2025 LUCIC Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: LUCIC's Market Position and Investment Value

LUCIC (Lucidum Coin) is a next-generation meme coin on Binance Smart Chain (BEP-20) that unites transparency, innovation, and ethical wealth creation. As of December 2025, LUCIC has achieved a market capitalization of $29.37 million with a circulating supply of approximately 164.1 million tokens, trading at a price of $0.179. This distinctive asset, characterized by its deflationary tokenomics and dividend-yielding NFTs designed by French artist Michel Saja, is increasingly playing a pivotal role in building decentralized financial ecosystems that align with mindfulness and long-term social impact.

This article will conduct a comprehensive analysis of LUCIC's price trajectory through 2030, integrating historical price movements, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies.

Lucidum Coin (LUCIC) Market Analysis Report

I. LUCIC Price History Review and Current Market Status

LUCIC Historical Price Movement Trajectory

- November 2025: LUCIC reached its all-time high of $0.735 on November 9, 2025, marking a significant peak in the token's trading history.

- December 2025: The token experienced a notable decline, reaching its all-time low of $0.1697 on December 3, 2025, representing a substantial pullback from the peak achieved just weeks earlier.

- Current Period (as of December 19, 2025): LUCIC is trading at $0.179, showing a recovery of approximately $0.0093 from its December low, though still significantly below its November highs.

LUCIC Current Market Status

As of December 19, 2025 at 21:27 UTC, LUCIC is trading at $0.179 with a market capitalization of approximately $29.37 million and a fully diluted valuation of $37.59 million. The token has experienced downward pressure across multiple timeframes:

- 1-hour change: -2.26%

- 24-hour change: -4.21%

- 7-day change: -29.62%

- 30-day change: -58.48%

- 1-year change: +351.37%

With a 24-hour trading volume of $52,951.70, LUCIC maintains liquidity across 2 exchanges. The circulating supply stands at 164,105,395 tokens out of a total supply of 210,000,000 tokens, representing a circulation ratio of 78.15%. The token currently ranks at position 701 in the global cryptocurrency market by market capitalization, with a market dominance of 0.0011%.

Current market sentiment reflects "Extreme Fear" conditions, with a significant correction from the November highs suggesting increased market volatility and investor caution.

Click to view current LUCIC market price

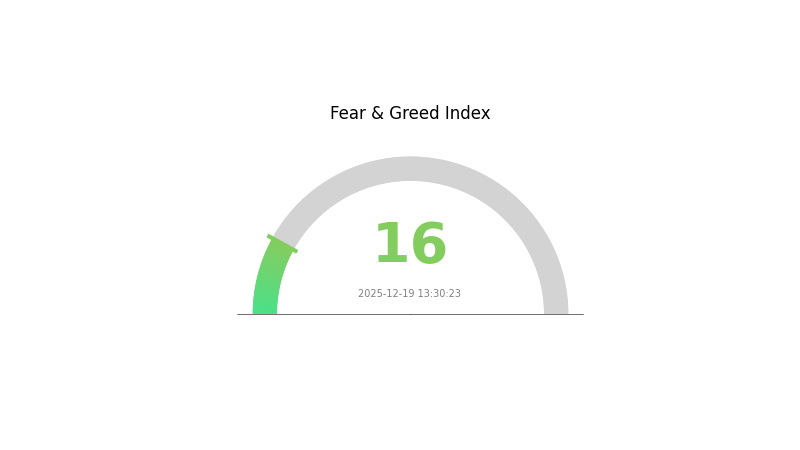

LUCIC Market Sentiment Index

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the index plummeting to 16. This indicates investors are highly pessimistic about market prospects, with widespread panic selling and risk aversion dominating sentiment. Such extreme readings often signal capitulation phases, presenting potential opportunities for contrarian investors. However, caution remains essential as further downside risks may persist. Monitor market developments closely and consider dollar-cost averaging strategies on Gate.com to manage volatility effectively during this high-fear period.

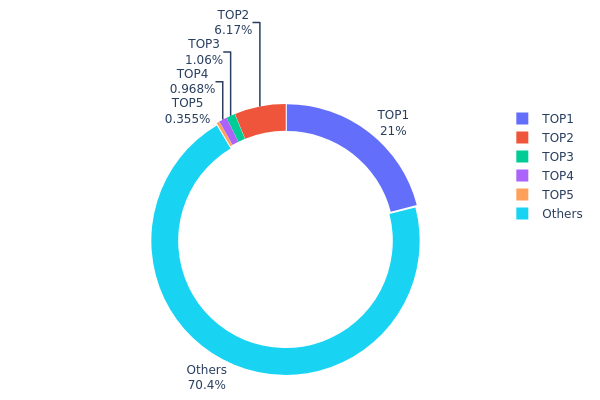

LUCIC Holdings Distribution

The address holdings distribution data provides a critical snapshot of how LUCIC tokens are dispersed across blockchain addresses, serving as a key metric for evaluating market concentration risk and decentralization dynamics. This distribution analysis reveals the proportion of total token supply held by major stakeholders, identifying potential concentration points that may influence market liquidity, price stability, and governance structures.

Current data indicates a moderate concentration pattern within the LUCIC ecosystem. The top address commands 21.00% of circulating supply, followed by a secondary holder at 6.17%, with the remaining top-tier addresses holding progressively smaller allocations. Notably, the burned address (0x0000...00dead) accounts for 0.96% of tokens, representing permanently removed supply that strengthens long-term scarcity dynamics. The substantial presence of distributed holdings, with 70.46% of tokens dispersed among numerous other addresses, suggests a relatively healthy decentralization profile compared to protocols exhibiting extreme concentration patterns.

The current distribution structure demonstrates balanced market architecture with meaningful implications for ecosystem stability. While the leading address retains significant influence, the absence of extreme concentration among top holders—with no single entity controlling over 21%—reduces acute manipulation risks associated with whale-driven volatility. The substantial tail distribution among minor holders indicates organic community participation and institutional diversification. However, continuous monitoring remains essential, as coordinated actions between the top three addresses could theoretically influence market dynamics, though such concentration levels remain within acceptable parameters for mature blockchain projects.

Click to view current LUCIC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4079...ee1bbe | 44100.00K | 21.00% |

| 2 | 0x8562...9a73aa | 12957.03K | 6.17% |

| 3 | 0xe9e0...179f13 | 2226.57K | 1.06% |

| 4 | 0x0000...00dead | 2032.94K | 0.96% |

| 5 | 0x34ce...86af65 | 745.90K | 0.35% |

| - | Others | 147937.57K | 70.46% |

II. Core Factors Impacting LUCIC's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: LUCIC's price shows high sensitivity to Federal Reserve interest rate policies. Changes in macro monetary policy directly influence cryptocurrency market sentiment and trading behavior.

-

Inflation Hedge Properties: LUCIC theoretically possesses inflation-resistant attributes, though the practical effectiveness requires long-term validation. Its performance during inflationary periods remains an area requiring further observation.

Market Sentiment and Adoption Dynamics

-

Positive Catalysts: When positive news emerges regarding widespread LUCIC adoption or major technological breakthroughs, it typically triggers optimistic market sentiment and drives LUCIC prices upward.

-

Negative Catalysts: Conversely, regulatory crackdowns and security vulnerabilities can trigger significant downward pressure on LUCIC pricing.

-

Whale Activity: Large investors ("whales") holding substantial LUCIC positions can create significant supply shocks through single large transactions, causing dramatic price fluctuations. These effects are often amplified by liquidation mechanisms.

-

Market Narrative: LUCIC has benefited from narrative-driven market momentum, recording notable gains through trending topics and market sentiment exploitation. Community-driven development approaches and transparent governance mechanisms support sustained interest.

III. 2025-2030 LUCIC Price Forecast

2025 Outlook

- Conservative Forecast: $0.1239 - $0.1761

- Base Case Forecast: $0.177

- Optimistic Forecast: $0.26373 (requiring sustained market recovery and positive regulatory developments)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with increasing institutional adoption and ecosystem expansion

- Price Range Forecasts:

- 2026: $0.20714 - $0.28647 (23% upside potential)

- 2027: $0.23821 - $0.34972 (41% upside potential)

- 2028: $0.28046 - $0.37093 (68% upside potential)

- Key Catalysts: Growing adoption across DeFi platforms, improved market liquidity on trading venues such as Gate.com, positive sentiment shifts, and technological upgrades to the protocol

2029-2030 Long-term Outlook

- Base Case Scenario: $0.3228 - $0.39005 (87% upside potential by 2029; assumes steady market growth and moderate regulatory clarity)

- Optimistic Scenario: $0.25784 - $0.52657 (102% upside potential by 2030; assumes accelerated institutional adoption and broader cryptocurrency market expansion)

- Transformative Scenario: Price exceeding $0.52657 (extreme favorable conditions including major partnership announcements, significant protocol innovations, and mainstream market acceptance)

Note: All price predictions are contingent upon market conditions, macroeconomic factors, and regulatory environment developments. Investors should conduct thorough due diligence and consider risk management strategies when engaging with cryptocurrency assets.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.26373 | 0.177 | 0.1239 | -1 |

| 2026 | 0.28647 | 0.22037 | 0.20714 | 23 |

| 2027 | 0.34972 | 0.25342 | 0.23821 | 41 |

| 2028 | 0.37093 | 0.30157 | 0.28046 | 68 |

| 2029 | 0.39005 | 0.33625 | 0.3228 | 87 |

| 2030 | 0.52657 | 0.36315 | 0.25784 | 102 |

LUCIC (Lucidum Coin) Professional Investment Strategy and Risk Management Report

IV. LUCIC Professional Investment Strategy and Risk Management

LUCIC Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Community-focused users seeking ethical wealth creation with long-term vision, those aligned with DAO principles and Web3 transparency values

- Operational Recommendations:

- Accumulate LUCIC during market downturns when price demonstrates technical support levels, leveraging the deflationary tokenomics that reward long-term holders through transaction-based scarcity mechanisms

- Participate in the LUCIC ecosystem's NFT offerings designed by Michel Saja to generate dividend yields alongside token appreciation, creating multiple revenue streams for patient investors

- Set 12-24 month holding horizons to maximize benefits from the deflationary token economics and community growth initiatives

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Price volatility tracking: Monitor the significant historical range from ATH of $0.735 (November 9, 2025) to ATL of $0.1697 (December 3, 2025) to identify key support and resistance levels for swing trading opportunities

- Volume analysis: Analyze the 24-hour trading volume of approximately $52,951.70 relative to market cap to assess liquidity conditions and optimal entry/exit timing

-

Wave Trading Key Points:

- Capitalize on the -4.21% 24-hour decline and -29.62% 7-day decline to identify potential reversal points and support zones for tactical re-entry

- Monitor the positive 351.37% 1-year performance trajectory to understand macro trend strength, using this as context for mid-term positioning decisions

LUCIC Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation maximum, focusing on the experimental nature of meme coins combined with DAO governance uncertainty

- Active Investors: 2-5% portfolio allocation, incorporating LUCIC alongside established altcoins in a diversified digital asset portfolio

- Professional Investors: 3-8% allocation for specialized strategies, potentially including NFT dividend yield arbitrage opportunities

(2) Risk Hedging Solutions

- Portfolio diversification approach: Balance LUCIC holdings with established cryptocurrencies that demonstrate lower volatility and stronger liquidity to offset meme coin market swings

- Dollar-cost averaging implementation: Execute staged purchases over multiple time periods rather than lump-sum investments to mitigate timing risk given the -58.48% 30-day decline

(3) Secure Storage Solutions

- Self-custody recommendation: Utilize Gate Web3 Wallet for secure, self-managed LUCIC holdings with direct control over private keys and transaction management

- Hardware security option: Employ BEP-20 compatible hardware solutions for large LUCIC positions requiring enhanced security protocols

- Security precautions: Never share private keys, enable multi-signature verification where available, regularly verify contract addresses via BSCscan (0xe054017a2f0ecfa294b08a74af319bce0b985a39), and maintain updated security firmware

V. LUCIC Potential Risks and Challenges

LUCIC Market Risks

- Extreme volatility exposure: The token has experienced a 76.9% decline from ATH to current price within approximately 40 days, demonstrating the severe price volatility characteristic of emerging meme coins that can result in substantial capital loss

- Liquidity constraints: With only 2 exchange listings and a relatively modest 24-hour volume of $52,951.70, LUCIC faces liquidity limitations that could make large position exits challenging and subject to significant slippage

- Market sentiment dependency: As a meme coin, LUCIC's value is heavily influenced by social media trends, community engagement, and broader market sentiment rather than fundamental utility metrics, creating unpredictable price movements

LUCIC Regulatory Risks

- Securities classification uncertainty: Regulatory bodies globally continue to evaluate meme coins and their DAO governance structures, creating potential reclassification risks that could impact trading availability and investor protections

- Geographic restrictions: Different jurisdictions may implement varying restrictions on meme coin trading or community participation, potentially limiting the project's growth and liquidity in key markets

- Compliance evolution: The emerging status of dividend-yielding NFTs within regulatory frameworks introduces uncertainty regarding future compliance requirements and potential operational constraints

LUCIC Technology Risks

- Smart contract vulnerability exposure: As a BEP-20 token with integrated NFT and deflationary mechanisms, the protocol carries inherent smart contract risks that could be exploited despite security audits

- Blockchain network dependency: LUCIC operates exclusively on Binance Smart Chain (BEP-20), creating concentrated technical risk tied to BSC infrastructure stability and performance

- DAO governance execution risk: The decentralized governance model, while aligned with transparency principles, introduces potential inefficiency risks in protocol decision-making and implementation compared to centralized management structures

VI. Conclusion and Action Recommendations

LUCIC Investment Value Assessment

LUCIC presents a speculative investment opportunity centered on ethical wealth creation principles, community governance, and innovative NFT dividend mechanisms. The project's 351.37% 1-year performance indicates strong historical appreciation potential; however, the recent 58.48% 30-day decline and extreme volatility underscore the high-risk nature of meme coin investments. LUCIC's value proposition depends heavily on sustained community engagement, DAO governance effectiveness, and broader market sentiment rather than traditional fundamental metrics. The limited exchange presence (2 listings) and modest liquidity create additional execution risks for significant position management.

LUCIC Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% portfolio maximum) through dollar-cost averaging on Gate.com, focus on understanding the whitepaper and community principles before scaling exposure, maintain holdings in Gate Web3 Wallet with secure private key management

✅ Experienced Investors: Implement 2-5% tactical allocations combining long-term DAO participation with selective wave-trading during significant support/resistance bounces, actively monitor the dividend-yielding NFT ecosystem for additional yield opportunities, utilize technical analysis on the $0.1697-$0.735 historical range for strategic positioning

✅ Institutional Investors: Conduct comprehensive smart contract security audits before engagement, evaluate DAO governance frameworks and decision-making efficiency, consider LUCIC's potential portfolio diversification benefits within emerging digital asset allocations while maintaining strict position sizing discipline

LUCIC Trading Participation Methods

- Gate.com exchange trading: Access LUCIC spot trading with professional charting tools and order management capabilities, leveraging the platform's liquidity and security infrastructure

- Direct BSC blockchain acquisition: Utilize BEP-20 compatible interfaces for peer-to-peer transactions and NFT engagement within the LUCIC ecosystem

- Community participation: Engage in DAO governance activities to influence protocol development while potentially accessing member-exclusive benefits and early NFT dividend distributions

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and financial circumstances. Professional financial consultation is strongly recommended. Never invest funds you cannot afford to lose completely.

FAQ

Is Lukso a buy or sell?

Lukso shows strong potential for long-term growth with its innovative Web3 ecosystem. Current market conditions suggest a buying opportunity for investors with a long-term perspective and risk tolerance.

What is the price prediction for LUCIC/Lukso in 2025?

In 2025, LUKSO is expected to trade between $0.3106 and $0.4472, with an average price of $0.3472, based on current market trends and expert analysis.

What are the main factors that could drive Lukso price up or down?

Lukso price movements depend on overall crypto market trends, trading volume, and investor sentiment. Major network upgrades, partnerships, and ecosystem developments drive prices up, while market corrections and selling pressure push prices down.

How does Lukso compare to other blockchain platforms in terms of adoption and technology?

Lukso specializes in social and cultural applications rather than competing directly with other platforms. It features unique scalability solutions and user-friendly technology designed to onboard new users. While adoption is emerging, its differentiated focus positions it as complementary to existing blockchains.

2025 LUCIC Price Prediction: Expert Analysis and Market Forecast for the Coming Year

What is LUCIC: A Comprehensive Guide to Understanding Lightweight Unified Computational Intelligence Framework

2025 LUCIC Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Why did Cookie DAO surge 56% in 7 days? Will it continue to rise in 2025?

Mog Coin Whitepaper Analysis: From Meme to $1.5B Market Cap in 2024

Will Crypto Recover in 2025?

What is Dogecoin (DOGE) fundamentals: whitepaper logic, use cases, and technical innovation explained

How Does Dogecoin (DOGE) Price Volatility Compare to Bitcoin with 70-80% Correlation?

What are the regulatory risks and compliance requirements for cryptocurrency exchanges in 2025?

Beginner's Guide to Setting Up Your First Digital Wallet

How does ADA fund flow and holding concentration affect Cardano price movements in 2025?