Tether (USDT) News Today

Latest crypto news and price forecasts for USDT: Gate News brings together the latest updates, market analysis, and in-depth insights.

CoinShares dismisses new concerns over Tether's solvency after Arthur Hayes' warning

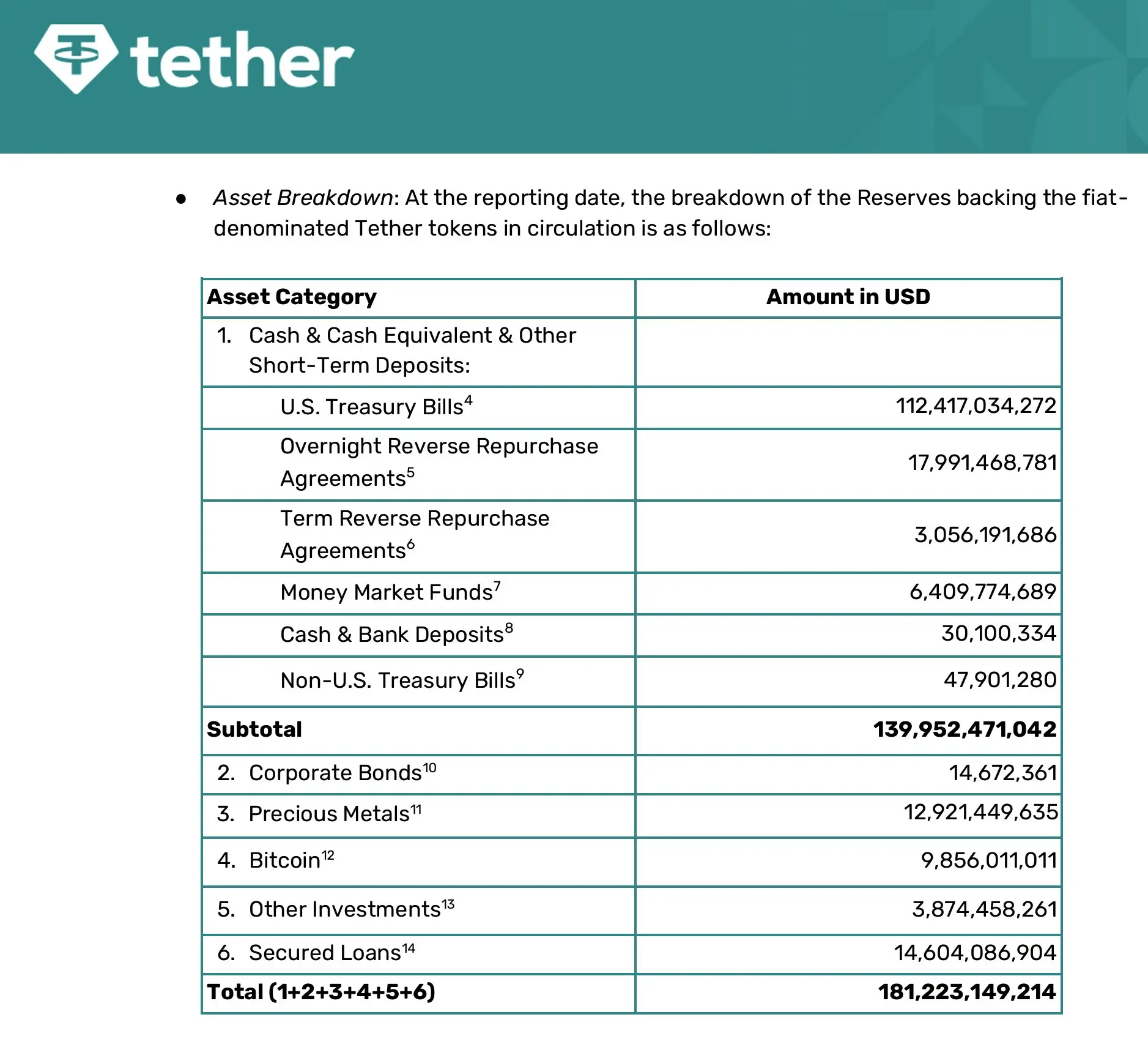

CoinShares dismissed concerns about Tether's ability to meet USDT obligations, highlighting a $6.55 billion reserve surplus. Despite warnings about Bitcoin and gold volatility, they assert strong profits mitigate risks. Tether remains the largest stablecoin.

BTC-2.75%

TapChiBitcoin·5h ago

Tether CEO Warns Paper Gold Era Could End “Gradually, Then Suddenly”

Tether CEO Paolo Ardoino suggests the impending collapse of "paper gold," referencing a Blockchain Research Lab study on leveraged investments.

BitcoinInsider·8h ago

IMF warns of stablecoin fragmentation crisis! $300 billion market faces major regulatory hurdles

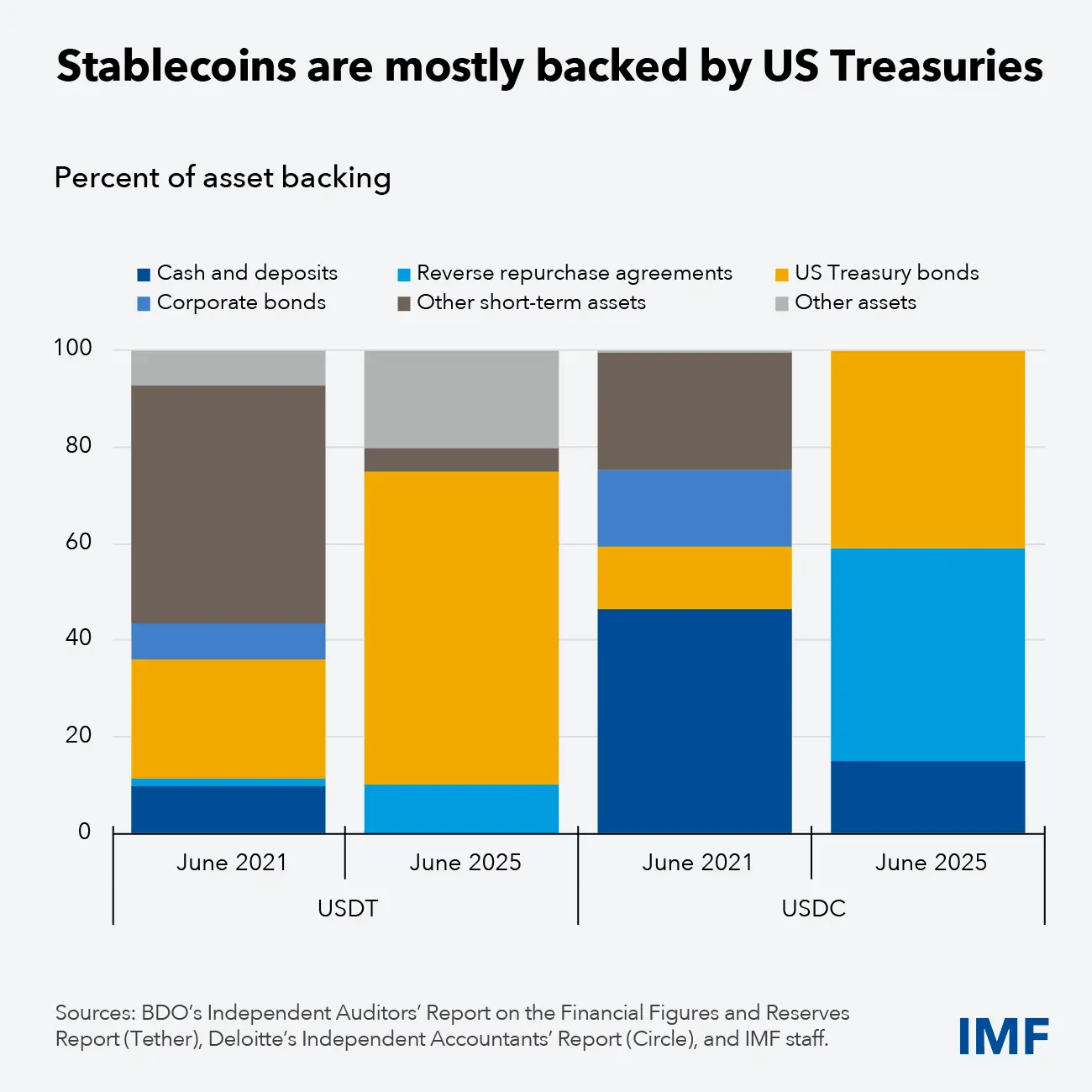

The International Monetary Fund (IMF) has released the "Understanding Stablecoins" report, warning that the fragmentation of regulatory frameworks across countries is creating structural "barriers," threatening financial stability, weakening regulation, and slowing the development of cross-border payments. The global stablecoin market capitalization has exceeded $300 billion, with Tether's USDT and Circle's USDC accounting for the majority of the supply.

USDC0.02%

MarketWhisper·12-05 00:43

Bitcoin consolidates above 90,000; is DAT poised for a rebound?

The S&P 500 Index and the Nasdaq Index edged higher as investors prepared for the Federal Reserve's interest rate decision next week. Bitcoin is consolidating above $90,000. Although market sentiment has moved out of the extreme fear zone, it remains cautious. Twenty One, a US Bitcoin company directly invested in with Bitcoin by Tether, the world’s largest stablecoin issuer, will begin trading next Monday (12/8) on the New York Stock Exchange under the ticker "XXI." The stock price rose 22% yesterday. Ethereum reserve company BitMine continues to buy ETH, and BMNR stock also rose nearly 8% yesterday, closing at $36.32.

Good data is good news, bad data is still good news—will a Fed rate cut become a certainty?

On Thursday, investors largely ignored the latest weekly jobless claims, which showed that the number of first-time unemployment benefit applicants fell to the 2022

ETH-4.06%

ChainNewsAbmedia·12-05 00:03

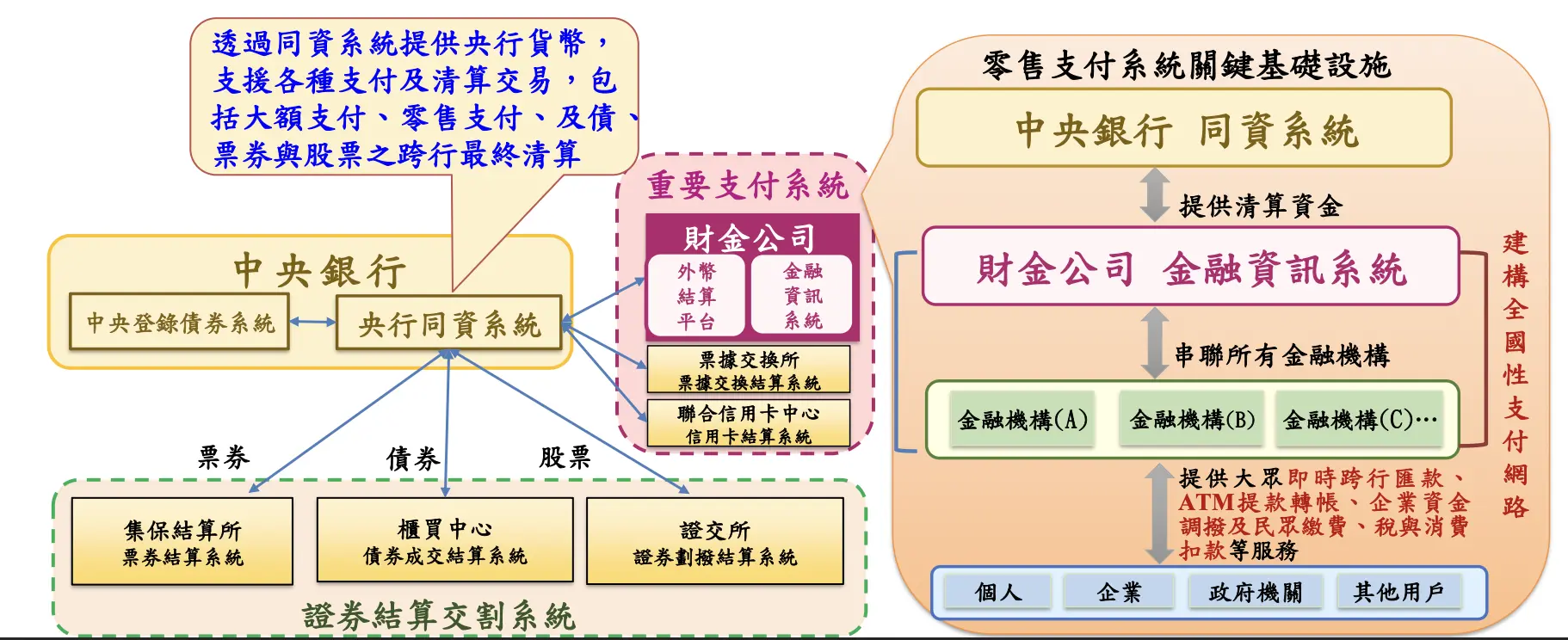

Central Bank Governor Yang Chin-long: Stablecoins are "wildcat banks," TWQR annual transactions reach 592 trillion

Taiwan Central Bank Governor Yang Chin-long stated that future payments will adopt a dual-track parallel strategy. On one hand, the bank will continue to optimize TWQR and promote cross-border interoperability; on the other hand, it will steadily advance wholesale CBDC and tokenized financial infrastructure. In 2024, TWQR's operational volume reached NT$582 trillion, 23 times the GDP for that year. Yang Chin-long warned of the risks of stablecoins, comparing them to "wildcat banks," which historically caused large-scale bank runs due to lack of regulation and insufficient reserves.

USDC0.02%

MarketWhisper·12-04 07:29

Tether's Decade-Long Gamble: How Did It Evolve from a "Stablecoin" to the "Shadow Central Bank" of the Crypto World?

Author: BlockWeeks

What supports the $2.6 trillion crypto market’s liquidity is not the sovereign credit of any nation, but a private company that moved its headquarters from Hong Kong to Switzerland, and ultimately settled in El Salvador—Tether. Its issued US dollar stablecoin, USDT, holds over 70% of the market share. Over the past decade, it has expanded amid crises and doubts, and is now attempting to define the industry's boundaries with its profits.

However, a recent “weak” rating from S&P Global has once again revealed the core contradiction of this grand experiment: a currency tool designed to be “stable” is itself becoming the system’s greatest point of risk.

>

> It’s like an elephant dancing on a tightrope, with a base of hundreds of billions of dollars in US Treasury bonds, but taking adventurous steps into AI, brain-computer interfaces, and Argentine farmland. — This is how the BlockWeeks editorial team describes it.

>

Part I

PANews·12-04 02:06

Tether Data Introduces QVAC Fabric, Bringing AI Fine-Tuning to Consumer Hardware

2 December, 2025 – Tether Data today announced the launch of QVAC Fabric LLM, a new comprehensive LLM inference runtime and fine-tuning framework that makes it possible to execute, train and personalize large language models directly on everyday hardware, including consumer GPUs, laptops, and even s

CryptoBreaking·12-03 17:04

Tether Data Unveils QVAC Fabric LLM Inference And Fine-Tuning Framework For Modern AI Models

In Brief

Tether Data has launched QVAC Fabric LLM framework that enables LLM inference and fine-tuning across consumer devices and multi-vendor hardware, supporting decentralized, privacy-focused, and scalable AI development.

Department of Financial Services company Tether, focused on

MpostMediaGroup·12-03 08:40

Gate Research: Tether Data Launches QVAC Fabric LLM|Bitcoin Mining Profits Hit Historic Lows

Crypto Market Overview

BTC (+0.25% | Current price 91,878 USDT): After completing its decline near $83,800, BTC began a gradual rebound on December 2, moving up to the $91,000–93,000 range, with a clearly strengthened short-term structure. In terms of moving averages, the MA5 and MA10 have quickly crossed above the MA30, forming a short-term bullish alignment, indicating that the market has entered a phase of rhythmic recovery after a sharp decline. Although the rebound is relatively steep, it has not yet broken through the resistance zone above $93,000. The price needs to consistently hold above $91,500–92,000 to consolidate the short-term bullish advantage. On December 2, the MACD showed a strong golden cross, with the red bars expanding significantly, indicating a substantial improvement in buying momentum compared to earlier. However, as it approaches the $93,000 high...

GateResearch·12-03 06:55

Tether-Backed Stable L1 Unveils STABLE Tokenomics Ahead of Dec 8 Launch

The Tether-backed Layer 1 blockchain Stable has officially revealed the full economic model for its native token, STABLE. Just days before its mainnet launch on December 8. The project confirmed that the network will run entirely on USDT for transactions. While STABLE will serve as the system’s

Coinfomania·12-03 05:50

10 EU Banks Join Forces! Euro Stablecoin to Launch in 2026, Challenging US Dollar Dominance

A consortium of 10 banks plans to launch a euro-pegged stablecoin in 2026 through an entity authorized by the Dutch central bank. BNP Paribas announced on Tuesday that it will cooperate with nine other EU banks to launch a euro-backed stablecoin “in the second half of 2026.” Currently, the market capitalization of euro-denominated stablecoins is less than €350 million (about $407 million), accounting for only 1% of the global market share, with US dollar stablecoins continuing to dominate the market.

USDC0.02%

MarketWhisper·12-03 01:37

Evening Must-Read 5 Articles | Tether with $184 Billion is Walking a Tightrope

The article discusses the investment returns and risks of Bitcoin, the dynamics of Trump's potential nomination for Fed chair, the evolution and significance of Ethereum, the redemption mechanisms of stablecoins, and the challenges faced by Tether, showcasing the complexity and future potential of the crypto market.

金色财经_·12-02 12:42

With Tether's investment and the endorsement of the Central Bank of Brazil, why is the enterprise-level Blockchain Rayls well-received but not popular?

Author: Frank, PANews

Recently, amidst the overall silence in the market, the niche project Rayls officially launched its TGE on December 1st. This project, which had almost no prior attention, received support from two major overseas exchanges known for their strict compliance and risk control, Coinbase and Kraken, at the initial phase. It also simultaneously launched on multiple exchanges including Binance Alpha, Gate, and Bitget.

This inevitably causes the market to cast curious glances at Rayls. What kind of background and resources can attract the favor of a compliant exchange? This project, which attempts to bridge the "permissioned chain" and "public chain," holding the ticket for the Brazilian Central Bank's DREX pilot program, has it opened a new era for RWA, or is it just "new wine in an old bottle"?

Brazil's central bank endorsement attracts Tether investment in Latin American resources.

Rayls

PANews·12-02 08:14

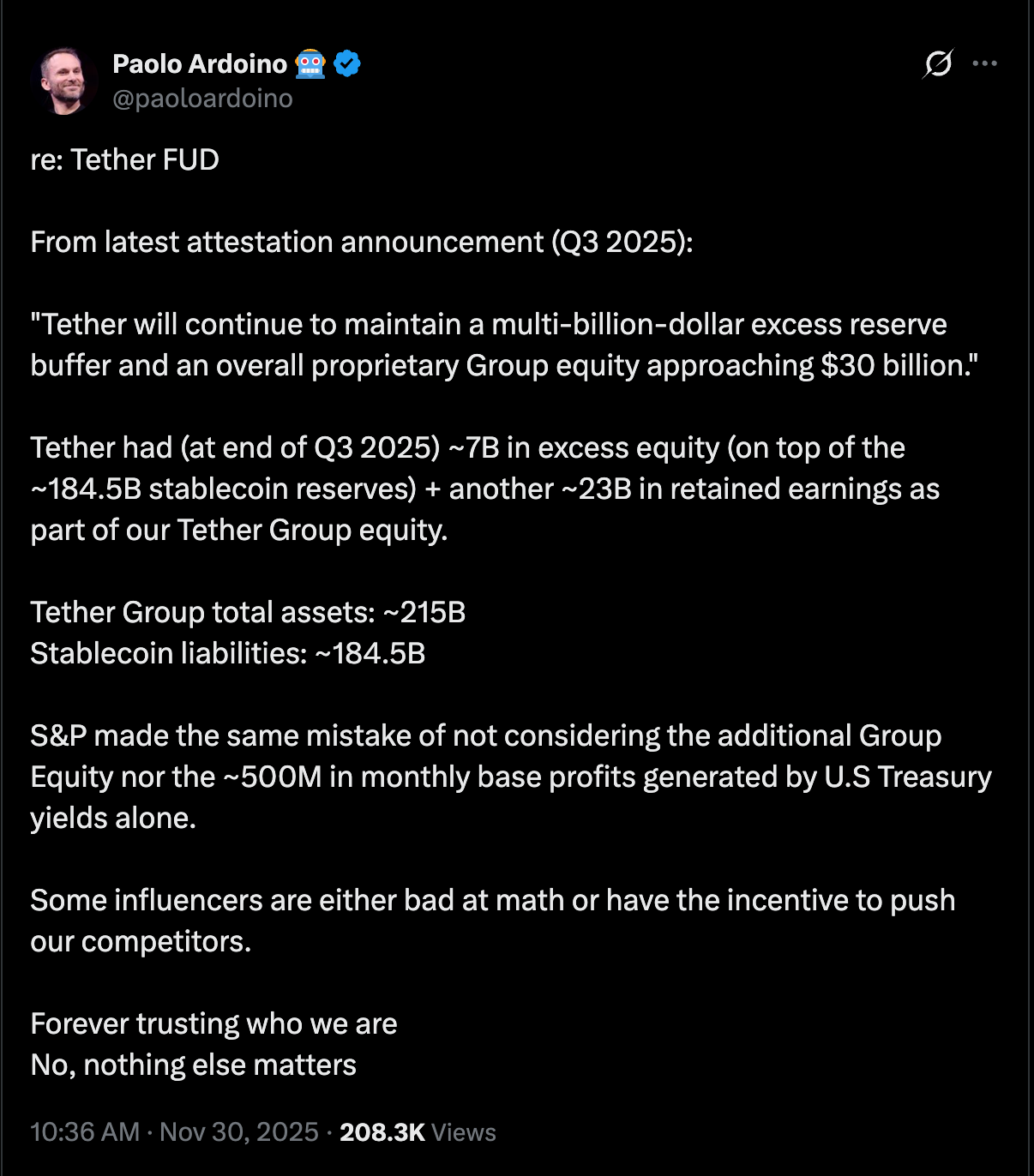

Tether CEO Counters Hayes’ Warning With Q3 Data Showing a Major Equity Cushion

Tether CEO Paolo Ardoino refuted claims of USDT stress due to potential drops in Bitcoin or gold, presenting Q3 2025 data showing $215 billion in assets and $30 billion in equity. S&P downgraded USDT citing high asset exposure, but Ardoino emphasized Tether's strong financial position.

BTC-2.75%

CryptoFrontNews·12-01 23:31

Tether Equity Debate Grows as Analysts Split on Risks

The debate over Tether's equity strength has intensified, with analysts questioning its reserve strategy and risk exposure amid concerns about Bitcoin and gold holdings potentially impacting equity.

BTC-2.75%

CryptoFrontNews·12-01 17:04

Former Citi Analyst Refutes Arthur Hayes’ Tether Insolvency Claims

A former Citi crypto research head contests Arthur Hayes' solvency concerns regarding Tether, highlighting undisclosed corporate assets and significant profits that suggest USDT's strength and profitability surpass criticisms.

BitcoincomNews·12-01 10:35

Tether Theory: The Architecture of Monetary Sovereignty and Private Dollarization

I. Core Argument

The international monetary order is undergoing a fundamental reorganization, which is not the result of deliberate actions by central banks or multilateral institutions, but rather stems from the emergence of an offshore entity that most policymakers still find difficult to categorize. Tether Holdings Limited (the issuer of the USDT stablecoin) has constructed a financial architecture that extends the United States' monetary hegemony to the deepest parts of the global informal economy, while simultaneously laying the groundwork for ultimately circumventing this hegemony.

This is not a story about cryptocurrency, but rather a story about the privatization of US dollar issuance, the fragmentation of monetary sovereignty, and the emergence of a new type of systemic actor that exists in the gray area between regulated finance and borderless capital. The passage of the GENIUS Act in July 2025 will solidify this shift into a binary choice faced by global dollar users: either accept the United States.

金色财经_·12-01 10:26

Former Head of Encryption Research at Citigroup: Tether has a "money printer" with no external bankruptcy risk concerns.

According to a TechFlow report, on December 1st, Joseph, the former head of encryption research at Citigroup, stated on social media that Tether operates a "printing press," far from the bankruptcy risks that the outside world is worried about.

Joseph pointed out that Tether's public disclosure of assets does not represent all of the company's assets. The company has a separate equity asset balance sheet, which includes equity investments, mining operations, corporate reserves, and possibly more Bitcoin, with the rest distributed as dividends to shareholders.

Secondly, Tether holds approximately 120 billion USD in interest-bearing government bonds, with a yield of about 4% since 2023, generating an annual income of around 10 billion USD. With a low-cost operation of only 150 employees, it has become one of the most efficient cash-generating businesses in the world.

Third, Joseph estimates the equity value of Tether to be between 500 and 1.

BTC-2.75%

DeepFlowTech·12-01 10:03

Former Citibank encryption research head: Arthur Hayes missed 3 key points on Tether's FUD.

According to Mars Finance news, in response to Arthur Hayes' doubts about the operation of USDT, former head of crypto research at Citibank, Joseph, stated on the X platform that @CryptoHayes' analysis missed several key points: 1. Disclosure of assets ≠ total corporate assets USDT discloses reserves according to the "matching principle", but its undisclosed balance sheet includes equity investment income, mining business, corporate reserves, and potential Bitcoin holdings, with remaining profits distributed to shareholders in the form of dividends. 2. Ultra-high profit margins and equity value Tether holds $120 billion in US Treasury bonds (annualized 4% yield), with an annual net profit of about $10 billion starting from 2023 (with only 150 employees), making it the world's most efficient money printer; equity valuation could reach $50-100 billion (close to...

BTC-2.75%

MarsBitNews·12-01 10:01

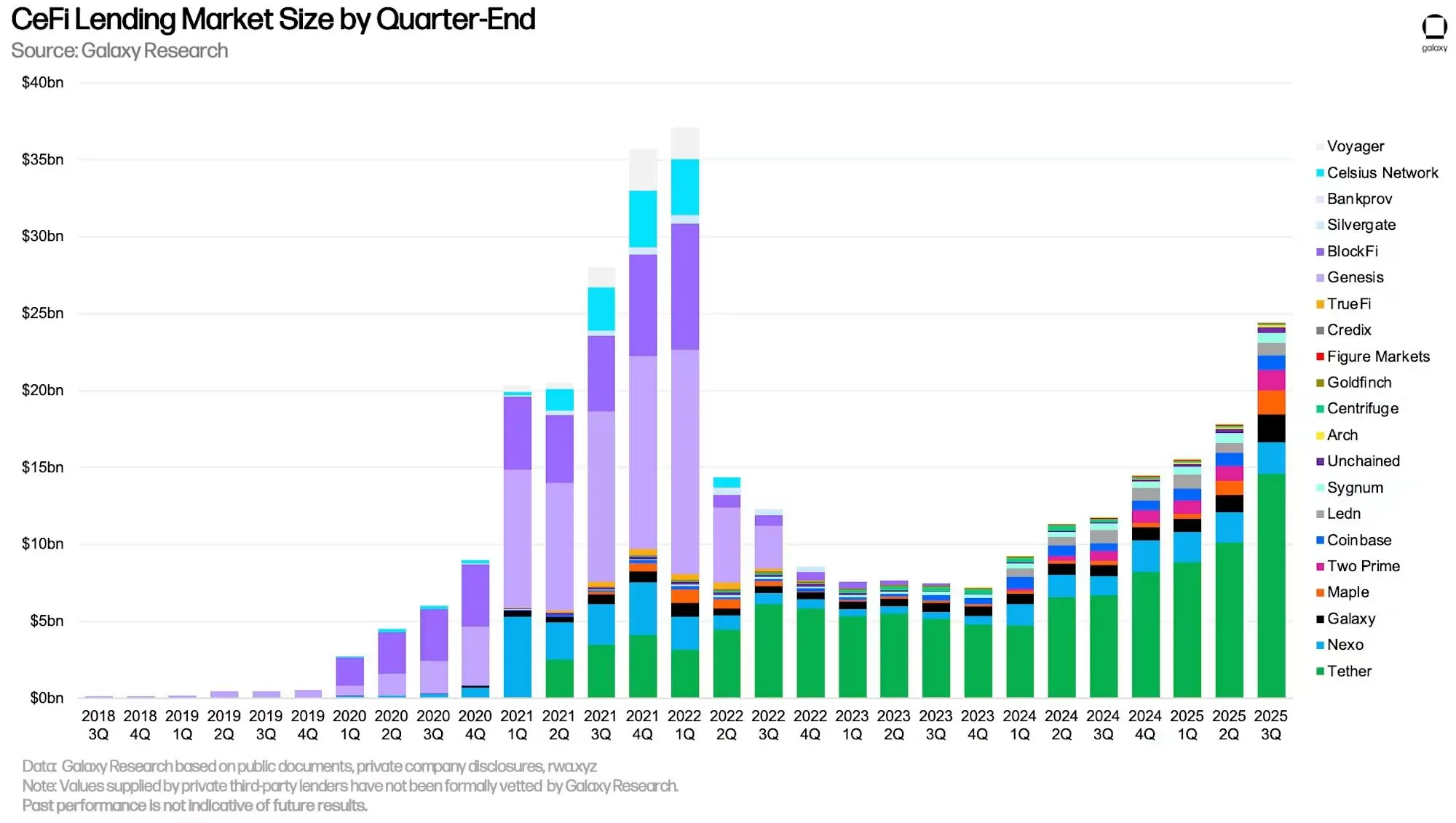

The lending market has exploded! CeFi recovers losses of 25 billion, with Tether issuers monopolizing 60%.

The total amount of outstanding loans in the cryptocurrency lending market in the third quarter has approached $25 billion, according to data from Galaxy Research. Since the beginning of 2024, the CeFi lending market has grown by over 200%, reaching its highest level since the peak in the first quarter of 2022. As of September 30, the outstanding loans of stablecoin issuer Tether amount to $14.6 billion, with a market share of 60%.

MarketWhisper·12-01 06:59

Tether CEO Fires Back at S&P Downgrade: “They Didn’t Do Their Homework”

Tether CEO Paolo Ardoino has strongly rejected S&P Global Ratings’ recent downgrade of USDt’s peg stability to the lowest possible score, calling the assessment “incomplete and misleading.”

BTC-2.75%

CryptoPulseElite·12-01 06:18

Willy Woo: Tether performed better than several banks during the bank run, still having 95% asset backing in extreme cases.

According to Mars Finance, crypto analyst Willy Woo released a comparison chart of bank runs, showing that Tether (USDT) fully honored redemptions even during a redemption wave of about 20–25%, outperforming traditional banks such as Silicon Valley Bank (25%) and First Republic Bank (57%). Woo pointed out that Tether currently has 77% of its assets in cash equivalents, with the remainder in gold and Bitcoin, leading to an overall over-collateralization of 3%. Even if volatile assets experience a big dump of 30% in extreme market conditions, USDT still has 95% asset backing.

BTC-2.75%

MarsBitNews·12-01 06:14

Tether's reserve transformation sparks controversy: Arthur Hayes warns of significant downside risks in Bitcoin's gold allocation, Paolo Ardoino responds strongly.

Notable industry figure Arthur Hayes pointed out that Tether is shifting its reserve assets towards Bitcoin and gold to respond to the Fed's interest rate cut cycle, but warned that if the prices of these two assets fall by 30%, it could deplete the company's equity capital. S&P Global Ratings downgraded the stability rating of USDT to "weak," reflecting an increase in high-risk asset exposure to nearly 23 billion USD. Tether CEO Paolo Ardoino strongly responded, revealing that the group's total assets reached 215 billion USD, with monthly profits exceeding 500 million USD, emphasizing that the company's financial strength far exceeds market perception. This debate highlights the value judgment discrepancies between traditional rating agencies and crypto-native enterprises.

MarketWhisper·12-01 02:33

Paolo Ardoino Fires Shots At S&P For Tether’s ‘Weak’ Rating

Tether CEO Paolo Ardoino fired back at S&P’s latest downgrade of his company.

The ratings firm gave the stablecoin company a “weak” rating of 5 due to its reserve’s exposure to high-risk assets, which could risk the USDT’s 1:1 peg to the US dollar.

S&P recently downgraded Tether’s ratings.

Blockzeit·12-01 01:08

Tether strikes back at S&P ratings! USDT earns 500 million a month, is the bankruptcy theory panic or truth?

S&P Global has downgraded the USD peg rating of USDT to "weak," the lowest score in its rating system, triggering panic in the crypto market. Tether CEO Paolo Ardoino countered that as of the end of Q3 2025, Tether's total assets amount to approximately 215 billion USD. Ardoino emphasized that the monthly yield from U.S. Treasury bonds alone generates $500 million in basic profit, but the S&P rating overlooked this crucial data.

MarketWhisper·12-01 00:35

Panic sentiment eases, Bitcoin holds at 90,000, can the Christmas market make a rebound?

The US stock market has slightly rebounded after experiencing a pullback, and the sentiment in the crypto market is gradually improving. Bitcoin remains above 90,000, but the cumulative decline still reaches 17%. Key data this week will affect interest rate decisions, and the market is looking forward to the appointment of the new chairman of The Federal Reserve (FED). The crypto market is cautiously optimistic, and it remains to be seen whether the Christmas rally can help Bitcoin recover.

ChainNewsAbmedia·12-01 00:14

Paolo Ardoino responds to reserve doubts, stating that S&P overlooks Tether group's equity and U.S. treasury yields.

Tether CEO Paolo Ardoino emphasized that the company's audit in Q3 2025 shows it has billions of dollars in excess reserves and close to 30 billion in group equity, pointing out the misunderstanding from the outside about its financial condition.

WuSaidBlockchainW·11-30 18:26

Tether CEO refutes doubts: the group has nearly $30 billion in equity and excess reserves of $7 billion.

Tether CEO Paolo Ardoino responded to negative rumors about Tether, stating that by the third quarter of 2025, Tether will maintain billions of dollars in excess reserves, with total assets of approximately $215 billion, of which excess equity is around $7 billion, and about $23 billion in retained earnings.

DeepFlowTech·11-30 15:59

Latam Insights: Bolivia Embraces Stablecoins, Tether Leaves Uruguay

Welcome to Latam Insights, a compilation of the most relevant crypto news from Latin America over the past week. In this week’s edition, Bolivia announces the integration of stablecoins into its banking system, Tether abandons mining operations in Uruguay, and the Libra Trust emerges out of the

Coinpedia·11-30 11:36

Arthur Hayes Warns: Tether’s Bitcoin and Gold Bet Could Trigger a Solvency Crisis

Arthur Hayes has raised a sharp warning about Tether’s reserve strategy after reviewing the company’s latest attestation report. In a post on X, Hayes suggested that Tether is no longer just passively backing USDT with cash-like instruments, but is now taking a far more aggressive position; one that

CaptainAltcoin·11-30 08:44

Tether Ceases Bitcoin Mining Operations in Uruguay Over High Energy Cost

Tether is closing its Bitcoin mining operations in Uruguay due to high energy costs and regulatory disputes, affecting 30 employees. Despite this setback, Tether remains committed to mining and exploring opportunities elsewhere.

BTC-2.75%

CryptoNewsLand·11-30 04:14

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreAbu Dhabi Buluşması

Helium, 10 Aralık'ta Abu Dhabi'de Helium House networking etkinliğine ev sahipliği yapacak ve bu etkinlik, 11-13 Aralık tarihlerinde düzenlenecek olan Solana Breakpoint konferansının öncesi olarak konumlandırılacak. Tek günlük toplantıda, Helium ekosistemindeki profesyonel ağ kurma, fikir alışverişi ve topluluk tartışmalarına odaklanılacak.

2025-12-09

Hayabusa Yükseltmesi

VeChain, Aralık ayında planlanan Hayabusa yükseltmesini duyurdu. Bu yükseltmenin, protokol performansını ve tokenomi'yi önemli ölçüde artırmayı hedeflediği belirtiliyor ve ekip, bu güncellemeyi bugüne kadarki en çok fayda odaklı VeChain sürümü olarak nitelendiriyor.

2025-12-27

Litewallet Gün Batımları

Litecoin Vakfı, Litewallet uygulamasının 31 Aralık'ta resmi olarak sona ereceğini duyurdu. Uygulama artık aktif olarak korunmamakta olup, bu tarihe kadar yalnızca kritik hata düzeltmeleri yapılacaktır. Destek sohbeti de bu tarihten sonra sona erecektir. Kullanıcıların Nexus Cüzdan'a geçiş yapmaları teşvik edilmektedir; Litewallet içinde geçiş araçları ve adım adım bir kılavuz sağlanmıştır.

2025-12-30

OM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27