2025 MONPRO Price Prediction: Expert Analysis and Market Forecast for the Next Year

Introduction: MONPRO's Market Position and Investment Value

Pixelmon (MONPRO) serves as a gaming IP token for Mon Protocol, a developer and leading publisher of blockchain-native gaming experiences. Since its token generation event in 2024, MONPRO has established itself within the Web3 gaming ecosystem. As of December 2025, MONPRO maintains a market capitalization of approximately $4.17 million with a circulating supply of approximately 593.78 million tokens, trading at around $0.007027 per token. This asset, positioned at the intersection of blockchain technology and gaming adoption, is playing an increasingly vital role in enabling mass adoption of blockchain-native gaming IPs.

This article will provide a comprehensive analysis of MONPRO's price performance and market dynamics through 2030, integrating historical trends, market supply and demand factors, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and actionable investment strategies for market participants.

I. MONPRO Price History Review and Current Market Status

MONPRO Historical Price Evolution Trajectory

-

May 2024: Token Generation Event (TGE) at launch price of $0.12, with rapid subsequent appreciation driven by strong community adoption exceeding 1 million members and the rollout of in-house developed Pixelmon gaming titles (Pixelpals, Warriors of Nova Thera, and Hunting Grounds).

-

May 27, 2024: All-time high (ATH) of $0.90 reached, representing a 650% increase from the launch price and reflecting peak market sentiment toward the blockchain gaming IP ecosystem.

-

2024-2025: Significant market correction phase, with price declining from the ATH, reflecting broader market dynamics and potential challenges in gaming adoption or token utility realization.

-

December 23, 2025: All-time low (ATL) of $0.006951 recorded, marking a 92.27% decline from the ATH and a 94.24% decrease over the one-year period, indicating sustained selling pressure and diminished investor sentiment.

MONPRO Current Market Status

As of December 24, 2025, MONPRO is trading at $0.007027, representing a marginal intraday gain of 0.0036% over the past hour but showing a 2.26% decline over the 24-hour period. The token's recent price action reflects weakness, with a 7-day decline of 20.95% and a 30-day decline of 34.23%, signaling continued downward momentum.

The market capitalization stands at approximately $4.17 million, with a fully diluted valuation of $7.02 million, indicating a market cap to FDV ratio of 59.38%. The circulating supply comprises 593.78 million tokens out of a total supply of 999.52 million tokens, representing 59.38% circulation. The token exhibits extremely low market dominance at 0.00022%, reflecting its niche position within the broader cryptocurrency ecosystem.

Trading volume over the past 24 hours totals approximately $12,942.47, with the token trading on three major exchanges. The holder base consists of 72,004 addresses, suggesting a distributed but relatively modest investor base.

Market sentiment currently registers as "Extreme Fear" (VIX indicator of 24 as of December 23, 2025), reflecting heightened risk aversion across the broader cryptocurrency market.

Check the current MONPRO market price

MONPRO Market Sentiment Index

2025-12-23 Fear & Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with the index at 24, signaling significant risk aversion among investors. This level typically indicates oversold conditions and potential accumulation opportunities for contrarian traders. Market participants are cautious, with negative sentiment dominating price movements. Such extreme readings often precede market recovery phases as fear gradually gives way to rational positioning. Investors should exercise due diligence and consider diversified strategies during this volatile period. Monitor Gate.com's market sentiment tools for real-time data to inform your trading decisions.

MONPRO Holdings Distribution

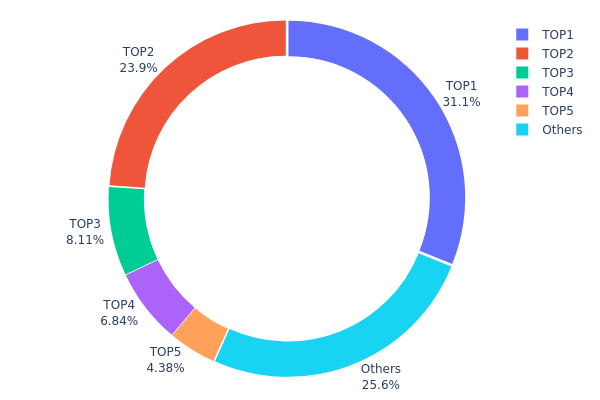

The address holdings distribution map illustrates the concentration of token ownership across blockchain addresses, serving as a critical indicator for assessing market decentralization and potential systemic risks. By analyzing the proportion of tokens held by top addresses relative to total supply, this metric reveals the degree of wealth concentration and provides insights into the token's governance structure and market dynamics.

MONPRO's current holdings distribution exhibits moderate concentration characteristics. The top address commands 31.13% of total supply, while the second-largest holder controls 23.93%, with these two addresses alone accounting for 55.06% of all circulating tokens. The distribution gradually disperses through addresses three through five, which collectively represent 19.30% of holdings, while the remaining addresses account for 25.64% of the supply. This pattern suggests a bifurcated ownership structure, where significant liquidity is concentrated among a limited number of major stakeholders, though the presence of a substantial "Others" category (25.64%) indicates meaningful participation from a broader holder base.

From a market structure perspective, this concentration level warrants consideration regarding price stability and governance influence. While the top five addresses collectively hold approximately 74.36% of tokens, the gradual distribution curve and the non-negligible weight of smaller holders mitigate extreme concentration risks. However, coordinated movements among the top two addresses could theoretically exert considerable downward pressure on price discovery. The current distribution reflects a semi-centralized market structure typical of projects in development phases or those with substantial early-stage funding allocations. Monitoring for further concentration or dispersion will be essential for evaluating the token's progression toward enhanced decentralization and long-term sustainability.

Click to view current MONPRO holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x65a8...a59780 | 311182.55K | 31.13% |

| 2 | 0x6094...846cf0 | 239192.67K | 23.93% |

| 3 | 0xeae2...4b5bde | 81037.67K | 8.10% |

| 4 | 0x9dc0...026bb8 | 68333.33K | 6.83% |

| 5 | 0xf3de...b1e245 | 43750.00K | 4.37% |

| - | Others | 256021.21K | 25.64% |

II. Core Factors Affecting MONPRO's Future Price

Macroeconomic Environment

-

Supply and Demand Dynamics: MONPRO's future price trajectory is influenced by supply-demand relationships and market demand conditions. The balance between available supply and market demand remains a fundamental driver of price movements.

-

Production Costs and Market Trends: Production costs and prevailing market trends significantly impact price direction. As economic conditions evolve, these factors become increasingly important for price determination.

-

International Trade Policy: International trade policies play a crucial role in shaping MONPRO's price outlook. Trade regulations and cross-border transaction policies can create both opportunities and constraints for market development and regional economic cooperation.

Three、2025-2030 MONPRO Price Forecast

2025 Outlook

- Conservative Prediction: $0.00585 - $0.00704

- Neutral Prediction: $0.00704

- Bullish Prediction: $0.00916 (requires sustained market sentiment and ecosystem development)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and stabilization phase with incremental growth trajectory

- Price Range Prediction:

- 2026: $0.00567 - $0.00988 (15% upside potential)

- 2027: $0.00485 - $0.01295 (27% upside potential)

- 2028: $0.0068 - $0.0136 (56% upside potential)

- Key Catalysts: Increased adoption of underlying protocol, ecosystem expansion, market cycle recovery, and strategic partnership announcements

2029-2030 Long-term Outlook

- Base Case: $0.00651 - $0.01228 (assumes moderate adoption and stable market conditions)

- Bullish Case: $0.01228 - $0.01794 (assumes accelerated ecosystem growth and positive regulatory environment)

- Transformational Case: $0.01330 - $0.02055 (assumes breakthrough technological advancement and mainstream institutional adoption by 2030)

- 2030-12-24: MONPRO trading near $0.02055 (potential 115% cumulative gain from 2025 levels, reflecting multi-year accumulation and platform maturation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00916 | 0.00704 | 0.00585 | 0 |

| 2026 | 0.00988 | 0.0081 | 0.00567 | 15 |

| 2027 | 0.01295 | 0.00899 | 0.00485 | 27 |

| 2028 | 0.0136 | 0.01097 | 0.0068 | 56 |

| 2029 | 0.01794 | 0.01228 | 0.00651 | 74 |

| 2030 | 0.02055 | 0.01511 | 0.0133 | 115 |

IV. MONPRO Professional Investment Strategy and Risk Management

MONPRO Investment Methodology

(1) Long-Term Holding Strategy

- Suitable for: Web3 gaming enthusiasts and blockchain believers with long-term conviction

- Operational recommendations:

- Accumulate MONPRO tokens during market downturns, particularly when prices approach historical lows

- Monitor Mon Protocol's game development roadmap and community growth metrics

- Hold tokens through market cycles to benefit from potential adoption growth as the gaming portfolio expands

(2) Active Trading Strategy

-

Technical analysis tools:

- Support and Resistance Levels: Identify key price points at $0.007027 (current level) and historical support at $0.006951 to optimize entry and exit positions

- Volume Analysis: Monitor the 24-hour trading volume of approximately $12,942 to assess liquidity and confirm price movements

-

Wave trading key points:

- Execute trades during periods of increased volatility, particularly around game announcements or platform updates

- Utilize the 24-hour price range ($0.006951 - $0.007222) for short-term profit opportunities

MONPRO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio allocation

- Active investors: 3-5% of portfolio allocation

- Professional investors: 5-10% of portfolio allocation

(2) Risk Hedging Solutions

- Diversification across gaming tokens: Spread investment across multiple blockchain gaming projects to reduce single-project risk

- Dollar-cost averaging: Implement regular, fixed-amount purchases over time to mitigate the impact of price volatility

(3) Secure Storage Solutions

- Hot Wallet Solution: Use Gate.com Web3 Wallet for active trading and quick access to MONPRO tokens

- Cold Storage Practice: For long-term holdings, transfer tokens to self-custody solutions with secure backup procedures

- Security Precautions: Never share private keys, enable multi-factor authentication, regularly audit wallet addresses, and verify contract addresses before transactions

V. MONPRO Potential Risks and Challenges

MONPRO Market Risk

- Extreme price volatility: MONPRO has experienced a 94.24% decline over the past year, indicating high volatility and substantial downside risk exposure

- Low liquidity concerns: With a 24-hour trading volume of only $12,942 and limited exchange presence (3 exchanges), liquidity is constrained, making large-volume trades difficult

- Market sentiment fluctuations: As an emerging gaming token, MONPRO is vulnerable to sentiment shifts and speculative trading patterns in the Web3 gaming space

MONPRO Regulatory Risk

- Evolving regulatory landscape: Gaming tokens and play-to-earn mechanics face increasing regulatory scrutiny from global authorities

- Classification uncertainty: Regulatory bodies may classify MONPRO as a security or commodity, subjecting it to new compliance requirements

- Geographic restrictions: Certain jurisdictions may restrict or prohibit trading of blockchain gaming tokens, limiting market access

MONPRO Technical Risk

- Smart contract vulnerabilities: As an ERC20 token, MONPRO depends on Ethereum network security and may be exposed to contract-level exploits or bugs

- Game development execution risk: Mon Protocol's success depends on successful development and market adoption of announced games (Pixelpals, Warriors of Nova Thera, Hunting Grounds)

- Blockchain dependency: Network congestion, high gas fees, or Ethereum protocol changes could negatively impact MONPRO usability and transaction costs

VI. Conclusion and Action Recommendations

MONPRO Investment Value Assessment

MONPRO operates within the competitive blockchain gaming sector under Mon Protocol's developer and publisher framework. While the project demonstrates community strength with over 1 million members at Token Generation Event and has established multiple game titles, the token faces significant headwinds: a 94.24% annual decline, minimal liquidity across three exchanges, and execution risks tied to game development roadmap. The current price of $0.007027 represents approximately 99% below its all-time high of $0.90, suggesting either substantial recovery potential or continued downside risk depending on platform adoption metrics.

MONPRO Investment Recommendations

✅ Beginners: Start with minimal allocations (0.5-1% of portfolio) through Gate.com's MONPRO trading pairs, focusing on understanding game development progress before scaling positions

✅ Experienced investors: Implement dollar-cost averaging strategies during downtrends, combine with active monitoring of Mon Protocol announcements regarding second game IP launches, and maintain strict stop-loss discipline at 10-15% below entry points

✅ Institutional investors: Conduct detailed due diligence on game development metrics, community engagement data, and revenue generation models before considering allocation, given the project's early-stage status and execution risks

MONPRO Trading Participation Methods

- Spot trading on Gate.com: Direct MONPRO token purchases using Gate.com's spot trading interface with various trading pairs

- Limit orders: Set automated buy orders at predetermined price levels during market downturns to optimize entry positions

- Portfolio rebalancing: Periodically adjust MONPRO holdings based on changing risk tolerance and market conditions

Cryptocurrency investment carries extreme risk. This article does not constitute investment advice. Investors should make prudent decisions based on their individual risk tolerance and are recommended to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will Monero reach $10,000?

Monero reaching $10,000 depends on market adoption and regulatory developments. While possible over the long term, significant price appreciation would require substantial increased demand and mainstream acceptance in the privacy coin sector.

Does Monero have a future?

Yes. Monero's strong privacy features and dedicated community position it well for long-term growth. As privacy concerns increase globally, Monero's demand for confidential transactions is likely to rise, supporting its future viability and potential price appreciation.

How high could Monero go?

Monero could reach $882.64 in 2025, with potential to hit $5,828.30 by 2030, driven by increased adoption and partnerships.

Is Monero a good investment now?

Yes, Monero presents a solid investment opportunity currently. With strong privacy features and consistent market performance, it demonstrates solid fundamentals for long-term growth potential in the crypto market.

What are the main risks and volatility factors affecting Monero's price?

Monero's price is driven by regulatory uncertainty, market speculation, and privacy concerns. Regulatory changes on privacy coins significantly impact volatility. Trading volume fluctuations and investor sentiment also influence price movements substantially.

How does Monero's privacy features compare to other cryptocurrencies in terms of price potential?

Monero's advanced privacy technology provides strong fundamentals, but price potential depends on market adoption. While privacy features are superior to many competitors, Monero's market cap and price volatility remain constrained compared to major cryptocurrencies, presenting moderate long-term appreciation prospects.

2025 UNA Price Prediction: Bullish Trends and Key Factors Shaping the Token's Future Value

Is Sidus (SIDUS) a good investment?: Analyzing the Potential and Risks of this Gaming Cryptocurrency

MAVIA vs CHZ: A Comparative Analysis of Two Leading Blockchain Gaming Ecosystems

GOG vs LINK: The Battle for Digital Distribution Supremacy in the Gaming Industry

Is NEXPACE (NXPC) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

Is Decimated (DIO) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

Crypto Heatmap

What is GCOIN: A Comprehensive Guide to Understanding the Next Generation of Digital Currency

What is ZAP: A Comprehensive Guide to Zero-Day Attack Prevention Tools and Security Testing Methodologies

What is MAJO: A Comprehensive Guide to Understanding the Emerging Technology and Its Applications

What Does On-Chain Mean in Crypto?