2025 SCARCITY Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: SCARCITY's Market Position and Investment Value

SCARCITY, a decentralized social media platform (DESOC) launched in August 2024, has emerged as an alternative solution addressing the inherent challenges of centralized social applications and media. As of December 2025, SCARCITY has established itself in the market with a total market capitalization of $212.5 million and a circulating supply of approximately 889.17 million tokens, currently trading at $0.02125 per token. This innovative blockchain-based social platform is playing an increasingly crucial role in advancing the Web3 social ecosystem.

This article will conduct a comprehensive analysis of SCARCITY's price trajectory from 2025 through 2030, integrating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. SCARCITY Price History Review and Market Status

SCARCITY Historical Price Trajectory

SCARCITY reached its all-time high of $0.68 on April 12, 2025, marking a significant peak in the token's trading history. From this apex, the token experienced substantial downward pressure, declining sharply over the subsequent months. The token touched its all-time low of $0.01827 on December 6, 2025, representing a severe correction from its historical peak. Over the one-year period, SCARCITY has depreciated by approximately 90.25%, reflecting significant losses for investors who entered at higher price levels.

SCARCITY Current Market Status

As of December 20, 2025, SCARCITY is trading at $0.02125, reflecting a 24-hour decline of 5.38%. The token has demonstrated modest short-term volatility, with a 1-hour gain of 4.39% and a 7-day increase of 3.35%, suggesting some recovery momentum in the immediate trading period. However, the 30-day performance shows a sharp decline of 57.87%, indicating continued bearish pressure over the medium term.

The current market capitalization stands at approximately $18.89 million, with a fully diluted valuation of $212.50 million. SCARCITY ranks 890th by market capitalization among all cryptocurrencies. The 24-hour trading volume totals $40,323.74, demonstrating relatively modest liquidity in the current market environment. The token maintains a circulating supply of 889.17 million SCARCITY out of a maximum supply of 10 billion tokens, representing approximately 8.89% circulation. The project currently has 13,007 active token holders and maintains a market dominance of 0.0066%.

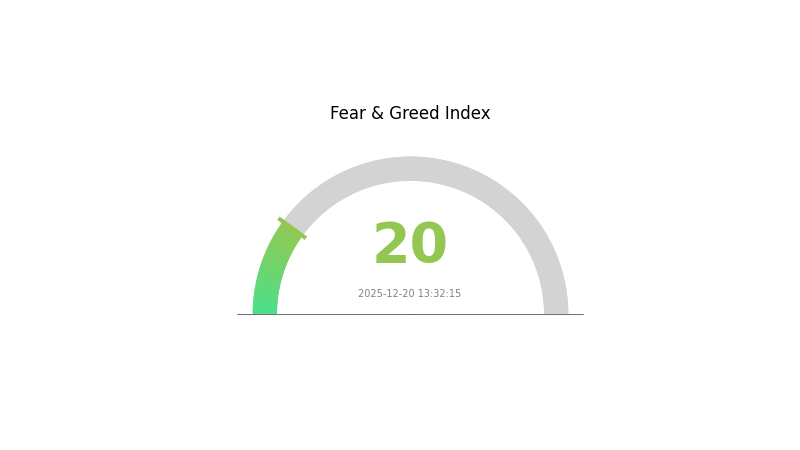

The current market sentiment reflects extreme fear, as indicated by the broader market conditions, which may be contributing to the downward price pressure observed across SCARCITY's recent trading activity.

Click to view current SCARCITY market price

SCARCITY 市场情绪指标

2025-12-20 恐惧与贪婪指数:20(Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear & Greed Index dropping to 20. This indicates significant market pessimism and heightened investor anxiety. When fear reaches such extreme levels, it often presents contrarian opportunities for long-term investors. Consider reviewing your portfolio strategy on Gate.com and evaluating potential entry points during periods of market weakness. Historically, extreme fear periods have preceded market recoveries, making this an important moment for strategic positioning.

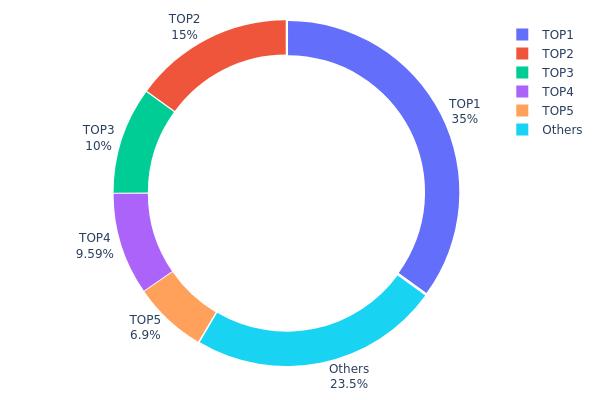

SCARCITY Holdings Distribution

The holdings distribution chart illustrates the concentration of SCARCITY tokens across the top wallet addresses on the blockchain. This metric serves as a critical indicator for assessing token decentralization, market structure stability, and potential risks associated with wealth concentration. By analyzing how tokens are distributed among the largest holders, we can evaluate the token's susceptibility to market manipulation and the overall health of its ecosystem.

The current holdings data reveals a moderate-to-high concentration risk in the SCARCITY ecosystem. The top holder commands 35.02% of total supply, while the combined holdings of the top five addresses account for 76.51% of all tokens in circulation. Notably, the address "0x0000...00dead" dominates with 3.5 million tokens, which is characteristic of tokens where a significant portion has been burned or locked in development-related contracts. The second-largest holder maintains 15.01% of the supply, followed by progressively smaller positions. This distribution pattern suggests that while a substantial portion of tokens may be removed from active circulation through burning mechanisms, the remaining liquid supply exhibits concentrated ownership among a limited number of addresses.

The concentration metrics indicate potential market structure vulnerabilities. With the top five addresses controlling approximately three-quarters of the non-burned supply, SCARCITY demonstrates below-average decentralization characteristics. This concentrated distribution could amplify price volatility during large liquidations or coordinated selling activities, while the fragmented "Others" segment at 23.49% represents retail participation. The ecosystem would benefit from observing whether these major holders maintain their positions or gradually redistribute tokens, as such movements could significantly impact price stability and long-term market development.

Click to view current SCARCITY holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 3500000.00K | 35.02% |

| 2 | 0xf6ef...ccdfec | 1500000.00K | 15.01% |

| 3 | 0xd78b...d41190 | 1000000.00K | 10.00% |

| 4 | 0xddee...f7d48d | 958333.34K | 9.58% |

| 5 | 0x6d41...d5f1fd | 690000.00K | 6.90% |

| - | Others | 2344833.78K | 23.49% |

II. Core Factors Affecting SCARCITY's Future Price

Supply Mechanism

- Historical Patterns: Past supply changes have produced obvious impacts on SCARCITY's price movements.

- Current Impact: Anticipated supply adjustments are expected to continue influencing future price performance.

Technology Development and Ecosystem Building

- Market Competition: Competition from other decentralized social projects creates pressure that may divert market share and affect price dynamics.

Market Risk Factors: SCARCITY faces several headwinds including high volatility with sharp price fluctuations, limited liquidity that affects price stability during periods of low trading activity, and competitive pressure from alternative decentralized social platforms.

III. 2025-2030 SCARCITY Price Forecast

2025 Outlook

- Conservative Forecast: $0.01195 - $0.02134

- Base Case Forecast: $0.02134

- Optimistic Forecast: $0.02945 (requiring sustained market momentum and increased adoption)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation phase with steady growth trajectory as the token establishes stronger market presence and utility expansion

- Price Range Forecast:

- 2026: $0.01879 - $0.032 (19% upside potential)

- 2027: $0.02611 - $0.03673 (35% cumulative gain)

- 2028: $0.03173 - $0.04416 (53% cumulative gain)

- Key Catalysts: Enhanced platform functionality, increasing ecosystem partnerships, growing institutional interest, and improving market liquidity conditions

2029-2030 Long-term Outlook

- Base Case Scenario: $0.03690 - $0.05074 (80% cumulative appreciation from 2025 levels, assuming steady market development and consistent adoption)

- Optimistic Scenario: $0.03567 - $0.05128 (109% cumulative appreciation by 2030, assuming accelerated ecosystem growth and broader market recognition)

- Transformation Scenario: Extended upside potential achievable under favorable conditions including mainstream adoption acceleration, significant strategic partnerships, and positive regulatory developments

- 2030-12-31: SCARCITY targeting $0.04459 average price level (stabilization phase with consolidated gains)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02945 | 0.02134 | 0.01195 | 0 |

| 2026 | 0.032 | 0.02539 | 0.01879 | 19 |

| 2027 | 0.03673 | 0.0287 | 0.02611 | 35 |

| 2028 | 0.04416 | 0.03271 | 0.03173 | 53 |

| 2029 | 0.05074 | 0.03844 | 0.0369 | 80 |

| 2030 | 0.05128 | 0.04459 | 0.03567 | 109 |

SCARCITY Investment Strategy and Risk Management Report

IV. SCARCITY Professional Investment Strategy and Risk Management

SCARCITY Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Community believers in decentralized social media platforms, Web3 adoption advocates, and long-term cryptocurrency portfolio diversifiers

- Operational Recommendations:

- Establish a core position during market corrections when SCARCITY trades below $0.025, with a focus on accumulating during the -57.87% 30-day decline periods

- Implement dollar-cost averaging (DCA) monthly purchases to reduce average entry cost and mitigate volatility risk

- Store acquired tokens securely and maintain a minimum 12-month holding period to allow for project maturation and ecosystem development

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Price Action Patterns: Monitor the $0.01827 support level (ATL) and $0.02278 24-hour high resistance, with breakout confirmation above $0.025 as a potential entry signal

- Volume Analysis: Track the 24-hour volume of $40,323.74 relative to historical averages; increased volume during uptrend could signal institutional interest in the DESOC ecosystem

-

Swing Trading Key Points:

- Capitalize on the recent -5.38% 24-hour decline as a potential entry for short-term bounces targeting $0.02278 resistance

- Set trailing stop losses at 8-10% below entry points to protect against rapid downside moves, given the -90.25% one-year performance

- Consider taking profits upon 15-20% rallies from entry points, as SCARCITY shows high volatility with limited liquidity (only 2 exchange listings)

SCARCITY Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-2% portfolio allocation - maintain minimal exposure given the extreme -90.25% annual decline and limited market capitalization of $18.89M

- Aggressive Investors: 2-5% portfolio allocation - suitable for those comfortable with DESOC platform risk and willing to hold through development phases

- Professional Investors: 3-7% portfolio allocation - with active hedging strategies and position rebalancing triggered by technical levels

(2) Risk Hedging Solutions

- Volatility Hedging: Maintain a 60-70% stablecoin reserve alongside SCARCITY holdings to capitalize on extreme price swings and execute tactical accumulation

- Diversification Strategy: Balance SCARCITY exposure with other established Web3 social platform tokens to reduce single-asset concentration risk

(3) Secure Storage Solutions

- Hot Wallet Usage: Gate.com Web3 wallet offers convenient access for active traders engaging with the DESOC ecosystem while maintaining non-custodial control

- Cold Storage Approach: Transfer long-term holdings to hardware-grade security solutions, given the irreversible nature of blockchain transactions

- Security Critical Notes: As SCARCITY operates on BSC (BEP-20 standard), verify contract address

0x0d67d1bec77e562a73a65eef5ed92ac46744671cbefore any transactions; never share private keys or seed phrases; enable multi-factor authentication on all exchange accounts

V. SCARCITY Potential Risks and Challenges

SCARCITY Market Risks

- Extreme Volatility: The asset has declined 90.25% over one year while showing a 4.39% hourly volatility, indicating severe price instability that can liquidate leveraged positions rapidly

- Liquidity Constraints: Trading on only 2 exchanges with 24-hour volume of $40,323.74 creates significant slippage risk for large orders, potentially causing 10-20% price impact on substantial trades

- Low Market Capitalization: Fully diluted valuation of $212.5M with only $18.89M market cap indicates a 91.11% circulating supply discount, creating potential dilution when vesting schedules unlock

SCARCITY Regulatory Risks

- Platform Compliance Uncertainty: As a decentralized social media project, SCARCITY faces evolving regulatory scrutiny regarding content moderation, data privacy, and compliance with jurisdiction-specific digital asset regulations

- Securities Classification: Regulatory bodies may reclassify SCARCITY tokens as securities in certain jurisdictions, potentially restricting trading and requiring compliance registrations

- Geographic Restrictions: Certain countries may prohibit or restrict participation in decentralized social platforms, limiting the addressable market and user adoption potential

SCARCITY Technical Risks

- Blockchain Dependency: SCARCITY's BEP-20 standard reliance on BSC creates single-chain risk exposure; potential BSC network disruptions or consensus failures would directly impact token functionality

- Smart Contract Vulnerabilities: Decentralized social platforms require complex smart contracts for token economics and governance; undiscovered vulnerabilities could result in loss of funds or operational disruption

- Adoption Rate Uncertainty: The success of DESOC depends entirely on user adoption competing against established centralized platforms with network effects; failure to achieve critical mass would severely diminish token value

VI. Conclusion and Action Recommendations

SCARCITY Investment Value Assessment

SCARCITY presents a speculative opportunity within the emerging decentralized social media (DESOC) sector. The project addresses genuine problems in centralized social platforms through decentralized architecture, offering long-term value potential for Web3 adoption believers. However, the extreme -90.25% annual decline, limited market liquidity, and unproven platform traction create substantial near-term risks. Current valuation of $0.02125 reflects heavy skepticism, potentially creating accumulation opportunities for conviction investors willing to endure 50%+ drawdowns. The 8.89% circulating-to-fully-diluted supply ratio suggests significant dilution risk ahead. Investors should view SCARCITY as a high-risk, early-stage technology bet rather than a stable store of value.

SCARCITY Investment Recommendations

✅ Beginners: Start with a micro position (0.25-0.5% of portfolio) purchased on Gate.com during extreme weakness (below $0.020) while learning about DESOC technology; avoid leverage or margin trading given volatility

✅ Experienced Investors: Implement a 2-3% core allocation with disciplined DCA monthly purchases; utilize technical levels ($0.01827 support, $0.02278 resistance) for tactical entry/exit timing; maintain 50% cash reserves for opportunistic accumulation

✅ Institutional Investors: Conduct thorough due diligence on DESOC platform development roadmap, user adoption metrics, and management team background; structure positions through tranches with milestone-based allocation triggers; establish hedging strategies through stablecoin reserves

SCARCITY Trading Participation Methods

- Gate.com Spot Trading: Direct BUY/SELL orders on BEP-20 token with real-time price discovery; recommended for position building and long-term portfolio construction

- Limit Order Strategy: Set buy orders at psychological support levels ($0.020, $0.0185) to accumulate without emotional timing; implement sell orders at resistance levels ($0.025, $0.03) for systematic profit-taking

- DCA Auto-Purchases: Utilize Gate.com recurring buy features to systematically accumulate SCARCITY monthly, removing emotion from market timing decisions

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and should consult professional financial advisors. Never invest capital you cannot afford to lose completely. SCARCITY's -90.25% annual performance demonstrates the speculative nature of early-stage tokens.

FAQ

Does scarcity lead to higher prices?

Yes, scarcity typically drives higher prices. Limited supply combined with consistent or growing demand increases asset value. In crypto, projects with capped supplies often see price appreciation as competition for limited tokens intensifies.

What is the price prediction for SCX coin?

Based on current market analysis, SCX is projected to reach approximately $5.48 by 2030. Price predictions depend on market adoption, trading volume, and overall crypto market conditions. Long-term growth potential exists as the platform expands its ecosystem and user base.

What factors influence SCARCITY token price movements?

Token scarcity, market demand, and burn events directly influence SCARCITY price. Reduced supply from burns increases scarcity, driving prices up. Trading volume, investor sentiment, and broader market trends also play critical roles in price movements.

What was SCARCITY's historical price performance?

SCARCITY experienced a significant decline of 83.39% over the past year. The token reached a high of $0.6111 and a low of $0.01 during this period.

How does SCARCITY's tokenomics affect its long-term price potential?

SCARCITY's fixed supply maximizes scarcity, enhancing long-term price potential as a store-of-value token. Combined with growing demand and utility, this tokenomic design supports sustained value appreciation, following successful models like Bitcoin.

Janitor Coin Deep Dive: Innovative Whitepaper Logic Reshaping Cryptocurrency Utility

Janitor Crypto Unveiled: How This Token Could Be The Next Blockchain Revolution

2025 LM Price Prediction: Analyzing Market Trends and Factors Shaping the Future of Lithium Metals

Bless (BLESS) rose by 230% in one day.

What is XAN and How Does its Innovative Technology Impact its Market Potential?

2025 LAUNCHCOIN Price Prediction: Bullish Trends and Key Factors Driving Potential Growth

Explore Strategies for Securing Airdrop Rewards

VIC vs ARB: A Comprehensive Comparison of Two Competing Technologies and Their Impact on Modern Industry

Guide to Using Innovative Platforms for Memecoin Trading in 2025

Exploring Dash: Fast and Secure Cryptocurrency Transactions

SEND vs OP: Understanding the Key Differences Between Two Popular Blockchain Tokens