2025 MLC Price Prediction: Expert Analysis and Market Forecast for Melania Coin in the Coming Year

Introduction: Market Position and Investment Value of MLC

My Lovely Coin (MLC), as the native token of My Lovely Planet, a Web3 mobile game dedicated to environmental protection, has established itself as a unique player in the gaming and sustainability sector. Since its launch in 2024, MLC has garnered significant attention within the blockchain gaming community. As of December 2025, MLC has achieved a market capitalization of $13.25 million, with a circulating supply of approximately 96.46 million tokens, currently trading at $0.05761. This innovative asset, recognized as a "Play-to-Earn Environmental Protection Token," is increasingly playing a pivotal role in bridging blockchain technology with real-world environmental impact.

This article will provide a comprehensive analysis of MLC's price trends and market dynamics, incorporating historical price patterns, market supply and demand fundamentals, ecosystem development, and broader macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors through 2030.

MLC (My Lovely Coin) Market Analysis Report

I. MLC Price History Review and Current Market Status

MLC Historical Price Evolution

Based on available data, My Lovely Coin has experienced significant volatility since its market entry:

- 2025 (May 21): All-Time High (ATH) reached $0.7526, marking the peak of market enthusiasm for the Web3 gaming project.

- 2025 (December 9): All-Time Low (ATL) fell to $0.0422, representing an approximately 94.4% decline from the historical peak, reflecting severe market correction and reduced investor confidence.

MLC Current Market Status

As of December 23, 2025, MLC is trading at $0.05761, positioned between its historical low and high points. The token demonstrates notable volatility across multiple timeframes:

Short-term Performance:

- 1-hour change: +0.47% ($0.000269 increase)

- 24-hour change: +6.93% ($0.003734 increase)

- 7-day change: +6.74% ($0.003638 increase)

Medium to Long-term Trend:

- 30-day change: -51.88% (significant downward pressure)

- 1-year performance: -91.33% (substantial erosion from launch levels)

Market Metrics:

- Current Market Capitalization: $5,557,153.87

- Fully Diluted Valuation (FDV): $13,250,300

- Market Cap to FDV Ratio: 41.94%, indicating significant dilution potential

- Circulating Supply: 96,461,619 MLC (41.94% of total supply)

- Total Supply: 230,000,000 MLC

- 24-hour Trading Volume: $36,993.26

- Active Token Holders: 33,508

- Market Dominance: 0.00041%

The token currently operates on the Polygon (MATIC) blockchain, with contract address 0x0566c506477cd2d8df4e0123512dbc344bd9d111. Trading is available on 4 exchanges including Gate.com.

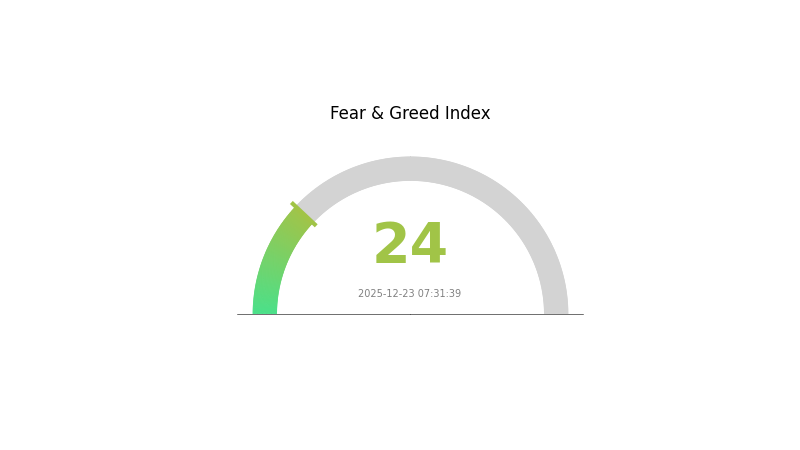

Market sentiment remains at Extreme Fear (VIX level: 24), reflecting bearish market conditions.

Visit MLC Market Price on Gate.com for real-time trading information

MLC 市场情绪指标

2025-12-23 恐惧与贪婪指数:24(Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index reading at 24. This indicates heightened market anxiety and pessimistic sentiment among investors. During such periods, asset prices often face significant downward pressure as selling pressure intensifies. Investors should exercise caution and avoid making impulsive decisions driven by fear. Consider maintaining a long-term investment perspective and gradually accumulating positions at lower prices. Monitor market developments closely on Gate.com to identify potential opportunities when sentiment begins to stabilize.

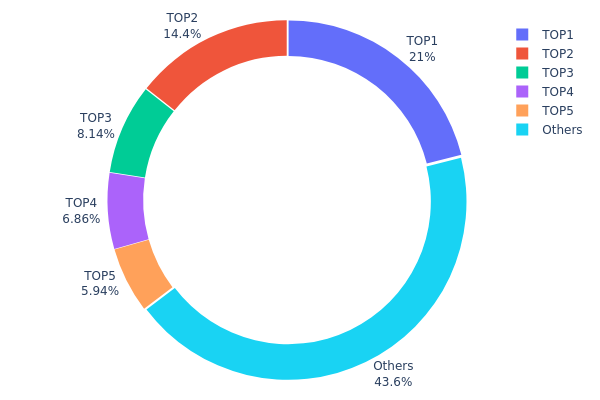

MLC Holdings Distribution

The address holdings distribution chart reveals the concentration of MLC tokens across the blockchain network by tracking the top holders and their proportional stakes. This metric serves as a critical indicator of token decentralization, market structure vulnerability, and potential systemic risks associated with concentrated ownership patterns.

The current MLC holdings data demonstrates moderate concentration characteristics. The top five addresses collectively control approximately 56.38% of the circulating supply, with the largest holder commanding 21.04% of total tokens. While this level of concentration is not uncommon in emerging cryptocurrency projects, it warrants careful consideration. The distribution shows a gradual decline in holdings across the top tier addresses—from 21.04% at rank one to 5.94% at rank five—suggesting a relatively balanced structure among major stakeholders rather than extreme dominance by a single entity. The remaining 43.62% dispersed across other addresses indicates a substantial portion of tokens held by smaller investors and distributed holders, which provides some degree of decentralization.

This holdings structure presents both opportunities and risks for market dynamics. Concentrated ownership among the top five addresses could potentially amplify price volatility if any major holder decides to execute significant transactions. However, the presence of a substantial portion held by other addresses provides a stabilizing effect and reduces the likelihood of coordinated market manipulation by a single party. The current distribution pattern reflects a market architecture with moderate decentralization, where governance and price discovery mechanisms are influenced by both concentrated stakeholders and a diverse base of smaller holders, creating a balanced ecosystem that mitigates extreme centralization risks while maintaining sufficient participation from the broader community.

Click here to view the current MLC holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe0bf...2c1ff4 | 48407.75K | 21.04% |

| 2 | 0xfa88...39c7cf | 33131.18K | 14.40% |

| 3 | 0x82ae...05b7c7 | 18728.56K | 8.14% |

| 4 | 0x51e1...84d1f9 | 15789.33K | 6.86% |

| 5 | 0x576b...018a58 | 13669.45K | 5.94% |

| - | Others | 100272.42K | 43.62% |

Core Factors Influencing MLC Future Price Trends

Supply Mechanism

-

Production Adjustment Strategy: Manufacturers utilize production cuts and price reductions as coordinated tools to control inventory levels. Starting from Q4 2022, major storage producers including Kioxia, Micron, SK Hynix, and Western Digital initiated production cuts. Samsung subsequently joined this effort in H1 2023, reducing NAND Flash output to 50% of total capacity by September 2023, primarily affecting products with 128-layer stacking and below.

-

Historical Patterns: The storage industry exhibits strong cyclicality. When market supply exceeds demand and upstream inventory accumulates, manufacturers adjust through price cuts and production reductions. Once selling prices approach production costs, manufacturers accelerate production cuts until storage chip prices recover. In Q3 2023, NAND Flash and DRAM contract prices stopped declining. By Q1 2024, all storage products experienced full recovery, with DRAM contract prices rising 20% and NAND prices increasing 23%-28%.

-

Current Impact: Morgan Stanley's November 2025 report indicates that MLC NAND faces a 20% capacity reduction due to Samsung's production cuts, with Q1 2026 prices expected to rise double-digits sequentially. MLC NAND pricing is projected to continue rising through Q2 2026, with potential 50% cumulative increases. The supply shortage is expected to persist through 2026 and potentially into 2027, providing sustained price support.

Institutional and Major Holder Dynamics

-

Market Structure: The global NAND Flash market exhibits highly concentrated oligopoly characteristics. As of 2024, the top five market share holders are Samsung (35.7%), SK Group (21.3%), Kioxia (14.4%), Micron (12.9%), and SanDisk (11.0%).

-

Enterprise Adoption: MLC NAND serves critical infrastructure across multiple sectors. AI-enabled smartphones from vivo, OPPO, Samsung, Xiaomi, Huawei, and others require upgraded storage capacities, with average phone storage surpassing 200GB and DRAM reaching 7GB or higher in 2024. These AI smartphones demand higher performance LPDDR5x memory. Additionally, automotive applications represent a major demand driver, with L3+ autonomous vehicles requiring increasingly high-capacity vehicle-grade storage, with per-vehicle capacity rapidly approaching the terabyte scale.

Macroeconomic Environment

-

AI-Driven Demand: The expansion of generative AI has fundamentally reshaped storage demand dynamics. Eight major cloud service providers (Google, AWS, Meta, Microsoft, Oracle, Tencent, Alibaba, Baidu) increased capital expenditure from USD 145.1 billion (2021) to USD 260.9 billion (2024), with projections reaching USD 602 billion by 2026, representing a 51.9% compound annual growth rate from 2024-2026. Global AI server market share is expected to grow from 12.5% of total servers in 2024 to 33.3% by 2030, driving substantial storage demand growth.

-

Device Replacement Cycle: Following pandemic-era surge in online learning and remote work device purchases, these devices have entered replacement cycles in 2023-2024. Global PC shipments grew 3% year-over-year in Q4 2023, while smartphone shipments rose 8%, with Q1 2024 showing continued momentum at 3.2% and 11% growth respectively.

Technology Development and Ecosystem Building

-

3D Stacking Architecture: Manufacturers are advancing towards higher stacking configurations, with industry focus shifting toward 300-layer NAND. Major producers including Samsung, Micron, Western Digital, Kioxia, Yangtze Memory, and SK Hynix are pursuing this roadmap. Yangtze Memory's proprietary Xtacking architecture, leveraging CMOS-Array hybrid bonding technology, enables decoupled process design and achieves faster I/O speeds, higher storage density, and superior reliability.

-

Logical Capacity Expansion: The evolution from SLC to MLC, TLC, QLC, and eventually PLC represents progressive logical expansion. Each cell stores increasingly larger data volumes, enabling SSDs to maintain more information in comparable physical space. Generative AI's demand surge has accelerated 2024 QLC flash commercialization, exemplified by Samsung's 128TB prototype SSD based on QLC architecture.

-

Hybrid Bonding Technology: Increased stacking layers have established hybrid bonding as mainstream architecture. This approach includes wafer-to-wafer bonding applications for CIS and NAND, plus die-to-wafer configurations meaningful for high-bandwidth memory. Optimization of peripheral logic circuits and storage cell distribution relationships, progressing from CNA and CUA configurations to CBA (direct peripheral circuit bonding to storage arrays), represents the current evolution trajectory.

-

Advanced Process Nodes: DRAM has progressed through 1x, 1y, 1z, 1α generations to 1β (fifth generation) following 10nm process entry. Samsung, SK Hynix, and Micron completed 1β research and development in 2023, now ramping production. Samsung's anticipated sixth-generation 1c process DRAM is expected to achieve volume production within 1-2 years. Samsung is also developing UFS 4.0 technology products with channel count increasing from 2 to 4, achieving 8GB/s sequential read speeds, with volume production targeted for 2025.

III. MLC Price Forecast 2025-2030

2025 Outlook

- Conservative Estimate: $0.05358 - $0.05761

- Base Case: $0.05761

- Optimistic Forecast: $0.07028 (subject to positive market sentiment and adoption momentum)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation phase with moderate growth trajectory, characterized by increased institutional interest and utility expansion

- Price Range Forecast:

- 2026: $0.03389 - $0.09528 (11% potential upside)

- 2027: $0.05414 - $0.08837 (38% cumulative growth potential)

- 2028: $0.08147 - $0.12263 (45% cumulative growth potential)

- Key Catalysts: Ecosystem development milestones, strategic partnerships, improved market liquidity on platforms like Gate.com, and enhanced utility in decentralized applications

2029-2030 Long-term Outlook

- Base Scenario: $0.10331 - $0.13121 by 2029 (79% cumulative appreciation, assuming steady adoption and market stability)

- Optimistic Scenario: $0.11726 - $0.14775 by 2030 (103% cumulative appreciation, assuming accelerated ecosystem growth and mainstream institutional adoption)

- Transformative Scenario: Price targets exceeding $0.14775 if MLC achieves significant breakthrough in market penetration, regulatory clarity, and competitive differentiation in its use cases

- 2030-12-31: MLC trading levels reflect matured market positioning and established market fundamentals

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.07028 | 0.05761 | 0.05358 | 0 |

| 2026 | 0.09528 | 0.06395 | 0.03389 | 11 |

| 2027 | 0.08837 | 0.07961 | 0.05414 | 38 |

| 2028 | 0.12263 | 0.08399 | 0.08147 | 45 |

| 2029 | 0.13121 | 0.10331 | 0.07025 | 79 |

| 2030 | 0.14775 | 0.11726 | 0.1114 | 103 |

My Lovely Coin (MLC) Investment Strategy & Risk Management Report

IV. MLC Professional Investment Strategy and Risk Management

MLC Investment Methodology

(1) Long-Term Holding Strategy

- Suitable For: Environmental-conscious investors, Web3 gaming enthusiasts, and long-term believers in play-to-earn gaming models with environmental impact

- Operation Recommendations:

- Accumulate MLC during market downturns when volatility decreases, focusing on dollar-cost averaging to mitigate entry price risk

- Hold positions through multiple gaming seasons as the project develops its 100 million player adoption roadmap

- Participate actively in the My Lovely Planet ecosystem to benefit from gameplay earnings alongside token appreciation

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the historical price range between $0.0422 (ATL on December 9, 2025) and $0.7526 (ATH on May 21, 2025) to identify key trading zones

- Volume Analysis: Track the 24-hour trading volume ($36,993.26) relative to average volume to confirm breakout or breakdown moves

- Wave Operation Key Points:

- Capitalize on the 24-hour price increase of 6.93% by identifying early momentum shifts and setting appropriate take-profit targets at resistance levels

- Monitor 7-day and 30-day trends (6.74% and -51.88% respectively) to understand longer-term market sentiment and avoid countertrend trading

MLC Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation, focusing on minimal exposure to emerging Web3 gaming tokens

- Active Investors: 3-8% of portfolio allocation, balancing speculative positions with established holdings

- Professional Investors: 5-15% of portfolio allocation, with sophisticated hedging and position management strategies

(2) Risk Hedging Solutions

- Stablecoin Reserves: Maintain 30-50% of intended investment capital in stablecoins to enable rapid repositioning during market corrections

- Profit-Taking Strategy: Establish predetermined price targets at 50% (+$0.3763 from current price) and 100% (+$0.7526) gains to lock in profits and reduce downside exposure

(3) Secure Storage Solutions

- Web3 wallet Recommendation: Gate Web3 Wallet provides integrated access to MLC trading on Gate.com with enhanced security features and direct blockchain interaction capabilities

- Self-Custody Option: Transfer MLC to personal Polygon wallets for long-term holding, ensuring full control of private keys and reducing counterparty risk

- Security Precautions: Enable multi-signature authentication, store recovery phrases offline in secure locations, and never share wallet private keys; regularly verify contract addresses before transactions to avoid scam tokens

V. MLC Potential Risks and Challenges

MLC Market Risk

- Extreme Price Volatility: The token has declined 91.33% over the past year despite recent 24-hour gains, indicating susceptibility to speculative cycles and potential for rapid price reversals

- Liquidity Constraints: With only 4 exchange listings and a 24-hour volume of $36,993.26, MLC faces limited trading liquidity that could result in significant slippage during large trades

- Founder/Team Dependency: Project success heavily relies on team execution from gaming industry veterans; any leadership changes or development delays could negatively impact token valuation

MLC Regulatory Risk

- Gaming Regulation Uncertainty: The play-to-earn model faces evolving regulatory scrutiny in multiple jurisdictions, potentially impacting user acquisition and token utility

- Token Classification Ambiguity: Regulatory bodies may classify MLC differently across regions, leading to trading restrictions or platform delistings in certain markets

- Environmental Claims Verification: Regulatory bodies may require substantiation of the "plant-one-tree" claims, creating compliance burden and reputational risk if verification proves insufficient

MLC Technology Risk

- Polygon Blockchain Dependency: MLC operates exclusively on Polygon; any critical security issues or network disruptions could directly impact token functionality and accessibility

- Smart Contract Vulnerabilities: As a newer token (published June 2024), potential undetected vulnerabilities in contract code could expose users to unexpected losses or exploit vectors

- Gaming Infrastructure Stability: Dependence on My Lovely Planet game infrastructure means server outages, gameplay bugs, or poor user experience could drive token devaluation through reduced engagement

VI. Conclusion and Action Recommendations

MLC Investment Value Assessment

My Lovely Coin presents a high-risk, high-reward opportunity within the Web3 gaming sector. The project demonstrates compelling fundamentals through established gaming industry leadership (Candy Crush Art Director, Royal Match Product Director), Ubisoft Incubator backing, and Unity for Humanity recognition. However, the token faces significant headwinds including severe year-over-year depreciation (-91.33%), limited exchange liquidity, and regulatory uncertainty surrounding play-to-earn mechanics and environmental impact claims.

The recent 24-hour price recovery of 6.93% suggests potential market interest, yet the 30-day decline of -51.88% reflects weak medium-term momentum. MLC should be considered exclusively as a speculative, high-volatility position suitable only for investors capable of absorbing potential total loss. The token's long-term value proposition depends critically on achieving the stated 100 million player adoption target and delivering sustainable gameplay-to-earnings mechanics that rival established Web3 gaming alternatives.

MLC Investment Recommendations

✅ Beginners: Start with a minimal position (1-2% of portfolio) after understanding the game mechanics through free play; avoid leveraged trading and prioritize learning the project's ecosystem before committing additional capital

✅ Experienced Investors: Implement a dollar-cost averaging strategy across 6-12 month periods with predetermined rebalancing triggers at 50% profit targets; combine with technical analysis of support levels around $0.0422-$0.05 to optimize entry points

✅ Institutional Investors: Conduct deep-dive analysis of user acquisition metrics, player retention rates, and revenue generation before institutional-scale positions; consider strategic partnerships with the development team rather than pure token speculation

MLC Trading Participation Methods

- Gate.com Spot Trading: Purchase MLC directly using fiat or stablecoins through Gate.com's platform, which supports direct Polygon network deposits and withdrawals

- Dollar-Cost Averaging: Execute recurring purchases on fixed schedules (weekly or monthly) to average entry prices and reduce timing risk

- Liquidity Pool Participation: Provide MLC/stablecoin liquidity on Polygon-based decentralized protocols to generate yield while maintaining price exposure, accepting impermanent loss risks

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and should consult qualified financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

How much is MLC worth?

MLC is currently worth $0.058295 as of December 23, 2025. The price has increased by 8.37042 in the last 24 hours, demonstrating strong market momentum. MLC continues to show positive price movement in the crypto market.

Does Mask Network have a future?

Yes, Mask Network has promising potential. With growing Web3 adoption and privacy-focused infrastructure demand, MASK is positioned for future growth. Strong community support and continuous development indicate solid long-term prospects for the project.

What is the price prediction for MLC in 2025?

MLC is predicted to trade between $0.03892 and $0.1561 in 2025. If it reaches the upper target, MLC could increase by 166.27% based on current market trends and analysis.

What factors influence MLC token price?

MLC token price is influenced by market sentiment, trading volume, technological developments, and user adoption trends. These factors collectively determine its market valuation.

How does MLC compare to other privacy-focused cryptocurrencies?

MLC uniquely integrates decentralized multi-level marketing with robust privacy features. It offers superior user control and anonymity, distinguishing itself through innovative tokenomics and community-driven governance compared to traditional privacy coins.

2025 WIZZ Price Prediction: Will This Budget Airline Soar to New Heights?

2025 XTER Price Prediction: Expert Analysis and Market Forecast for the Next Year

Empire Token Current Market Overview and Analysis

2025 RON Price Prediction: Analyzing Growth Potential in the Play-to-Earn Gaming Ecosystem

What is SLP: Understanding the Speech-Language Pathology Profession and Its Impact on Communication Disorders

Is Zoo Telegram the Next Crypto Game Trend? Key Features to Know

What is a cryptographer?

What is Altcoin Season and Why Everyone Awaits It

What Is Shiba Inu (SHIB)? How to Buy, Price Predictions, and Everything Beginners Should Know

Satoshi Mining

Understanding Bitcoin Dominance (BTC.D): An In-Depth Analysis of the Metric and Its Influence on the Cryptocurrency Market