Gold and silver surge sharply: Is Bitcoin "falling behind" or gathering strength during Christmas week?

6h ago

Price decline, massive whales dumping and leaving the market—A look at the DeFi governance dilemma through the battle for control of Aave

6h ago

Trending Topics

View More102.88K Popularity

51.95K Popularity

28.65K Popularity

9.58K Popularity

5.29K Popularity

Hot Gate Fun

View More- MC:$3.52KHolders:10.00%

- MC:$3.51KHolders:10.00%

- MC:$3.53KHolders:20.00%

- MC:$3.56KHolders:20.00%

- MC:$3.53KHolders:20.04%

Pin

🎉 Share Your 2025 Year-End Summary & Win $10,000 Sharing Rewards!

Reflect on your year with Gate and share your report on Square for a chance to win $10,000!

👇 How to Join:

1️⃣ Click to check your Year-End Summary: https://www.gate.com/competition/your-year-in-review-2025

2️⃣ After viewing, share it on social media or Gate Square using the "Share" button

3️⃣ Invite friends to like, comment, and share. More interactions, higher chances of winning!

🎁 Generous Prizes:

1️⃣ Daily Lucky Winner: 1 winner per day gets $30 GT, a branded hoodie, and a Gate × Red Bull tumbler

2️⃣ Lucky Share Draw: 10🔥 Gate Square Event | #PostToWinLaunchpadKDK 🔥

KDK | The latest Gate Launchpad spotlight token

Before: stake USDT to join

Now 👉 just post for a chance to win KDK!

🎁 Gate Square exclusive: 2,000 KDK total rewards up for grabs

🚀 Launchpad star project — big potential ahead 👀

📅 Event Duration

Dec 19, 04:00 – Dec 30, 16:00 (UTC)

📌 How to Join

Post on Gate Square (text, images, analysis, or opinions)

Content should relate to KDK price predictions at launch, project insights, or your understanding of the Gate Launchpad mechanism

Add one hashtag: #发帖赢Launchpad新币KDK 或 #PostToWinLaunchpadKDK

�🎨 Gate AI Creation Contest | One Sentence, Draw Your 2026

On Gate Square, anyone can be a visual creator — truly zero barriers to entry.

With just one sentence, generate an image and bring your vision of 2026 to life.

Create and post your work using Gate Square AI Creation for a chance to win the Gate Year of the Horse New Year Gift Box.

📅 Duration

Dec 17, 2025, 10:00 – Jan 3, 2026, 18:00 UTC

🎯 How to Join

1. Go to Gate Square → Create Post → AI Creation

2. Enter one sentence to generate your image

3. Post with #GateAICreation

🏆 Rewards

5 winners: Gate Year of the Horse New Year

Price decline, massive whales dumping and leaving the market—A look at the DeFi governance dilemma through the battle for control of Aave

Author: Jae, PANews

When the governance benchmark of the DeFi market collides with real-world commercial interests, a brutal game of “who is the master” is unfolding inside the top lending protocol Aave.

As a leader in the DeFi market, Aave manages approximately $34 billion in assets and is regarded as a model of on-chain governance. However, in December 2025, Aave found itself in its most severe trust crisis in its 8-year history.

This controversy was not accidental. The initial trigger was a seemingly minor front-end fee distribution, but it unexpectedly set off a domino effect. Under layers of catalyzing key events, it ultimately pushed the lending giant Aave into the spotlight.

This is not just a simple dispute over profit sharing; it has torn open a fundamental and sensitive conflict in the DeFi space: under the narrative of decentralization, who truly holds the authority—the founding team with control over the code and brand, or the DAO community holding governance tokens?

This is not only a crisis for Aave but also raises an urgent question for the entire DeFi market: as protocols mature, how can we balance the commercial incentives of development teams with the governance rights of token holders?

$10 million “disappears,” Aave Labs accused of depriving community rights

The internal governance war within Aave began with an update on technical optimization.

On December 4, 2025, Aave Labs announced it would replace its official front-end (app.aave.com) asset swap service provider from ParaSwap to CoWSwap, citing better prices and MEV resistance.

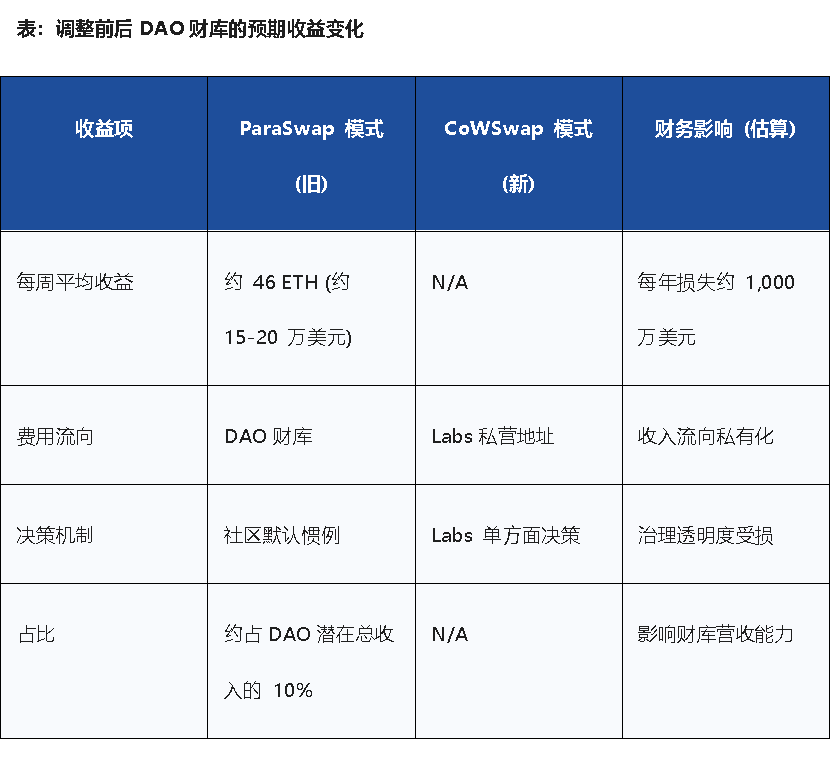

However, the subsequent financial changes were not fully disclosed in the announcement. Community representative EzR3aL tracked on-chain data and found that after the fee structure change, the fees generated from user transactions no longer flowed into the DAO’s public treasury but were transferred to an address controlled by Labs. Based on historical data, this lost annualized revenue could amount to $10 million.

Aave community leader Marc Zeller pointed out: this is a form of covert privatization of brand assets. Labs is profiting by leveraging DAO-funded technology and brand value, breaking the long-standing trust tacit agreement.

Aave founder Stani Kulechov believes this is a division between protocol and product. He explained that the Aave protocol built on smart contracts belongs to the DAO, while the front-end app (app.aave.com), which requires high operational costs, should have its commercial rights belong to the builder, Labs. The fees previously flowing to the DAO were just “voluntary donations.”

This view challenges the traditional understanding of the DeFi community—that tokens should capture all economic value generated by the protocol ecosystem.

To the community, Stani’s logic is akin to a sovereignty deprivation. If the front-end, as the most critical user entry point and traffic gate, can have its revenue unilaterally intercepted by Labs, will future projects like Aave V4, GHO stablecoin, and Horizon RWA face similar revenue captures? Under such circumstances, the value capture promise of governance token AAVE could become a mere empty check.

Internal conflict intensifies, DAO proposal seeks to reclaim brand ownership

When gentle negotiations fail to reach consensus, the community’s radical faction begins to adopt extreme game strategies. On December 15, a governance proposal called the “Poison Pill Plan” was proposed by user tulipking, with three highly aggressive demands:

Although this heavy-hitter proposal was temporarily shelved due to procedural issues, its deterrent effect was evident, indicating that the community has the ability and willingness to use governance votes to reverse and absorb non-cooperative development teams.

Under the shadow of this extreme proposal, former CTO Ernesto Boado put forward a more constructive “Phase One - Ownership” proposal, signaling a sovereignty recovery initiative: reclaim domains like aave.com; regain control of official social media accounts such as X and Discord; and take back control of GitHub repositories.

Boado stated plainly that, true decentralization must include the decentralization of “soft assets.” He proposed establishing a legal entity controlled by the DAO to hold these brand assets, thereby gaining recourse within traditional legal jurisdictions. This marks an attempt for the DAO to evolve from a loose on-chain voting organization into a “digital sovereignty entity” with actual legal definitions and assets.

Token price drops, whale offloads, Labs unilaterally pushing votes cause dissatisfaction

As governance descends into internal strife, the secondary market begins to vote with its feet. Although the $34 billion assets locked in the protocol show no obvious fluctuations, the AAVE token price—closely related to holder interests—has continued to decline by over 25% within two weeks.

On December 22, the second-largest AAVE holder sold off, having accumulated around 230,000 AAVE tokens near an average price of $223, but liquidated at about $165 amid governance chaos, with an estimated paper loss of up to $13.45 million. The whale’s exit is a negative signal regarding Aave’s current governance chaos and deep skepticism about its future value capture ability: if profits can be easily stripped, the previous valuation models for the token will also become invalid.

Adding insult to injury, Labs unilaterally advanced the proposal to the Snapshot voting stage without the consent of original author Boado, sparking strong community protests. Several representatives criticized this move as a breach of normal governance procedures.

Crypto KOL 0xTodd pointed out two issues: 1) The voting period was set from December 23-26, during which many users are on holiday for Christmas, potentially reducing participation; 2) Boado’s proposal was still in the discussion phase, which typically requires 3-6 months of repeated communication and refinement before entering voting.

However, Stani responded that the new ARFC proposal voting fully complies with the governance framework, and voting is the best and final way to resolve the issue. This reveals a divergence: DAO emphasizes procedural correctness, while Labs prioritizes efficiency.

On the other hand, perfect procedural correctness can also stifle efficiency. If the development team’s commercial returns are completely stripped, Labs’ motivation to push protocol V4 upgrades will significantly decline. Managing brand via DAO, in case of legal disputes, could lead to slow responses due to the absence of responsible individuals, potentially resulting in the brand being directly seized by regulators.

So far, approval votes only account for 3%, indicating a one-sided situation. The community might once again enter the “proposal—vote” cycle, possibly worsening into a vicious loop. In reality, Aave has already wasted a lot of time stuck in governance deadlock.

However, this trust crisis is likely only a phase—an “adulthood” milestone that Aave, as a DeFi leader, must pass.

Many veteran DAO participants believe that even the on-chain governance benchmark Aave is on the verge of splitting; perhaps the DAO governance model itself is inherently unfeasible. Yet, the fact that such transparent, intense, and evenly matched debates can occur within Aave proves its high level of decentralized governance. This collective ability to correct biases is precisely the value of decentralized governance.

A more critical turning point comes from external regulation. On December 20, the US SEC concluded a four-year investigation without taking any enforcement action against Aave. This is widely interpreted as regulatory tolerance for highly decentralized governance models like Aave.

Amid the storm, Aave’s fundamentals remain highly resilient. Founder Stani continues to respond to doubts, personally accumulating a total of $15 million worth of AAVE, enduring over $2 million in paper losses, and announcing a “Three Pillars” strategy to rebuild community consensus and trust. However, this move has also been questioned by the community, which suspects it aims to increase his voting influence. Even so, simply increasing Labs’ influence in governance is a superficial solution.

Governance evolution, hybrid organizations may become a path for利益重構

As the turmoil unfolds, a new governance evolution path may emerge: Aave could transform from a single on-chain protocol into a “hybrid organization.”

Returning to the latest proposal, Boado’s model fundamentally redefines the relationship from three aspects:

In fact, this controversy is highly similar to the incident in 2023 when Uniswap Labs charged front-end fees, which caused community dissatisfaction. Ultimately, Uniswap defined Labs’ commercialization rights and the protocol’s decentralization, reaching an agreement with the community.

Aave might take a further step—by attempting to resolve the “who owns the brand” issue through the “Phase One—Ownership” proposal from the legal root. If approved, any commercial activity by Labs would require DAO approval at the procedural level, fundamentally ending the possibility of “covert privatization.”

Aave’s dilemma reflects a common contradiction faced by all decentralized protocols. Does the market want an efficient but potentially centralized “product,” or a decentralized but possibly less efficient “protocol”? This not only concerns the authority boundaries of governance tokens but also determines the future direction of DeFi’s evolution.

Currently, this $30+ billion DeFi experiment stands at a crossroads, with its future gradually revealed through each on-chain vote.