2025 EVAA Price Prediction: Expert Analysis and Market Outlook for the Next Generation of Digital Assets

Introduction: EVAA's Market Position and Investment Value

EVAA Protocol (EVAA) serves as a decentralized lending and yield protocol built on the TON blockchain, designed to strengthen DeFi liquidity and community participation. Since its launch, EVAA has established itself as a key infrastructure component within the TON ecosystem. As of December 2025, EVAA has achieved a market capitalization of $37.25 million with a circulating supply of approximately 6.62 million tokens, trading at $0.745 per token. This innovative protocol, characterized by its open-source smart contracts and Pyth Oracle integrations, is playing an increasingly critical role in expanding decentralized finance opportunities on the TON network.

The native EVAA token supports protocol benefits, utilities, and governance functions, backed by a gradual release schedule aimed at sustainable growth. With 22,476 token holders and availability on Gate.com, EVAA has garnered growing attention from the crypto community seeking exposure to emerging DeFi infrastructure.

This article will provide a comprehensive analysis of EVAA's price trajectory through 2030, integrating historical performance patterns, market supply and demand dynamics, ecosystem development milestones, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for both institutional and retail investors navigating the evolving DeFi landscape.

EVAA Protocol Market Analysis Report

I. EVAA Price History Review and Current Market Status

EVAA Historical Price Evolution

- October 27, 2025: EVAA reached its all-time high of $13.7054, marking the peak of the token's trading history.

- December 18, 2025: EVAA declined to its all-time low of $0.6063, representing a significant correction from the peak.

- December 23, 2025: Token price stabilized at $0.745, showing a recovery trajectory from the recent lows.

EVAA Current Market Situation

As of December 23, 2025, EVAA is trading at $0.745, with a 24-hour trading volume of $232,958.83. The token exhibits short-term volatility with a -0.58% change in the last 24 hours. Over the broader 7-day period, EVAA has declined by -2.36%, while the 30-day performance shows a more pronounced -33.72% decrease from recent highs.

The current market capitalization stands at $4,930,389.44, with a fully diluted valuation of $37,250,000. The circulating supply is 6,617,972.4 EVAA tokens out of a maximum supply of 50,000,000 tokens, representing 13.24% circulation ratio. EVAA maintains a market dominance of 0.0011%, with 22,476 token holders currently active in the ecosystem.

The 24-hour trading range shows EVAA fluctuating between a low of $0.7204 and a high of $0.818. The token is available for trading on multiple blockchain networks, including BSC (Binance Smart Chain) and TON blockchain, providing users with diverse trading and interaction options.

View current EVAA market price on Gate.com

EVAA Market Sentiment Index

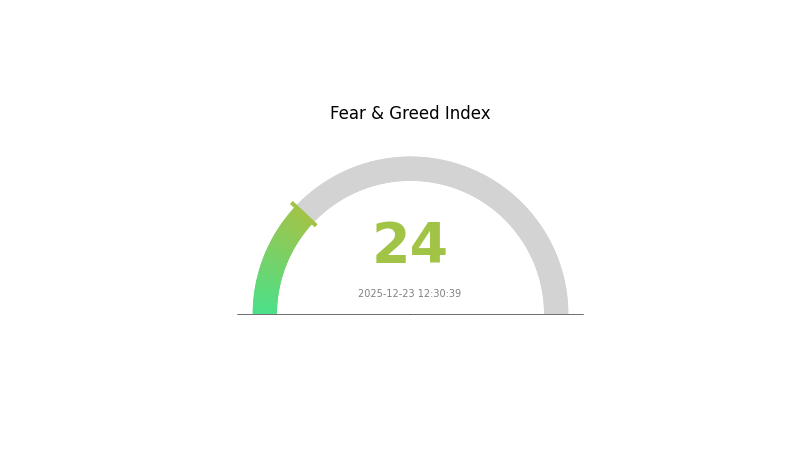

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 24. This exceptionally low reading indicates widespread investor pessimism and risk aversion across digital assets. During such periods, market volatility typically intensifies as panic selling dominates trading activity. However, historically, extreme fear often presents contrarian opportunities for long-term investors seeking discounted entry points. Traders should exercise caution, maintain disciplined risk management, and avoid emotionally-driven decisions. Monitoring this sentiment indicator on Gate.com can help traders better understand market psychology and make more informed investment decisions.

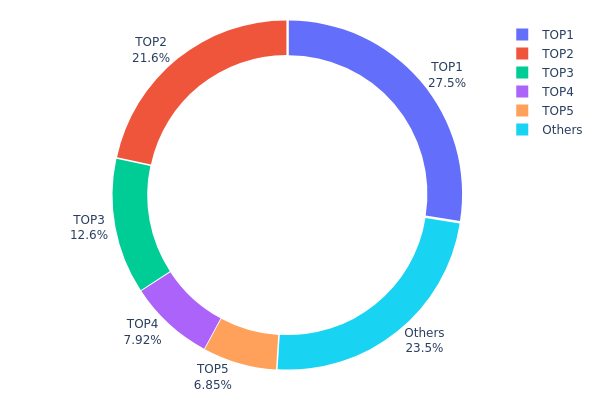

EVAA Holding Distribution

The address holding distribution represents the concentration of token ownership across the top holders and the broader holder base. This metric is instrumental in assessing the decentralization level of a project, as it reveals the proportion of total supply controlled by individual addresses and identifies potential risks associated with wealth concentration.

EVAA currently exhibits moderate to elevated concentration characteristics. The top five addresses collectively control 76.47% of the circulating supply, with the largest holder commanding 27.50% alone. The second and third largest holders account for 21.62% and 12.59% respectively, indicating a relatively steep decline in holdings among top addresses. This distribution pattern suggests that while ownership is not severely concentrated in a single entity, decision-making power remains significantly tilted toward a limited number of stakeholders. The remaining 23.53% distributed across other addresses demonstrates some level of holder diversification, though this portion remains relatively modest compared to the dominant five addresses.

The concentration structure presents both operational implications and market dynamics considerations. A holding distribution where the top five addresses control over three-quarters of supply raises concerns regarding potential coordinated selling pressure, governance influence, and price volatility susceptibility. However, the lack of extreme concentration in a single address (below 30%) suggests that unilateral market manipulation becomes more complex to execute. The moderate dispersion among the remaining holder base indicates that liquidity and trading dynamics may be influenced by a relatively small group of informed participants, potentially resulting in asymmetric price movements during periods of elevated volatility or significant trading activity.

Visit EVAA Holding Distribution for current data.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x483a...c5c36d | 8250.00K | 27.50% |

| 2 | 0x5aa5...352fd4 | 6486.17K | 21.62% |

| 3 | 0x448d...2c3596 | 3779.44K | 12.59% |

| 4 | 0x3b8b...082c73 | 2375.00K | 7.91% |

| 5 | 0xe4e5...a9aa22 | 2055.56K | 6.85% |

| - | Others | 7053.83K | 23.53% |

II. Core Factors Affecting EVAA's Future Price

Supply Mechanism

-

Short-term Token Unlocks: Short-term token unlock expectations are driving EVAA price volatility. In the past week, EVAA experienced approximately 30% price fluctuations, primarily influenced by overall market adjustments and short-term unlock anticipations.

-

Historical Pattern: The token unlock cycles have historically demonstrated direct correlation with price movements, with market volatility intensifying during periods of significant supply releases.

-

Current Impact: As trading depth increases and multiple exchanges continue to launch EVAA listings, market liquidity is expected to strengthen further. Enhanced liquidity on platforms like Gate.com is contributing to more stable price discovery mechanisms and reduced volatility from unlock events.

Macroeconomic Environment

-

Cryptocurrency Market Correlation: The EVAA token price is inevitably influenced by the market movements of mainstream cryptocurrencies such as Bitcoin and Ethereum. During bull market cycles, EVAA is likely to gain more upward momentum, while during bear market phases, it may face selling pressure.

-

Geopolitical Factors: In 2025, overseas trade barriers and geopolitical tensions are deeply affecting the broader digital asset environment, though the market has demonstrated significant resilience with price stabilization and multiple counter-trend rallies observed.

Three、2025-2030 EVAA Price Forecast

2025 Outlook

- Conservative Forecast: $0.66 - $0.74

- Neutral Forecast: $0.74 - $0.98

- Optimistic Forecast: $0.98 (requires market stabilization and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectations: Gradual recovery and consolidation phase with increasing institutional interest

- Price Range Forecast:

- 2026: $0.58 - $1.02 (15% potential upside)

- 2027: $0.72 - $1.14 (26% potential upside)

- 2028: $0.87 - $1.31 (39% potential upside)

- Key Catalysts: Ecosystem expansion, technological upgrades, regulatory clarity, and growing DeFi integration

2029-2030 Long-term Outlook

- Base Case: $0.93 - $1.42 (2029 projection with moderate adoption curve)

- Optimistic Case: $0.67 - $1.60 (2030 projection assuming accelerated ecosystem growth and market expansion)

- Transformative Case: $1.60+ (2030 projection under conditions of widespread institutional adoption, major partnerships, and breakthrough technological developments)

Key Metrics Summary: The forecast indicates a compound growth trajectory with EVAA potentially reaching $1.60 by 2030 under favorable conditions, representing a 74% increase from 2025 baseline levels. Trading and price tracking capabilities are available on Gate.com for real-time market monitoring.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.97706 | 0.7402 | 0.65878 | 0 |

| 2026 | 1.02177 | 0.85863 | 0.57528 | 15 |

| 2027 | 1.13764 | 0.9402 | 0.72396 | 26 |

| 2028 | 1.30904 | 1.03892 | 0.8727 | 39 |

| 2029 | 1.42052 | 1.17398 | 0.92745 | 57 |

| 2030 | 1.59562 | 1.29725 | 0.67457 | 74 |

EVAA Protocol Investment Analysis Report

IV. EVAA Professional Investment Strategy and Risk Management

EVAA Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Cryptocurrency enthusiasts seeking exposure to TON ecosystem DeFi protocols with governance participation

- Operation Recommendations:

- Accumulate EVAA tokens during market downturns when price volatility increases opportunity windows

- Participate in protocol governance through token holdings to gain voting rights on liquidity initiatives

- Monitor the gradual release schedule to understand token supply dynamics and anticipate potential market impacts

(2) Active Trading Strategy

- Price Action Monitoring:

- Track the 24-hour price movements and volatility patterns relative to the historical high of $13.7054 and current support levels

- Observe 7-day and 30-day trends to identify medium-term directional bias

- Trading Considerations:

- Monitor volume trends on Gate.com to confirm price movements with sufficient liquidity

- Watch for announcements regarding TON DeFi liquidity initiatives that could trigger price movements

EVAA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% portfolio allocation

- Moderate Investors: 3-5% portfolio allocation

- Aggressive Investors: 5-10% portfolio allocation

(2) Risk Mitigation Approaches

- Position Sizing: Maintain strict position limits relative to total portfolio size to limit downside exposure

- Dollar-Cost Averaging: Spread purchases over multiple time periods to reduce entry price volatility impact

- Profit Taking: Establish predetermined exit targets at key resistance levels, particularly near historical highs

(3) Secure Storage Solutions

- Custodial Option: Gate.com provides secure exchange storage for active traders requiring frequent transactions

- Self-Custody Approach: Transfer EVAA to secure wallets for long-term holders prioritizing personal security

- Security Best Practices: Enable two-factor authentication on exchange accounts, maintain private key security, regularly verify contract addresses before transactions

V. EVAA Potential Risks and Challenges

Market Risk Factors

- Price Volatility Risk: EVAA has experienced significant drawdowns (down 33.72% over 30 days), indicating high price volatility that could result in substantial capital losses

- Liquidity Risk: Current 24-hour trading volume of $232,958.82 is relatively modest, potentially limiting large position entry and exit opportunities

- Market Concentration Risk: With only 22,476 token holders, the token distribution may be concentrated among early holders, creating potential for sharp price movements from large holder actions

Regulatory Risk Factors

- TON Blockchain Regulatory Status: EVAA operates on the TON blockchain, which faces varying regulatory treatments across different jurisdictions

- DeFi Protocol Compliance: Lending and yield protocols may face increased regulatory scrutiny regarding consumer protection and financial stability requirements

- Jurisdictional Uncertainty: Different countries may impose restrictions on DeFi protocol participation or token trading

Technology Risk Factors

- Smart Contract Risk: While EVAA features open-source smart contracts, vulnerabilities in code could expose users to loss of funds

- Oracle Dependency: Reliance on Pyth Oracle integration creates risk if oracle feeds experience disruption or provide inaccurate price data

- Platform Risk: TON blockchain technical issues or network congestion could impact protocol functionality and token trading

VI. Conclusion and Action Recommendations

EVAA Investment Value Assessment

EVAA Protocol represents a focused DeFi lending and yield initiative on the TON ecosystem. With clear utility through protocol governance and participation in liquidity initiatives, the token has defined use cases. However, significant price volatility, concentrated holder distribution, and early-stage protocol maturity present material risks. The project's value proposition depends heavily on TON ecosystem adoption and successful execution of liquidity roadmap initiatives.

Investment Recommendations

✅ Beginners: Start with minimal allocations (1-2% of crypto portfolio) on Gate.com to understand protocol mechanics before increasing exposure. Focus on learning about TON DeFi ecosystem fundamentals.

✅ Experienced Investors: Consider 3-5% portfolio allocations using dollar-cost averaging over multiple purchase periods. Monitor governance participation opportunities and protocol developments closely.

✅ Institutional Investors: Conduct thorough smart contract audits and evaluate TON ecosystem growth trajectory before entering position. Consider small pilot positions to assess liquidity and operational factors.

EVAA Trading Participation Methods

- Exchange Trading: Access EVAA on Gate.com for spot trading with clear price discovery and trading pairs

- Liquidity Protocol Participation: Engage with EVAA DeFi lending and yield opportunities directly through the protocol for additional returns

- Governance Participation: Hold EVAA tokens to participate in protocol governance decisions regarding future development and liquidity initiatives

Cryptocurrency investment carries extreme risk and volatility. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose. Conduct thorough due diligence before any investment decision.

FAQ

What is EVAA? What are its main uses and application scenarios?

EVAA is a governance and utility token for next-generation DeFi platforms designed to enhance capital efficiency. It enables protocol governance through voting, secures the platform via staking, and integrates deeply with DEXs and Layer 2 networks for optimized composability and transaction efficiency.

How has EVAA performed historically in terms of price, and what are the main factors affecting its price fluctuations?

EVAA's price has been influenced by market sentiment and technology adoption trends. Key factors include investor confidence, trading volume, market trends, and overall crypto market conditions.

What is the current market liquidity and trading volume of EVAA? On which exchanges can it be traded?

EVAA maintains growing market liquidity and trading volume across multiple platforms. The token is actively traded on major exchanges with expanding liquidity pools. Trading activity continues to strengthen as adoption increases within the TON ecosystem.

What is the technical team background and development roadmap of EVAA?

EVAA's technical team comprises experts with finance and blockchain development experience. The roadmap includes tokenomics optimization, market expansion, and broader blockchain application deployment for future growth.

What are the main risks of investing in EVAA? What are its advantages and disadvantages compared to similar tokens?

EVAA faces price volatility and market uncertainty risks. Compared to other tokens, it offers higher return potential but with less stability than mature projects. Its unique technology and community support provide competitive advantages in the prediction market sector.

What are professional analysts' price predictions for EVAA's future? What is the basis for these predictions?

Professional analysts predict EVAA could trade between US$3.774 and US$4.6126 by end of 2026, with an average forecast of US$4.1933. These predictions are based on historical patterns and technical analysis of market trends.

Is Storm Trade (STORM) a good investment?: A Comprehensive Analysis of Risks, Potential Returns, and Market Viability

Avalanche (AVAX) 2025 Price Analysis and Market Trends

Latest analysis and investment prospects for Toncoin price in June 2025

SEI Staking Analysis: 60-70% Supply Locked and Its Price Impact

Latest Analysis and Investment Outlook for Chainlink Price in June 2025

FTT Explained

What is Altcoin Season and Why Everyone Awaits It

Satoshi Mining

Understanding Bitcoin Dominance (BTC.D): An In-Depth Analysis of the Metric and Its Influence on the Cryptocurrency Market

Crypto Heatmap

What is GCOIN: A Comprehensive Guide to Understanding the Next Generation of Digital Currency