While Crypto Struggles, Privacy Coins Surge: 5 High-Risk Bets Leading Into 100x surge this year-end

Privacy-focused tokens show relative strength during broader market consolidation phases.

Technological differentiation, not hype, drives short-term attention in high-risk assets.

Volatility and regulatory uncertainty remain central risks heading into year-end.

With the larger

CryptoNewsLand·14m ago

Solana (SOL) Price in 2026: Possible Catalysts - U.Today

Alpenglow: Biggest revamp in Solana's history

P-token standard and SIMD-0266: 10x more resource-effective Solana

Solana (SOL) price in 2026: Possible effects of upgrades

In 2024-2025, Solana (SOL) evolved from yet another non-EVM chain to a strong contender of Ethereum (ETH) and its L2s. In 2026

UToday·34m ago

OG Esports Enters New Chapter As Chiliz Group Secures Majority Ownership

The Chiliz Group, the largest blockchain sports and entertainment provider in the world, has confirmed the purchase of a 51 percent ownership in OG Esports. The strategic initiative is a milestone to both companies, reuniting OG with its original management and placing the legendary esports brand on

BlockChainReporter·37m ago

2025 Asset Review: Silver Surge, Taiwan Stocks Reach New Highs, Did Your Performance Meet the Goals?

Looking back at 2025, the global capital markets experienced extreme capital rotation: precious metals surged due to safe-haven and industrial demand, with silver leading the way with triple-digit gains; simultaneously, the AI trend continued to drive record highs in the Taiwan and US stock markets, and the average profit for Taiwanese stock investors was substantial, only cryptocurrencies experienced a significant correction. Reflecting on 2025, did you meet your performance targets? How should you adjust your strategy to迎接 2026 年?

Performance Rankings of Various Assets in 2025

The turbulent year of 2025 has quickly come to an end. The performance rankings of various assets in 2025 are now available. Did you meet your performance targets?

Strong Rise of Precious Metals: Dual Drivers of Safe-Haven Sentiment and Industrial Demand

The most impressive asset performance in 2025 belonged to the precious metals sector, with silver soaring by 141% to take the top spot, and gold also recording a significant increase of 64%. This reflects that, against the backdrop of ongoing geopolitical tensions worldwide, the market

ETH0.29%

ChainNewsAbmedia·37m ago

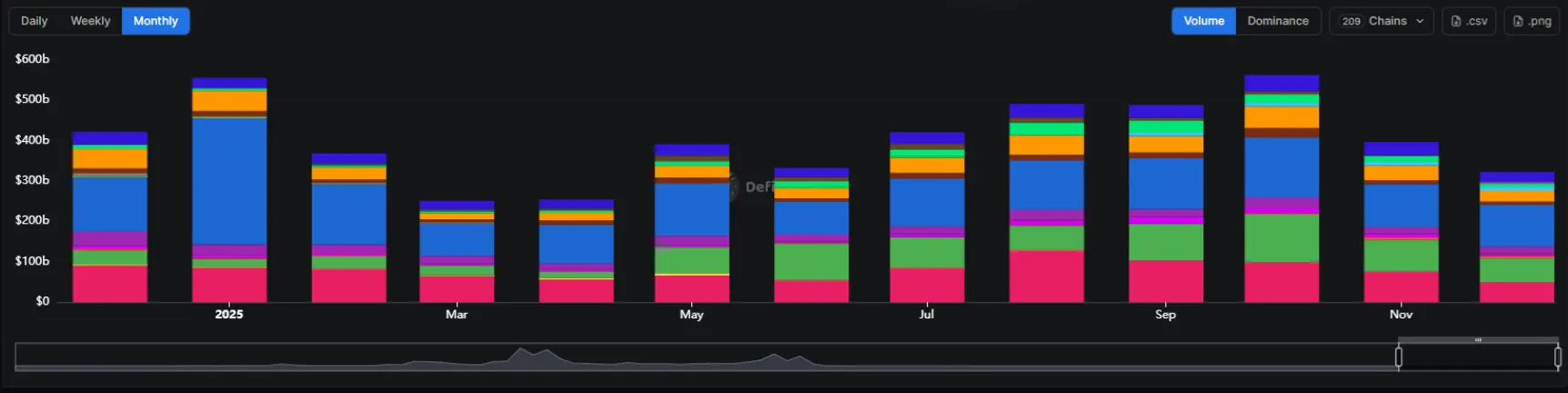

Solana DEX trading volume continues to lead over competing platforms through the end of 2025

In 2025, Solana dominated DEX activity, surpassing Ethereum and BNB Chain with over $100 billion in monthly trading volume in December. Despite meme token declines, Solana maintained strong growth and significant revenue, driven by platforms like PumpSwap and HumidiFi. However, SOL prices faced downward pressure.

TapChiBitcoin·44m ago

AI Threatens to Break Encryption in Private Messaging Apps

Decentralized Messaging Apps Face Growing Challenges Amid Privacy and Regulation Concerns

The future of private messaging is under threat from advances in artificial intelligence, increasing regulatory pressures, and widespread data privacy issues, warn industry leaders from the decentralized messa

CryptoBreaking·56m ago

Strategy Ends 2025 With 672,497 BTC as Saylor’s Hyper-Bullish Bitcoin Accumulation Stance Holds Firm

Strategy Inc.’s massive bitcoin exposure keeps it central to institutional crypto debates, blending extreme leverage, deep liquidity and index inclusion while facing volatility, dilution pressure and looming index-rule risks that could reshape how investors access bitcoin through equities.

Strateg

BTC-0.67%

Coinpedia·1h ago

Extended Crypto Cycle Ahead? 5 Altcoins Positioned to Survive With 200%+ Upside

Extended crypto cycles favor structurally resilient and liquid networks.

Interoperability and governance remain critical survival factors.

High-yield speculative assets amplify risk within diversified portfolios.

The digital asset market is being assessed for signs o

CryptoNewsLand·1h ago

Crypto Outperforms Gold & Stocks – 2026 Could Spark a Major Rally

Crypto Market Shows Signs of Potential Rebound Ahead of 2026

The cryptocurrency market remains subdued amid broader asset recoveries, yet analysts see opportunities for a turnaround as we approach 2026. Recent data indicates Bitcoin and other major crypto assets lag behind traditional safe havens a

CryptoBreaking·1h ago

Traders Ignored a 50-Year Veteran’s Silver Warning – And Paid the Price Within Hours

When one of the world’s most seasoned traders issued a warning about the silver market, most investors shrugged it off. The result? A sharp reversal and painful losses for those who believed in endless gains.

Sharp Highs, Painful Lows

Peter Brandt, a veteran with nearly 50 years of trading

Moon5labs·1h ago

10 Perspectives Worth Noting Behind Meta's Acquisition of Manus

Meta's acquisition of Manus for approximately $2 billion has garnered widespread attention in the crypto and AI communities. KOLs believe that this acquisition not only aims to enhance AI deployment but also signifies the mature integration of the AI industry. Manus's successful overseas entrepreneurial model and Meta's strategic breakthrough have sparked reflections on the long-term development of the crypto industry.

Biteye·1h ago

Load More

Hot Topics

MoreCrypto Calendar

MoreOM Tokens Migration Ends

MANTRA Chain issued a reminder for users to migrate their OM tokens to the MANTRA Chain mainnet before January 15. The migration ensures continued participation in the ecosystem as $OM transitions to its native chain.

2026-01-14

CSM Price Change

Hedera has announced that starting January 2026, the fixed USD fee for the ConsensusSubmitMessage service will increase from $0.0001 to $0.0008.

2026-01-27

Vesting Unlock Delayed

Router Protocol has announced a 6-month delay in the vesting unlock of its ROUTE token. The team cites strategic alignment with the project’s Open Graph Architecture (OGA) and the goal of maintaining long-term momentum as key reasons for the postponement. No new unlocks will take place during this period.

2026-01-28

Tokens Unlock

Berachain BERA will unlock 63,750,000 BERA tokens on February 6th, constituting approximately 59.03% of the currently circulating supply.

2026-02-05

Tokens Unlock

Wormhole will unlock 1,280,000,000 W tokens on April 3rd, constituting approximately 28.39% of the currently circulating supply.

2026-04-02