# 歐美關稅風波衝擊市場

8.43萬

特朗普再度威脅對歐洲國家加徵關稅,歐盟準備反製,避險情緒迅速昇溫。比特幣在衝高後出現“閃崩”,多頭大規模被清算。你認爲當前市場是在定價“貿易衝突昇級”,還是短期情緒過度反應?後續走勢會如何演變?

市場分析:

1月23日早間BTC、ETH 兩大主流幣呈窄幅震盪走勢,受美聯儲政策定調與特朗普降息呼籲博弈影響,多空情緒趨於平衡,短期維持區間拉鋸。

宏觀方面:

1、據 CME“美聯儲觀察” 數據,1月維持利率不變概率達95%,3 月累計降息25個基點概率僅15.4%,維持利率不變概率84.1%,降息預期持續低迷,對風險資產估值形成壓制。

2、 特朗普呼籲全球央行集體降息,威脅對非美本土生產企業加徵關稅,引發市場對貨幣政策獨立性的擔憂。受此影響美元指數由漲轉跌,部分資金試探性回流另類資產,但未形成明確趨勢。

3、近 24小時全網爆倉總金額3.01億美元,主爆多單2.18億美元,爆倉人數12.4萬人,較 21 日暴跌期間大幅降溫,多空博弈回歸理性,槓桿清洗進入尾聲。

操作建議:

低吸:BTC 88500-89000、ETH 2900-2920,企穩建倉

試空:BTC 91000+、ETH3060+,輕倉快進快出。

特別叮囑:暴跌後進入弱勢震盪,警惕修復性反彈陷阱!

#加密市场回调 #欧美关税风波冲击市场 $BTC $ETH $SOL

查看原文1月23日早間BTC、ETH 兩大主流幣呈窄幅震盪走勢,受美聯儲政策定調與特朗普降息呼籲博弈影響,多空情緒趨於平衡,短期維持區間拉鋸。

宏觀方面:

1、據 CME“美聯儲觀察” 數據,1月維持利率不變概率達95%,3 月累計降息25個基點概率僅15.4%,維持利率不變概率84.1%,降息預期持續低迷,對風險資產估值形成壓制。

2、 特朗普呼籲全球央行集體降息,威脅對非美本土生產企業加徵關稅,引發市場對貨幣政策獨立性的擔憂。受此影響美元指數由漲轉跌,部分資金試探性回流另類資產,但未形成明確趨勢。

3、近 24小時全網爆倉總金額3.01億美元,主爆多單2.18億美元,爆倉人數12.4萬人,較 21 日暴跌期間大幅降溫,多空博弈回歸理性,槓桿清洗進入尾聲。

操作建議:

低吸:BTC 88500-89000、ETH 2900-2920,企穩建倉

試空:BTC 91000+、ETH3060+,輕倉快進快出。

特別叮囑:暴跌後進入弱勢震盪,警惕修復性反彈陷阱!

#加密市场回调 #欧美关税风波冲击市场 $BTC $ETH $SOL

- 讚賞

- 2

- 1

- 轉發

- 分享

卿山 :

:

新年暴富 🤑全球都在漲,就你的幣在跌?

真正的危險可能還沒開始…

我有個朋友,去年底清空了所有倉位,跑去買黃金和美股小盤股。昨晚他給我曬收益,輕飄飄丟來一句話:“現在賺錢的祕訣是 ABC——Anything But Crypto(除了加密,什麼都買)。” 那一瞬間,我嘴裡像吃了口隔夜飯,堵得慌。

數據確實扎心:黃金今年漲超60%,白銀飆了210%,美股羅素2000指數連漲11天,A股科創50一個月漲15%。而比特幣呢?在10萬美金門口磨蹭了三個月,最近又是五連陰,從98000跌回91000。

這不對勁,太不對勁了。 當SEC批准ETF、華爾街擁抱、國家戰略儲備都配齊後,比特幣卻像個局外人,眼看著其他市場開派對。原因有三:

比特幣是“預警機”:它由全球流動性直接驅動,往往先於其他風險資產見頂或見底。它的停滯,可能預示著其他市場的上漲動能也快耗盡了。

全球在“抽水”:美聯儲縮表(QT)和日本央行加息,兩大流動性源頭都在收緊。市場缺錢,比特幣這個“水漲船高”的資產自然難飛。

世界在“拆伙”:特朗普的一系列動作,把世界推向了局部衝突與“新冷戰”的灰色地帶。這種不確定性,讓大資金本能地逃離比特幣這類高風險資產。

但黃金、美股的上漲,真的是健康的“牛”嗎?不,那是 “國家意志”在主導:央行買黃金是對美元信用的不信任票;股市漲是AI國產化、產業自主等政策在強行引導資本。它們的邏輯,和去中心化、全球化的加密市

查看原文真正的危險可能還沒開始…

我有個朋友,去年底清空了所有倉位,跑去買黃金和美股小盤股。昨晚他給我曬收益,輕飄飄丟來一句話:“現在賺錢的祕訣是 ABC——Anything But Crypto(除了加密,什麼都買)。” 那一瞬間,我嘴裡像吃了口隔夜飯,堵得慌。

數據確實扎心:黃金今年漲超60%,白銀飆了210%,美股羅素2000指數連漲11天,A股科創50一個月漲15%。而比特幣呢?在10萬美金門口磨蹭了三個月,最近又是五連陰,從98000跌回91000。

這不對勁,太不對勁了。 當SEC批准ETF、華爾街擁抱、國家戰略儲備都配齊後,比特幣卻像個局外人,眼看著其他市場開派對。原因有三:

比特幣是“預警機”:它由全球流動性直接驅動,往往先於其他風險資產見頂或見底。它的停滯,可能預示著其他市場的上漲動能也快耗盡了。

全球在“抽水”:美聯儲縮表(QT)和日本央行加息,兩大流動性源頭都在收緊。市場缺錢,比特幣這個“水漲船高”的資產自然難飛。

世界在“拆伙”:特朗普的一系列動作,把世界推向了局部衝突與“新冷戰”的灰色地帶。這種不確定性,讓大資金本能地逃離比特幣這類高風險資產。

但黃金、美股的上漲,真的是健康的“牛”嗎?不,那是 “國家意志”在主導:央行買黃金是對美元信用的不信任票;股市漲是AI國產化、產業自主等政策在強行引導資本。它們的邏輯,和去中心化、全球化的加密市

- 讚賞

- 點讚

- 留言

- 轉發

- 分享

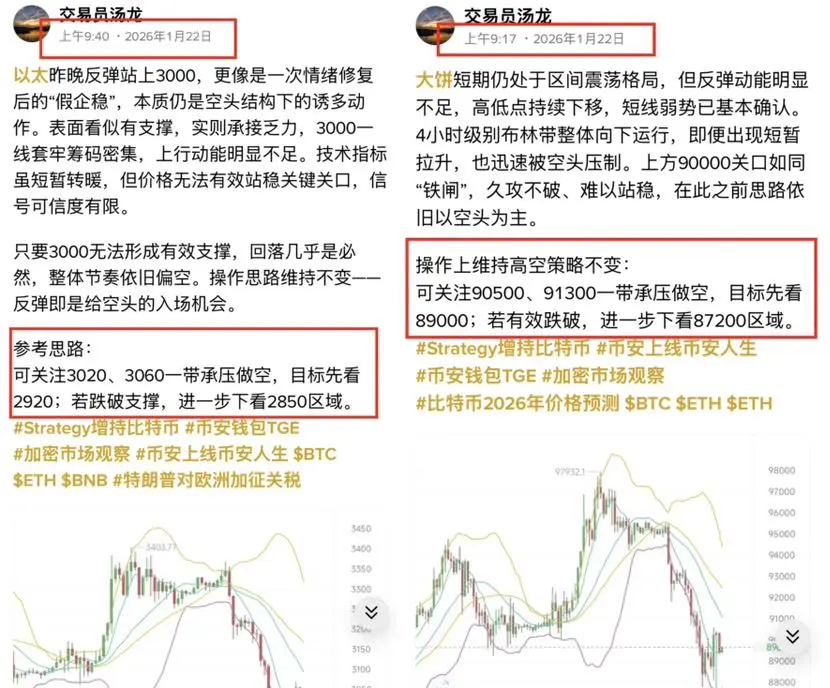

1.23 大饼絲路分享

從目前的盤面節奏來看,大饼在衝擊 九萬關口的過程中明顯顯得力不從心。價格多次上探至 九萬附近,但只要一觸及布林帶中軌區域,就會迅速遭遇拋壓並回落,這種“碰軌即跌”的走勢已經非常清晰地反映出當前多頭動能的衰減。

整體來看,今日行情大概率仍將維持震盪偏弱的格局。反彈的力度有限,而上方的壓力卻非常明確,因此操作思路上仍以“反彈做空”為主旋律。

臨近周末,市場交投情緒往往會趨於謹慎,流動性也可能出現萎縮,這個階段更不適合盲目追多,尤其是在沒有明顯突破信號之前。

操作上建議保持穩健,見好就收,落袋為安,不要被短暫的上沖迷惑。

大饼建議:

• 反彈至 90500—91500 附近時,可根據盤面強弱擇機布局空單

• 目標位先看 88000 附近,若跌破可進一步看向 87000 附近

$BTC $GT $ETH

#加密市场回调 #欧美关税风波冲击市场 #加密市场观察 #Gate广场创作者新春激励

查看原文從目前的盤面節奏來看,大饼在衝擊 九萬關口的過程中明顯顯得力不從心。價格多次上探至 九萬附近,但只要一觸及布林帶中軌區域,就會迅速遭遇拋壓並回落,這種“碰軌即跌”的走勢已經非常清晰地反映出當前多頭動能的衰減。

整體來看,今日行情大概率仍將維持震盪偏弱的格局。反彈的力度有限,而上方的壓力卻非常明確,因此操作思路上仍以“反彈做空”為主旋律。

臨近周末,市場交投情緒往往會趨於謹慎,流動性也可能出現萎縮,這個階段更不適合盲目追多,尤其是在沒有明顯突破信號之前。

操作上建議保持穩健,見好就收,落袋為安,不要被短暫的上沖迷惑。

大饼建議:

• 反彈至 90500—91500 附近時,可根據盤面強弱擇機布局空單

• 目標位先看 88000 附近,若跌破可進一步看向 87000 附近

$BTC $GT $ETH

#加密市场回调 #欧美关税风波冲击市场 #加密市场观察 #Gate广场创作者新春激励

- 讚賞

- 點讚

- 1

- 轉發

- 分享

核心PCE是今日最強變數,數據超預期利空加密;初請偏強利空、偏弱利多;GDP終值上修利空、下修利多。三者同向時波動放大,反向時互相抵消,加密短期看流動性預期,長期仍看行業自身敘事。

一、核心PCE物價指數(21:30)

- 核心邏輯:美聯儲最看重的通脹指標,直接影響降息預期與流動性,對加密影響權重最高。

- 預期:11月核心PCE年率2.8%、月率0.2%。

- 超預期(年率>2.8%,月率>0.2%):強化高利率長持,美元與美債收益率上行,風險偏好回落,利空加密,比特幣、以太坊或承壓下行。

- 符合預期:維持現有降息預期,影響中性,加密或震盪整理。

- 低於預期(年率<2.8%,月率<0.2%):降息預期升溫,資金流向風險資產,利好加密,或推動反彈。

二、初請失業金人數(21:30)

- 核心邏輯:反映勞動力市場強度,間接影響貨幣政策,進而作用於加密等風險資產。

- 預期:21萬人。

- 低於預期(<21萬):就業韌性強,加息或推遲降息預期,利空加密。

- 符合預期:勞動力市場穩定,影響中性,波動有限。

- 高於預期(>21萬):就業走弱,降息預期升溫,利好加密。

三、GDP終值(21:30)

- 核心邏輯:體現經濟強度,影響政策與風險偏好,終值影響弱於PCE與初請。

- 預期:年化季率4.3%。

- 上修(>4.3%):經濟過熱,推遲降息,利空加密。

- 符合預期:經濟穩定,影

查看原文一、核心PCE物價指數(21:30)

- 核心邏輯:美聯儲最看重的通脹指標,直接影響降息預期與流動性,對加密影響權重最高。

- 預期:11月核心PCE年率2.8%、月率0.2%。

- 超預期(年率>2.8%,月率>0.2%):強化高利率長持,美元與美債收益率上行,風險偏好回落,利空加密,比特幣、以太坊或承壓下行。

- 符合預期:維持現有降息預期,影響中性,加密或震盪整理。

- 低於預期(年率<2.8%,月率<0.2%):降息預期升溫,資金流向風險資產,利好加密,或推動反彈。

二、初請失業金人數(21:30)

- 核心邏輯:反映勞動力市場強度,間接影響貨幣政策,進而作用於加密等風險資產。

- 預期:21萬人。

- 低於預期(<21萬):就業韌性強,加息或推遲降息預期,利空加密。

- 符合預期:勞動力市場穩定,影響中性,波動有限。

- 高於預期(>21萬):就業走弱,降息預期升溫,利好加密。

三、GDP終值(21:30)

- 核心邏輯:體現經濟強度,影響政策與風險偏好,終值影響弱於PCE與初請。

- 預期:年化季率4.3%。

- 上修(>4.3%):經濟過熱,推遲降息,利空加密。

- 符合預期:經濟穩定,影

- 讚賞

- 1

- 2

- 轉發

- 分享

areejfatimakhizarnaseem :

:

新年快樂!🤑查看更多

全球都在漲,就你的幣在跌?

真正的危險可能還沒開始…

我有個朋友,去年底清空了所有倉位,跑去買黃金和美股小盤股。昨晚他給我曬收益,輕飄飄丟來一句話:“現在賺錢的祕訣是 ABC——Anything But Crypto(除了加密,什麼都買)。” 那一瞬間,我嘴裡像吃了口隔夜飯,堵得慌。

數據確實扎心:黃金今年漲超60%,白銀飆了210%,美股羅素2000指數連漲11天,A股科創50一個月漲15%。而比特幣呢?在10萬美金門口磨蹭了三個月,最近又是五連陰,從98000跌回91000。

這不對勁,太不對勁了。 當SEC批准ETF、華爾街擁抱、國家戰略儲備都配齊後,比特幣卻像個局外人,眼看著其他市場開派對。原因有三:

比特幣是“預警機”:它由全球流動性直接驅動,往往先於其他風險資產見頂或見底。它的停滯,可能預示著其他市場的上漲動能也快耗盡了。

全球在“抽水”:美聯儲縮表(QT)和日本央行加息,兩大流動性源頭都在收緊。市場缺錢,比特幣這個“水漲船高”的資產自然難飛。

世界在“拆伙”:特朗普的一系列動作,把世界推向了局部衝突與“新冷戰”的灰色地帶。這種不確定性,讓大資金本能地逃離比特幣這類高風險資產。

但黃金、美股的上漲,真的是健康的“牛”嗎?不,那是 “國家意志”在主導:央行買黃金是對美元信用的不信任票;股市漲是AI國產化、產業自主等政策在強行引導資本。它們的邏輯,和去中心化、全球化的加密市

查看原文真正的危險可能還沒開始…

我有個朋友,去年底清空了所有倉位,跑去買黃金和美股小盤股。昨晚他給我曬收益,輕飄飄丟來一句話:“現在賺錢的祕訣是 ABC——Anything But Crypto(除了加密,什麼都買)。” 那一瞬間,我嘴裡像吃了口隔夜飯,堵得慌。

數據確實扎心:黃金今年漲超60%,白銀飆了210%,美股羅素2000指數連漲11天,A股科創50一個月漲15%。而比特幣呢?在10萬美金門口磨蹭了三個月,最近又是五連陰,從98000跌回91000。

這不對勁,太不對勁了。 當SEC批准ETF、華爾街擁抱、國家戰略儲備都配齊後,比特幣卻像個局外人,眼看著其他市場開派對。原因有三:

比特幣是“預警機”:它由全球流動性直接驅動,往往先於其他風險資產見頂或見底。它的停滯,可能預示著其他市場的上漲動能也快耗盡了。

全球在“抽水”:美聯儲縮表(QT)和日本央行加息,兩大流動性源頭都在收緊。市場缺錢,比特幣這個“水漲船高”的資產自然難飛。

世界在“拆伙”:特朗普的一系列動作,把世界推向了局部衝突與“新冷戰”的灰色地帶。這種不確定性,讓大資金本能地逃離比特幣這類高風險資產。

但黃金、美股的上漲,真的是健康的“牛”嗎?不,那是 “國家意志”在主導:央行買黃金是對美元信用的不信任票;股市漲是AI國產化、產業自主等政策在強行引導資本。它們的邏輯,和去中心化、全球化的加密市

- 讚賞

- 3

- 6

- 轉發

- 分享

一点归红 :

:

币圈最起码也要等到下半年才能起飛了吧,沒有預期推動現在查看更多

1. 行情走势深度分析

從多周期圖表來看,以太坊目前處於大跌後的超跌反彈與震盪磨底階段。

• 日線級別(1D): 整體趨勢向下,價格在此前觸及 $2837 附近後企穩。MACD 柱狀圖雖在零軸下方收縮,但 DIF/DEA 仍處於死叉狀態,說明大趨勢的空頭力量尚未完全消散。

• 4小時級別(4H): 價格在觸及 $2863 後走出了一波反彈,目前正面臨 MA21(黃線,約 $3089) 的壓制。如果不能有效突破並站穩 3100,這波反彈可能僅是技術性回抽。

• 1小時/15分鐘級別(1H/15M): 均線開始糾纏並趨於平緩,MACD 在零軸附近徘徊,顯示市場在美股開盤前進入了窄幅震盪(Consolidation),成交量有所萎縮,市場在等待方向選擇。

2. 小止損入場點位與邏輯

如果你考慮在美股開盤前進行超短線操作,建議以**“低吸”**為主,因為下方 $2950-$2980 區域表現出了一定的支撐。

• 入場區間: $2985 - $3000 附近。

• 邏輯: 這裡是 15 分鐘和 1 小時級別多條均線交匯處,也是心理關口 3000 點的反覆爭奪區。

• 止損位: $2945 附近。

• 邏輯: 止損設在 4 小時近期小平台低點下方。若跌破 $2950,說明反彈力度極弱,價格極大概率會二次探底甚至刷新 $2863 的低點。

• 止盈目標: 第一目標位 $3070(4H

從多周期圖表來看,以太坊目前處於大跌後的超跌反彈與震盪磨底階段。

• 日線級別(1D): 整體趨勢向下,價格在此前觸及 $2837 附近後企穩。MACD 柱狀圖雖在零軸下方收縮,但 DIF/DEA 仍處於死叉狀態,說明大趨勢的空頭力量尚未完全消散。

• 4小時級別(4H): 價格在觸及 $2863 後走出了一波反彈,目前正面臨 MA21(黃線,約 $3089) 的壓制。如果不能有效突破並站穩 3100,這波反彈可能僅是技術性回抽。

• 1小時/15分鐘級別(1H/15M): 均線開始糾纏並趨於平緩,MACD 在零軸附近徘徊,顯示市場在美股開盤前進入了窄幅震盪(Consolidation),成交量有所萎縮,市場在等待方向選擇。

2. 小止損入場點位與邏輯

如果你考慮在美股開盤前進行超短線操作,建議以**“低吸”**為主,因為下方 $2950-$2980 區域表現出了一定的支撐。

• 入場區間: $2985 - $3000 附近。

• 邏輯: 這裡是 15 分鐘和 1 小時級別多條均線交匯處,也是心理關口 3000 點的反覆爭奪區。

• 止損位: $2945 附近。

• 邏輯: 止損設在 4 小時近期小平台低點下方。若跌破 $2950,說明反彈力度極弱,價格極大概率會二次探底甚至刷新 $2863 的低點。

• 止盈目標: 第一目標位 $3070(4H

ETH-2.87%

- 讚賞

- 11

- 12

- 轉發

- 分享

Vortex_King :

:

買入理財 💎查看更多

1. 行情走势深度分析

從多周期圖表來看,以太坊目前處於大跌後的超跌反彈與震盪磨底階段。

• 日線級別(1D): 整體趨勢向下,價格在此前觸及 $2837 附近後企穩。MACD 柱狀圖雖在零軸下方收縮,但 DIF/DEA 仍處於死叉狀態,說明大趨勢的空頭力量尚未完全消散。

• 4小時級別(4H): 價格在觸及 $2863 後走出了一波反彈,目前正面臨 MA21(黃線,約 $3089) 的壓制。如果不能有效突破並站穩 3100,這波反彈可能僅是技術性回抽。

• 1小時/15分鐘級別(1H/15M): 均線開始糾纏並趨於平緩,MACD 在零軸附近徘徊,顯示市場在美股開盤前進入了窄幅震盪(Consolidation),成交量有所萎縮,市場在等待方向選擇。

2. 小止損入場點位與邏輯

如果你考慮在美股開盤前進行超短線操作,建議以**“低吸”**為主,因為下方 $2950-$2980 區域表現出了一定的支撐。

• 入場區間: $2985 - $3000 附近。

• 邏輯: 這裡是 15 分鐘和 1 小時級別多條均線交匯處,也是心理關口 3000 點的反覆爭奪區。

• 止損位: $2945 附近。

• 邏輯: 止損設在 4 小時近期小平台低點下方。若跌破 $2950,說明反彈力度極弱,價格極大概率會二次探底甚至刷新 $2863 的低點。

• 止盈目標: 第一目標位 $3070(4H

從多周期圖表來看,以太坊目前處於大跌後的超跌反彈與震盪磨底階段。

• 日線級別(1D): 整體趨勢向下,價格在此前觸及 $2837 附近後企穩。MACD 柱狀圖雖在零軸下方收縮,但 DIF/DEA 仍處於死叉狀態,說明大趨勢的空頭力量尚未完全消散。

• 4小時級別(4H): 價格在觸及 $2863 後走出了一波反彈,目前正面臨 MA21(黃線,約 $3089) 的壓制。如果不能有效突破並站穩 3100,這波反彈可能僅是技術性回抽。

• 1小時/15分鐘級別(1H/15M): 均線開始糾纏並趨於平緩,MACD 在零軸附近徘徊,顯示市場在美股開盤前進入了窄幅震盪(Consolidation),成交量有所萎縮,市場在等待方向選擇。

2. 小止損入場點位與邏輯

如果你考慮在美股開盤前進行超短線操作,建議以**“低吸”**為主,因為下方 $2950-$2980 區域表現出了一定的支撐。

• 入場區間: $2985 - $3000 附近。

• 邏輯: 這裡是 15 分鐘和 1 小時級別多條均線交匯處,也是心理關口 3000 點的反覆爭奪區。

• 止損位: $2945 附近。

• 邏輯: 止損設在 4 小時近期小平台低點下方。若跌破 $2950,說明反彈力度極弱,價格極大概率會二次探底甚至刷新 $2863 的低點。

• 止盈目標: 第一目標位 $3070(4H

ETH-2.87%

- 讚賞

- 點讚

- 留言

- 轉發

- 分享

全球都在漲,就你的幣在跌?

真正的危險可能還沒開始…

我有個朋友,去年底清空了所有倉位,跑去買黃金和美股小盤股。昨晚他給我曬收益,輕飄飄丟來一句話:“現在賺錢的祕訣是 ABC——Anything But Crypto(除了加密,什麼都買)。” 那一瞬間,我嘴裡像吃了口隔夜飯,堵得慌。

數據確實扎心:黃金今年漲超60%,白銀飆了210%,美股羅素2000指數連漲11天,A股科創50一個月漲15%。而比特幣呢?在10萬美金門口磨蹭了三個月,最近又是五連陰,從98000跌回91000。

這不對勁,太不對勁了。 當SEC批准ETF、華爾街擁抱、國家戰略儲備都配齊後,比特幣卻像個局外人,眼看著其他市場開派對。原因有三:

比特幣是“預警機”:它由全球流動性直接驅動,往往先於其他風險資產見頂或見底。它的停滯,可能預示著其他市場的上漲動能也快耗盡了。

全球在“抽水”:美聯儲縮表(QT)和日本央行加息,兩大流動性源頭都在收緊。市場缺錢,比特幣這個“水漲船高”的資產自然難飛。

世界在“拆伙”:特朗普的一系列動作,把世界推向了局部衝突與“新冷戰”的灰色地帶。這種不確定性,讓大資金本能地逃離比特幣這類高風險資產。

但黃金、美股的上漲,真的是健康的“牛”嗎?不,那是 “國家意志”在主導:央行買黃金是對美元信用的不信任票;股市漲是AI國產化、產業自主等政策在強行引導資本。它們的邏輯,和去中心化、全球化的加密市

查看原文真正的危險可能還沒開始…

我有個朋友,去年底清空了所有倉位,跑去買黃金和美股小盤股。昨晚他給我曬收益,輕飄飄丟來一句話:“現在賺錢的祕訣是 ABC——Anything But Crypto(除了加密,什麼都買)。” 那一瞬間,我嘴裡像吃了口隔夜飯,堵得慌。

數據確實扎心:黃金今年漲超60%,白銀飆了210%,美股羅素2000指數連漲11天,A股科創50一個月漲15%。而比特幣呢?在10萬美金門口磨蹭了三個月,最近又是五連陰,從98000跌回91000。

這不對勁,太不對勁了。 當SEC批准ETF、華爾街擁抱、國家戰略儲備都配齊後,比特幣卻像個局外人,眼看著其他市場開派對。原因有三:

比特幣是“預警機”:它由全球流動性直接驅動,往往先於其他風險資產見頂或見底。它的停滯,可能預示著其他市場的上漲動能也快耗盡了。

全球在“抽水”:美聯儲縮表(QT)和日本央行加息,兩大流動性源頭都在收緊。市場缺錢,比特幣這個“水漲船高”的資產自然難飛。

世界在“拆伙”:特朗普的一系列動作,把世界推向了局部衝突與“新冷戰”的灰色地帶。這種不確定性,讓大資金本能地逃離比特幣這類高風險資產。

但黃金、美股的上漲,真的是健康的“牛”嗎?不,那是 “國家意志”在主導:央行買黃金是對美元信用的不信任票;股市漲是AI國產化、產業自主等政策在強行引導資本。它們的邏輯,和去中心化、全球化的加密市

- 讚賞

- 1

- 1

- 轉發

- 分享

华尔街姐夫 :

:

新年暴富 🤑全球都在漲,就你的幣在跌?

真正的危險可能還沒開始…

我有個朋友,去年底清空了所有倉位,跑去買黃金和美股小盤股。昨晚他給我曬收益,輕飄飄丟來一句話:“現在賺錢的祕訣是 ABC——Anything But Crypto(除了加密,什麼都買)。” 那一瞬間,我嘴裡像吃了口隔夜飯,堵得慌。

數據確實扎心:黃金今年漲超60%,白銀飆了210%,美股羅素2000指數連漲11天,A股科創50一個月漲15%。而比特幣呢?在10萬美金門口磨蹭了三個月,最近又是五連陰,從98000跌回91000。

這不對勁,太不對勁了。 當SEC批准ETF、華爾街擁抱、國家戰略儲備都配齊後,比特幣卻像個局外人,眼看著其他市場開派對。原因有三:

比特幣是“預警機”:它由全球流動性直接驅動,往往先於其他風險資產見頂或見底。它的停滯,可能預示著其他市場的上漲動能也快耗盡了。

全球在“抽水”:美聯儲縮表(QT)和日本央行加息,兩大流動性源頭都在收緊。市場缺錢,比特幣這個“水漲船高”的資產自然難飛。

世界在“拆伙”:特朗普的一系列動作,把世界推向了局部衝突與“新冷戰”的灰色地帶。這種不確定性,讓大資金本能地逃離比特幣這類高風險資產。

但黃金、美股的上漲,真的是健康的“牛”嗎?不,那是 “國家意志”在主導:央行買黃金是對美元信用的不信任票;股市漲是AI國產化、產業自主等政策在強行引導資本。它們的邏輯,和去中心化、全球化的加密市

查看原文真正的危險可能還沒開始…

我有個朋友,去年底清空了所有倉位,跑去買黃金和美股小盤股。昨晚他給我曬收益,輕飄飄丟來一句話:“現在賺錢的祕訣是 ABC——Anything But Crypto(除了加密,什麼都買)。” 那一瞬間,我嘴裡像吃了口隔夜飯,堵得慌。

數據確實扎心:黃金今年漲超60%,白銀飆了210%,美股羅素2000指數連漲11天,A股科創50一個月漲15%。而比特幣呢?在10萬美金門口磨蹭了三個月,最近又是五連陰,從98000跌回91000。

這不對勁,太不對勁了。 當SEC批准ETF、華爾街擁抱、國家戰略儲備都配齊後,比特幣卻像個局外人,眼看著其他市場開派對。原因有三:

比特幣是“預警機”:它由全球流動性直接驅動,往往先於其他風險資產見頂或見底。它的停滯,可能預示著其他市場的上漲動能也快耗盡了。

全球在“抽水”:美聯儲縮表(QT)和日本央行加息,兩大流動性源頭都在收緊。市場缺錢,比特幣這個“水漲船高”的資產自然難飛。

世界在“拆伙”:特朗普的一系列動作,把世界推向了局部衝突與“新冷戰”的灰色地帶。這種不確定性,讓大資金本能地逃離比特幣這類高風險資產。

但黃金、美股的上漲,真的是健康的“牛”嗎?不,那是 “國家意志”在主導:央行買黃金是對美元信用的不信任票;股市漲是AI國產化、產業自主等政策在強行引導資本。它們的邏輯,和去中心化、全球化的加密市

- 讚賞

- 2

- 1

- 轉發

- 分享

財源廣进 :

:

新年暴富 🤑加載更多

加入 4000萬 人匯聚的頭部社群

⚡️ 與 4000萬 人一起參與加密貨幣熱潮討論

💬 與喜愛的頭部創作者互動

👍 查看感興趣的內容

熱門話題

17.91萬 熱度

6120 熱度

2595 熱度

1.3萬 熱度

3799 熱度

1812 熱度

1596 熱度

247 熱度

1608 熱度

1766 熱度

1505 熱度

974 熱度

7.05萬 熱度

1.72萬 熱度

3.69萬 熱度

最新消息

查看更多置頂

#交易員說Gate廣場

跟單交易員訪談來襲!我們將採訪數位收益勝率優秀的交易員,分享他們在廣場記錄交易的體驗。

今天我們請到的是,在廣場分享操盤RIVER 取得10000USDT收益的 TX纏論量化實盤全自動。聽聽他使用Gate廣場記錄交易的心得吧!

更多關於明星交易員

https://www.gate.com/zh/announcements/article/49427Gate 廣場內容挖礦煥新公測進行中!

發帖互動帶交易,最高享 60% 手續費返佣!

參與教程

1️⃣ 報名公測:https://www.gate.com/questionnaire/7358

2️⃣ 用代幣組件 / 跟單卡片發帖,分享行情觀點

3️⃣ 與粉絲互動,促成真實交易

🎁 獎勵機制

• 基礎返佣:粉絲交易即得 10%

• 發帖 / 互動達標:每週再加 10%

• 排名加碼:周榜前 100 再享 10%

• 新 / 回歸創作者:返佣翻倍

活動詳情:https://www.gate.com/announcements/article/49475

加入 Gate 廣場,變身內容礦工,讓內容真正變成長期收益Gate 廣場“新星計劃”正式上線!

開啟加密創作之旅,瓜分月度 $10,000 獎勵!

參與資格:從未在 Gate 廣場發帖,或連續 7 天未發帖的創作者

立即報名:https://www.gate.com/questionnaire/7396

您將獲得:

💰 1,000 USDT 月度創作獎池 + 首帖 $50 倉位體驗券

🔥 半月度「爆款王」:Gate 50U 精美周邊

⭐ 月度前 10「新星英雄榜」+ 粉絲達標榜單 + 精選帖曝光扶持

加入 Gate 廣場,贏獎勵 ,拿流量,建立個人影響力!

詳情:https://www.gate.com/announcements/article/49672