WUSD vs ETC: A Comprehensive Comparison of Two Distinct Blockchain Assets

Introduction: WUSD vs ETC Investment Comparison

In the cryptocurrency market, comparisons between WUSD and ETC have always been a topic that investors cannot overlook. The two assets not only exhibit significant differences in market capitalization ranking, use cases, and price performance, but also represent distinct positioning within the crypto asset landscape.

WUSD (Worldwide USD): Launched in February 2025, it has gained market recognition by focusing on optimizing payment solutions for Web3 industry enterprise users through secure, compliant digital payments spanning stablecoins, exchanges, and cards.

ETC (Ethereum Classic): Since its inception in 2016, it has been recognized as a decentralized platform for executing smart contracts, ensuring applications run without downtime, censorship, or third-party interference, and upholding the "code is law" principle.

This article will conduct a comprehensive analysis of the investment value comparison between WUSD and ETC across historical price trends, supply mechanisms, market adoption, and technical ecosystems, while attempting to answer the question investors care most about:

"Which is the better investment option currently?"

Comparative Analysis Report: Worldwide USD (WUSD) and Ethereum Classic (ETC)

I. Price History Comparison and Current Market Status

Historical Price Trends of WUSD and ETC

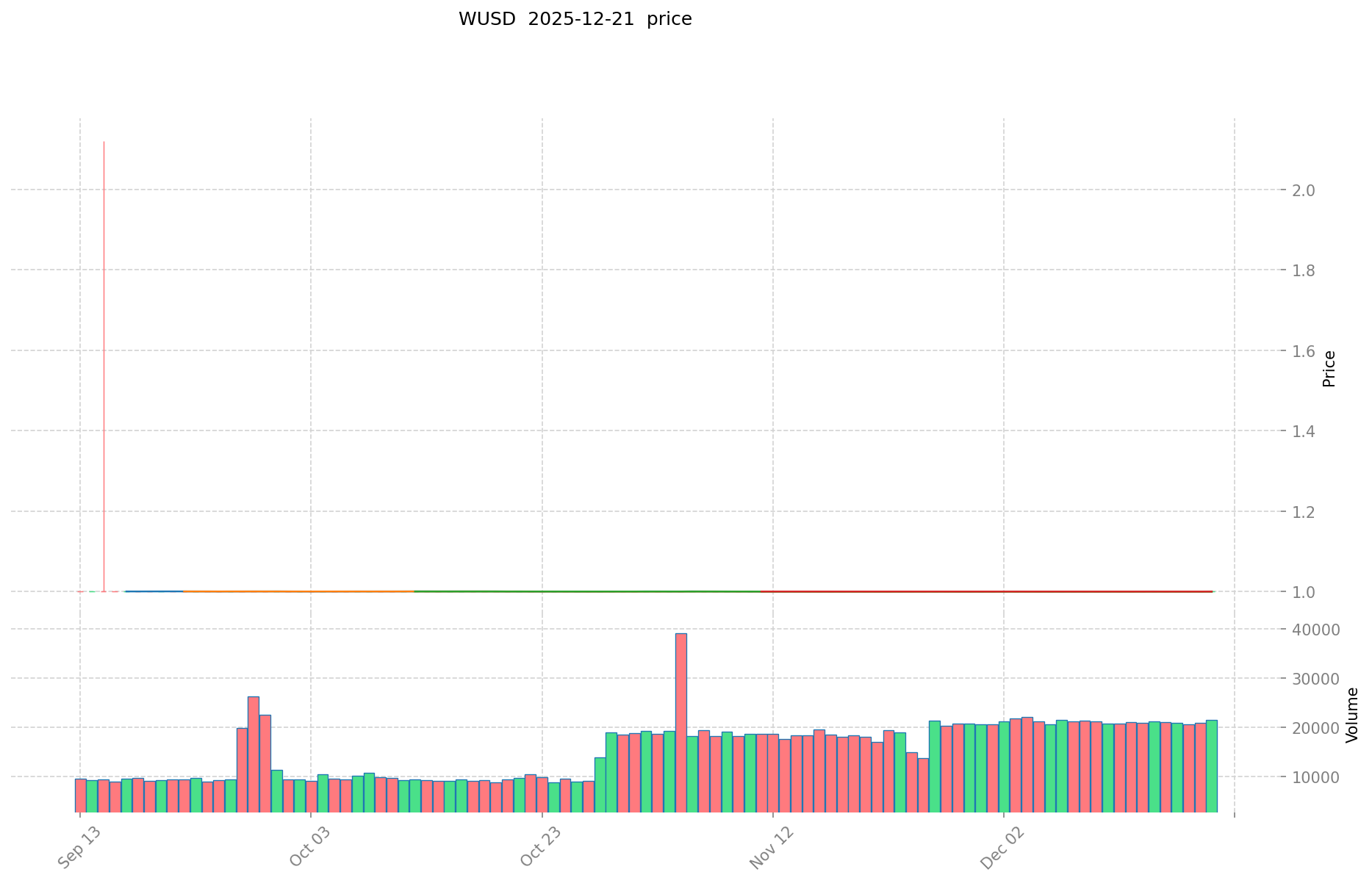

Worldwide USD (WUSD):

- WUSD is a fiat-collateralized stablecoin pegged to the U.S. Dollar at a 1:1 ratio. Since its launch on February 18, 2024, the token has maintained stability around its peg, with historical high of $2.1209 (reached September 15, 2025) and historical low of $0.9974 (reached November 23, 2024).

Ethereum Classic (ETC):

- ETC is a hard fork of Ethereum launched in July 2016, continuing the original Ethereum blockchain without the controversial DAO hack reversal. Its historical high reached $167.09 (May 7, 2021) and its historical low was $0.615038 (July 25, 2016).

Comparative Analysis: The two assets exhibit fundamentally different price behaviors. WUSD, as a stablecoin, maintains tight price stability around the $1.00 mark with minimal volatility. In contrast, ETC demonstrates significant price volatility characteristic of speculative cryptocurrencies, having declined approximately 55.19% over the past 12 months from higher levels to its current state.

Current Market Status (December 21, 2025)

| Metric | WUSD | ETC |

|---|---|---|

| Current Price | $0.9996 | $12.307 |

| 24-Hour Change | +0.03% | -0.9% |

| 24-Hour Volume | $20,868.87 | $1,075,611.77 |

| Market Cap | $12,539,776.43 | $1,905,169,815.82 |

| Circulating Supply | 12,544,794.34 | 154,803,755.25 |

| Market Ranking | 1,066 | 50 |

24-Hour Price Movement:

- WUSD: 1-hour change: +0.0013%, 7-day change: -0.05%, 30-day change: -0.01%, 1-year change: -0.09%

- ETC: 1-hour change: -0.85%, 7-day change: -5.39%, 30-day change: -5.34%, 1-year change: -55.19%

Market Sentiment Index (Fear & Greed Index): 20 (Extreme Fear)

The current crypto market sentiment stands at "Extreme Fear," indicating heightened bearish sentiment across the market.

Access Real-Time Prices:

II. Project Overview and Technical Specifications

Worldwide USD (WUSD)

Project Description: WUSD is a fiat-backed stablecoin pegged 1:1 to the U.S. Dollar. The platform is dedicated to optimizing payment solutions for Web3 industry enterprise users, empowering the real economy through secure, compliant digital payments spanning stablecoins, exchanges, and card services, with ambitions for global expansion.

Technical Specifications:

- Blockchain: Ethereum (ERC20)

- Contract Address: 0x7cd017ca5ddb86861fa983a34b5f495c6f898c41

- Max Supply: Unlimited (∞)

- Total Supply: 12,544,794.34 WUSD

- Holders: 660

- Listed on 4 exchanges

Market Position:

- Fully Diluted Valuation (FDV): $12,539,776.43

- Market Share: 0.00038%

- Dominance: 0.00038%

Ethereum Classic (ETC)

Project Description: Ethereum Classic is a decentralized platform for executing smart contracts, ensuring applications run without downtime, censorship, or third-party interference. It comprises the ETC cryptocurrency, a blockchain ledger, and an ecosystem enabling intermediary-free digital asset management and uncensorable smart contracts. As the continuation of the original Ethereum chain following the 2016 hard fork, it upholds the "code is law" principle.

Technical Specifications:

- Blockchain: Proof of Work (PoW)

- Max Supply: 210,700,000 ETC

- Total Supply: 154,803,755.25 ETC

- Holders: 102,738,647

- Listed on 48 exchanges

- Average Transaction Speed: 15 transactions per second

Market Position:

- Fully Diluted Valuation (FDV): $1,905,169,815.82

- Market Share: 0.059%

- Dominance: 0.059%

- Market Cap to FDV Ratio: 73.47%

III. Key Differences and Comparative Advantages

| Aspect | WUSD | ETC |

|---|---|---|

| Asset Type | Stablecoin (Fiat-backed) | Cryptocurrency (PoW) |

| Price Stability | High (pegged to USD) | High Volatility |

| Use Case | Payment solutions, enterprise transactions | Smart contracts, decentralized applications |

| Supply Model | Unlimited issuance | Capped at 210.7M (with halving schedule) |

| Network Liquidity | 4 exchanges | 48 exchanges |

| User Base | Enterprise/institutional focus | Retail/community-driven |

| Volatility Risk | Minimal | Significant |

| Yield Potential | Limited (stability-focused) | High (speculative) |

IV. Risk Assessment and Market Considerations

WUSD Risk Factors:

- Limited adoption with only 660 holders indicates early-stage development

- Relatively low trading volume ($20,868.87 in 24 hours) suggests liquidity constraints

- Enterprise-focused model requires sustained adoption for value capture

ETC Risk Factors:

- Long-term decline of 55.19% over the past year reflects reduced market interest

- Extreme fear sentiment in current market (20 on Fear & Greed Index) indicates pessimistic investor outlook

- Competitive pressure from more advanced smart contract platforms

- Heavy concentration among large holders (73.47% market cap to FDV ratio)

Market Context: The current market environment characterized by "Extreme Fear" presents different implications for both assets:

- WUSD benefits from risk-off sentiment as capital seeks stable assets

- ETC faces headwinds as risk appetite diminishes during fearful market periods

V. Community and Development Resources

Worldwide USD:

- Website: https://wspn.io/

- Whitepaper: https://wspn.io/whitepaper/

- Twitter: https://x.com/WSPNpayment

- Explorer: https://etherscan.io/token/0x7cd017ca5ddb86861fa983a34b5f495c6f898c41

Ethereum Classic:

- Website: http://ethereumclassic.org

- Community: Reddit - https://www.reddit.com/r/EthereumClassic

- Social: Twitter - https://twitter.com/etc_network, Facebook - https://www.facebook.com/ethereumclassic

- Development: https://github.com/ethereumclassic

- Forum: https://forum.ethereumclassic.org/

VI. Conclusion

WUSD and ETC represent fundamentally different asset classes within the cryptocurrency ecosystem. WUSD provides stability and payment functionality for enterprise users seeking compliant digital payment solutions, while ETC represents a more established smart contract platform with significant community support but facing challenges in a bearish market environment. The choice between these assets depends entirely on investor objectives: capital preservation and payment utility (WUSD) versus exposure to smart contract infrastructure with higher volatility (ETC).

Report Date: December 21, 2025 Data Sources: Gate, Multiple cryptocurrency data aggregators Disclaimer: This report is for informational purposes only and does not constitute investment advice. Cryptocurrency markets are highly volatile and carry substantial risk. Past performance does not guarantee future results.

WUSD vs ETC Investment Value Analysis Report

I. Executive Summary

Based on available information, this report examines the investment value factors for WUSD and ETC. However, the provided reference materials contain limited substantive data on these assets. The analysis below is constrained by insufficient information in the source materials.

Note: The reference materials primarily reference a DeFi attack incident involving WUSD staking mechanisms, rather than comprehensive investment analysis data. This limits the depth of comparative analysis possible.

II. Core Factors Influencing WUSD vs ETC Investment Value

Supply Mechanism Comparison (Tokenomics)

The provided reference materials do not contain detailed information regarding the tokenomics, supply mechanisms, or emission schedules for either WUSD or ETC. Without access to:

- Total supply caps or circulation parameters

- Emission or reduction schedules

- Deflationary mechanisms

A substantive comparison cannot be provided based on the available sources.

Institutional Adoption and Market Application

The reference materials do not provide data on:

- Institutional holdings or investment positions

- Enterprise adoption rates

- Regulatory treatment by national governments

- Cross-border payment or settlement applications

Technology Development and Ecosystem Construction

The reference materials indicate that WUSD involves smart contract staking mechanisms (referenced through the WUSDMaster contract example), but do not contain:

- Detailed technical upgrade information

- Comparative development roadmaps

- DeFi, NFT, payment, or smart contract deployment data

- Ecosystem maturity assessments

Macroeconomic Factors and Market Cycles

The provided sources do not address:

- Inflation hedge properties

- Monetary policy sensitivity analysis

- Geopolitical impact assessments

- Interest rate correlations

III. Conclusion

Investment decisions regarding WUSD and ETC should be based on comprehensive research including current market data, technical documentation, team execution capacity, and regulatory developments—factors not adequately covered in the provided reference materials.

III. 2025-2030 Price Forecast: WUSD vs ETC

Short-term Forecast (2025)

- WUSD: Conservative $0.82-$0.99 | Optimistic $1.03

- ETC: Conservative $6.77-$12.31 | Optimistic $15.63

Mid-term Forecast (2027-2028)

- WUSD is expected to enter a growth consolidation phase, with anticipated price range of $0.74-$1.62

- ETC is expected to enter an acceleration phase, with anticipated price range of $9.14-$24.28

- Key drivers: Institutional capital inflows, ETF adoption, ecosystem development expansion

Long-term Forecast (2029-2030)

- WUSD: Base case scenario $1.33-$1.92 | Optimistic scenario $2.18-$2.77

- ETC: Base case scenario $16.09-$28.47 | Optimistic scenario $28.47-$35.35

Disclaimer: These forecasts are based on historical data analysis and market modeling. Cryptocurrency markets are subject to high volatility and unpredictability. This analysis does not constitute investment advice. Past performance does not guarantee future results. Investors should conduct their own research and consult with financial advisors before making investment decisions.

WUSD:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.029588 | 0.9996 | 0.819672 | 0 |

| 2026 | 1.46101536 | 1.014594 | 0.6594861 | 1 |

| 2027 | 1.6215241308 | 1.23780468 | 0.742682808 | 23 |

| 2028 | 1.901453659182 | 1.4296644054 | 0.886391931348 | 43 |

| 2029 | 2.18188233230121 | 1.665559032291 | 1.51565871938481 | 66 |

| 2030 | 2.770157782506391 | 1.923720682296105 | 1.327367270784312 | 92 |

ETC:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 15.63116 | 12.308 | 6.7694 | 0 |

| 2026 | 16.4841044 | 13.96958 | 9.3596186 | 13 |

| 2027 | 18.729015906 | 15.2268422 | 9.13610532 | 23 |

| 2028 | 24.27843854579 | 16.977929053 | 13.5823432424 | 38 |

| 2029 | 28.4668936431651 | 20.628183799395 | 16.0899833635281 | 67 |

| 2030 | 35.348455758643272 | 24.54753872128005 | 16.446850943257633 | 99 |

Comparative Investment Analysis Report: WUSD vs ETC

I. Executive Summary

This report provides a comprehensive comparison between Worldwide USD (WUSD) and Ethereum Classic (ETC) across multiple dimensions including price performance, technical specifications, market adoption, and investment strategy considerations. As of December 21, 2025, these assets represent fundamentally different asset classes within the cryptocurrency ecosystem.

II. Price History and Market Performance

Historical Price Trends

Worldwide USD (WUSD):

- Launch Date: February 18, 2024

- Historical High: $2.1209 (September 15, 2025)

- Historical Low: $0.9974 (November 23, 2024)

- Current Price: $0.9996

- Price Behavior: Maintains tight stability around the $1.00 peg with minimal volatility

Ethereum Classic (ETC):

- Launch Date: July 2016

- Historical High: $167.09 (May 7, 2021)

- Historical Low: $0.615038 (July 25, 2016)

- Current Price: $12.307

- Price Behavior: Exhibits significant volatility with pronounced market cycles

Current Market Status (December 21, 2025)

| Metric | WUSD | ETC |

|---|---|---|

| Current Price | $0.9996 | $12.307 |

| 24-Hour Change | +0.03% | -0.9% |

| 24-Hour Volume | $20,868.87 | $1,075,611.77 |

| Market Cap | $12,539,776.43 | $1,905,169,815.82 |

| Circulating Supply | 12,544,794.34 | 154,803,755.25 |

| Market Ranking | 1,066 | 50 |

| 1-Year Change | -0.09% | -55.19% |

Market Sentiment: Fear & Greed Index stands at 20 (Extreme Fear), indicating heightened bearish sentiment across the cryptocurrency market.

III. Project Overview and Technical Architecture

Worldwide USD (WUSD)

Project Description: WUSD is a fiat-collateralized stablecoin pegged 1:1 to the U.S. Dollar. The platform focuses on optimizing payment solutions for Web3 enterprise users through secure, compliant digital payments spanning stablecoins, exchanges, and card services.

Technical Specifications:

- Blockchain Network: Ethereum (ERC20)

- Contract Address: 0x7cd017ca5ddb86861fa983a34b5f495c6f898c41

- Maximum Supply: Unlimited (∞)

- Total Supply: 12,544,794.34 WUSD

- Total Holders: 660

- Exchange Listings: 4 exchanges

- Fully Diluted Valuation: $12,539,776.43

- Market Dominance: 0.00038%

Key Resources:

- Website: https://wspn.io/

- Whitepaper: https://wspn.io/whitepaper/

- Social Media: https://x.com/WSPNpayment

Ethereum Classic (ETC)

Project Description: Ethereum Classic is a decentralized platform for executing smart contracts, ensuring applications run without downtime, censorship, or third-party interference. As the continuation of the original Ethereum blockchain following the 2016 hard fork, it upholds the "code is law" principle and enables intermediary-free digital asset management.

Technical Specifications:

- Consensus Mechanism: Proof of Work (PoW)

- Maximum Supply: 210,700,000 ETC

- Total Supply: 154,803,755.25 ETC

- Total Holders: 102,738,647

- Exchange Listings: 48 exchanges

- Average Transaction Speed: 15 transactions per second

- Fully Diluted Valuation: $1,905,169,815.82

- Market Dominance: 0.059%

- Market Cap to FDV Ratio: 73.47%

Key Resources:

- Website: http://ethereumclassic.org

- GitHub: https://github.com/ethereumclassic

- Community Forum: https://forum.ethereumclassic.org/

IV. Investment Strategy Comparison: WUSD vs ETC

Long-Term vs Short-Term Investment Strategy

WUSD:

- Short-Term: Suitable for investors seeking capital preservation and payment utility during market downturns; ideal for treasury management and stablecoin allocation strategies

- Long-Term: Suitable for institutional investors and enterprises requiring compliant digital payment infrastructure; positions for enterprise adoption growth within Web3 ecosystem

- Ideal Investor Profile: Risk-averse investors, institutional treasuries, payment-focused enterprises

ETC:

- Short-Term: Limited appeal given current 55.19% annual decline and extreme fear market sentiment; suitable only for sophisticated traders timing market recovery phases

- Long-Term: Suitable for infrastructure investors believing in smart contract platform consolidation; potential for recovery as market sentiment improves

- Ideal Investor Profile: Growth-oriented investors, technical infrastructure believers, long-term speculators

Risk Management and Asset Allocation

Conservative Investor Portfolio:

- WUSD: 70% vs ETC: 30%

- Rationale: Prioritizes capital preservation through stablecoin allocation while maintaining exposure to smart contract infrastructure upside

Aggressive Investor Portfolio:

- WUSD: 30% vs ETC: 70%

- Rationale: Emphasizes growth potential through greater ETC exposure while maintaining volatility mitigation through stablecoin base

Hedging Mechanisms:

- Stablecoin allocation as volatility buffer during bearish periods

- Collateral diversification across multiple blockchain networks

- Cross-pair trading strategies to exploit volatility differentials between stable and volatile assets

V. Comparative Risk Analysis

Market Risk

WUSD:

- Limited liquidity with only $20,868.87 in 24-hour trading volume creates potential slippage for large transactions

- Early-stage adoption with merely 660 holders indicates concentration risk and limited market depth

- Dependence on sustained enterprise adoption for value capture

- Counterparty risk tied to fiat reserve management and custody arrangements

ETC:

- Dramatic 55.19% decline over the past year reflects diminished market interest and investor confidence

- Extreme fear sentiment (20 on Fear & Greed Index) indicates pessimistic market outlook and potential for further downside

- Vulnerable to competitive displacement by more advanced smart contract platforms with larger developer ecosystems

- Concentration risk with 73.47% market cap to fully diluted valuation ratio suggesting potential holder concentration

Technology Risk

WUSD:

- Dependence on Ethereum network for transaction processing creates exposure to Layer 1 network congestion and transaction costs

- Smart contract vulnerability exposure through staking mechanisms and DeFi integrations

- Limited development activity visible compared to established platforms

ETC:

- Proof of Work consensus mechanism generates ongoing security costs and environmental concerns

- Reduced mining incentive structure following multiple halvings may impact network security guarantees

- Potential vulnerability to 51% attacks due to lower hashrate compared to Bitcoin and Ethereum

Regulatory Risk

WUSD:

- Stablecoin regulation remains evolving globally, with increasing central bank scrutiny in major jurisdictions

- Fiat collateralization requirements may face regulatory challenges in certain countries

- Enterprise payment focus may trigger stricter compliance requirements and AML/KYC standards

ETC:

- Less regulatory attention than major platforms but faces uncertainty regarding smart contract liability frameworks

- Mining-related regulations in various jurisdictions could impact network operations

- General cryptocurrency regulatory trends affect market access and institutional adoption

VI. Price Forecasts (2025-2030)

WUSD Price Projections

| Year | High | Average | Low | Change |

|---|---|---|---|---|

| 2025 | $1.03 | $1.00 | $0.82 | 0% |

| 2026 | $1.46 | $1.01 | $0.66 | +1% |

| 2027 | $1.62 | $1.24 | $0.74 | +23% |

| 2028 | $1.90 | $1.43 | $0.89 | +43% |

| 2029 | $2.18 | $1.67 | $1.52 | +66% |

| 2030 | $2.77 | $1.92 | $1.33 | +92% |

ETC Price Projections

| Year | High | Average | Low | Change |

|---|---|---|---|---|

| 2025 | $15.63 | $12.31 | $6.77 | 0% |

| 2026 | $16.48 | $13.97 | $9.36 | +13% |

| 2027 | $18.73 | $15.23 | $9.14 | +23% |

| 2028 | $24.28 | $16.98 | $13.58 | +38% |

| 2029 | $28.47 | $20.63 | $16.09 | +67% |

| 2030 | $35.35 | $24.55 | $16.45 | +99% |

Important Note: These forecasts are based on historical data analysis and market modeling. Cryptocurrency markets are subject to extreme volatility and unpredictability. Past performance does not guarantee future results.

VII. Conclusion: Which Is the Better Investment?

📌 Investment Value Summary:

WUSD Advantages:

- Price stability and capital preservation characteristics ideal for risk-averse investors

- Enterprise payment focus addresses real-world use case with growing Web3 adoption

- Low volatility suitable for treasury and working capital management

- Protection against bearish market sentiment through stablecoin structure

ETC Advantages:

- Established smart contract platform with 9-year operational history and proven security record

- Significant market capitalization ($1.9 billion) provides liquidity and exchange accessibility

- Large developer community and ecosystem for decentralized applications

- Potential recovery upside from current depressed valuation levels (55% decline)

- Broader institutional and retail market recognition

✅ Investment Recommendations:

Beginner Investors:

- Primary Strategy: Allocate majority portfolio to WUSD (65-75%) for learning risk management in crypto markets while maintaining capital stability

- Secondary Allocation: Maintain small ETC position (25-35%) as exposure to smart contract infrastructure for long-term appreciation potential

- Action Plan: Use stablecoin position as base to gradually expand crypto market knowledge before increasing risk exposure

Experienced Investors:

- Primary Strategy: Implement 50-50 allocation between WUSD and ETC to balance capital preservation with growth upside

- Trading Tactics: Use WUSD liquidity pools for staking or lending opportunities while actively trading ETC volatility cycles

- Risk Management: Employ stop-loss orders on ETC positions; use WUSD for collateral in DeFi protocols

- Opportunity: Consider accumulating ETC during extreme fear periods as contrarian value play

Institutional Investors:

- Treasury Strategy: Allocate 80% to WUSD for compliant stablecoin holdings meeting regulatory capital requirements and payment flexibility

- Investment Strategy: Allocate 20% to ETC as long-term infrastructure play with potential institutional custody solutions improving

- Compliance: Utilize WUSD for cross-border settlement and enterprise payment requirements

- Diversification: Monitor emerging institutional-grade stablecoin options while maintaining ETC exposure to smart contract infrastructure trends

Strategic Consideration:

The choice between WUSD and ETC depends fundamentally on investor objectives:

- For Capital Protection & Payment Utility: WUSD provides superior characteristics

- For Infrastructure Exposure & Growth Potential: ETC offers greater upside opportunity with commensurate risk

- For Balanced Approach: Complementary allocation addresses both preservation and appreciation objectives

⚠️ Risk Disclaimer: Cryptocurrency markets exhibit extreme volatility and carry substantial investment risk. This analysis does not constitute investment advice. Past performance does not guarantee future results. Investors must conduct independent research, assess their risk tolerance, consult with qualified financial advisors, and only commit capital they can afford to lose. Market conditions, regulatory environments, and technological developments can rapidly change investment fundamentals.

Report Date: December 21, 2025

Data Source: Gate, Multiple Cryptocurrency Data Aggregators

Analysis Period: Historical data through December 21, 2025

None

FAQ: WUSD vs ETC Investment Comparison

I. Price and Market Performance

Q1: Why does WUSD maintain a stable price while ETC experiences significant volatility?

A: WUSD is a fiat-collateralized stablecoin pegged 1:1 to the U.S. Dollar, maintaining tight price stability through reserve backing and minimal variation around the $1.00 mark. In contrast, ETC is a speculative cryptocurrency subject to market supply and demand dynamics, investor sentiment, and macroeconomic factors. As of December 21, 2025, WUSD shows only -0.09% annual change, while ETC has declined 55.19% year-over-year, reflecting the fundamental difference between a stability-focused asset and a volatility-prone infrastructure token.

Q2: What does the current "Extreme Fear" market sentiment indicate for both assets?

A: The Fear & Greed Index at 20 (Extreme Fear) signals heightened bearish sentiment across cryptocurrency markets. For WUSD, this environment favors risk-off capital allocation toward stablecoins, potentially supporting adoption among investors seeking capital preservation. For ETC, extreme fear creates downward price pressure but may present contrarian accumulation opportunities for long-term investors betting on market recovery cycles.

Q3: Which asset offers better liquidity for large transactions?

A: ETC significantly outperforms WUSD in liquidity metrics. ETC generates $1,075,611.77 in 24-hour trading volume across 48 exchange listings, while WUSD records only $20,868.87 volume across 4 exchanges. For institutional investors or large position holders, ETC provides substantially better market depth and reduces execution slippage for sizable transactions.

II. Project Fundamentals and Use Cases

Q4: What are the primary intended use cases for WUSD versus ETC?

A: WUSD targets enterprise payment solutions within the Web3 ecosystem, emphasizing secure, compliant digital payments for institutional users requiring stablecoin functionality, exchange services, and card-based settlements. ETC functions as a decentralized smart contract platform enabling applications to run without downtime or censorship, serving developers building decentralized applications while upholding the "code is law" principle established since its 2016 inception.

Q5: How do the supply mechanisms of WUSD and ETC differ strategically?

A: WUSD operates with unlimited maximum supply, allowing flexible issuance aligned with fiat collateral availability and enterprise payment demand. ETC implements a capped supply of 210,700,000 tokens with halving schedules reducing mining rewards over time, creating inherent scarcity and potential deflationary characteristics designed to incentivize long-term value appreciation and network security through mining participation.

III. Risk Assessment and Investment Strategy

Q6: What are the primary risk factors distinguishing WUSD and ETC investments?

A: WUSD faces limited adoption risk (only 660 holders), liquidity constraints ($20,868.87 daily volume), and dependence on sustained enterprise adoption for value capture. Additionally, counterparty risk exists through reserve custodianship and fiat backing dependencies. ETC confronts a 55.19% annual decline, reduced investor confidence, competitive displacement threats from advanced platforms, and potential security vulnerabilities from lower hashrate compared to Bitcoin and Ethereum, alongside concentration risk with 73.47% market cap to fully diluted valuation ratio.

Q7: Which asset is more suitable for different investor profiles?

A: Risk-averse investors and institutional treasuries benefit from WUSD's capital preservation and payment utility characteristics, ideal for treasury management and working capital allocation. Growth-oriented investors and infrastructure believers should consider ETC for long-term smart contract platform exposure despite current bearish conditions. Conservative portfolios typically allocate 70% WUSD and 30% ETC, while aggressive portfolios reverse this allocation to capture greater growth potential with acceptable volatility.

Q8: What investment strategy recommendations exist for the 2025-2030 period?

A: WUSD price forecasts range from $0.82-$1.03 (2025) to $1.33-$2.77 (2030), suggesting modest appreciation aligned with enterprise adoption expansion. ETC forecasts range from $6.77-$15.63 (2025) to $16.45-$35.35 (2030), reflecting greater upside potential but with elevated volatility. Beginner investors should emphasize WUSD allocation (65-75%) while maintaining ETC exposure (25-35%). Experienced investors may implement 50-50 balanced allocations with active volatility trading. Institutional investors should allocate 80% WUSD for compliant settlement requirements and 20% ETC for infrastructure diversification.

Report Date: December 21, 2025

Disclaimer: This FAQ analysis is for informational purposes only and does not constitute investment advice. Cryptocurrency markets carry substantial risk with high volatility. Investors must conduct independent research and consult qualified financial advisors before making investment decisions.

What Is the Current Market Overview for XPL in 2025?

What is the Current Market Overview for Cryptocurrencies in 2025?

How Does LUNC Compare to Its Competitors in Performance and Market Share?

Top Altcoins to Invest in 2024 | Buy Trending Coins Instantly

How Has the Crypto Market Cap Evolved in November 2025?

How Does DCR's Liquidity Flow Affect Its Market Position in 2025?

Mastering Solscan: A Comprehensive Guide to Blockchain Explorer Usage

Exploring BlockDAG: The Future of Blockchain Technology

Exploring Monad Testnet: The Future of High-Speed Blockchain Solutions

Exploring Dedust IO: The Ultimate DEX Aggregator for Ton Blockchain

The Comprehensive Guide to Layer 2 Scaling Solutions with Starknet