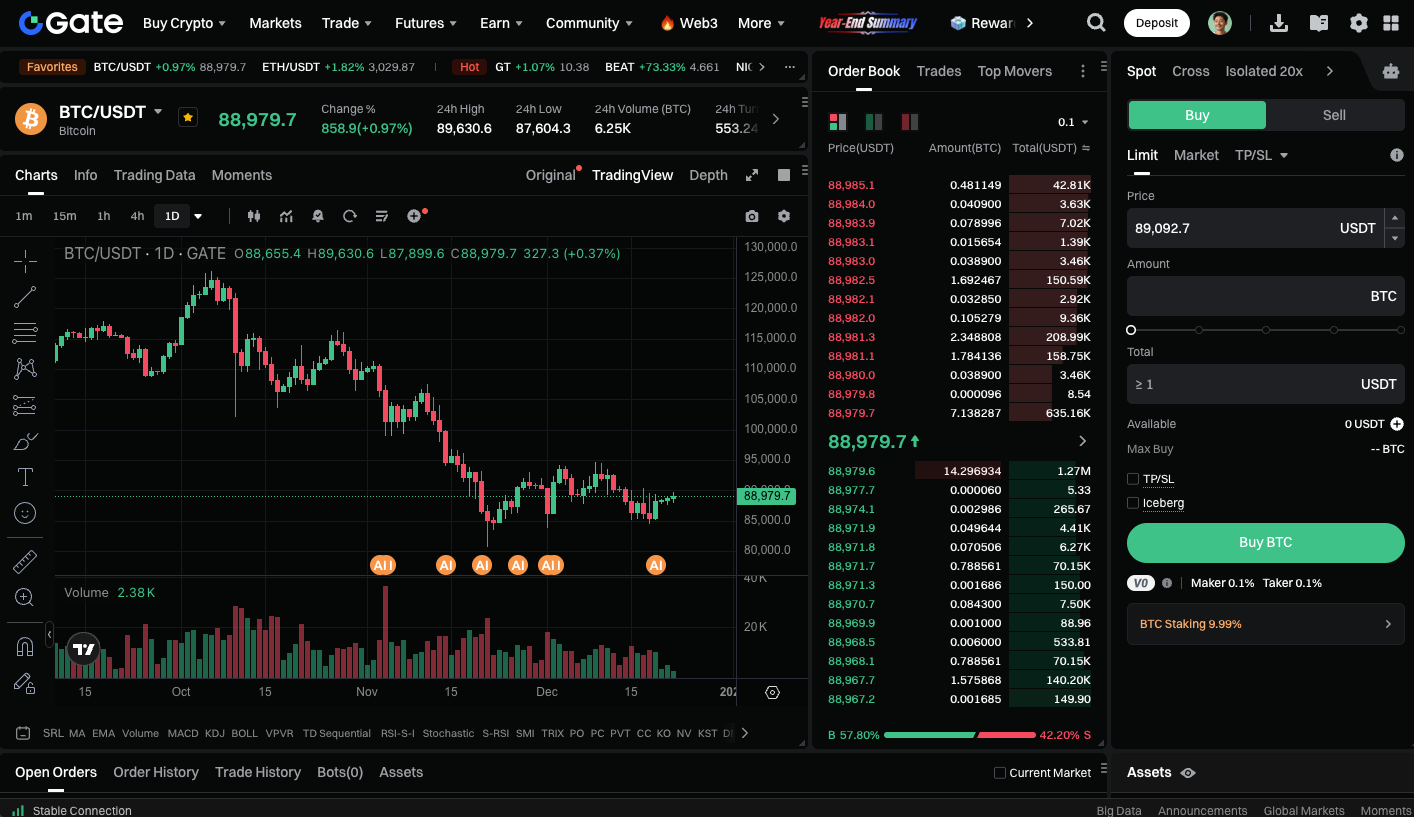

Bitcoin Price Prediction: Demand Weakens, Could Drop to $56,000 with Over 50% Loss

Bitcoin Enters Bear Market

Blockchain analytics firm CryptoQuant reported Thursday that Bitcoin demand is falling, with major investors steadily reducing their positions. The market has now entered a bear phase. Their analysis suggests prices could drop further to $70,000, and in the long term, may reach as low as $56,000.

(Source: cryptoquant_com)

CryptoQuant highlighted that since 2023, Bitcoin has seen three major demand surges: the launch of US spot Bitcoin ETFs, the US presidential election, and increased purchases by corporate treasury departments. As demand growth slows, the key drivers that previously supported price momentum have faded away.

ETF and Large Holder Positions Turn Cautious

Institutional demand is cooling, drawing further attention. In Q4 2025, US spot Bitcoin ETFs shifted to net selling, reducing their Bitcoin holdings by about 24,000 coins. Wallets holding 100 to 1,000 Bitcoins—including ETF and corporate treasury wallets—also show slower accumulation. The last time this pattern emerged was just before the 2022 bear market.

Risk appetite in the derivatives market is also declining. Funding rates for perpetual contracts have dropped to their lowest levels since December 2023, signaling that traders are less willing to maintain long positions— a trend commonly seen in bear markets.

Technical Support

Bitcoin’s price has fallen below its 365-day moving average, a technical threshold that typically marks the shift between bull and bear markets. CryptoQuant notes that Bitcoin’s four-year cycle is primarily driven by demand shifts rather than halving events. Although the outlook remains bearish, this correction may be relatively moderate. Historically, Bitcoin bear market lows often align with the realized price, which is currently around $56,000—about a 55% drop from the recent all-time high. Medium-term support sits near $70,000, providing a degree of market stability.

Start trading BTC spot now: https://www.gate.com/trade/BTC_USDT

Summary

Overall, Bitcoin faces mounting pressure from both weakening demand and institutional selling, leading to a cautious market sentiment in the near term. Technical analysis points to medium-term support at $70,000 and a potential long-term bottom around $56,000. For investors, while downside risks persist, this pullback could set the stage for the next bull market and present opportunities for strategic positioning.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution