2025 KLV Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: KLV's Market Position and Investment Value

Klever (KLV), a cryptocurrency platform designed to address two major challenges in today's encryption field—encryption security and user experience—has been making strides since its inception in 2020. As of December 2025, KLV boasts a market capitalization of approximately $14.52 million with a circulating supply of around 9.03 billion tokens, trading at approximately $0.001609 per token. This asset, which bridges the currency world and the crypto world through a secure and intelligent approach, is increasingly playing a crucial role in simplifying cryptocurrency transactions and enhancing user security.

This article will comprehensively analyze KLV's price movements and market trends, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies for the period ahead.

I. KLV Price History Review and Current Market Status

KLV Historical Price Evolution

- March 2021: Peak price of $0.166705 reached, representing the all-time high (ATH) for KLV.

- September 2020 - Present: Following the 2021 peak, KLV has experienced a sustained decline, losing approximately 68.52% of its value over the one-year period.

- December 2025: New all-time low (ATL) of $0.0015233 recorded on December 19, 2025, marking significant depreciation from historical highs.

KLV Current Market Status

As of December 21, 2025, KLV is trading at $0.001609 with a market capitalization of $14,523,793.77. The token shows negative price momentum across multiple timeframes: down 2.19% over the past 24 hours, declining 6.52% over seven days, and falling 16.49% over the past month. In the immediate short term, KLV demonstrated minimal positive movement with a 0.54% gain over the past hour and a 1H price change of +$0.000008641933558783.

The 24-hour trading volume stands at $17,302.33, with price fluctuations ranging between $0.001572 (24H low) and $0.001664 (24H high). KLV maintains a circulating supply of 9,026,596,500.11 tokens against a maximum supply of 10,000,000,000, representing a circulation ratio of 90.27%. The token ranks 990th by market capitalization with a market dominance of 0.00045%.

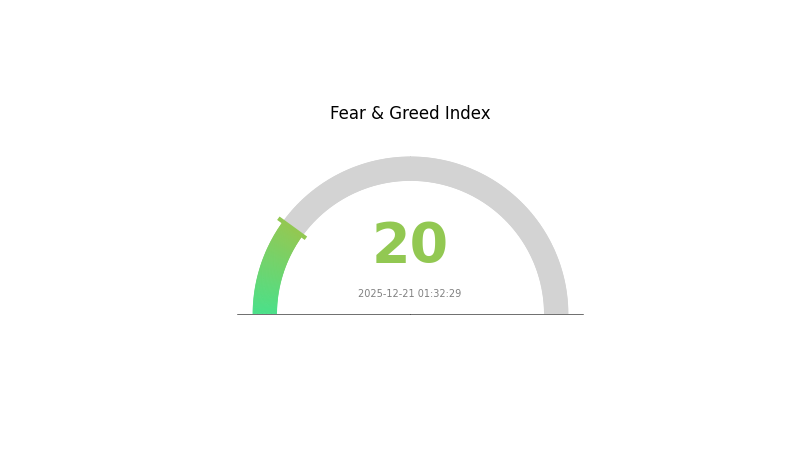

Currently, there are 176,901 KLV token holders, and the asset is available for trading across 5 exchanges. Market sentiment remains negative, with the cryptocurrency market currently experiencing extreme fear conditions (VIX reading of 20).

Click to view current KLV market price

KLV 市场情绪指标

2025-12-21 恐惧与贪婪指数:20(Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 20. This exceptionally low reading indicates heightened market anxiety and pessimistic sentiment among investors. During periods of extreme fear, market participants often panic sell, creating potential opportunities for contrarian investors. However, such volatility requires careful risk management and thorough analysis before making investment decisions. Monitor market developments closely on Gate.com to make informed trading choices during this turbulent phase.

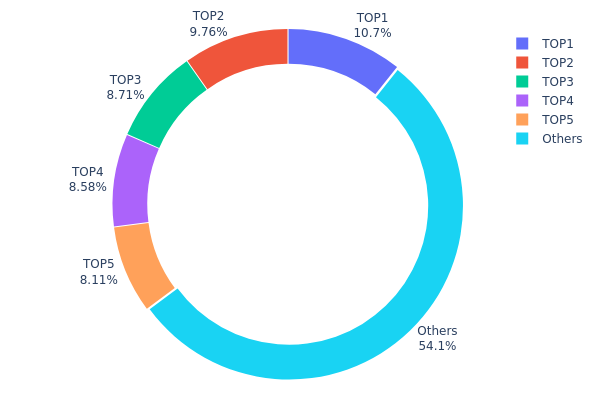

KLV Holdings Distribution

The address holdings distribution represents the concentration of KLV tokens across different blockchain addresses, serving as a critical indicator of token ownership fragmentation and potential market structure risks. By analyzing the top holders versus the broader distribution, we can assess the degree of decentralization and evaluate vulnerability to coordinated selling pressure or market manipulation.

Current data reveals a moderately concentrated holdings structure. The top five addresses collectively control 45.87% of circulating KLV tokens, with the largest holder commanding 10.73% of total supply. While this concentration level does not suggest extreme centralization, it warrants attention regarding potential price volatility. The remaining 54.13% distributed among other addresses indicates a relatively dispersed secondary tier, which provides some resilience against single-entity market dominance. However, the cumulative effect of the top five holders represents a meaningful concentration threshold that could facilitate coordinated market movements if these addresses act in concert.

From a market structure perspective, this distribution pattern suggests moderate concentration risk. The presence of five entities controlling nearly half of the token supply creates potential flash point scenarios where significant liquidations or transfers could trigger substantial price fluctuations. The substantial tail of smaller holders (54.13%) provides baseline market depth, yet the dominance of the top tier indicates that genuine price discovery mechanisms may be constrained during periods of reduced on-chain liquidity. This distribution pattern reflects a market structure characterized by meaningful institutional or early-stage holder concentration, indicating that KLV's long-term decentralization trajectory will depend on continued token distribution and organic accumulation by new market participants.

Click to view current KLV Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | TTo1ef...4QWyFn | 171674.76K | 10.73% |

| 2 | TTrCkG...QPEH8c | 156114.14K | 9.75% |

| 3 | TANyqL...oCzaSk | 139315.00K | 8.70% |

| 4 | TVWZJX...AXhcpV | 137328.94K | 8.58% |

| 5 | TBvmoZ...6kCNGp | 129802.03K | 8.11% |

| - | Others | 865662.02K | 54.13% |

II. Core Factors Affecting KLV's Future Price

Supply and Demand Dynamics

- Market Demand: KLV's future price is primarily driven by market demand, with supply and demand balance serving as a key price determinant.

- Price Volatility: The market exhibits significant volatility influenced by news developments and investor sentiment, which create short-term price fluctuations.

Market Sentiment and External Influences

- Investor Sentiment: Cryptocurrency market sentiment plays a crucial role in price movements, with emotional factors often driving trading decisions.

- News Impact: Market developments and news coverage significantly influence investor perception and price trends.

Note: Investment in KLV or any cryptocurrency carries inherent risks and uncertainty. Interested investors can trade KLV on Gate.com.

III. KLV Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.00128 - $0.00161

- Neutral Forecast: $0.00161 (average expected level)

- Optimistic Forecast: $0.00169 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation phase with steady growth trajectory as the project matures and achieves ecosystem milestones

- Price Range Predictions:

- 2026: $0.00158 - $0.00184

- 2027: $0.00141 - $0.00213

- 2028: $0.00147 - $0.00228

- Key Catalysts: Enhanced protocol adoption, increased utility across the Klever ecosystem, improvements in on-chain activity metrics, and broader market recovery cycles

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00152 - $0.00293 (assumes continued ecosystem development with moderate adoption growth)

- Optimistic Scenario: $0.00199 - $0.00333 (predicated on significant mainstream adoption and successful protocol upgrades)

- Transformational Scenario: $0.00333+ (contingent upon breakthrough developments, major partnership announcements, or transformative use case implementations within the Klever platform)

Note: Price forecasts are speculative in nature and subject to significant market volatility. Investors are advised to conduct thorough research through platforms such as Gate.com and consult with financial advisors before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00169 | 0.00161 | 0.00128 | 0 |

| 2026 | 0.00184 | 0.00165 | 0.00158 | 2 |

| 2027 | 0.00213 | 0.00174 | 0.00141 | 8 |

| 2028 | 0.00228 | 0.00194 | 0.00147 | 20 |

| 2029 | 0.00293 | 0.00211 | 0.00152 | 31 |

| 2030 | 0.00333 | 0.00252 | 0.00199 | 56 |

Klever (KLV) Professional Investment Strategy and Risk Management Report

I. Executive Summary

Klever (KLV) is a cryptocurrency platform designed to address two major challenges in the encryption field: encryption security and user experience. As a bridge between traditional finance and the cryptocurrency world, Klever enables secure and simple cryptocurrency transactions with a referral incentive program offering 50% fee returns on friends' swaps.

Key Metrics (as of December 21, 2025):

- Current Price: $0.001609

- 24-Hour Change: -2.19%

- Market Capitalization: $14,523,793.77

- Circulating Supply: 9,026,596,500.11 KLV

- Total Supply: 9,026,596,500.11 KLV

- Maximum Supply: 10,000,000,000 KLV

- Market Rank: #990

- All-Time High: $0.166705 (March 11, 2021)

- All-Time Low: $0.0015233 (December 19, 2025)

II. KLV Market Performance Analysis

Price Trends

| Time Period | Price Change | Amount Change |

|---|---|---|

| 1 Hour | +0.54% | +$0.000008642 |

| 24 Hours | -2.19% | -$0.000036026 |

| 7 Days | -6.52% | -$0.000112224 |

| 30 Days | -16.49% | -$0.000317715 |

| 1 Year | -68.52% | -$0.003502182 |

Market Indicators

- Trading Volume (24H): $17,302.33

- Circulating Supply Ratio: 90.27%

- Fully Diluted Valuation: $14,523,793.77

- Market Dominance: 0.00045%

- Total Holders: 176,901

- Active Exchanges: 5

III. KLV Professional Investment Strategy and Risk Management

KLV Investment Methodology

(1) Long-Term Holding Strategy

Target Investor Profile: Conservative investors seeking exposure to emerging cryptocurrency platforms with focus on security and user experience, with a medium-to-long-term investment horizon (2+ years).

Operational Recommendations:

-

Dollar-Cost Averaging (DCA): Execute regular monthly or quarterly purchases of KLV at fixed intervals to reduce timing risk and average entry price over time. This approach mitigates the impact of price volatility.

-

Accumulation During Downtrends: Utilize price weakness below psychological support levels as buying opportunities. Given KLV's 68.52% annual decline, careful accumulation during oversold conditions may present asymmetric risk-reward scenarios for patient investors.

-

Storage Solution: Utilize Gate.com's secure Web3 wallet for long-term custody, ensuring private key control while maintaining access to staking and platform rewards. Implement multi-signature protocols for enhanced security of larger holdings.

(2) Active Trading Strategy

Technical Analysis Tools:

-

Moving Average Convergence Divergence (MACD): Monitor MACD crossovers on 4-hour and daily timeframes to identify momentum shifts. Bullish crossovers suggest potential entry points, while bearish crossovers indicate possible exit signals for active traders.

-

Relative Strength Index (RSI): Utilize RSI oscillator set at 14-period intervals to identify oversold (below 30) and overbought (above 70) conditions. Current market conditions suggest potential RSI extremes due to recent volatility.

Wave Trading Key Points:

-

Volatility Exploitation: KLV's significant daily price ranges (24H high: $0.001664 vs. low: $0.001572) offer opportunities for intraday swing trading with 2-4% potential moves.

-

Resistance/Support Levels: Establish key technical levels around recent highs ($0.001664) and 7-day moving averages. Breakouts above resistance coupled with volume confirmation provide actionable trade signals.

KLV Risk Management Framework

(1) Asset Allocation Principles

-

Conservative Investors: KLV allocation should not exceed 0.5-1% of total cryptocurrency portfolio, with maximum 2-3% of overall investment portfolio. This limits exposure to highly volatile, lower-cap assets.

-

Aggressive Investors: KLV can constitute 2-5% of total cryptocurrency holdings, with position sizing reflecting higher risk tolerance and ability to weather significant drawdowns exceeding 50-70%.

-

Professional Investors: Institutional positions typically range 0.1-1% of AUM, with strict risk limits and hedging protocols. Professional allocators require minimum liquidity thresholds and may execute partial positions across multiple tranches.

(2) Risk Hedging Solutions

-

Volatility Hedge via Stablecoins: Maintain 20-30% of KLV position value in stablecoins (USDT, USDC). During periods of extreme market stress, this provides dry powder for re-accumulation and reduces forced selling pressure.

-

Position Sizing Controls: Implement strict maximum position size limits of 5% of daily trading volume to ensure exit liquidity. Establish trailing stop-losses at 15-20% below entry points to contain downside risk.

(3) Security Storage Solutions

-

Hot Wallet Management: Gate.com Web3 wallet is recommended for active trading and daily transaction requirements. Implement withdrawal whitelisting and 2FA authentication to prevent unauthorized access.

-

Cold Storage Protocol: For holdings exceeding 6 months of anticipated transactions, migrate 70-80% of KLV to hardware-secured storage solutions with enhanced backup protocols and geographic redundancy.

-

Security Considerations: Primary risks include smart contract vulnerabilities on the Tron network (KLV's primary chain), phishing attacks targeting exchange credentials, and private key compromise. Never share seed phrases, utilize hardware security devices for transaction signing, and maintain updated antivirus protocols across all devices.

IV. KLV Potential Risks and Challenges

KLV Market Risks

-

Extreme Volatility: KLV has experienced a 68.52% decline over the past year with all-time high of $0.166705 down to recent lows of $0.0015233. This extreme volatility increases risk of substantial losses for retail investors employing excessive leverage.

-

Low Trading Liquidity: Daily trading volume of $17,302 relative to market cap of $14.5 million indicates constrained liquidity. Large position entries/exits may face slippage exceeding 5-10%, making institutional adoption challenging.

-

Concentrated Market Structure: With only 5 active exchanges and 176,901 holders (relatively low for a project of this age), KLV exhibits significant concentration risk. Market manipulation and whale-driven price swings pose material risks to minority holders.

KLV Regulatory Risks

-

Evolving Regulatory Landscape: Jurisdiction-specific cryptocurrency regulations continue evolving globally. Potential restrictions on token trading or platform operations could materially impact KLV's accessibility and valuation across regulated markets.

-

Compliance Uncertainties: Klever's security-focused positioning and referral fee structure may face scrutiny under anti-money laundering (AML) and know-your-customer (KYC) regulations. Increased compliance requirements could reduce platform utility and user growth.

-

Platform Jurisdictional Risk: Operational base and regulatory licensing of Klever platform remains subject to changing requirements. Changes in host jurisdiction's regulatory framework could impose operational constraints or mandate significant protocol modifications.

KLV Technical Risks

-

Tron Network Dependency: KLV's primary deployment on Tron (contract: TVj7RNVHy6thbM7BWdSe9G6gXwKhjhdNZS) creates technical and systemic risk tied to Tron network security and sustainability. Layer-1 blockchain vulnerabilities could affect token security.

-

Smart Contract Risk: Platform's core security features are implemented through smart contracts. Undetected vulnerabilities, exploits, or front-running attacks could compromise user funds and platform integrity.

-

Ecosystem Development Risk: Limited information on ongoing development roadmap, protocol upgrades, or technical innovation indicates potential stagnation. Competitive threats from well-funded security-focused platforms may reduce KLV's market relevance.

V. Conclusion and Action Recommendations

KLV Investment Value Assessment

Klever (KLV) represents a security and user experience-focused cryptocurrency platform operating in a highly competitive market segment. The project's 68.52% annual decline, constrained liquidity (5 exchanges, $17.3K daily volume), and low market capitalization ($14.5M) reflect market challenges and limited institutional adoption. However, the platform's focus on addressing critical pain points in cryptocurrency security and user experience maintains potential long-term value proposition for niche users. Investors should recognize KLV as a speculative, early-stage cryptocurrency with asymmetric risk profile skewed toward downside in near-to-medium term, though recovery potential exists under favorable platform adoption scenarios.

KLV Investment Recommendations

✅ Beginners: Execute small exploratory positions (0.5-1% of crypto portfolio) via dollar-cost averaging on Gate.com. Utilize educational resources to understand security mechanisms before committing capital. Maintain holdings in secure storage solutions.

✅ Experienced Investors: Consider 2-5% tactical allocations during significant oversold conditions (RSI below 25, 50%+ pullbacks). Employ technical analysis to time entries around key support levels. Maintain strict 15-20% stop-loss discipline and harvest losses for tax optimization.

✅ Institutional Investors: Evaluate KLV as speculative allocation (0.1-1% of AUM) only after rigorous due diligence on platform security, regulatory compliance, and development roadmap. Require minimum liquidity assurances before position establishment and implement hedging strategies.

KLV Trading Participation Methods

-

Spot Trading on Gate.com: Purchase KLV directly using fiat or stablecoins on Gate.com's secure platform. Execute market or limit orders based on technical analysis. Withdraw to personal wallet for enhanced security of longer-term holdings.

-

Staking and Platform Participation: Engage with Klever's referral program offering 50% fee returns on friends' swap transactions. Deploy capital in platform activities aligned with use case (security-conscious users, transaction fee optimization).

-

Technical Analysis Trading: Utilize price action analysis across major resistance/support levels identified on 4-hour and daily timeframes. Execute short-term swing trades (2-7 day holding periods) capturing 3-8% price movements during volatile periods.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and financial circumstances. Consult professional financial advisors before committing capital. Never invest funds exceeding your loss capacity.

FAQ

Is Klever a good investment?

Klever shows strong potential as a cryptocurrency investment with solid fundamentals and growing adoption. Its innovative features and active development make it an attractive option for investors seeking exposure to the digital asset space.

Which coin price prediction 2025?

KLV token's 2025 price prediction depends on market momentum and adoption. Based on technical analysis, potential targets range from $0.50 to $2.00. Bitcoin leading bullish trends and KLV ecosystem development will drive upside potential this year.

What is Klever (KLV) and what is its use case?

Klever (KLV) is the native utility token of the Klever Blockchain. It facilitates transactions, supports platform governance, and enhances user experience within the Klever ecosystem. KLV powers the network's core operations and utility functions.

What factors affect KLV price prediction?

KLV price prediction is influenced by supply and demand dynamics, block reward changes, protocol updates, market sentiment, and broader cryptocurrency trends. Real-world events and adoption also play significant roles in price movement.

What was KLV historical price performance and what is the price forecast for 2024-2025?

KLV's historical price has experienced significant fluctuations. Based on current market analysis, KLV is forecasted to reach $0.001611 by end of 2025, reflecting market dynamics and trend indicators.

2025 BGSC Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Aergo Price Analysis: 112% Surge in 90 Days - What's Next for 2025?

2025 XLM Price Prediction: Stellar Lumens' Potential Growth Trajectory in a Maturing Crypto Ecosystem

2025 1INCH Price Prediction: Analyzing Growth Potential and Market Trends for the DeFi Aggregator Token

2025 SUTPrice Prediction: Comprehensive Analysis and Forecast of Market Trends and Value Projections

2025 FTT Price Prediction: Analyzing Market Trends and Potential Growth Factors in the Digital Asset Ecosystem

Top 10 Cryptocurrency Payment Cards for 2025: An In-Depth Review

Pi Network Launch Date: Discover Listing Insights, Future Price Forecast, and Purchase Guide

Bobo The Bear NFT Meme Token Achieves $150 Million Market Cap Milestone

Understanding the Simple Moving Average Formula

Ethereum Approaches $4000: Will It Surpass Resistance or Face Reversal?