2025 MITO Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of MITO

Mitosis (MITO) is a liquidity protocol for the modular era that redefines cross-chain liquidity. Since its launch in January 2025, Mitosis has established itself as an innovative solution for cross-chain DeFi applications. As of December 21, 2025, MITO has achieved a market capitalization of $74.56 million with a circulating supply of approximately 196.27 million tokens, currently trading at $0.07456. This protocol, recognized for making cross-chain liquidity provision more attractive and liquid, is playing an increasingly important role in enabling liquidity providers to generate additional yield on their cross-chain assets across Ethereum L1 and L2 rollups.

This comprehensive analysis will examine MITO's price trajectory through 2025-2030, incorporating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

MITO Market Analysis Report

I. MITO Price History Review and Current Market Status

MITO Historical Price Trajectory

MITO reached its all-time high of $0.45 on September 14, 2025, marking the peak of investor optimism during the period. Subsequently, the token experienced a significant decline, hitting its all-time low of $0.05 on October 10, 2025. This represents a decline of approximately 88.89% from its peak, reflecting considerable market volatility and adjustment in investor sentiment.

MITO Current Market Position

As of December 21, 2025, MITO is trading at $0.07456, with a 24-hour trading volume of $16,820.01. The token's market capitalization stands at approximately $14.63 million, while its fully diluted valuation reaches $74.56 million. With 196,273,082 tokens in circulation out of a total supply of 1 billion, the circulating supply represents 19.63% of the total supply.

The token exhibits short-term weakness, declining 0.84% in the past hour and 0.1% over the last 24 hours. Weekly performance shows a steeper decline of 0.86%, while the 30-day period reflects a 6.60% decrease. Over the past year, MITO has declined significantly by 63.61%, indicating substantial long-term depreciation from its launch valuation.

MITO holds the 988th position by market capitalization and commands a market dominance of 0.0023%. The token is listed on 18 exchanges and maintains a holder base of 75,627 addresses. Current market sentiment reflects extreme fear, with a VIX reading of 20.

Click to view current MITO market price

MITO Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index dropping to 20. This indicates intense selling pressure and widespread investor pessimism across the market. During such periods, risk-averse traders typically reduce positions, while contrarian investors may identify potential buying opportunities as assets reach oversold levels. Market participants should remain cautious and conduct thorough due diligence before making investment decisions. On Gate.com, you can monitor real-time market sentiment and adjust your trading strategy accordingly.

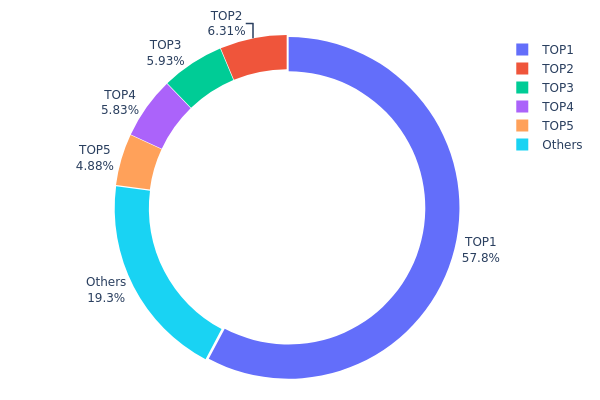

MITO Holdings Distribution

An address holdings distribution map illustrates the concentration patterns of token ownership across the blockchain network by tracking the percentage of total supply held by individual addresses. This metric serves as a critical indicator for evaluating token decentralization, market structure integrity, and potential vulnerability to coordinated selling or price manipulation events.

The current MITO holdings data reveals a highly concentrated distribution pattern that warrants careful consideration. The top holder commands 57.75% of the total supply, representing approximately 29.77 million tokens. This single address concentration substantially exceeds prudent decentralization benchmarks, with the top five addresses collectively controlling 80.66% of circulating tokens. The remaining 19.34% distributed among other addresses indicates a fragmented secondary market structure. Such extreme concentration in the top holder creates significant structural imbalances that could facilitate abrupt price movements if these positions experience substantial changes in holding status or trading activity.

The concentration dynamics present both market structure and stability concerns for MITO. While the secondary distribution among the second through fifth-largest holders demonstrates moderate dispersion, the overwhelming dominance of the primary address creates an asymmetric risk profile. The 57.75% concentration threshold positions this asset toward the higher end of concentration risk levels observed in the broader token ecosystem. This structural imbalance suggests limited market depth in the secondary holder categories and underscores the importance of monitoring large holder activity, as movements by the top address could disproportionately influence price discovery mechanisms and overall market liquidity conditions.

Access current MITO Holdings Distribution on Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 29773.00K | 57.75% |

| 2 | 0x4368...26f042 | 3250.79K | 6.30% |

| 3 | 0x238a...d5e6c4 | 3056.24K | 5.92% |

| 4 | 0x7fcb...9f56f7 | 3003.96K | 5.82% |

| 5 | 0x8894...e2d4e3 | 2515.30K | 4.87% |

| - | Others | 9955.65K | 19.34% |

II. Core Factors Affecting MITO's Future Price

Supply Mechanism

- Tiered Token Design: MITO employs a dual-token mechanism with tMITO and rMITO. tMITO is designed for long-term token locking, encouraging capital deposit and maintaining system stability. rMITO focuses on short-term incentives, keeping users active and maintaining market momentum. This layered design allows the token to balance both long-term and short-term demand requirements, avoiding supply pressure concentration.

Technology Development and Ecosystem Building

-

Multi-Chain Liquidity Infrastructure: Mitosis positions itself as a liquidity hub in the multi-chain finance world, facilitating cross-chain interactions and enabling seamless asset transfers across different blockchain networks.

-

New Feature Development: Continuous innovation in protocol functionality is critical for MITO's future value. Attracting more developers and projects into the ecosystem directly increases demand for MITO tokens, supporting future price appreciation.

-

Smart Contract Security: The clarity and robustness of smart contract audit status remains an important consideration for DeFi investors and represents a potential risk factor that could affect market confidence.

Macro Economic Environment

- Federal Reserve Policy Impact: The cryptocurrency market, including MITO, remains susceptible to short-term volatility driven by macroeconomic factors such as Federal Reserve policy decisions and broader market sentiment shifts.

Three, 2025-2030 MITO Price Forecast

2025 Outlook

- Conservative Forecast: $0.06867-$0.07464

- Neutral Forecast: $0.07464-$0.08500

- Optimistic Forecast: $0.08500-$0.09554 (requiring sustained market interest and ecosystem development)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Recovery and gradual appreciation phase with increasing adoption momentum

- Price Range Forecast:

- 2026: $0.06467-$0.11742 (14% potential upside)

- 2027: $0.09721-$0.14378 (35% cumulative growth)

- 2028: $0.07474-$0.13232 (64% cumulative growth)

- Key Catalysts: Enhanced tokenomics implementation, expanded partnership ecosystem, increased utility adoption, and positive regulatory developments

2029-2030 Long-term Outlook

- Base Case: $0.10194-$0.18604 (70% cumulative growth by 2029)

- Optimistic Case: $0.12225-$0.17554 (110% cumulative growth by 2030, assuming sustained market bullish sentiment)

- Transformation Case: $0.18604+ (assuming breakthrough in platform adoption and major institutional participation)

- 2030-12-21: MITO approaches $0.17554 average price level (consolidation and maturation phase)

Note: These forecasts are based on historical trend analysis and market cycle patterns. Actual price performance may vary significantly based on macroeconomic conditions, regulatory changes, technological breakthroughs, and broader cryptocurrency market sentiment. Investors should conduct independent research before making investment decisions and consider trading on established platforms like Gate.com for reliable market access.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.09554 | 0.07464 | 0.06867 | 0 |

| 2026 | 0.11742 | 0.08509 | 0.06467 | 14 |

| 2027 | 0.14378 | 0.10126 | 0.09721 | 35 |

| 2028 | 0.13232 | 0.12252 | 0.07474 | 64 |

| 2029 | 0.18604 | 0.12742 | 0.10194 | 70 |

| 2030 | 0.17554 | 0.15673 | 0.12225 | 110 |

MITO Investment Strategy and Risk Management Report

IV. MITO Professional Investment Strategy and Risk Management

MITO Investment Methodology

(1) Long-term Holding Strategy

-

Target Investor Profile: DeFi-focused investors seeking exposure to cross-chain liquidity infrastructure, institutional players interested in yield-generating strategies, and risk-tolerant individuals with medium to long-term investment horizons.

-

Operation Recommendations:

- Accumulate MITO during market downturns when prices deviate significantly from moving averages, with particular attention to support levels established during previous consolidation phases.

- Participate in liquidity provision opportunities on Ethereum L1 and L2 rollups using derivative tokens received from Mitosis LP positions, enabling passive yield generation on locked assets.

- Maintain position through market cycles by setting clear entry and exit targets based on historical resistance levels (previous ATH of $0.45 in September 2025) and support levels (ATL of $0.05 in October 2025).

-

Storage Solution:

- For substantial holdings, utilize Gate.com Web3 Wallet for secure management of MITO tokens, enabling seamless participation in DeFi applications while maintaining custody control.

- Implement multi-signature verification protocols for enhanced security when managing large positions exceeding personal risk thresholds.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Moving Averages (MA): Employ 20-day and 50-day moving averages to identify trend direction and potential reversal points; trading signals emerge when price crosses these critical levels.

- Relative Strength Index (RSI): Monitor RSI oscillator readings to identify overbought (>70) and oversold (<30) conditions, particularly useful given MITO's recent volatility (-63.61% over 1-year period).

-

Wave Trading Key Points:

- Execute buy positions when price demonstrates consolidation near support levels with increasing trading volume, targeting short-term bounces of 5-10% before profit-taking.

- Establish stop-loss orders at 2-3% below entry points to manage downside exposure during intraday volatility spikes.

- Monitor 24-hour trading volume trends; increased volume above the current $16,820 daily average signals potential breakout opportunities or corrective pressures.

MITO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total portfolio allocation to MITO tokens, complemented by stablecoin positions, with emphasis on long-term holding and minimal active trading.

- Active Investors: 3-5% portfolio allocation permitting more frequent trading activities, hedged through diversified DeFi protocol exposure and selective stablecoin reserves.

- Professional Investors: 5-10% allocation potentially including leveraged positions on margin trading platforms, sophisticated hedging strategies, and tactical rebalancing based on technical and fundamental analysis.

(2) Risk Hedging Solutions

- Stablecoin Reserve Strategy: Maintain 20-30% of allocated capital in USDT or USDC reserves to execute opportunistic accumulation during pronounced drawdowns, reducing average entry costs and managing sequence-of-returns risk.

- Diversified DeFi Exposure: Complement MITO holdings with exposure to complementary cross-chain infrastructure projects and established liquidity protocols, reducing concentration risk while maintaining sector focus.

(3) Secure Storage Solution

- Web3 Wallet Recommendation: Gate.com Web3 Wallet provides integrated security features, seamless token management, and direct access to supported DeFi applications on Ethereum L1 and L2 networks without custodial intermediaries.

- Cold Storage Approach: For holdings exceeding three-month operational requirements, consider transferring MITO to self-custody solutions with hardware verification capabilities, eliminating counterparty risk exposure.

- Security Precautions: Never share private keys or seed phrases with any third parties; utilize strong password protection with alphanumeric complexity; enable all available two-factor authentication mechanisms; regularly verify contract addresses on official Mitosis channels (Twitter: https://x.com/MitosisOrg, Discord: https://discord.com/invite/mitosis) before transactions; remain vigilant against phishing attempts targeting wallet access credentials.

V. MITO Potential Risks and Challenges

MITO Market Risks

-

Liquidity Volatility Risk: Current 24-hour trading volume of approximately $16,820 with 988th market ranking indicates moderate liquidity constraints; rapid position accumulation or liquidation may generate significant slippage, adversely affecting execution prices.

-

Market Sentiment Deterioration: Year-to-date performance reflects -63.61% depreciation, signaling substantial losses for early investors; sustained negative sentiment could trigger cascading liquidations and further downward pressure absent fundamental catalysts.

-

Correlated Asset Risk: As infrastructure-level protocol, MITO demonstrates high correlation with broader Ethereum ecosystem performance and DeFi market cycles, limiting portfolio diversification benefits during sector-wide corrections.

MITO Regulatory Risks

-

Jurisdiction Compliance Uncertainty: Evolving regulatory frameworks across multiple jurisdictions where Ethereum L1 and L2 networks operate create compliance uncertainties; adverse regulatory actions targeting cross-chain protocols or liquidity providers could materially constrain operational scope.

-

Securities Classification Risk: Regulatory authorities may reclassify MITO tokens or associated derivative instruments as unregistered securities, triggering enforcement actions, delisting pressures, or trading restrictions across regulated platforms.

-

DeFi Protocol Regulation: Increasing scrutiny of decentralized finance activities by regulatory bodies may impose operational constraints on supported applications utilizing Mitosis derivative tokens, reducing yield-generation opportunities and investor utility.

MITO Technical Risks

-

Smart Contract Vulnerability Risk: Complex multi-chain architecture introducing cross-chain message passing and derivative token mechanisms inherently exposes protocol to potential smart contract vulnerabilities; historical precedent demonstrates that infrastructure-level exploits can result in substantial capital losses.

-

Cross-Chain Bridge Risk: Mitosis operation across multiple Ethereum L1 and L2 rollup networks necessitates reliance on bridge infrastructure; bridge compromise or failure could strand liquidity or trigger involuntary settlement at unfavorable conditions.

-

Liquidity Provider Concentration Risk: Derivative token design creating artificial liquidity may obscure underlying asset concentration; if primary liquidity providers withdraw positions simultaneously, secondary market illiquidity could impair redemption rates and create execution challenges.

VI. Conclusion and Action Recommendations

MITO Investment Value Assessment

Mitosis represents an infrastructure-focused investment thesis addressing legitimate cross-chain liquidity fragmentation challenges within the Ethereum ecosystem. The protocol's core value proposition—enabling LPs to simultaneously realize yield while maintaining asset liquidity through derivative tokens—addresses an authentic market demand. However, significant headwinds temper enthusiasm: the -63.61% annual decline, modest trading liquidity, relatively early project maturity, and regulatory uncertainties surrounding DeFi infrastructure present material risks. The fully diluted valuation of $74.56 million against a 19.63% circulating supply ratio indicates substantial future dilution potential. Investment merit depends on individual conviction regarding cross-chain liquidity market adoption trajectories and tolerance for extended drawdown scenarios.

MITO Investment Recommendations

✅ For Newcomers: Begin with minimal position sizing (0.5-1% portfolio allocation) on Gate.com, prioritizing education regarding cross-chain architecture and DeFi mechanics before scaling exposure; utilize limit orders targeting 15-20% dips from current price levels to execute disciplined accumulation.

✅ For Experienced Investors: Implement structured position scaling across three distinct price targets (current level, -10%, -20%) while actively monitoring technical indicators for breakout formation; consider derivative token participation only after establishing foundational spot holdings and understanding associated smart contract risks.

✅ For Institutional Investors: Conduct comprehensive due diligence on Mitosis protocol team credentials, code audit results, and insurance coverage; structure exposure through tranched allocations with clear liquidity checkpoints; maintain active monitoring of regulatory developments and competitive protocol launches; consider governance participation to influence protocol development priorities.

MITO Trading Participation Methods

-

Spot Trading on Gate.com: Execute buy and sell orders directly through Gate.com's trading interface, accessing MITO/USDT and MITO/ETH trading pairs; ideal for position establishment and rebalancing with transparent pricing.

-

Limit Order Strategy: Place orders at predetermined price levels below current market rates ($0.67-$0.71 range) to average acquisition costs downward during intraday volatility without requiring active monitoring.

-

DeFi Yield Participation: Upon MITO accumulation, explore Mitosis protocol's cross-chain LP participation mechanisms on supported Ethereum L1 and L2 networks, potentially generating additional yield on locked positions through derived token utility.

Cryptocurrency investment involves extreme risk. This report does not constitute investment advice. Investors should make decisions according to their personal risk tolerance and financial circumstances. Consultation with professional financial advisors is strongly recommended. Never invest capital exceeding your maximum loss tolerance threshold.

FAQ

What is the price prediction for mitosis token 2025?

Based on consensus forecasts, MITO is predicted to reach approximately $0.096624 in 2025. This projection reflects market analysis and community sentiment regarding the token's future performance.

How high can Miota go?

Based on current forecasts, MIOTA could potentially reach $2.23 in 2025 according to high-quality analysis. Long-term growth depends on network adoption, technological developments, and market conditions. Price potential remains significant with continued ecosystem expansion.

What factors influence MITO token price movements?

MITO token price is influenced by project fundamentals, underlying technology, token supply, 24-hour trading volume, market demand, and overall cryptocurrency market trends.

Is MITO token a good investment for long-term holders?

MITO token shows strong long-term potential as adoption and protocol performance strengthen. Aligned with project execution, it rewards patient investors with sustainable value growth and ecosystem participation benefits.

What is the current market cap and trading volume of MITO token?

The current market cap of MITO token is $17.151 million, with a 24-hour trading volume of $16.88 million. The live price stands at $0.221636 USD.

2025 LRC Price Prediction: Analyzing Market Trends, Tokenomics and Growth Potential in the Layer 2 Ecosystem

GLQ vs OP: Exploring the Impact of Different Optimization Algorithms on Machine Learning Performance

JUICE vs UNI: The Battle of Decentralized Exchanges - Which Will Dominate the Crypto Market?

HORD vs OP: The Battle for Decentralized Finance Supremacy

GET vs LRC: Comparing Two Popular Approaches to Lyric Synchronization in Music

Ethereum to AUD: What Australian Traders Need to Know in 2025

Pi Network Launch Date: Discover Listing Insights, Future Price Forecast, and Purchase Guide

Bobo The Bear NFT Meme Token Achieves $150 Million Market Cap Milestone

Understanding the Simple Moving Average Formula

Ethereum Approaches $4000: Will It Surpass Resistance or Face Reversal?

The Ultimate Guide to Selecting a Top Crypto Wallet for Beginners in 2025