# VitalikSellsETH

9.2K

CryptoChampion

#VitalikSellsETH – Señal, Ruido y la Psicología de los Mercados Cripto

Cuando se rompe la noticia de que Vitalik Buterin ha vendido ETH, la reacción es casi predecible. Las redes sociales se encienden. El miedo se propaga. Los gráficos se vuelven rojos. Los influencers corren a interpretar los motivos. Pero en un mercado impulsado por la velocidad y el sentimiento, la verdadera ventaja la tienen quienes se detienen y piensan.

Seamos claros: separar señal de ruido.

Primero, la actividad de los fundadores no es lo mismo que una debilidad del protocolo. La Fundación Ethereum y el ecosistema

Ver originalesCuando se rompe la noticia de que Vitalik Buterin ha vendido ETH, la reacción es casi predecible. Las redes sociales se encienden. El miedo se propaga. Los gráficos se vuelven rojos. Los influencers corren a interpretar los motivos. Pero en un mercado impulsado por la velocidad y el sentimiento, la verdadera ventaja la tienen quienes se detienen y piensan.

Seamos claros: separar señal de ruido.

Primero, la actividad de los fundadores no es lo mismo que una debilidad del protocolo. La Fundación Ethereum y el ecosistema

- Recompensa

- 5

- 10

- Republicar

- Compartir

CryptoDaisy :

:

DYOR 🤓Ver más

#VitalikSellsETH

#VitalikVendeETH

LOS TITULARES DICEN QUE VENDIÓ.

Los mercados dicen: Reacciona primero. Piensa después.

Cuando Vitalik Buterin mueve ETH,

el pánico se propaga rápidamente.

📉 El comercio minorista ve “dump”

🧠 El dinero inteligente pregunta “¿por qué?”

⚖️ El contexto decide la narrativa

¿Es toma de ganancias?

¿Financiamiento del desarrollo?

¿Movimiento rutinario de billeteras?

En cripto —

La emoción es instantánea.

La comprensión es rara.

Los grandes nombres crean volatilidad.

La volatilidad crea oportunidad.

La pregunta no es quién vendió.

La pregunta es —

¿se rompió la estr

#VitalikVendeETH

LOS TITULARES DICEN QUE VENDIÓ.

Los mercados dicen: Reacciona primero. Piensa después.

Cuando Vitalik Buterin mueve ETH,

el pánico se propaga rápidamente.

📉 El comercio minorista ve “dump”

🧠 El dinero inteligente pregunta “¿por qué?”

⚖️ El contexto decide la narrativa

¿Es toma de ganancias?

¿Financiamiento del desarrollo?

¿Movimiento rutinario de billeteras?

En cripto —

La emoción es instantánea.

La comprensión es rara.

Los grandes nombres crean volatilidad.

La volatilidad crea oportunidad.

La pregunta no es quién vendió.

La pregunta es —

¿se rompió la estr

ETH8,77%

- Recompensa

- 6

- 9

- Republicar

- Compartir

CryptoSocietyOfRhinoBrotherIn :

:

Año del Caballo, ¡hazte rico! 🐴Ver más

#VitalikSellsETH

#VitalikSellsETH

Crypto Twitter está en ebullición tras los informes de que Vitalik Buterin movió y supuestamente vendió una parte de sus holdings de Ethereum — y como siempre, el mercado reaccionó instantáneamente.

Pero antes de que las emociones tomen el control, hagamos un zoom out.

Cuando un fundador de alto perfil hace un movimiento, los titulares se difunden rápidamente. La especulación sigue. Los traders sobreanalizan. La volatilidad se dispara. Sin embargo, la historia ha demostrado que las transacciones de los fundadores no indican automáticamente debilidad en los f

#VitalikSellsETH

Crypto Twitter está en ebullición tras los informes de que Vitalik Buterin movió y supuestamente vendió una parte de sus holdings de Ethereum — y como siempre, el mercado reaccionó instantáneamente.

Pero antes de que las emociones tomen el control, hagamos un zoom out.

Cuando un fundador de alto perfil hace un movimiento, los titulares se difunden rápidamente. La especulación sigue. Los traders sobreanalizan. La volatilidad se dispara. Sin embargo, la historia ha demostrado que las transacciones de los fundadores no indican automáticamente debilidad en los f

ETH8,77%

- Recompensa

- 3

- 2

- Republicar

- Compartir

EagleEye :

:

¡Gran trabajo! Muy claro y profesionalVer más

#VitalikSellsETH recientemente ha generado una intensa discusión en toda la comunidad cripto, provocando olas de especulación, miedo y debate entre inversores y entusiastas por igual. Siempre que el nombre de Vitalik Buterin aparece en tendencia junto a Ethereum, las emociones en el mercado tienden a ser altas.

Como cofundador de Ethereum, Vitalik es ampliamente respetado no solo como desarrollador, sino como un líder visionario cuyas acciones son vigiladas de cerca por traders en todo el mundo.

Sin embargo, antes de sacar conclusiones, es importante entender el contexto. Las grandes billetera

Como cofundador de Ethereum, Vitalik es ampliamente respetado no solo como desarrollador, sino como un líder visionario cuyas acciones son vigiladas de cerca por traders en todo el mundo.

Sin embargo, antes de sacar conclusiones, es importante entender el contexto. Las grandes billetera

ETH8,77%

- Recompensa

- 6

- 4

- Republicar

- Compartir

repanzal :

:

Hacia La Luna 🌕Ver más

#VitalikSellsETH

#VitalikVendeETH

La actividad en cadena reciente muestra que Vitalik Buterin, cofundador de Ethereum, ha estado vendiendo progresivamente partes de sus holdings de ETH. Esto ha generado una amplia discusión en el mercado cripto, no por una venta de pánico, sino porque las transacciones de los fundadores suelen actuar como potentes señales de sentimiento.

🔹 Qué pasó

Durante el último mes, Buterin ha vendido una cantidad significativa de Ether a través de múltiples transacciones pequeñas en lugar de una gran venta. Las estimaciones de análisis en cadena sugieren:

• Aproximadam

#VitalikVendeETH

La actividad en cadena reciente muestra que Vitalik Buterin, cofundador de Ethereum, ha estado vendiendo progresivamente partes de sus holdings de ETH. Esto ha generado una amplia discusión en el mercado cripto, no por una venta de pánico, sino porque las transacciones de los fundadores suelen actuar como potentes señales de sentimiento.

🔹 Qué pasó

Durante el último mes, Buterin ha vendido una cantidad significativa de Ether a través de múltiples transacciones pequeñas en lugar de una gran venta. Las estimaciones de análisis en cadena sugieren:

• Aproximadam

ETH8,77%

- Recompensa

- 10

- 16

- Republicar

- Compartir

Luna_Star :

:

LFG 🔥Ver más

#我在Gate广场过新年

#VitalikSellsETH

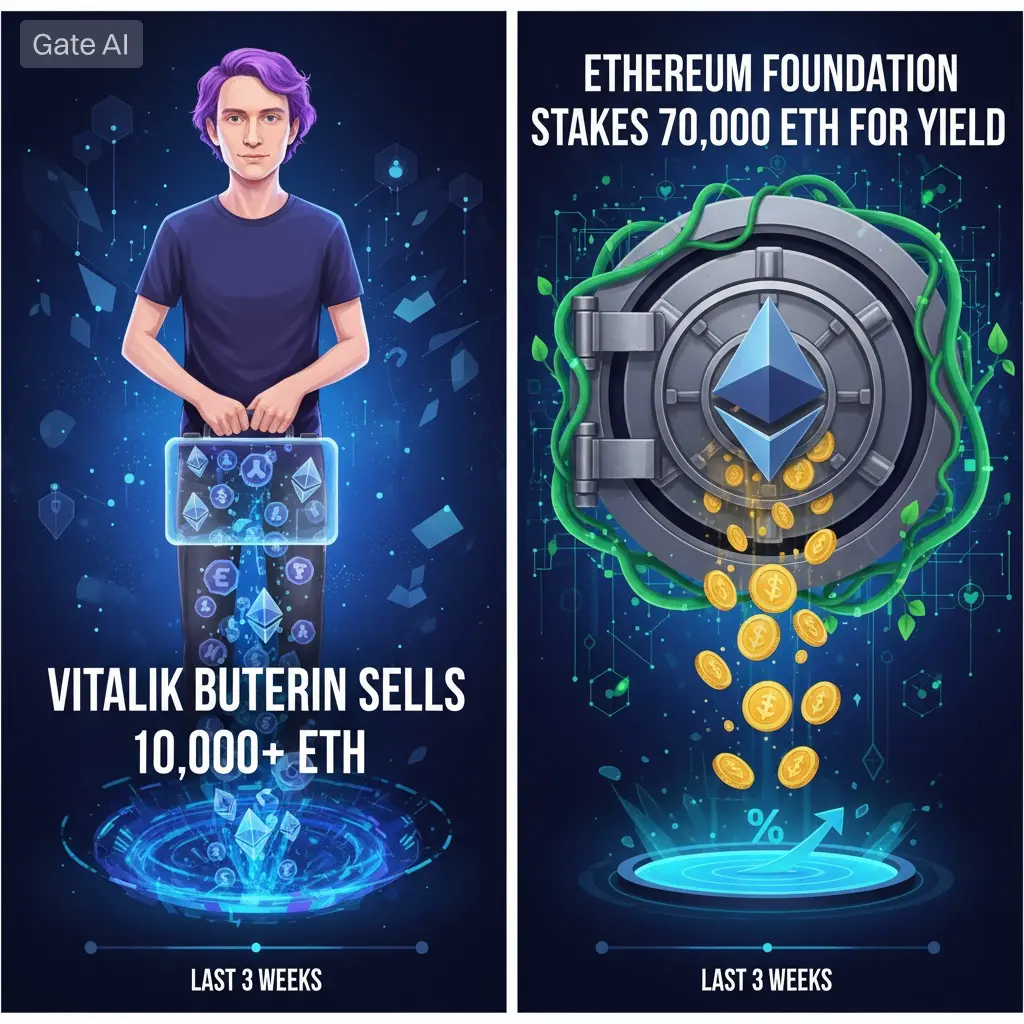

Recientemente, Ethereum ha visto dos desarrollos importantes que acaparan titulares: Vitalik Buterin, cofundador de Ethereum, ha vendido más de 10,000 ETH en las últimas tres semanas, mientras que la Fundación Ethereum ha comenzado a apostar su tesorería y planea apostar alrededor de 70,000 ETH para la generación de rendimiento.

Específicamente, los datos en cadena muestran que desde principios de febrero, Buterin intercambió aproximadamente 10,723 ETH por stablecoins—unos $21,740,000—sumándose a una reducción de aproximadamente 17,000 ETH en sus carteras en un

#VitalikSellsETH

Recientemente, Ethereum ha visto dos desarrollos importantes que acaparan titulares: Vitalik Buterin, cofundador de Ethereum, ha vendido más de 10,000 ETH en las últimas tres semanas, mientras que la Fundación Ethereum ha comenzado a apostar su tesorería y planea apostar alrededor de 70,000 ETH para la generación de rendimiento.

Específicamente, los datos en cadena muestran que desde principios de febrero, Buterin intercambió aproximadamente 10,723 ETH por stablecoins—unos $21,740,000—sumándose a una reducción de aproximadamente 17,000 ETH en sus carteras en un

ETH8,77%

- Recompensa

- 17

- 22

- Republicar

- Compartir

EagleEye :

:

¡Gran trabajo! Muy claro y profesionalVer más

#VitalikSellsETH

25 de febrero de 2026 — Hoy, la comunidad cripto está en ebullición tras la noticia de que Vitalik Buterin supuestamente ha vendido una parte de sus holdings de Ethereum. Este anuncio generó inmediatamente debates en redes sociales, foros de criptomonedas y plataformas de trading, mientras los inversores intentan interpretar las implicaciones. Mientras algunos ven esto como un ajuste rutinario de cartera por parte de un fundador, otros están preocupados por posibles impactos en el precio a corto plazo. El mercado de Ethereum, que ya ha experimentado períodos de volatilidad, r

25 de febrero de 2026 — Hoy, la comunidad cripto está en ebullición tras la noticia de que Vitalik Buterin supuestamente ha vendido una parte de sus holdings de Ethereum. Este anuncio generó inmediatamente debates en redes sociales, foros de criptomonedas y plataformas de trading, mientras los inversores intentan interpretar las implicaciones. Mientras algunos ven esto como un ajuste rutinario de cartera por parte de un fundador, otros están preocupados por posibles impactos en el precio a corto plazo. El mercado de Ethereum, que ya ha experimentado períodos de volatilidad, r

ETH8,77%

- Recompensa

- 4

- 3

- Republicar

- Compartir

EagleEye :

:

¡Esto es increíble! Realmente bien hechoVer más

#VitalikSellsETH

Se están difundiendo informes de que Vitalik Buterin ha vendido una parte de sus holdings de Ethereum — un titular que naturalmente capta la atención del mercado.

Pero el contexto importa.

🔍 Lo que los inversores deben entender

1️⃣ Las transacciones de los fundadores no siempre son bajistas

Las grandes transferencias de tokens por parte de los fundadores a menudo están relacionadas con:

• Financiamiento del ecosistema

• Donaciones filantrópicas

• Liquidez operativa

• Diversificación de cartera

No cada venta equivale a una pérdida de convicción.

2️⃣ Reacción del mercado vs. i

Se están difundiendo informes de que Vitalik Buterin ha vendido una parte de sus holdings de Ethereum — un titular que naturalmente capta la atención del mercado.

Pero el contexto importa.

🔍 Lo que los inversores deben entender

1️⃣ Las transacciones de los fundadores no siempre son bajistas

Las grandes transferencias de tokens por parte de los fundadores a menudo están relacionadas con:

• Financiamiento del ecosistema

• Donaciones filantrópicas

• Liquidez operativa

• Diversificación de cartera

No cada venta equivale a una pérdida de convicción.

2️⃣ Reacción del mercado vs. i

ETH8,77%

- Recompensa

- 5

- 8

- Republicar

- Compartir

EagleEye :

:

¡Gran trabajo! Muy claro y profesionalVer más

#VitalikSellsETH $ETH

Los rumores están circulando de que Vitalik Buterin ha vendido ETH — pero antes de reaccionar emocionalmente, entendamos el panorama general.

Cada vez que grandes carteras mueven fondos, el mercado entra en pánico. Pero pregúntate:

🔹 ¿Es una transferencia personal, donación o movimiento estratégico?

🔹 ¿Es una entrada en exchanges o simplemente una reorganización de carteras?

🔹 ¿La tendencia general sigue intacta?

Recuerda — las ballenas mueven los mercados a corto plazo, pero los fundamentos impulsan el largo plazo.

📊 ETH todavía está respaldado por: • Crecimiento só

Los rumores están circulando de que Vitalik Buterin ha vendido ETH — pero antes de reaccionar emocionalmente, entendamos el panorama general.

Cada vez que grandes carteras mueven fondos, el mercado entra en pánico. Pero pregúntate:

🔹 ¿Es una transferencia personal, donación o movimiento estratégico?

🔹 ¿Es una entrada en exchanges o simplemente una reorganización de carteras?

🔹 ¿La tendencia general sigue intacta?

Recuerda — las ballenas mueven los mercados a corto plazo, pero los fundamentos impulsan el largo plazo.

📊 ETH todavía está respaldado por: • Crecimiento só

ETH8,77%

- Recompensa

- 4

- 2

- Republicar

- Compartir

Discovery :

:

LFG 🔥Ver más

¡ALERTA DE RUPTURA!

ETH está rompiendo un triángulo simétrico, un patrón clásico de continuación alcista 📊

🟢 Condición clave:

Si el precio se mantiene por encima de la ruptura del triángulo, podemos esperar un fuerte rally alcista.

🎯 Objetivos al alza:

➡️ Zona de $2,400 – $2,500

Invalidación: $ETH

📌 El impulso está cambiando, pero la confirmación es clave.

Observa cómo se comporta ETH por encima del área de ruptura.

Mantén la paciencia. Opera con la estructura.

Mantén la disciplina. Mantente rentable 💪

$1890

$ETH

#BitcoinBouncesBack

#TrumpAnnouncesNewTariffs

#VitalikSellsETH

#Gate

ETH está rompiendo un triángulo simétrico, un patrón clásico de continuación alcista 📊

🟢 Condición clave:

Si el precio se mantiene por encima de la ruptura del triángulo, podemos esperar un fuerte rally alcista.

🎯 Objetivos al alza:

➡️ Zona de $2,400 – $2,500

Invalidación: $ETH

📌 El impulso está cambiando, pero la confirmación es clave.

Observa cómo se comporta ETH por encima del área de ruptura.

Mantén la paciencia. Opera con la estructura.

Mantén la disciplina. Mantente rentable 💪

$1890

$ETH

#BitcoinBouncesBack

#TrumpAnnouncesNewTariffs

#VitalikSellsETH

#Gate

ETH8,77%

- Recompensa

- 1

- Comentar

- Republicar

- Compartir

Cargar más

Únete a 40M usuarios en nuestra comunidad en crecimiento.

⚡️ Únete a 40M usuarios en el debate sobre la fiebre cripto

💬 Interactúa con tus creadores favoritos

👍 Explora lo que te interesa

Temas de actualidad

80.08K Popularidad

170.68K Popularidad

36.51K Popularidad

9.2K Popularidad

417.56K Popularidad

333.22K Popularidad

45.68K Popularidad

59.24K Popularidad

2.09K Popularidad

6.26K Popularidad

8.66K Popularidad

6.69K Popularidad

1.03K Popularidad

2.17K Popularidad

33.17K Popularidad

Noticias

Ver másKalshi toma su primera acción de cumplimiento contra la entidad asociada a MrBeast y candidato a gobernador anterior

1 m

Linea planea actualizar los términos de servicio el 28 de marzo para preparar el lanzamiento de Yield Boost

12 m

El gigante de ETH con la posición larga más grande en Hyperliquid actualmente ha pasado de pérdidas a ganancias, con una ganancia flotante de 2.75 millones de dólares.

25 m

El banco de divisas más grande de Brasil amplía la stablecoin BBRL a la red Polygon

30 m

HyperLiquid cofundador: 173,000 HYPE serán despuestados y distribuidos a los miembros del equipo el 6 de marzo

45 m

Anclado