XRP Price Prediction: Could XRP Reach 1000 USD in 10 Years

South Korean Scientist Issues Bold Long-Term Projection

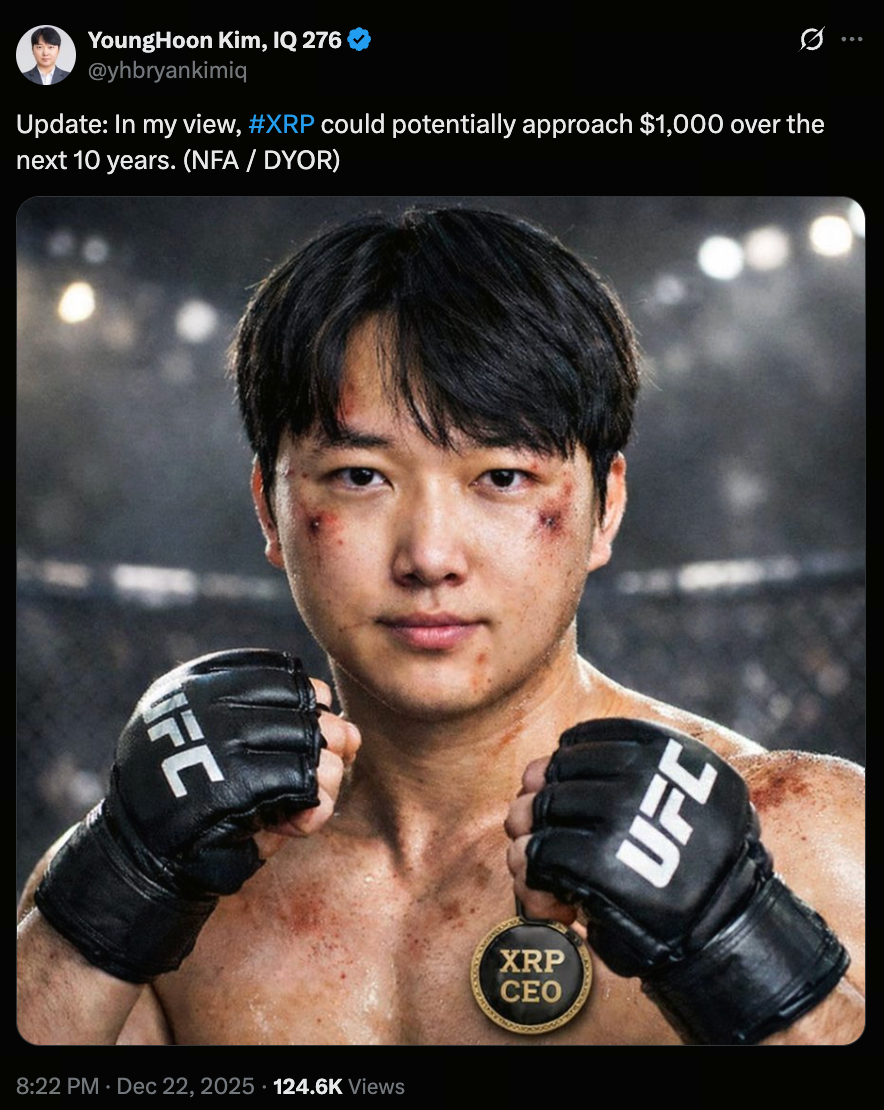

(Source: yhbryankimiq)

South Korean scientist YoungHoon Kim shared his perspective on X, forecasting that XRP could reach $1,000 over the next decade. Kim noted that this projection relies on several macroeconomic assumptions, including substantial capital inflows into the crypto market, a weakening US dollar, and sustained high inflation. He also cautioned that this is not financial advice and the figure only applies under specific conditions.

High Price Scenarios and Assumptions

Kim explained that a jump from the current price of about $1.87 to $1,000 would require more than just market sentiment. With approximately 60.57 billion XRP in circulation, a $1,000 price per token would give XRP a total market capitalization of around $60.57 trillion. This valuation would eclipse major assets like gold, leading to skepticism in the marketplace.

Community Support and Doubt

Some supporters remain optimistic. CryptoCharged COO Matthew Brienen, for example, asserts that a price range of $100 to $1,000 within ten years is very possible and personally holds a significant stake in XRP. Investor Armando Pantoja also expressed willingness to wait a decade for substantial returns, pointing out that SEC regulations have previously constrained XRP’s price growth.

However, skepticism persists. X user Utumax and YouTuber Zach Humphries have both called for more transparent calculation methods, highlighting clear issues with the $60 trillion market cap assumption.

Assessing the Reality of $1,000

For XRP to reach $1,000, its value would need to far surpass current on-chain usage and settlement volumes. Long-term value hinges on real-world utility, stable liquidity, and widespread market acceptance. Regulatory clarity could support price growth, but policy alone is insufficient to achieve multi-trillion-dollar market capitalization. Some analysts argue that such round-number targets are more about grabbing attention than offering rigorous forecasts.

Start trading XRP spot now: https://www.gate.com/trade/XRP_USDT

Conclusion

Kim’s prediction underscores deep market divides: some investors are willing to bet on extraordinary upside, while others demand more robust evidence and logic. When considering ambitious targets like these, investors should carefully assess the underlying assumptions and keep in mind that sweeping forecasts often depend on major developments beyond XRP itself.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Pi Coin Transaction Guide: How to Transfer to Gate.com

What is N2: An AI-Driven Layer 2 Solution