The Russian Central Bank proposes "Legalization of Crypto Trading"! Aiming to complete legislation by 2026

27m ago

IMF praises El Salvador's "economic growth" surpassing expectations! Controversy over the "Bitcoin ban" cools down

37m ago

Trending Topics

View More105.39K Popularity

56.65K Popularity

29.86K Popularity

268 Popularity

10.86K Popularity

Hot Gate Fun

View More- MC:$3.53KHolders:10.00%

- MC:$3.53KHolders:10.00%

- MC:$3.52KHolders:10.00%

- MC:$3.53KHolders:10.00%

- MC:$3.53KHolders:10.00%

Pin

🎉 Share Your 2025 Year-End Summary & Win $10,000 Sharing Rewards!

Reflect on your year with Gate and share your report on Square for a chance to win $10,000!

👇 How to Join:

1️⃣ Click to check your Year-End Summary: https://www.gate.com/competition/your-year-in-review-2025

2️⃣ After viewing, share it on social media or Gate Square using the "Share" button

3️⃣ Invite friends to like, comment, and share. More interactions, higher chances of winning!

🎁 Generous Prizes:

1️⃣ Daily Lucky Winner: 1 winner per day gets $30 GT, a branded hoodie, and a Gate × Red Bull tumbler

2️⃣ Lucky Share Draw: 10🔥 Gate Square Event | #PostToWinLaunchpadKDK 🔥

KDK | The latest Gate Launchpad spotlight token

Before: stake USDT to join

Now 👉 just post for a chance to win KDK!

🎁 Gate Square exclusive: 2,000 KDK total rewards up for grabs

🚀 Launchpad star project — big potential ahead 👀

📅 Event Duration

Dec 19, 04:00 – Dec 30, 16:00 (UTC)

📌 How to Join

Post on Gate Square (text, images, analysis, or opinions)

Content should relate to KDK price predictions at launch, project insights, or your understanding of the Gate Launchpad mechanism

Add one hashtag: #发帖赢Launchpad新币KDK 或 #PostToWinLaunchpadKDK

�🎨 Gate AI Creation Contest | One Sentence, Draw Your 2026

On Gate Square, anyone can be a visual creator — truly zero barriers to entry.

With just one sentence, generate an image and bring your vision of 2026 to life.

Create and post your work using Gate Square AI Creation for a chance to win the Gate Year of the Horse New Year Gift Box.

📅 Duration

Dec 17, 2025, 10:00 – Jan 3, 2026, 18:00 UTC

🎯 How to Join

1. Go to Gate Square → Create Post → AI Creation

2. Enter one sentence to generate your image

3. Post with #GateAICreation

🏆 Rewards

5 winners: Gate Year of the Horse New Year

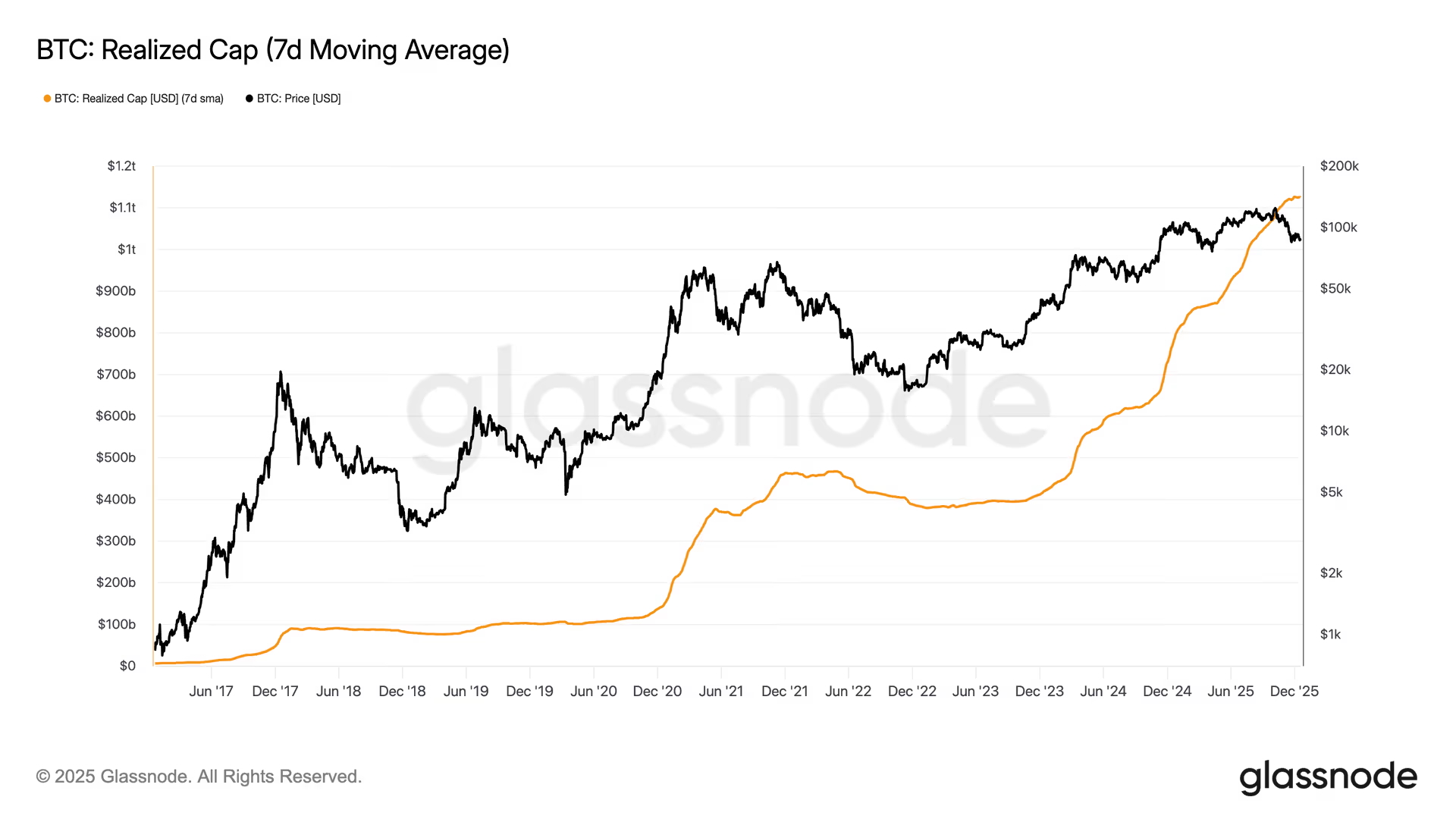

Bitcoin's "Realized Market Cap" firmly holds at $1.1 trillion! Analyst: The 2026 market outlook is worth looking forward to

Despite Bitcoin experiencing a decline of over 30% in the past 10 weeks, causing concern among many investors, on-chain data shows that the spark of a bullish trend has not been extinguished.

According to Glassnode data, Bitcoin’s “Realized Cap” currently remains firmly above the historic high of $1.125 trillion, indicating that there has been no large-scale capital withdrawal from the market, and suggesting that the bull market structure remains solid.

Unlike the commonly watched “Market Cap” (current price x total circulating supply), this on-chain indicator is more valuable for reference. “Realized Cap” is calculated based on the “last on-chain movement price” of each Bitcoin, removing the influence of short-term speculation, and reflecting the “actual cost basis” invested by investors and the “real capital inflow.”

In other words, when the total market cap soars or plummets with the price of the coin, the Realized Cap remains high and stable, indicating that holders are reluctant to sell and that there has been no large-scale loss realization.

According to data from blockchain analysis firm Glassnode, even when Bitcoin plunged more than 30% from its October all-time high, the “Realized Cap” not only did not fall but continued to rise during the correction period, only recently stabilizing around $1.125 trillion.

This trend is reminiscent of the scene during the “tariff panic” outbreak in April this year. At that time, Bitcoin briefly dipped to $76,000, but on-chain capital levels did not retreat. The price then rebounded strongly and reached new highs.

In contrast, during the 2022 bear market, as the price collapsed, investor confidence shattered, and many capitulated, causing the Realized Cap to bleed from $470 billion down to $385 billion. However, currently, the market does not show such panic-driven “mass exodus” or “collective surrender” behavior.

Therefore, analysts are beginning to question the widely accepted “4-year cycle” theory in the crypto world.

“The 4-Year Cycle” Narrative Shakes, Surprises in 2026?

Bitwise Europe Research Director Andre Dragosch believes that Bitcoin is very likely to break free from the “4-year cycle” constraints and experience an unexpected surge in 2026.

He explains that against the backdrop of a resilient global economy, continued rate cuts by major central banks, a steepening yield curve, and overall liquidity expansion, such an environment often weakens the US dollar. Historical experience tells us that a “weak dollar” is beneficial for risk assets like Bitcoin.