bán tháo đã kết thúc chưa.

Mặc dù không có một yếu tố nào gây ra cú giảm này, nhưng có năm lực lượng chồng chéo đẩy Bitcoin đi xuống và có thể duy trì áp lực lên giá trong ngắn hạn.

Nỗi sợ tăng lãi suất của

BTC-6,58%

- Phần thưởng

- 3

- 1

- Đăng lại

- Retweed

Discovery :

:

Giảm của BTC xuống 85K bị thúc đẩy bởi kỳ vọng tăng lãi suất của BOJ, thanh lý ký quỹ, và thanh khoản thấp; các diễn biến vĩ mô sẽ quyết định hướng đi.#BitcoinDropsBelowKeyPriceLevel

Bitcoin hiện đang giao dịch quanh mức $85,000 – $88,000 USD, vẫn chưa vượt qua mức hỗ trợ tâm lý và kỹ thuật quan trọng là $90,000. Động thái này đã gây ra sự thận trọng trong giới giao dịch, vì $90K được xem là vùng quan trọng để duy trì ổn định thị trường trong ngắn hạn.

---

🔍 Ý Nghĩa Của Việc Giảm Giá

Việc giảm xuống dưới một mức giá chủ chốt có nghĩa là người mua yếu hơn người bán ở vùng đó. Một khi Bitcoin rơi dưới $90,000:

Áp lực bán tăng lên

Nhiều nhà giao dịch ngắn hạn thoát vị thế

Biến động tăng vọt khi giá di chuyển nhanh chóng

Các mức hỗ trợ chính

Bitcoin hiện đang giao dịch quanh mức $85,000 – $88,000 USD, vẫn chưa vượt qua mức hỗ trợ tâm lý và kỹ thuật quan trọng là $90,000. Động thái này đã gây ra sự thận trọng trong giới giao dịch, vì $90K được xem là vùng quan trọng để duy trì ổn định thị trường trong ngắn hạn.

---

🔍 Ý Nghĩa Của Việc Giảm Giá

Việc giảm xuống dưới một mức giá chủ chốt có nghĩa là người mua yếu hơn người bán ở vùng đó. Một khi Bitcoin rơi dưới $90,000:

Áp lực bán tăng lên

Nhiều nhà giao dịch ngắn hạn thoát vị thế

Biến động tăng vọt khi giá di chuyển nhanh chóng

Các mức hỗ trợ chính

BTC-6,58%

- Phần thưởng

- 20

- 13

- Đăng lại

- Retweed

Crypto_Buzz_with_Alex :

:

1000x Vibes 🤑Xem thêm

Tải thêm

Tham gia cùng 40M người dùng trong cộng đồng đang phát triển của chúng tôi

⚡️ Tham gia cùng 40M người dùng trong cuộc thảo luận về cơn sốt tiền điện tử

💬 Tương tác với những nhà sáng tạo hàng đầu mà bạn yêu thích

👍 Xem những điều bạn quan tâm

Chủ đề thịnh hành

23.09K Phổ biến

61.49K Phổ biến

366.6K Phổ biến

45.04K Phổ biến

61.03K Phổ biến

18K Phổ biến

25.48K Phổ biến

18.79K Phổ biến

92.41K Phổ biến

36.62K Phổ biến

32.17K Phổ biến

28.75K Phổ biến

16.6K Phổ biến

23.14K Phổ biến

214.06K Phổ biến

Tin nhanh

Xem thêmETH giảm xuống dưới 2400 USDT

2 phút

Trong tháng 1, số địa chỉ hoạt động hàng ngày của Solana đã tăng vọt 115%, trong khi số địa chỉ hoạt động hàng ngày của mạng Ethereum tăng 25%.

5 phút

Jupiter:Phiên bản thử nghiệm GUM của chúng tôi sắp ra mắt, chào đón các người dùng thử nghiệm để trải nghiệm các tính năng mới và cung cấp phản hồi quý giá nhằm hoàn thiện sản phẩm trước khi chính thức ra mắt.

9 phút

Nhà phân tích PlanC cho rằng Bitcoin giảm xuống còn 77.000 USD có thể là mức thấp của chu kỳ, nhưng nhiều nhà phân tích vẫn tiếp tục dự đoán giảm giá

35 phút

Dữ liệu: 3.000 mã BNB đã chuyển vào Wintermute, trị giá khoảng 2,34 triệu USD.

35 phút

Ghim