# Microstrategy

355.2K

DragonKing143

# StrategyBitcoinPositionTurnsRed

📉 Strategy's BTC

Holdings Turn Red: Institutional Impact?

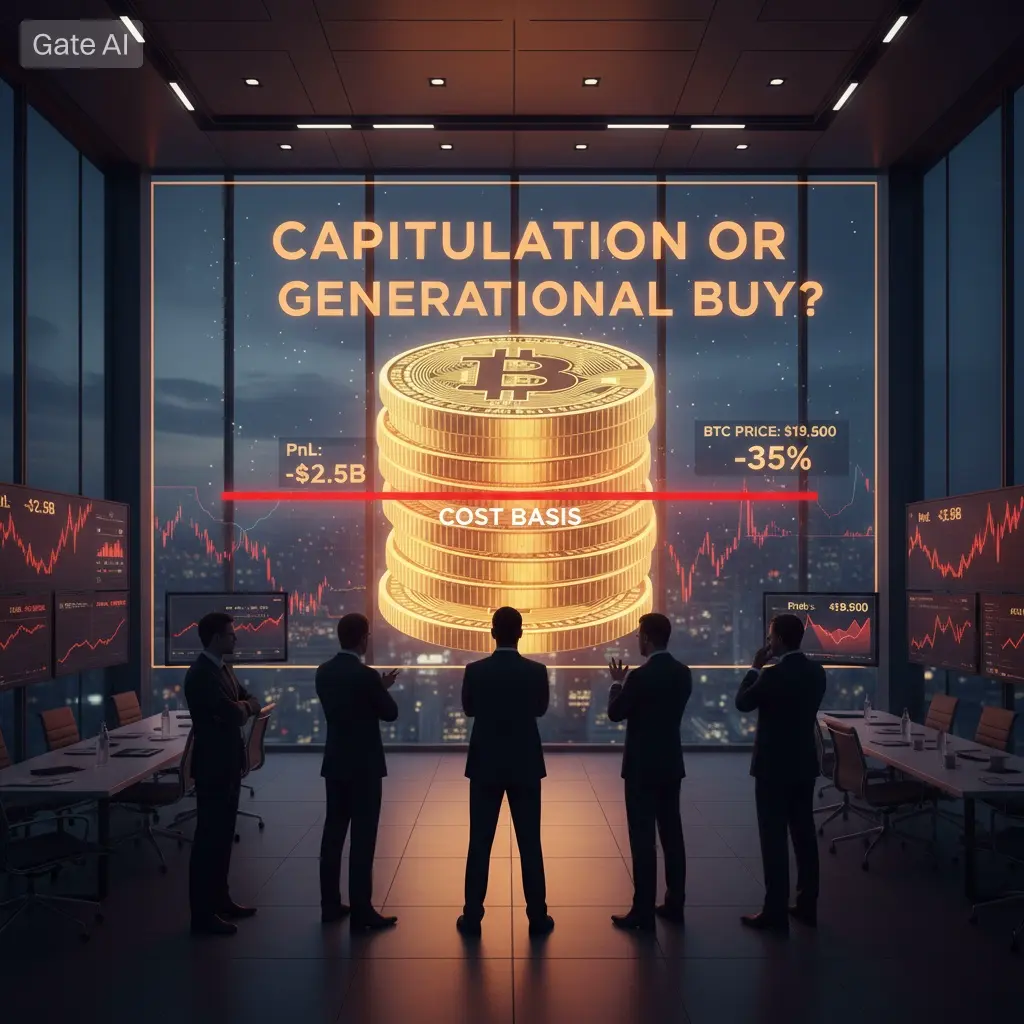

Even the giants aren't immune to the market dip. With Strategy

(formerly MicroStrategy) now showing substantial unrealized losses on its

massive Bitcoin holdings amid recent price drops, the spotlight is on

institutional risk. 🏦

It brings a critical question to the forefront: Does

this change the game for big money?

🤔 We want to

know:

• Will this deter other institutions from adopting a

similar accumulation strategy? • Or do you view this as a temporary paper loss

that won't sway long-term conv

📉 Strategy's BTC

Holdings Turn Red: Institutional Impact?

Even the giants aren't immune to the market dip. With Strategy

(formerly MicroStrategy) now showing substantial unrealized losses on its

massive Bitcoin holdings amid recent price drops, the spotlight is on

institutional risk. 🏦

It brings a critical question to the forefront: Does

this change the game for big money?

🤔 We want to

know:

• Will this deter other institutions from adopting a

similar accumulation strategy? • Or do you view this as a temporary paper loss

that won't sway long-term conv

BTC4.9%

- Reward

- like

- Comment

- Repost

- Share

JUST IN: $1.7 Billion Wiped Out as Bitcoin Tests Sub-$90k Liquidity.

The leverage flush is finally here. In the last 24 hours, over $1.7 billion in positions has been liquidated across the market, dragging Bitcoin down to test the $89,400 support level. The primary trigger was a wave of "risk-off" selling driven by new geopolitical fears regarding U.S.-Greenland tariffs.

This matters because the market is misinterpreting the flows. While ETF investors panic-sold roughly $500 million this week, Strategy (MicroStrategy) used the volatility to execute a massive $2.1 billion Bitcoin purchase. The

The leverage flush is finally here. In the last 24 hours, over $1.7 billion in positions has been liquidated across the market, dragging Bitcoin down to test the $89,400 support level. The primary trigger was a wave of "risk-off" selling driven by new geopolitical fears regarding U.S.-Greenland tariffs.

This matters because the market is misinterpreting the flows. While ETF investors panic-sold roughly $500 million this week, Strategy (MicroStrategy) used the volatility to execute a massive $2.1 billion Bitcoin purchase. The

BTC4.9%

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊MicroStrategy has become one of the most reliable early indicators for the wider Bitcoin market and its latest weekly chart is sending a message that traders should not ignore. The company’s fifty week moving average has started to bend downward and that gentle curve often marks the beginning of a shift in momentum. It is the same kind of behavior that appeared in the past during major turning points. The last time this average curled over was in late twenty twenty four and only a short time later Bitcoin entered a clear correction. The pattern did not take long to play out and the timing was

BTC4.9%

- Reward

- 2

- Comment

- Repost

- Share

MicroStrategy (#Strategy / MSTR) currently in this round's top structure, almost mirrors the performance before and after the previous BTC bull market.

It's not the price, but the structure itself.

Let's start with a few highly similar aspects.

First, BTC's subsequent price keeps hitting new highs, but MSTR does not.

On the contrary, MSTR forms a lower high, a typical relative weakness turning into weakness structure.

Second, from the all-time high, MSTR's maximum drawdown is also over 70%.

This magnitude has already been fully demonstrated by the market in the previous cycle.

In other words,

It's not the price, but the structure itself.

Let's start with a few highly similar aspects.

First, BTC's subsequent price keeps hitting new highs, but MSTR does not.

On the contrary, MSTR forms a lower high, a typical relative weakness turning into weakness structure.

Second, from the all-time high, MSTR's maximum drawdown is also over 70%.

This magnitude has already been fully demonstrated by the market in the previous cycle.

In other words,

BTC4.9%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

128.44K Popularity

26.56K Popularity

390.52K Popularity

10.56K Popularity

9.92K Popularity

8.3K Popularity

7.43K Popularity

7.82K Popularity

5.28K Popularity

3.23K Popularity

16.65K Popularity

10.55K Popularity

23.13K Popularity

30.91K Popularity

25.88K Popularity