秦政闯天涯

No content yet

秦政闯天涯

Tonight's volatility is a bit overwhelming.

View Original

- Reward

- 1

- Comment

- Repost

- Share

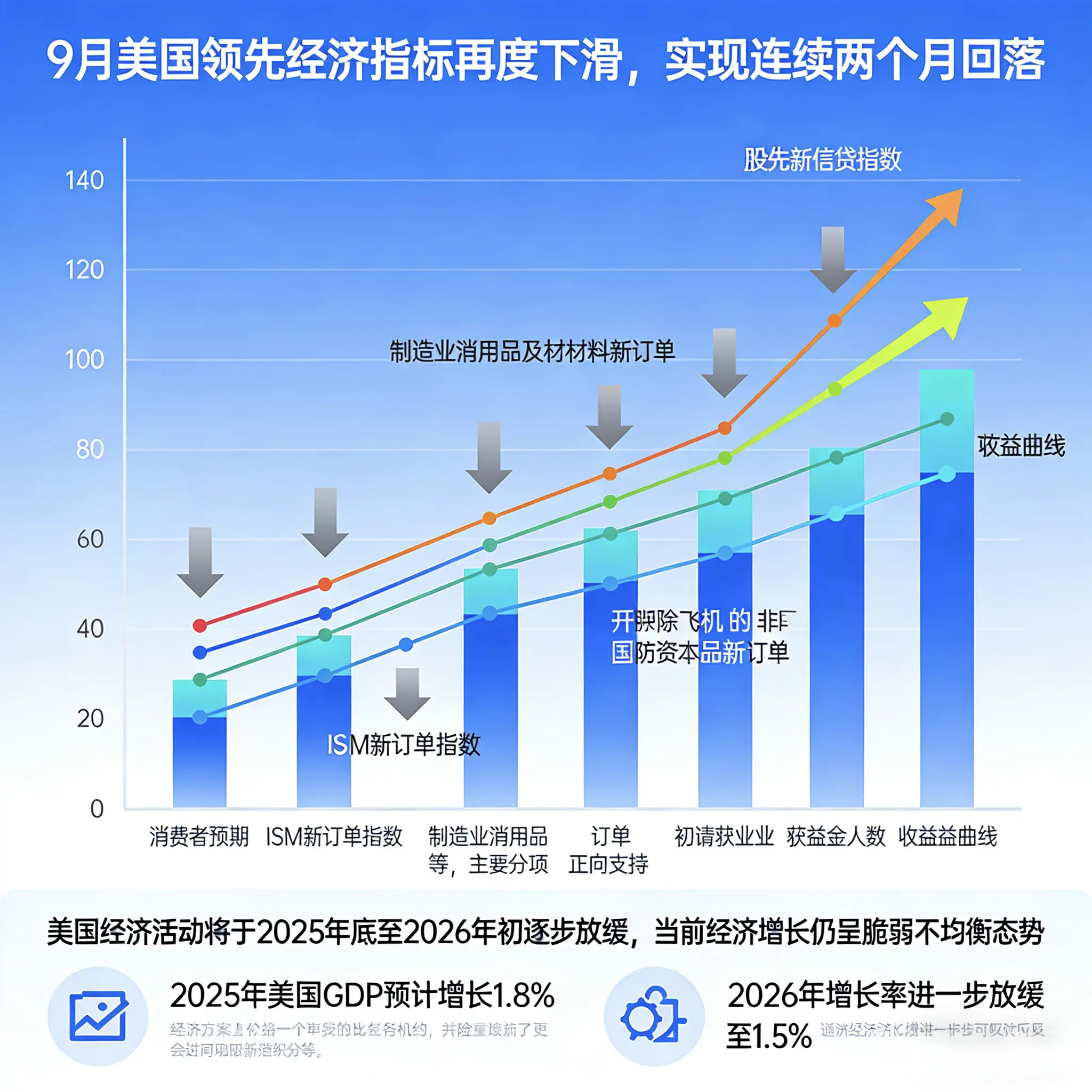

In September, the US Leading Economic Index declined again, marking two consecutive months of decreases. Weaker consumer and business expectations have become the core factors dragging down the overall contraction of the index. Specifically, major components such as consumer expectations, the ISM new orders index, new orders for manufactured consumer goods and raw materials, initial jobless claims, and the yield curve all exerted downward pressure on the index; meanwhile, stock prices, the leading credit index, and new orders for non-defense capital goods excluding aircraft contributed positiv

View Original

- Reward

- like

- Comment

- Repost

- Share

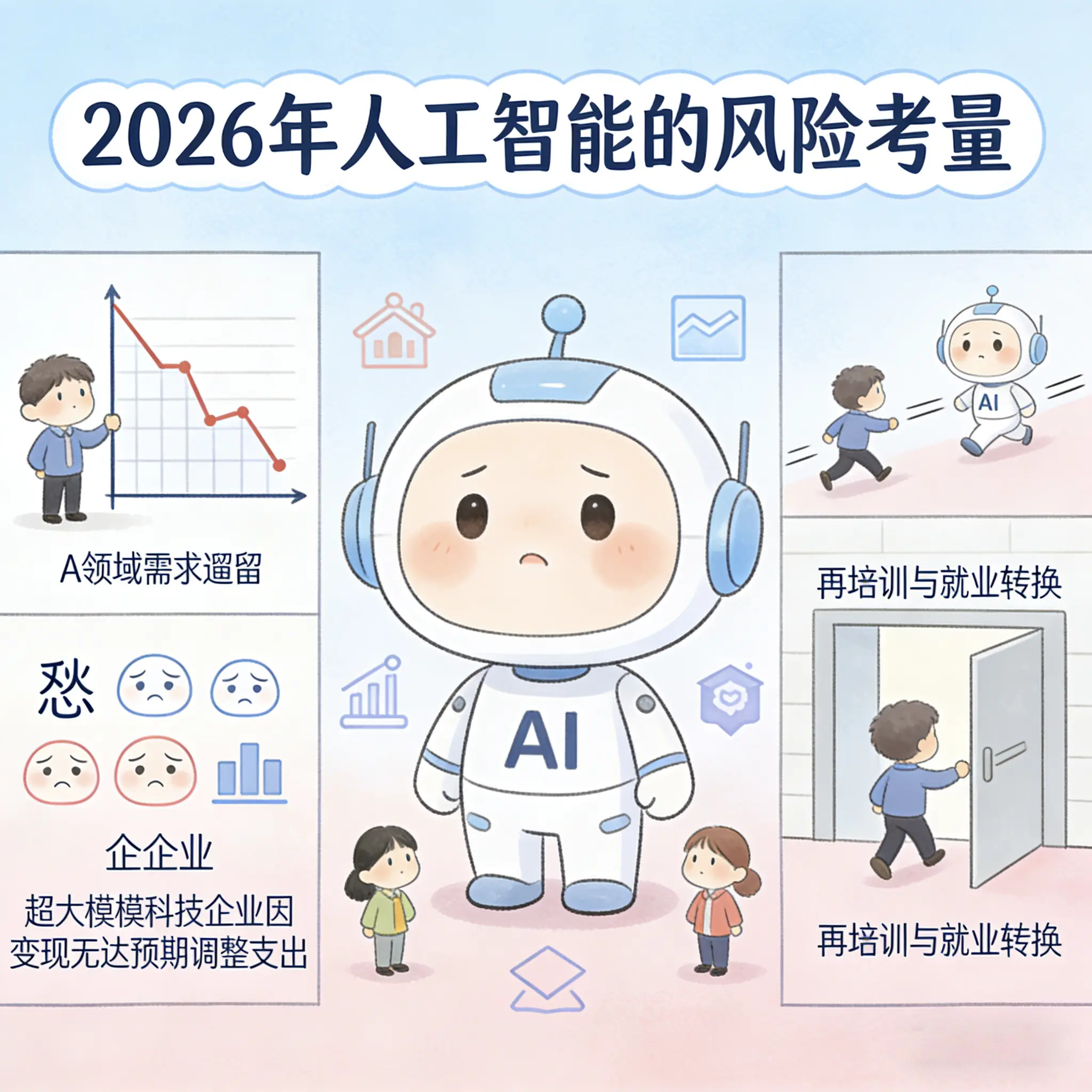

The co-president of hedge fund Balyasny Asset Management pointed out on Tuesday that artificial intelligence will become the primary tail risk in 2026: on one hand, a decline in AI sector demand and spending adjustments by mega-cap tech companies due to monetization falling short of expectations could trigger unexpected downside risks;

On the other hand, AI development exceeding expectations could accelerate a wave of unemployment, leading to gaps in employee retraining and job transitions. He believes that both scenarios could trigger market volatility, but it is more likely that AI will cont

View OriginalOn the other hand, AI development exceeding expectations could accelerate a wave of unemployment, leading to gaps in employee retraining and job transitions. He believes that both scenarios could trigger market volatility, but it is more likely that AI will cont

- Reward

- like

- Comment

- Repost

- Share

Go long on the second one around 3120-3080, add more at 3050, target 3170-3320

View Original

- Reward

- like

- Comment

- Repost

- Share

After the market held steady above the key psychological level of 90,000, a classic shakeout and consolidation took place, but the technical structure remains healthy. The current trend is in a reasonable pullback to confirm the previous breakout level of 91,400, showing strong volume and price resonance with increased volume on rallies and decreased volume during pullbacks.

If the price can firmly hold the support zone, the short-term upward channel will be further consolidated. After some consolidation, the market is expected to make another push toward the 91,800-92,000 resistance area, wit

If the price can firmly hold the support zone, the short-term upward channel will be further consolidated. After some consolidation, the market is expected to make another push toward the 91,800-92,000 resistance area, wit

BTC4.25%

- Reward

- like

- Comment

- Repost

- Share

Sorry to keep everyone waiting, the downward validation was a bit later today.

View Original

- Reward

- like

- Comment

- Repost

- Share

Pre-market outlook: Nasdaq futures up 0.3%, U.S. stocks continue to approach all-time highs. This week is packed with central bank meetings, with the Federal Reserve meeting being the main focus. Rate cut expectations have been fully priced in by the market, but there are significant differences among committee members, so the final outcome of the meeting remains uncertain.

View Original

- Reward

- like

- Comment

- Repost

- Share

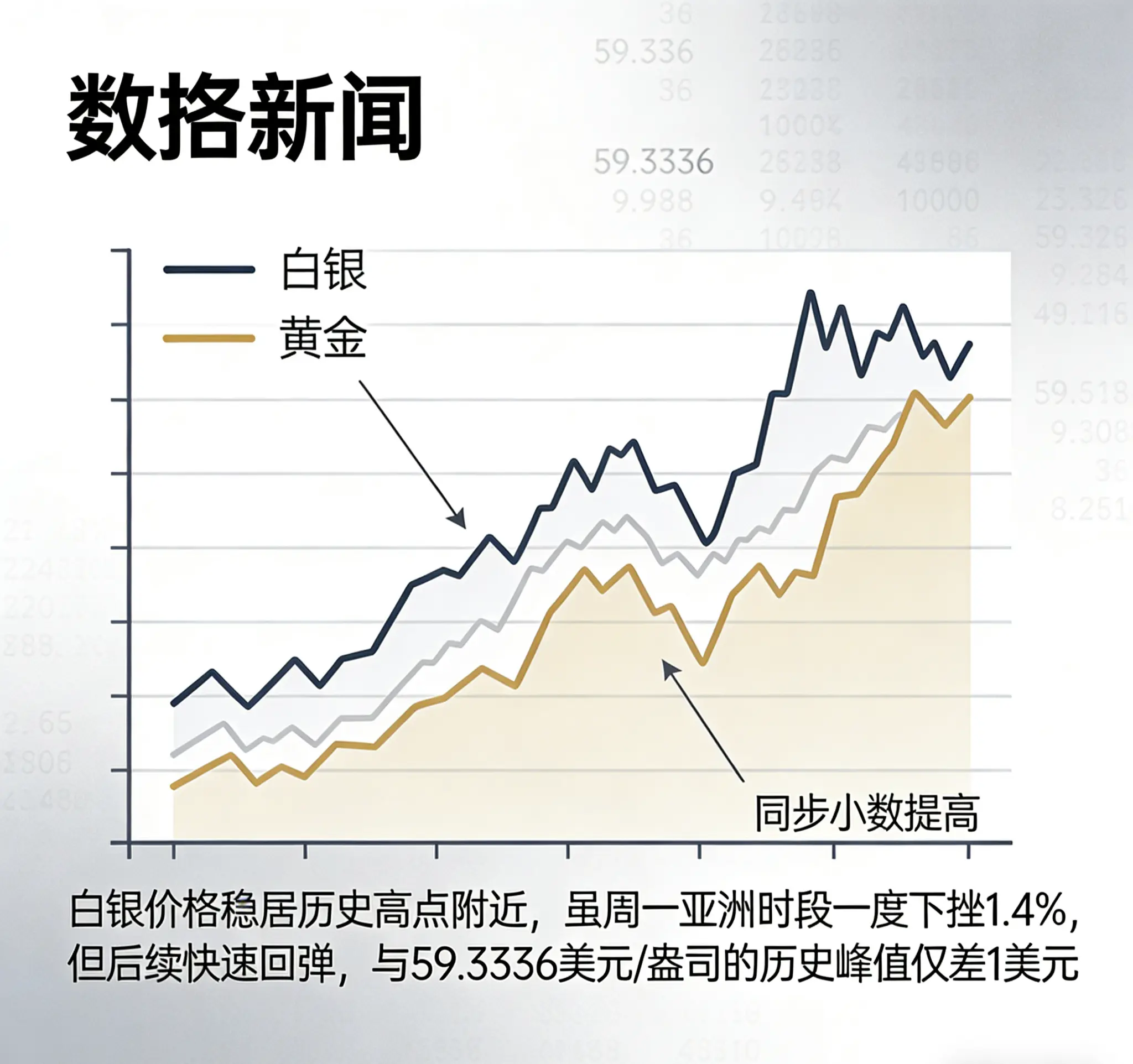

Silver prices remain near historical highs. Although they once fell by 1.4% during Monday's Asian session, they quickly rebounded afterward, now just $1 away from the all-time peak of $59.3336 per ounce.

Gold also edged up slightly. Providing even stronger support, silver ETFs saw their largest inflows since July last week, with nearly 590 tons of new holdings added—clearly signaling that the rally still has room to run.

View OriginalGold also edged up slightly. Providing even stronger support, silver ETFs saw their largest inflows since July last week, with nearly 590 tons of new holdings added—clearly signaling that the rally still has room to run.

- Reward

- like

- Comment

- Repost

- Share

LG Energy Solution and Mercedes-Benz reach $11 billion electric vehicle battery agreement (107GWh), totaling over 157.5GWh in collaboration, with deliveries from 2028 to 2037.

Stock performance: Shares surged nearly 7% in early Seoul trading, closing up 5.3% at 448,500 KRW (approximately $304.31)).

Market impact: LG solidifies its position in the premium battery market, boosting performance expectations; long-term partnerships among industry leaders intensify competition and accelerate technological iteration; Mercedes-Benz secures stable supply, supporting its electrification transformation.

View OriginalStock performance: Shares surged nearly 7% in early Seoul trading, closing up 5.3% at 448,500 KRW (approximately $304.31)).

Market impact: LG solidifies its position in the premium battery market, boosting performance expectations; long-term partnerships among industry leaders intensify competition and accelerate technological iteration; Mercedes-Benz secures stable supply, supporting its electrification transformation.

- Reward

- like

- Comment

- Repost

- Share

The four-hour chart shows high-level consolidation with a weak bias. The battle between bulls and bears is intensifying, with clear support and resistance ranges and fierce competition at key price levels. After a rapid decline, the price is now operating at a low level. Technical indicators are clear: the KDJ indicator has formed a death cross, signaling short-term oversold conditions and a continuation of bearish momentum. Based on candlestick patterns and trading volume, the short-term trend is dominated by bears, and there is significant room for downward movement. It is recommended to con

BTC4.25%

- Reward

- like

- Comment

- Repost

- Share

Brothers, the level we targeted over the weekend has already dropped to 1274 points.

View Original

- Reward

- like

- Comment

- Repost

- Share

This year, the A-share market has remained generally active, achieving both quantitative and qualitative growth since its market capitalization surpassed 100 trillion yuan in August. As a core bridge for investment and financing in the capital market, securities institutions are vital to the improvement of market functions and the construction of the ecosystem. Currently, brokerages have total assets of 14.5 trillion yuan and net assets of about 3.3 trillion yuan, representing increases of over 60% and 40% respectively in just over four years, and have cumulatively helped more than 1,200 tech

View Original

- Reward

- like

- Comment

- Repost

- Share

Go short on the second one around 3060-3100, add at 3150, target 3000-2900.

View Original

- Reward

- like

- Comment

- Repost

- Share

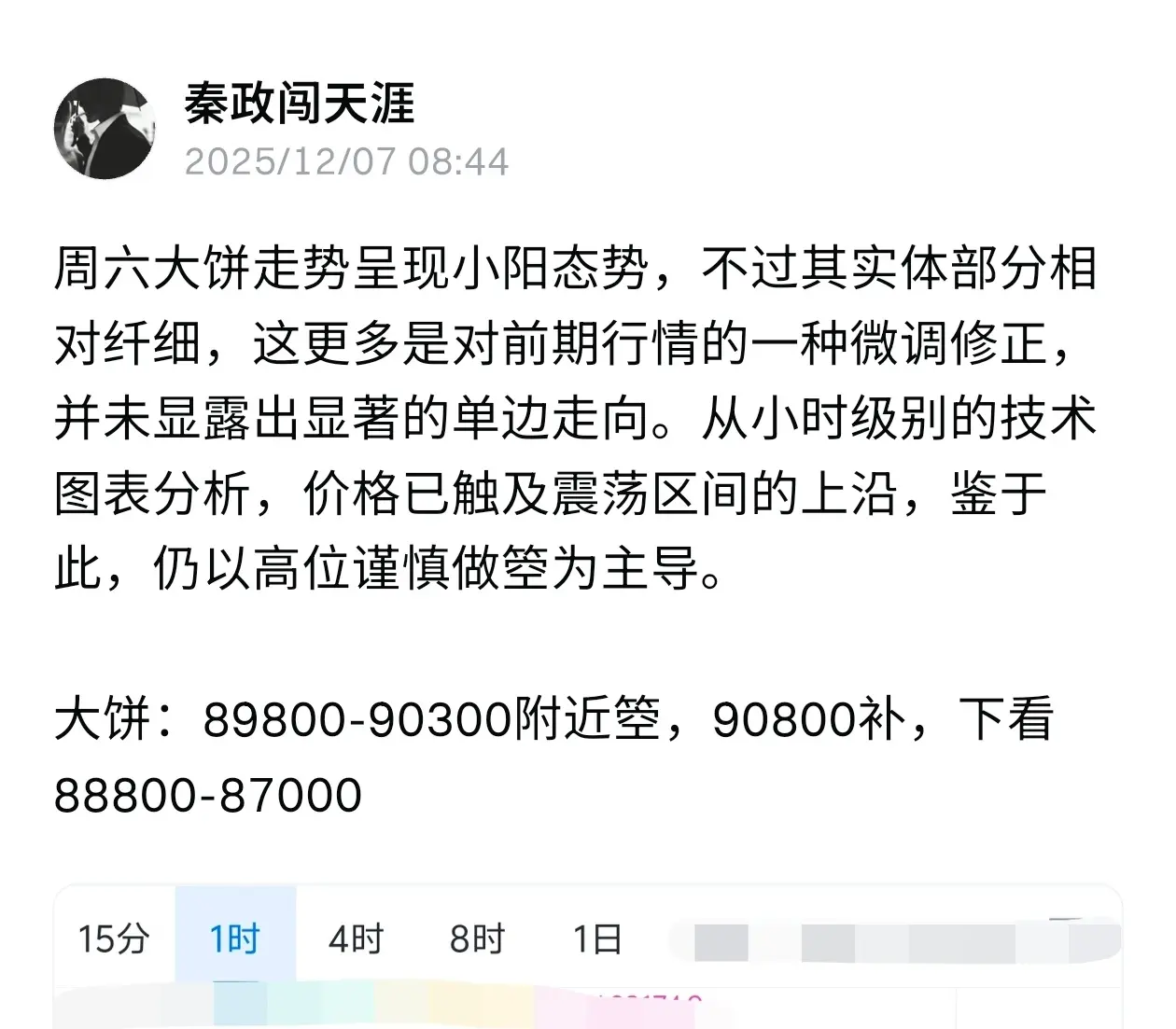

Saturday’s BTC price action showed a slight bullish tendency, but the real body was relatively thin, which is more of a minor correction to the previous trend rather than a significant move in either direction. From the hourly technical chart, the price has reached the upper edge of the consolidation range. Given this, it is advisable to remain cautious with short positions at higher levels.

BTC: Short around 89,800-90,300, add at 90,800, target 88,800-87,000

BTC: Short around 89,800-90,300, add at 90,800, target 88,800-87,000

BTC4.25%

- Reward

- like

- Comment

- Repost

- Share

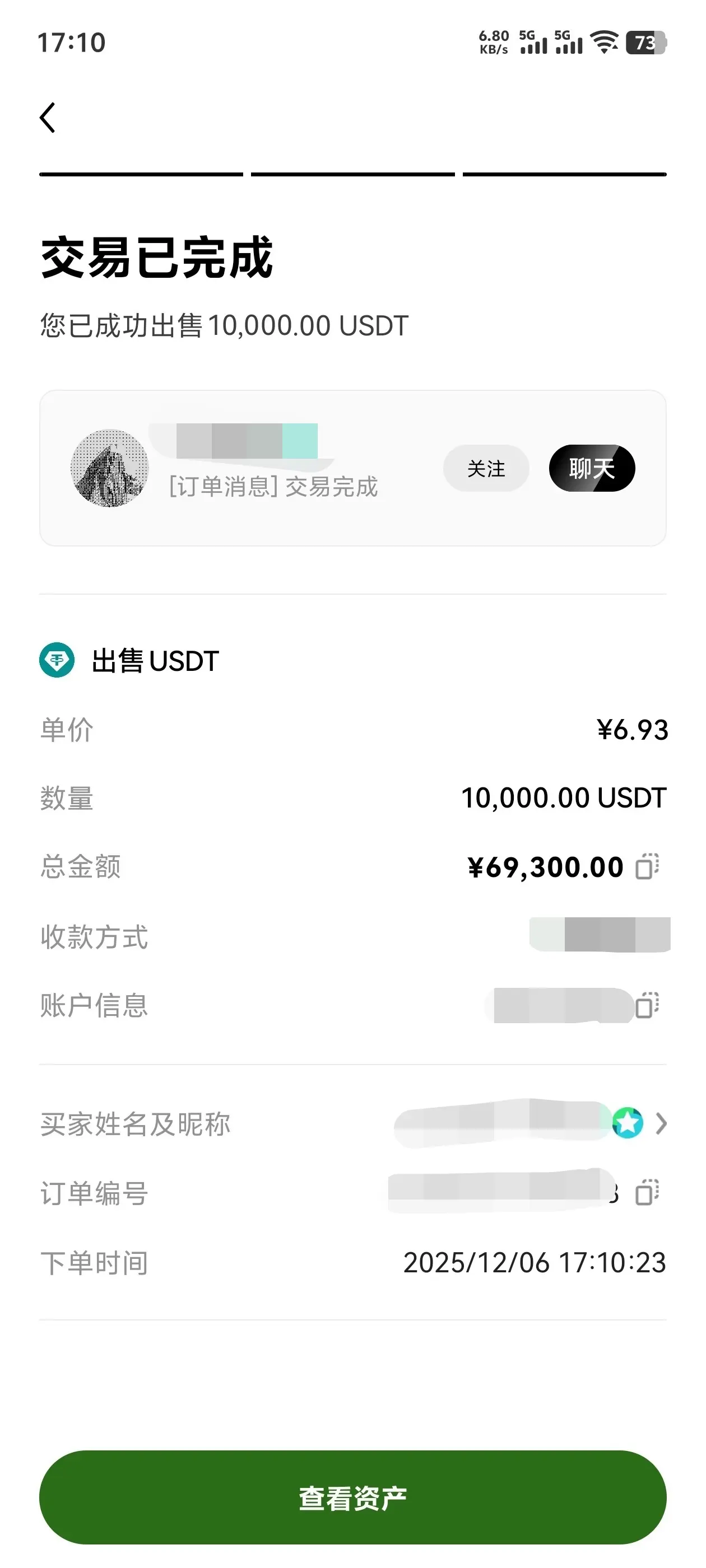

The U price has dropped again. I just sold 10,000 U, and watched my assets shrink before my eyes;

The crypto world is just this real—even if you don’t move, you might still lose 💰.

View OriginalThe crypto world is just this real—even if you don’t move, you might still lose 💰.

- Reward

- like

- Comment

- Repost

- Share

A joint letter reveals that six European countries are appealing to the European Commission, calling for a relaxation of the ban on the sale of internal combustion engine vehicles set to take effect in 2035. This request was made ahead of the release of a new package of automotive policies next week.

The countries state clearly that if existing or future vehicle technologies can help achieve emission reduction targets, hybrid and related models should be allowed to continue to be sold after 2035.

View OriginalThe countries state clearly that if existing or future vehicle technologies can help achieve emission reduction targets, hybrid and related models should be allowed to continue to be sold after 2035.

- Reward

- like

- Comment

- Repost

- Share

On the 4-hour chart, BTC price has posted three consecutive bearish candles, continuing to move lower. The Bollinger Bands are converging, and technical indicators favor a bearish setup. The MACD is above the zero axis, but the DIF line has crossed below the DEA line, forming a death cross, with increasing red histogram bars, indicating the market remains in a downtrend.

On the 1-hour chart, the middle and lower Bollinger Bands are pointing downward. After the price broke below the lower band, some bullish capital entered to trigger a rebound, but momentum is lacking. The market may enter a co

On the 1-hour chart, the middle and lower Bollinger Bands are pointing downward. After the price broke below the lower band, some bullish capital entered to trigger a rebound, but momentum is lacking. The market may enter a co

BTC4.25%

- Reward

- like

- Comment

- Repost

- Share

The spot silver price touched $59 per ounce during intraday trading, setting a new all-time high, with a year-to-date increase exceeding 100%. New York silver futures surged 4.00% intraday, currently quoted at $59.80 per ounce, and the silver sector continues its strong upward trend.

View Original

- Reward

- like

- Comment

- Repost

- Share