Byte_drift1

Người tin vào BTC • Tò mò về DeFi • Kết nối Web3

byte_drift1

Mô hình sốc địa chính trị:

Tháng 2 năm 2022 – Nga tấn công Ukraine →

$BTC bán tháo, sau đó tăng khoảng 40%.

Tháng 6 năm 2025 – Israel tấn công Iran →

Bitcoin giảm, rồi phục hồi khoảng 25%.

Tháng 2 năm 2026 – Mỹ hành động chống Iran.

Hoảng loạn ban đầu → mô hình phục hồi sau đó lặp lại?

Tháng 2 năm 2022 – Nga tấn công Ukraine →

$BTC bán tháo, sau đó tăng khoảng 40%.

Tháng 6 năm 2025 – Israel tấn công Iran →

Bitcoin giảm, rồi phục hồi khoảng 25%.

Tháng 2 năm 2026 – Mỹ hành động chống Iran.

Hoảng loạn ban đầu → mô hình phục hồi sau đó lặp lại?

BTC-1,46%

- Phần thưởng

- 2

- Bình luận

- Đăng lại

- Retweed

- Phần thưởng

- 1

- Bình luận

- Đăng lại

- Retweed

- Phần thưởng

- 2

- Bình luận

- Đăng lại

- Retweed

- Phần thưởng

- 1

- Bình luận

- Đăng lại

- Retweed

- Phần thưởng

- 1

- Bình luận

- Đăng lại

- Retweed

- Phần thưởng

- 2

- Bình luận

- Đăng lại

- Retweed

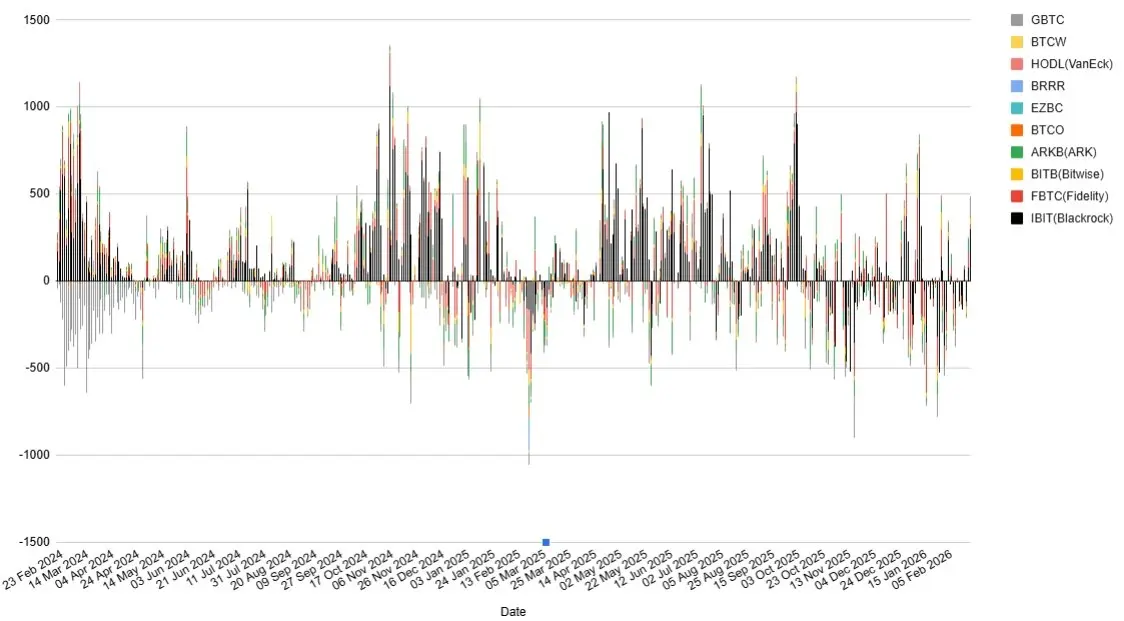

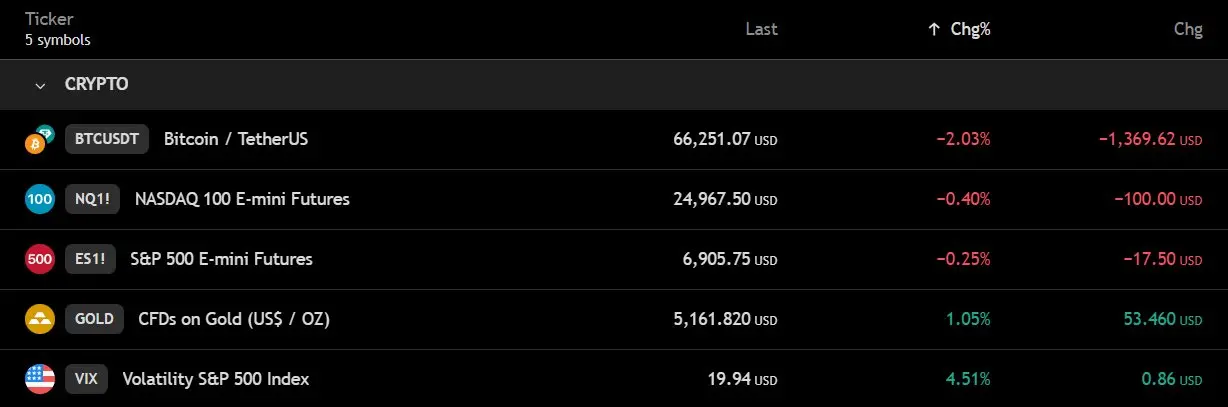

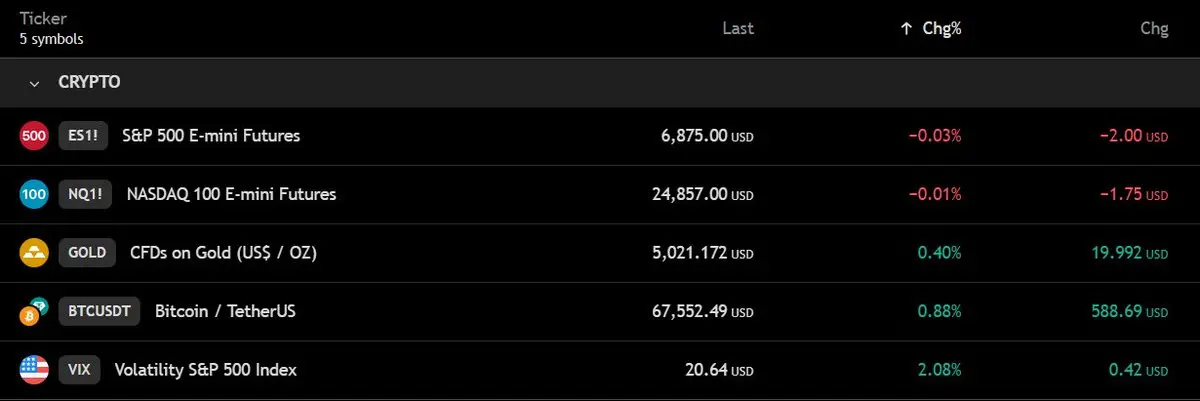

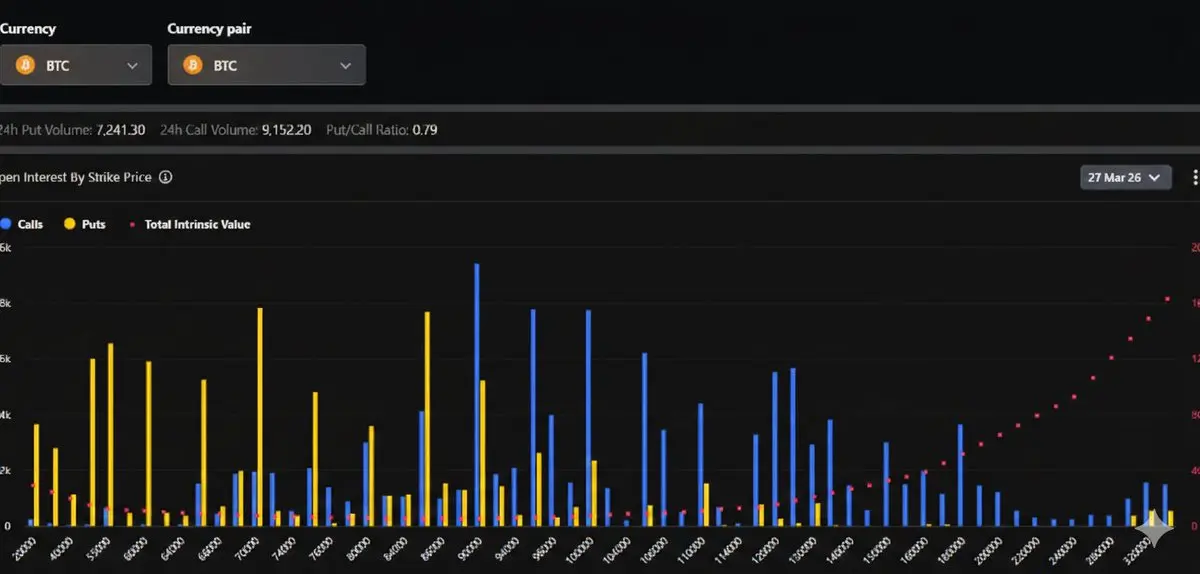

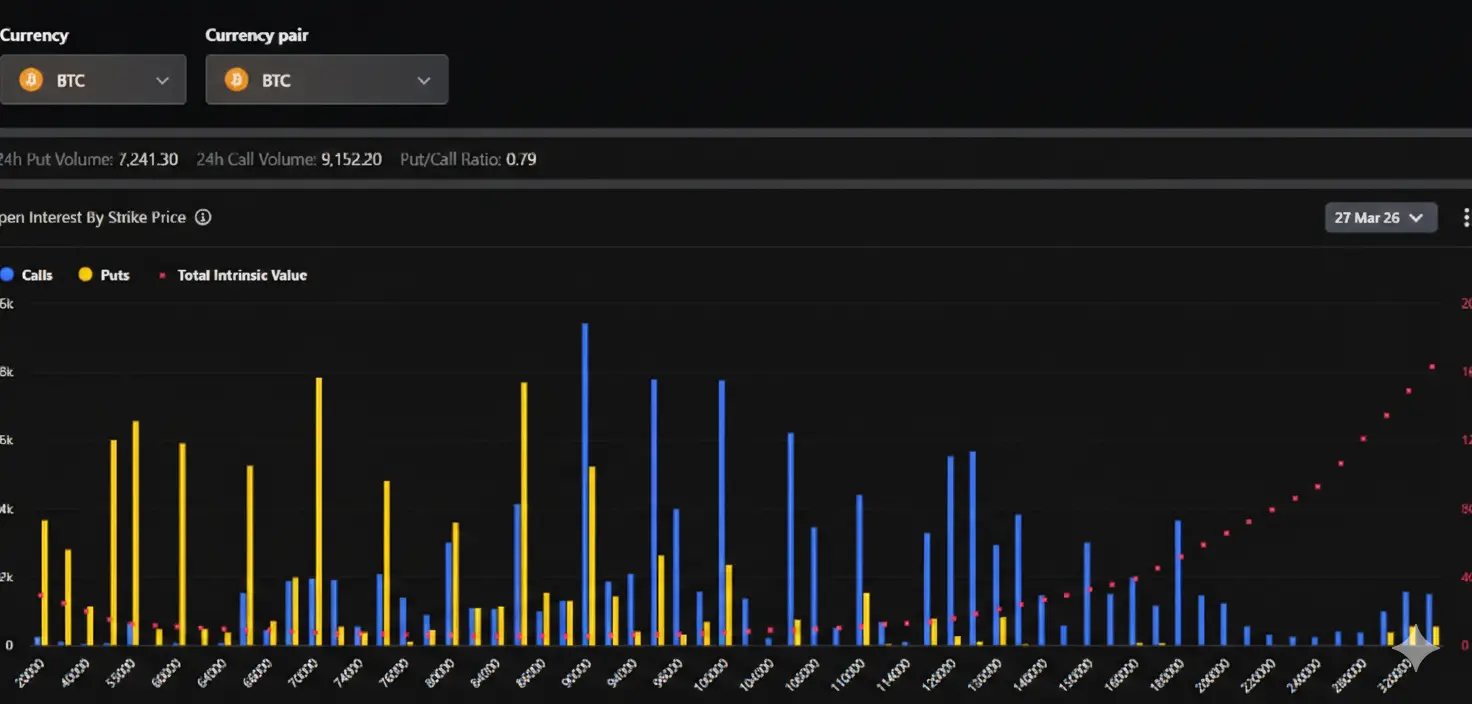

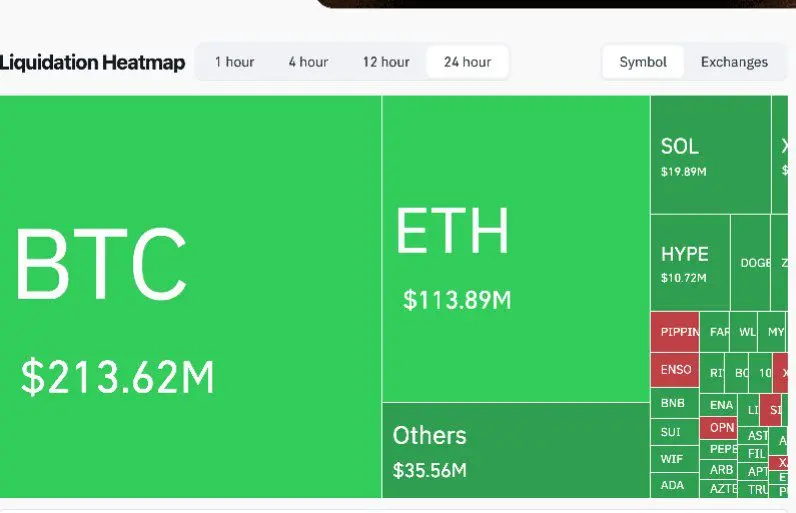

$BTC giảm từ $68.6K → $64.3K, hiện đang bật trở lại gần $66K.

• $468M Thanh lý hợp đồng tương lai (chủ yếu là các vị thế Long)

• Một lần xóa sạch 61,5 triệu đô la trên HTX

• Chỉ số Sợ Hãi & Tham Lam ở mức 5 (Sợ Hãi Tột Độ)

• Vẫn còn thấp hơn 48% so với đỉnh cao tháng 10

Tỷ lệ đòn bẩy được nạp lại sau mỗi lần bật.

Phục hồi → Thanh lý → Đặt lại.

Xem bản gốc• $468M Thanh lý hợp đồng tương lai (chủ yếu là các vị thế Long)

• Một lần xóa sạch 61,5 triệu đô la trên HTX

• Chỉ số Sợ Hãi & Tham Lam ở mức 5 (Sợ Hãi Tột Độ)

• Vẫn còn thấp hơn 48% so với đỉnh cao tháng 10

Tỷ lệ đòn bẩy được nạp lại sau mỗi lần bật.

Phục hồi → Thanh lý → Đặt lại.

- Phần thưởng

- 1

- Bình luận

- Đăng lại

- Retweed

- Phần thưởng

- 1

- Bình luận

- Đăng lại

- Retweed

- Phần thưởng

- 1

- Bình luận

- Đăng lại

- Retweed

Lịch sử BTC/Gold:

• 2014 → Đáy sau 14 tháng

• 2018 → Đáy sau 14 tháng

• 2022 → Đáy sau 14 tháng

Chu kỳ hiện tại → 14 tháng trong giai đoạn giảm giá.

Thời điểm hiện tại phù hợp với các đáy chu kỳ trước đó.

• 2014 → Đáy sau 14 tháng

• 2018 → Đáy sau 14 tháng

• 2022 → Đáy sau 14 tháng

Chu kỳ hiện tại → 14 tháng trong giai đoạn giảm giá.

Thời điểm hiện tại phù hợp với các đáy chu kỳ trước đó.

BTC-1,46%

- Phần thưởng

- 1

- Bình luận

- Đăng lại

- Retweed

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

- Phần thưởng

- 1

- Bình luận

- Đăng lại

- Retweed

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

- Phần thưởng

- 2

- Bình luận

- Đăng lại

- Retweed

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

- Phần thưởng

- 2

- Bình luận

- Đăng lại

- Retweed

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

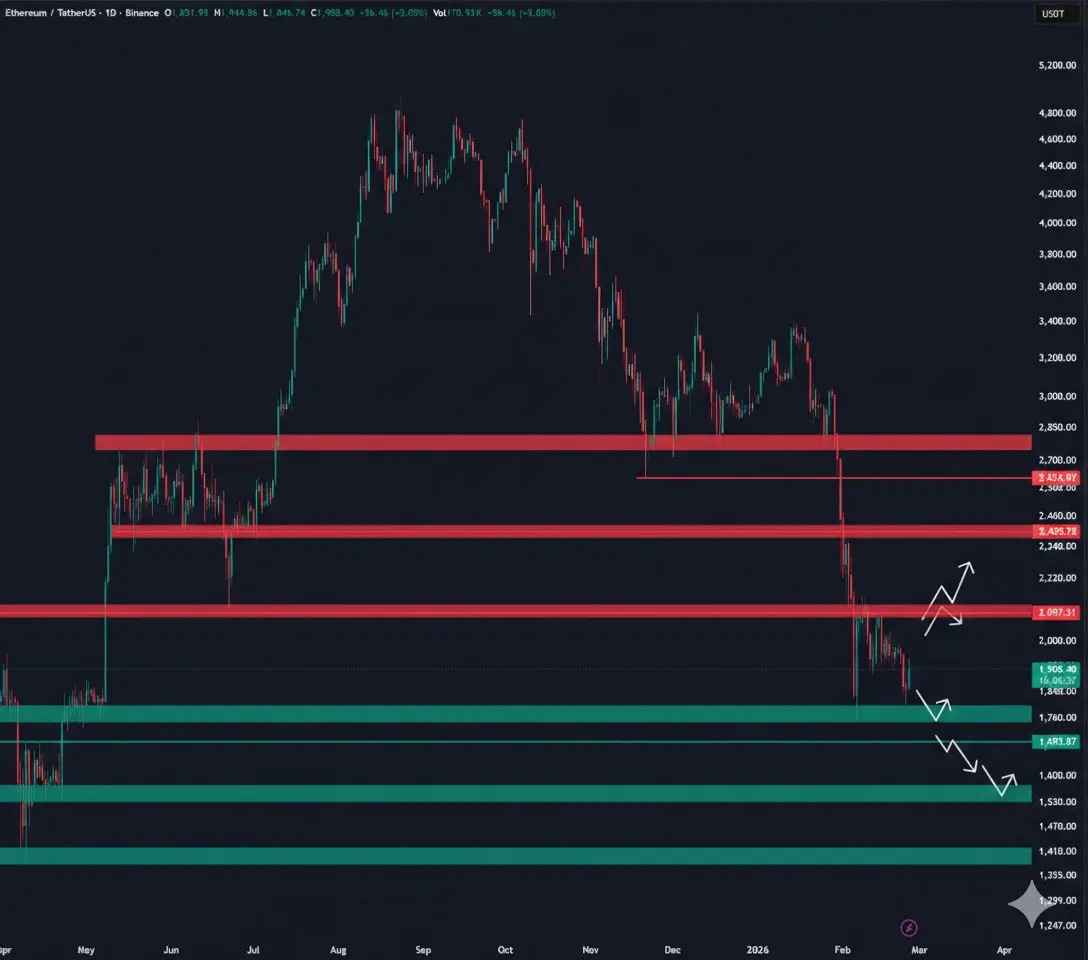

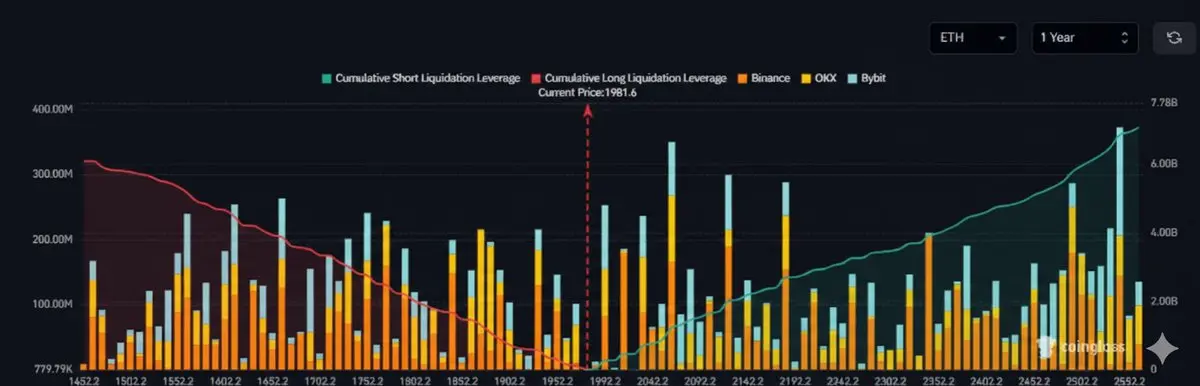

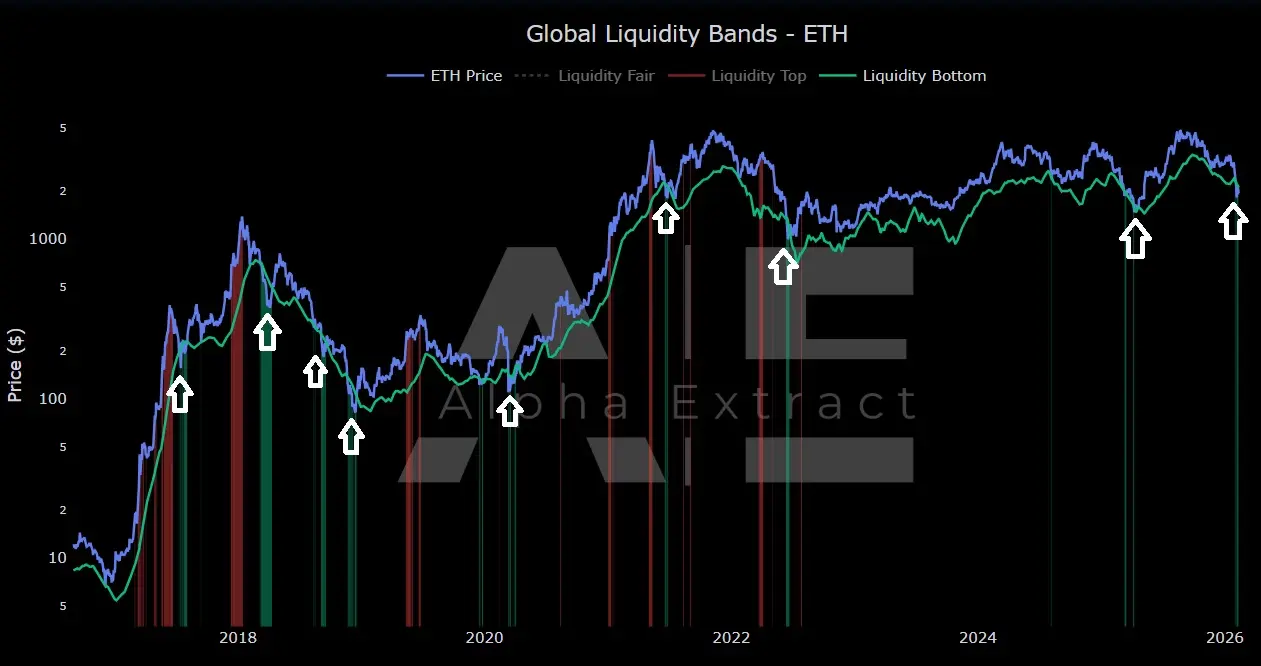

🚨 $ETH Tín hiệu Lịch sử

Từ năm 2018 → 8 lần xuất hiện

• Tháng 4 năm 2025 → Tăng trưởng gấp 3 lần

• Tháng 6 năm 2022 → Đáy chu kỳ

• Tháng 6 năm 2021 → Tăng trưởng gấp 2.5 lần

• Tháng 3 năm 2020 → Đáy của thế hệ

• Từ 2018 đến 2019 → Nhiều lần tăng gấp 2 lần

Xác suất lịch sử → Khoảng 90% khả năng là đáy, phản ứng bật mạnh.

Từ năm 2018 → 8 lần xuất hiện

• Tháng 4 năm 2025 → Tăng trưởng gấp 3 lần

• Tháng 6 năm 2022 → Đáy chu kỳ

• Tháng 6 năm 2021 → Tăng trưởng gấp 2.5 lần

• Tháng 3 năm 2020 → Đáy của thế hệ

• Từ 2018 đến 2019 → Nhiều lần tăng gấp 2 lần

Xác suất lịch sử → Khoảng 90% khả năng là đáy, phản ứng bật mạnh.

ETH-2,53%

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed