Altcoin ETFs Go Mainstream: Data Overview, Opportunities, and Risk Assessment

I. Introduction

In the fourth quarter of 2025, the U.S. market witnessed a wave of altcoin ETF launches, with several single-asset spot ETFs approved and listed in quick succession—an unprecedented “batch issuance” event for the crypto sector. The successful introduction of spot Bitcoin (BTC) and Ethereum (ETH) ETFs not only opened the door for institutional investors to compliantly allocate crypto assets, but also established a clear regulatory approval model and product pathway, directly accelerating the mass filing and rollout of altcoin ETFs.

As the U.S. Securities and Exchange Commission (SEC) continues to refine its crypto ETF approval process, and asset managers and market participants strategically position themselves, Q4 2025 has become a pivotal window for the rollout of altcoin ETFs. ETFs for assets such as XRP, SOL, DOGE, LTC, HBAR, and LINK have launched on exchanges, while the next wave—including AVAX and AAVE—is advancing rapidly. The swift expansion of altcoin ETFs highlights the accelerating institutionalization of the crypto market and marks a shift in crypto asset products from “single core asset dominance” to a more diversified and layered maturity.

Within this context, this article reviews the development of altcoin ETFs, examining the demonstration effect of Bitcoin and Ethereum ETFs, the surge in batch listings, and the pipeline of pending altcoin ETF applications. We analyze capital flows, trading activity, AUM, and price performance for listed altcoin ETFs. Building on this, we discuss the opportunities and risks for altcoin ETFs and outline future trends, aiming to provide a well-structured, logically sound, and actionable industry perspective for both retail and institutional investors navigating this emerging sector.

II. Altcoin ETF Overview

1. The Demonstration Effect of Bitcoin and Ethereum ETFs

Over the past several years, the approval of spot Bitcoin (BTC) and Ethereum (ETH) ETFs in the U.S. has been the most significant milestone for bringing crypto assets into traditional finance. The launch of the Bitcoin ETF drew massive institutional inflows in a short period, driving up market participation. The Ethereum ETF followed, giving both institutions and retail investors compliant access to crypto investments.

This “gateway effect” fundamentally changed market dynamics: investors’ risk tolerance rose, institutions became more motivated to allocate digital assets, asset managers actively expanded product lines, and regulators gained experience and confidence in the approval process. As a result, a wave of altcoin ETF applications quickly emerged, with many asset managers rolling out single-asset and multi-asset ETF products for XRP, DOGE, LTC, HBAR, SUI, and LINK.

Source: https://x.com/Minh_BNB10000/status/1999307817430462471?s=20

Another key driver has been the SEC’s incremental regulatory changes. In September 2025, the SEC formally adopted revised “Generic Listing Standards for Commodity Trust Shares,” giving crypto asset ETFs clearer entry criteria and much shorter approval times—cutting the process from roughly 240 days to just 60–75 days. This regulatory framework is the foundation for the surge in batch applications and concentrated altcoin ETF listings.

Additionally, the U.S. government shutdown in November 2025 created a temporary regulatory gap. Under certain provisions (such as Section 8(a) of the Securities Act of 1933), some fund registration statements without delay clauses could take effect automatically, effectively creating a “silent approval channel” for fast-track listings. These factors together triggered the recent wave of mass altcoin ETF launches.

2. The Altcoin ETF Batch Listing Surge

Since the second half of 2025, the pace of U.S. altcoin ETF approvals and listings has accelerated, showing a pattern of “queueing for listing” and progressive batch approvals.

- Solana ETF: In October 2025, the Solana (SOL) ETF was approved and listed on exchanges such as the NYSE, marking the first true spot altcoin ETF to trade in the U.S.

- Hedera ETF: Also in October, multiple applications for Hedera (HBAR) ETFs entered review. Canary Capital and others revised HBAR ETF registration statements, and these ETFs were approved and listed in the following weeks.

- XRP ETF: In November 2025, the XRP ETF became the second spot altcoin ETF to be approved in a batch and quickly listed. Canary Capital, Grayscale, 21Shares, and others launched XRP ETFs on NYSE Arca and other exchanges, attracting significant capital inflows in a short time.

- DOGE ETF: In November 2025, the DOGE (Dogecoin) ETF was approved by the DEC, signaling regulatory acceptance—albeit cautious—of meme coins.

- LTC ETF: The legacy altcoin LTC (Litecoin) ETF was also approved in November. While capital inflows have been modest, this set the stage for additional legacy altcoin ETF filings.

- LINK ETF: Following XRP, SOL, DOGE, and LTC, the LINK (Chainlink) ETF “broke the ice” in early December. LINK ETF drew tens of millions of dollars on its first day, showing investor demand for on-chain infrastructure asset ETFs with strong ecosystem and utility link protocols.

- SUI ETF: On December 5, the SEC approved the first 2x leveraged SUI ETF (TXXS), issued by 21Shares and listed on Nasdaq.

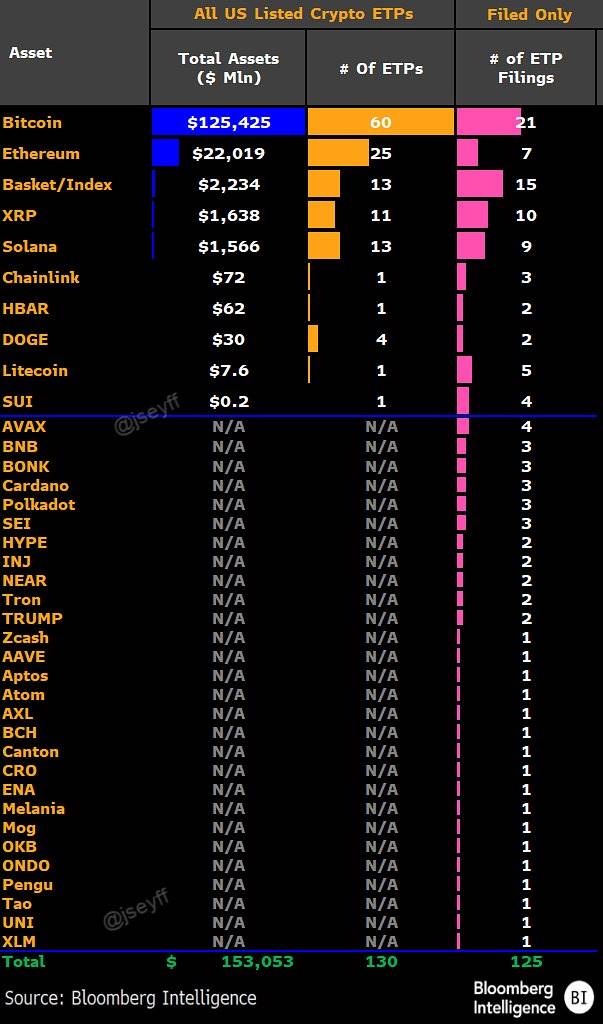

3. Altcoin ETFs in the Application Pipeline

Beyond those already listed, many potential altcoin ETFs remain under SEC review, with active filings driving the next phase of market focus.

Key assets under review include:

- AVAX ETF: Avalanche, a major smart contract chain, has entered the fast-track approval process and is a likely candidate for the next round of approvals.

- BNB ETF: BNB ETF applications are led by VanEck, REX Shares, and Osprey Funds, and have entered the SEC review process, making BNB a strong contender to become the first Binance ecosystem ETF approved in the U.S.

- Other potential assets: ADA (Cardano), DOT (Polkadot), INJ (Injective), SEI, APTOS, and AAVE have also filed ETF applications now in the regulatory queue. According to Bloomberg Intelligence analyst James Seyffart, the SEC currently has dozens of pending asset-class ETF applications, with altcoins making up a significant share.

- Multi-asset ETFs: Some firms are exploring “multi-asset basket ETFs,” staking-yield ETFs, and even memecoin-themed ETFs. If approved, these innovations would further expand the boundaries of compliant altcoin investing.

Overall, U.S. altcoin ETF approvals are expected to remain dense over the next 6–12 months. The current XRP, SOL, DOGE, LTC, HBAR, and LINK ETFs are just the first wave, with many more assets in the pipeline, setting a systematic market development trend.

III. Performance Review of Listed Altcoin ETFs

The debut of spot altcoin ETFs has become a focal point for the crypto market. While overall sentiment remains weak for mainstream assets, several altcoin ETFs continue to attract notable capital flows.

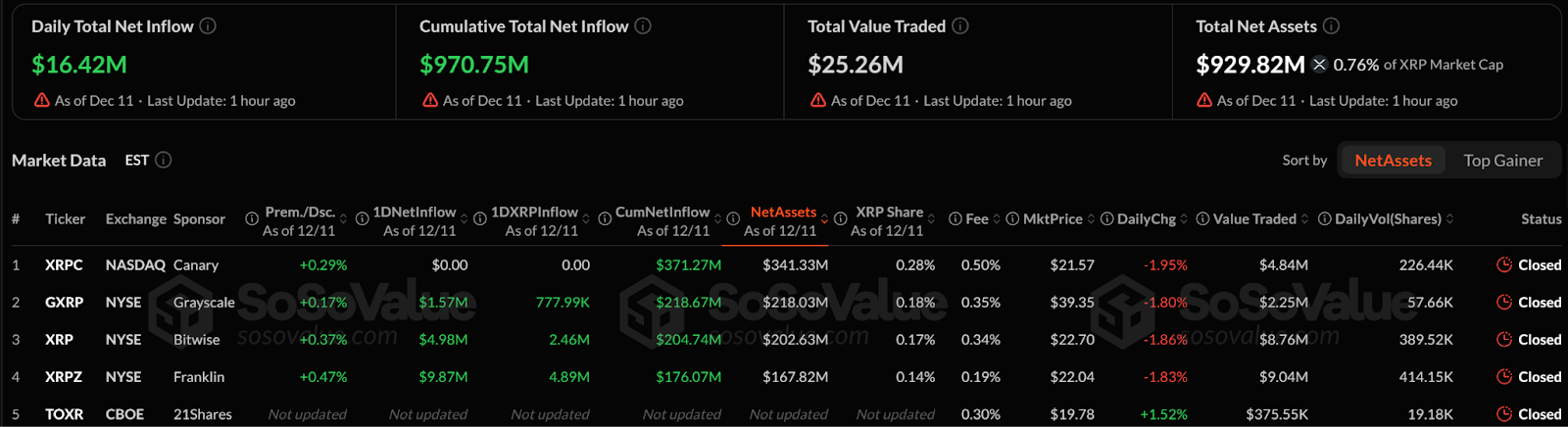

1. XRP Spot ETF

Source: https://sosovalue.com/assets/etf

The XRP spot ETF has been issued by multiple asset managers, including Canary Capital, Grayscale, Franklin Templeton, and Bitwise. It is one of the most widely issued and institutionally active altcoin ETFs.

Since launch, XRP ETFs have demonstrated strong capital attraction, with cumulative net inflows of approximately $970 million and total AUM exceeding $929 million. Since its November 13 debut, net inflows have been recorded for multiple consecutive trading days, totaling around $756 million over the past 11 sessions.

XRP ETFs are currently among the most popular altcoin ETF products, serving as the “preferred entry point” for institutions seeking altcoin exposure due to their multiple issuers, robust inflows, and large AUM.

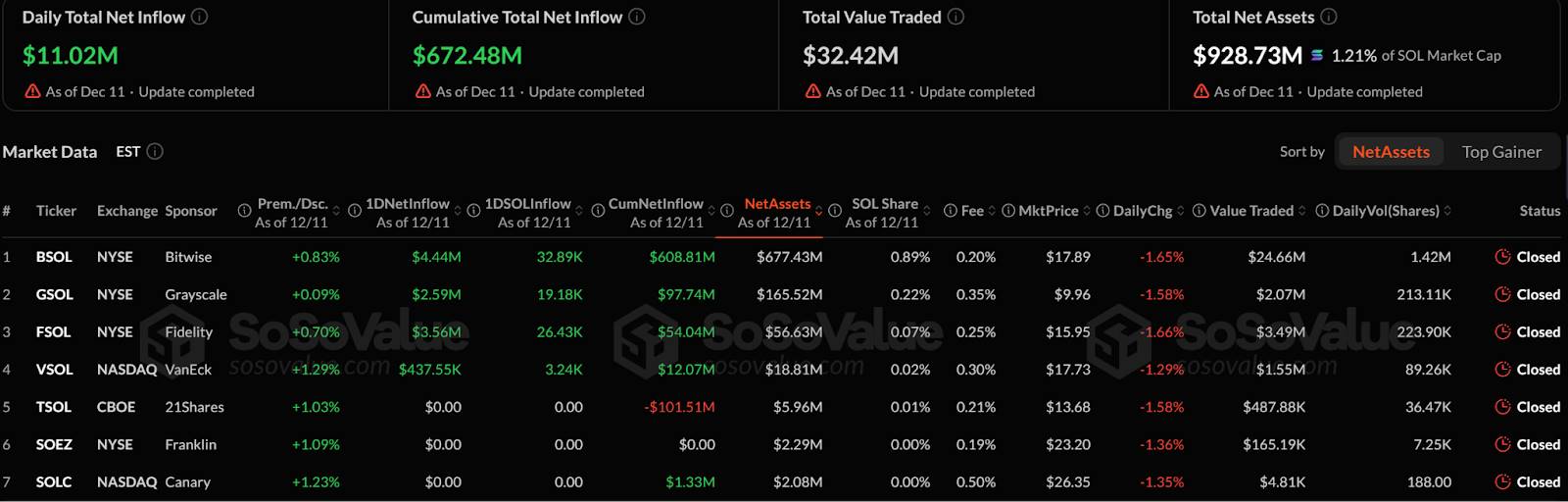

2. SOL Spot ETF

Source: https://sosovalue.com/assets/etf

The Solana ETF was jointly launched by several asset managers. Since listing, Solana ETFs have seen cumulative net inflows of about $672 million, with total AUM around $928 million—making it one of the largest altcoin ETF products and a leading example of sustained capital absorption.

Unlike XRP, Solana ETF inflows have been more phased: a large initial surge on day one, followed by a steadier pace rather than explosive growth. This suggests investors are focused on long-term positioning rather than short-term trading.

Solana ETF’s performance highlights the potential for altcoin ETFs to attract institutional allocations and reflects a “patient positioning” trend. While its scale leads among peers, the disconnect between price and inflows also points to ongoing short-term volatility risks.

3. HBAR Spot ETF

Source: https://sosovalue.com/assets/etf

The Hedera (HBAR) ETF has also entered the trading market and attracted some attention. Early HBAR ETFs have drawn about $82 million in net inflows, making them mid-sized altcoin products. Compared to XRP and SOL, HBAR’s capital base is smaller.

HBAR ETFs have shown continuous weekly net inflows, with steady capital movement and no major outflows even in smaller weeks. This stability is tied to its ecosystem and use cases. However, since ETF listing, HBAR’s price has fallen nearly 20%, reflecting broader crypto market weakness.

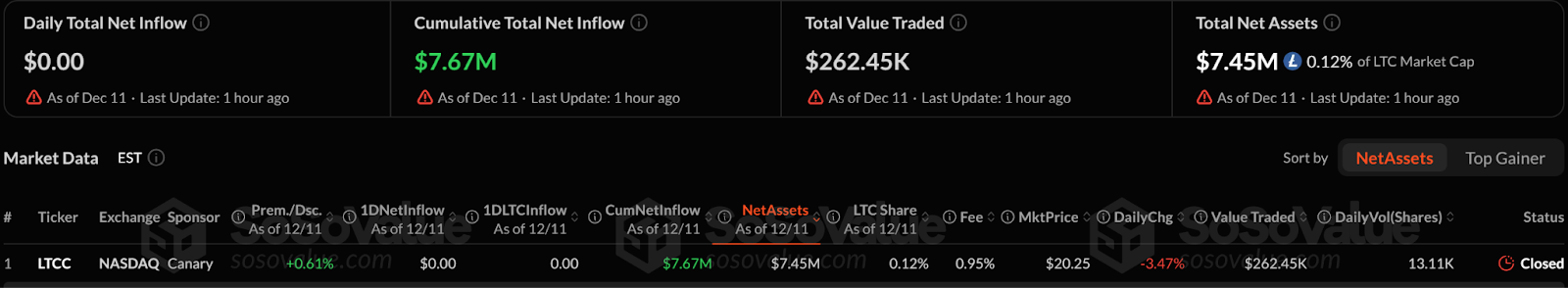

4. LTC Spot ETF

Source: https://sosovalue.com/assets/etf

LTC (Litecoin), one of the earliest altcoins, had its spot ETF launched by Canary Capital and others at the end of October 2025, making it among the first approved altcoin ETFs. Despite its legacy status and active trading, the ETF has drawn far less capital and attention than top-tier altcoin ETFs like XRP and SOL.

SoSoValue data shows that as of mid-November 2025, the LTC ETF (often called LTCC) had cumulative net inflows of about $7.67 million. Multiple days have seen zero inflows. Compared to the hundreds of millions for XRP ETFs and tens to hundreds of millions for SOL ETFs, LTC’s capital draw is weak, and it has not become a core holding for altcoin ETF investors.

5. DOGE Spot ETF

Source: https://sosovalue.com/assets/etf

DOGE (Dogecoin) is one of the most iconic meme coins, long considered a community-driven asset. With SEC approval in November 2025 for Rex-Osprey and others to list DOGE ETFs, DOGE became one of the first and most symbolic meme coin ETFs.

SoSoValue data shows DOGE spot ETFs have accumulated about $2.05 million in net inflows, reflecting very limited capital allocation. Trading activity is also subdued, with only a few million dollars in turnover on the first day and generally thin, uneven flows afterward. This suggests institutions remain wary of deep exposure to DOGE ETFs.

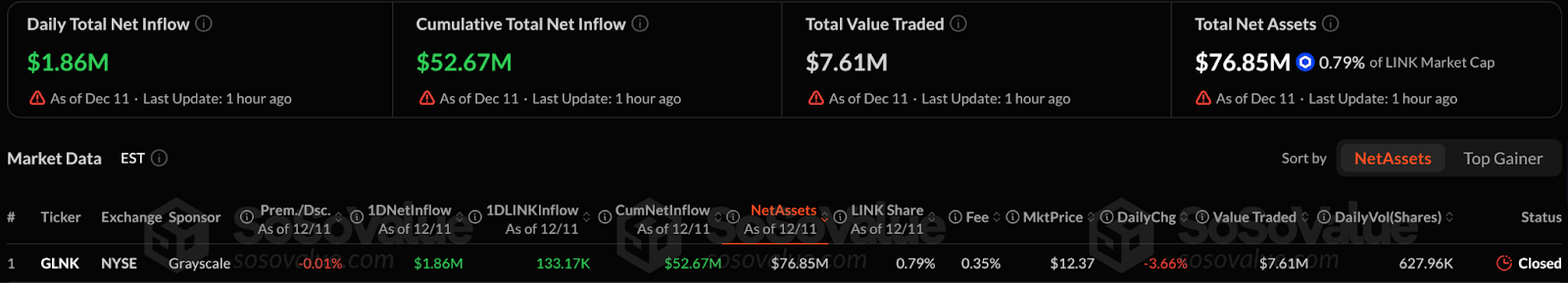

6. LINK Spot ETF

Source: https://sosovalue.com/assets/etf

The first U.S. spot ETF for LINK (Chainlink), the Grayscale Chainlink Trust ETF (GLNK), was listed on the NYSE on December 2, 2024 (Eastern Time). Since launch, LINK ETF has drawn about $52 million in net inflows, with AUM at $76 million. Chainlink’s role in blockchain data infrastructure has attracted some long-term institutional allocations to the ETF.

While LINK’s price performance remains largely tied to broader market swings, ETF inflows could provide a stable demand base going forward.

7. Summary of Listed Altcoin ETF Performance

Performance across these ETFs shows a clear “divergence” in the U.S. altcoin spot ETF market:

- Major capital is concentrated in XRP and Solana ETFs, which have the most issuances, fastest inflows, and largest AUM, making them the market’s core focus.

- Mid-sized ETFs like HBAR and LINK perform steadily, balancing ecosystem value and institutional recognition, but still lag behind the top tier.

- LTC and DOGE ETFs are marginalized, with limited capital, low trading activity, and little price support, resulting in weak market attention.

- Across the board, altcoin ETF prices have generally struggled since launch, showing that market sentiment and macro factors still heavily influence prices, and ETF inflows have not immediately driven price gains.

In short, while altcoin ETFs have yet to match the depth and scale of BTC/ETH ETFs, they already show trends of more targeted allocation, long-term inflows, and higher institutional participation—laying the groundwork for a new era of “institutionalized investment” in the altcoin sector.

IV. Opportunities and Risks of Altcoin ETFs

With the rapid approval and successive launch of U.S. spot altcoin ETFs, the market is entering a new phase of institutionalized investment. While their scale still trails Bitcoin and Ethereum ETFs, their growth potential and demonstration effect are significant.

1. From Institutionalization to Segmentation: Structural Opportunities for Altcoin ETFs

1) Regulatory tailwinds: The success of spot Bitcoin and Ethereum ETFs paved a compliant path for altcoin products. In 2025, the SEC revised ETF listing standards and introduced mechanisms like the “fast track” and Section 8(a) of the Securities Act of 1933, allowing altcoin ETFs to reach exchanges more efficiently—streamlining approvals, expanding product diversity, and lowering institutional entry barriers.

2) Institutional capital reallocation: November 2025 data shows that while Bitcoin and Ethereum spot ETFs saw large outflows, altcoin ETFs attracted about $1.3 billion in net inflows, mainly into XRP and Solana products. This indicates institutions are reconsidering altcoin allocations. Importantly, these flows reflect selective pursuit of fundamentals, compliance, and ecosystem value—not just market sentiment. For example:

- XRP ETFs are favored for their cross-border payments use case and clearer regulatory path;

- Solana ETFs combine staking yield structures, appealing to institutions seeking long-term allocation.

This rotation from BTC/ETH to altcoin ETFs shows institutional acceptance of altcoins as long-term value assets is growing.

3) ETFs as compliant access for retail and institutions: Altcoin ETFs give retail investors a simplified way to access on-chain assets—no need for wallets or private keys, no reliance on centralized exchanges, and more controllable risk than self-custody. For institutions, ETFs are mature, compliant tools suitable for pension funds, hedge funds, and wealth management portfolios, expanding the capital base.

ETFs also enhance industry transparency and visibility, making altcoin investment accessible through traditional financial vehicles rather than relying solely on decentralized trading or OTC liquidity.

2. Core Risks: Market, Regulatory, and Technical Challenges

Despite the opportunities, altcoin ETFs face significant risks—from asset characteristics to macro and regulatory environments.

1) Regulatory uncertainty: While approval processes have improved, the SEC remains highly cautious on altcoin ETFs. Legal status, classification, and evolving compliance requirements can affect ETF operations and liquidity. The SEC’s determination of asset status (security vs. commodity) remains a key issue, and any policy reversal or court ruling could force adjustments or delistings. Rapid “default effectiveness” approvals also raise concerns, as some products may need post-listing compliance enhancements—creating price and allocation uncertainty.

2) Market depth and liquidity risks: Unlike BTC and ETH, many altcoins lack deep liquidity. Large ETF inflows can move markets, while redemptions during downturns can worsen liquidity stress. For example, Solana ETFs have attracted strong inflows but face downward price pressure, showing that altcoin pricing depends on more than capital flows—market sentiment and liquidity are crucial. For smaller altcoins like DOGE and LTC, weak inflows mean insufficient depth for large institutional trades, raising slippage risk in volatile markets.

3) Market saturation and product competition: As altcoin ETF numbers surge, capital may be spread thin, limiting the scale and impact of individual ETFs. Over 100 crypto ETF filings are pending at the SEC, and a growing asset universe dilutes investor focus. If oversupply and “fee wars” become common, lower fees may attract flows at the expense of product quality—hurting long-term holders.

4) High volatility and price risk: Altcoins are inherently more volatile than BTC/ETH, so even with ETFs providing compliant access, prices can swing sharply. As seen, ETF inflows do not guarantee price gains. Macro sentiment, liquidity tightening, and forced liquidations can trigger steep drawdowns, challenging lower-risk investors. Retail-heavy ETFs are especially vulnerable to sentiment-driven swings and amplified irrational behavior.

5) Technical and operational risks: ETFs depend on exchange custody, clearing, and underlying asset security. Altcoin smart contract risks, exchange custody issues, and “zombie order book” risk (widened spreads due to low activity) can all threaten ETF operations. For smaller altcoins, the “trading island effect” may emerge if ETF growth slows, quickly exposing these risks.

V. Altcoin ETF Outlook and Conclusion

Looking ahead, altcoin ETFs will continue to reshape the crypto asset market. As regulatory tailwinds take hold, the compliance environment clarifies, and institutional interest grows, this segment is moving from infancy to maturity.

- Regulatory: The SEC has overhauled crypto ETF rules, introducing generic listing standards and cutting approval times from hundreds of days to about 75. This paves the way for more assets—such as SOL, XRP, LTC, and HBAR—to enter the ETF market, shifting from case-by-case approvals to large-scale rollouts. We can expect more altcoin ETFs to gain approval and go live in the coming quarters.

- Market sentiment: Analysts widely expect a high approval probability for altcoin ETFs. Bloomberg ETF analysts put the odds for mainstream altcoin spot ETFs like Solana, XRP, and LTC above 90%, with some approvals seen as nearly certain in the coming months. This measured optimism reflects regulatory recognition of compliance, transparency, and market maturity—drawing more institutions and long-term capital to the sector.

- International: The altcoin ETF trend is advancing globally. Canada, Europe, and Asia have launched crypto ETFs or similar products, each with unique designs and regulations. These markets provide models for the U.S. and encourage global capital to diversify digital asset allocations. For example, France and Germany support crypto index ETFs, and Asian exchanges are rolling out altcoin options and futures—offering U.S. investors broader data and strategies.

- Market structure: “Layered allocation” is emerging—core assets like XRP, SOL, ETH, and BTC remain institutional and compliance mainstays, while mid- and small-cap altcoin ETFs (like DOT, ADA, AVAX, INJ) appeal to high-risk, high-reward investors. As product variety grows, investors will focus more on ecosystem value, liquidity, and long-term fundamentals—not just short-term trends.

Still, altcoin ETFs carry cyclical and structural risks. Regulatory shifts, liquidity swings, and macroeconomic factors can drive asset divergence. Investors must emphasize risk management and dynamic portfolio adjustments, monitoring policy, sentiment, and capital flows.

In summary, altcoin ETFs are a natural result of the convergence of traditional finance and crypto markets, aligning with market segmentation and regulatory adaptation. By mid-2026, as regulatory experience grows and approval processes improve, dozens to over a hundred altcoin ETFs from more than a dozen asset managers are expected to launch, creating a more mature, diverse, and layered ETF ecosystem. For retail investors, this means more compliant, convenient investment channels and a crypto market entering a new era of institutionalization, diversification, and professionalism. The altcoin ETF wave is underway—future opportunities and risks will coexist, and the key is rational participation and strategic portfolio construction.

About Us

Hotcoin Research is the core research arm of Hotcoin Exchange, dedicated to turning professional analysis into actionable insights. Our “Weekly Insights” and “In-depth Reports” dissect market trends; through our exclusive “Hotcoin Select” (AI + expert dual screening), we help you identify promising assets and minimize trial-and-error costs. Weekly live sessions bring our researchers face-to-face with you to explain market hot topics and forecast trends. We believe that expert guidance and a human touch can help more investors navigate cycles and capture Web3 value opportunities.

Risk Disclosure

The cryptocurrency market is highly volatile and investing carries risk. We strongly advise investors to fully understand these risks and invest only within a robust risk management framework to ensure capital safety.

Statement:

- This article is reprinted from [TechFlow]. Copyright belongs to the original author [Hotcoin Research]. If you have any objections to this reprint, please contact the Gate Learn team for prompt handling in accordance with relevant procedures.

- Disclaimer: The views and opinions expressed in this article are those of the author alone and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is mentioned, do not copy, distribute, or plagiarize translated content.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?