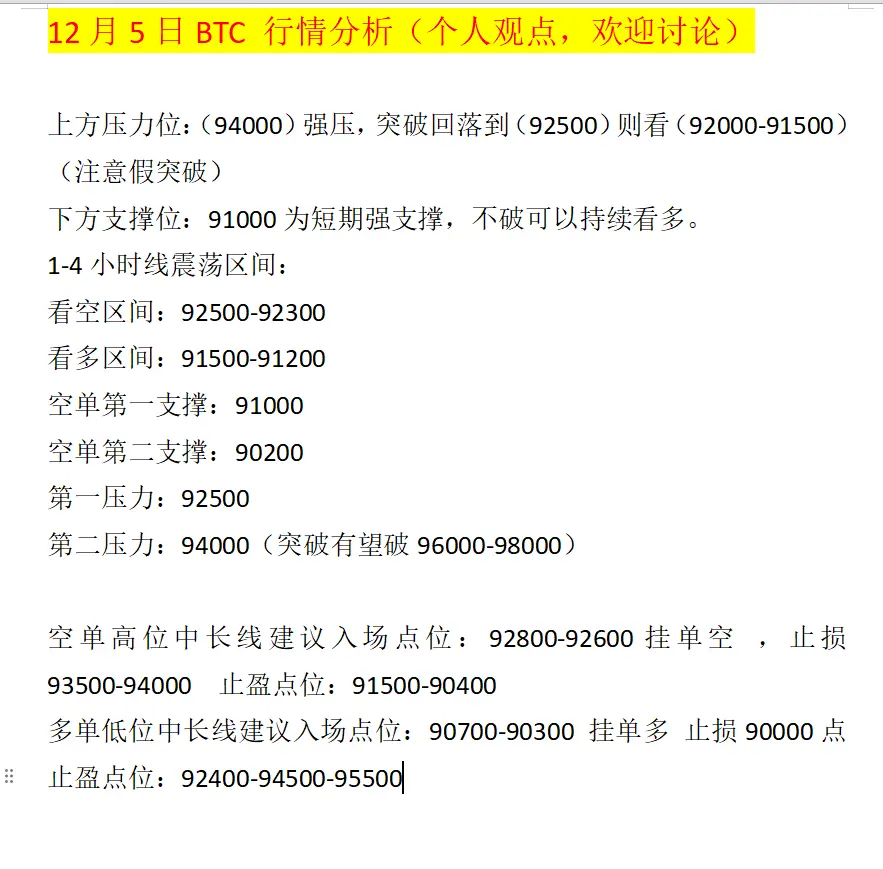

December 3 Today's plan: Go long at 3060-65, Take profit: 3130-3165-3200

View Original加密王先生

No content yet

加密王先生

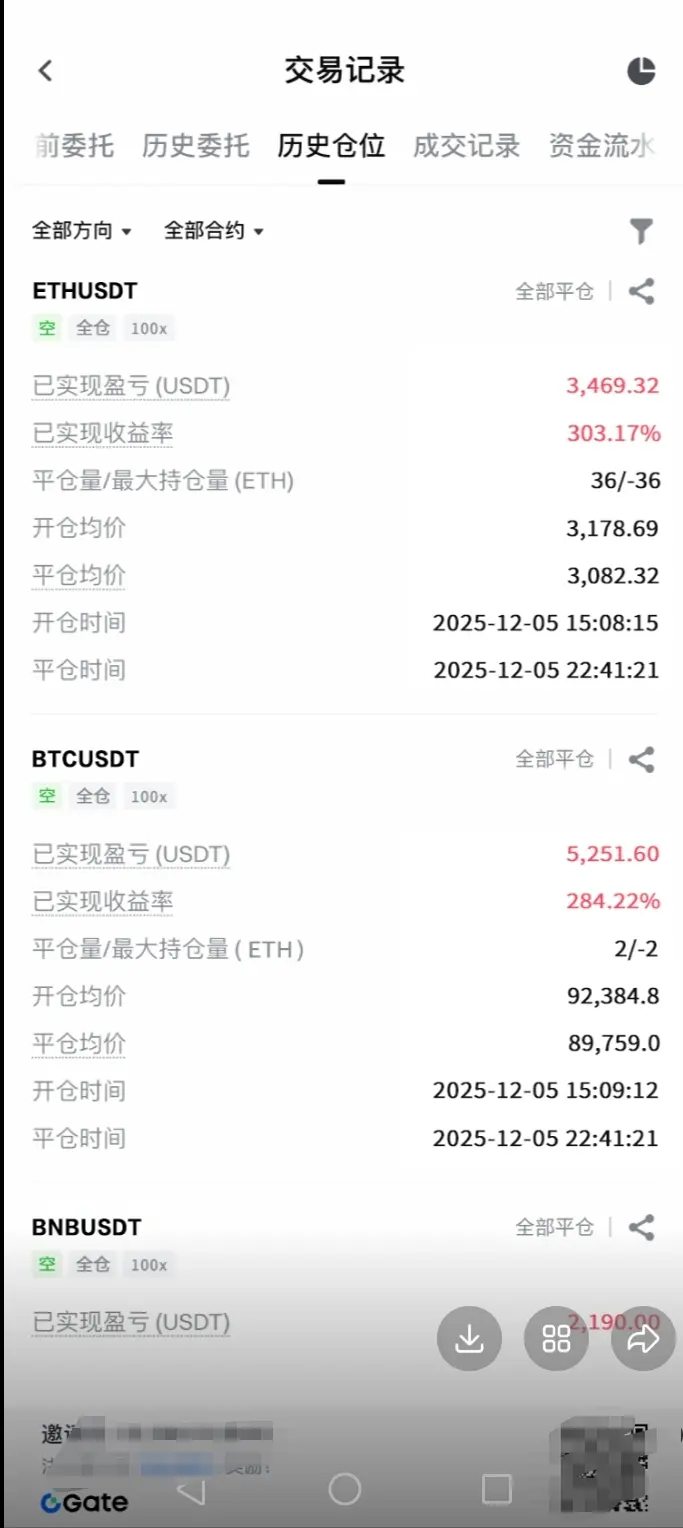

Every day in the livestream room, the brothers in the fan group earn $10,000 in profits with ease. Profit is never about luck—it's about precise market analysis and a strategic approach that leads to consistent returns. With accurate market interpretation, precise signal capture, and risk control that maximizes returns, we plan entry points, take-profit, and stop-loss levels in advance, avoid choppy market traps, and steadily realize gains. Profit is never accidental; it comes from keen market insight and professional control. Strength speaks for itself, returns are visible, and we move forwar

View Original

- Reward

- 26

- 18

- Repost

- Share

You126129 :

:

666View More

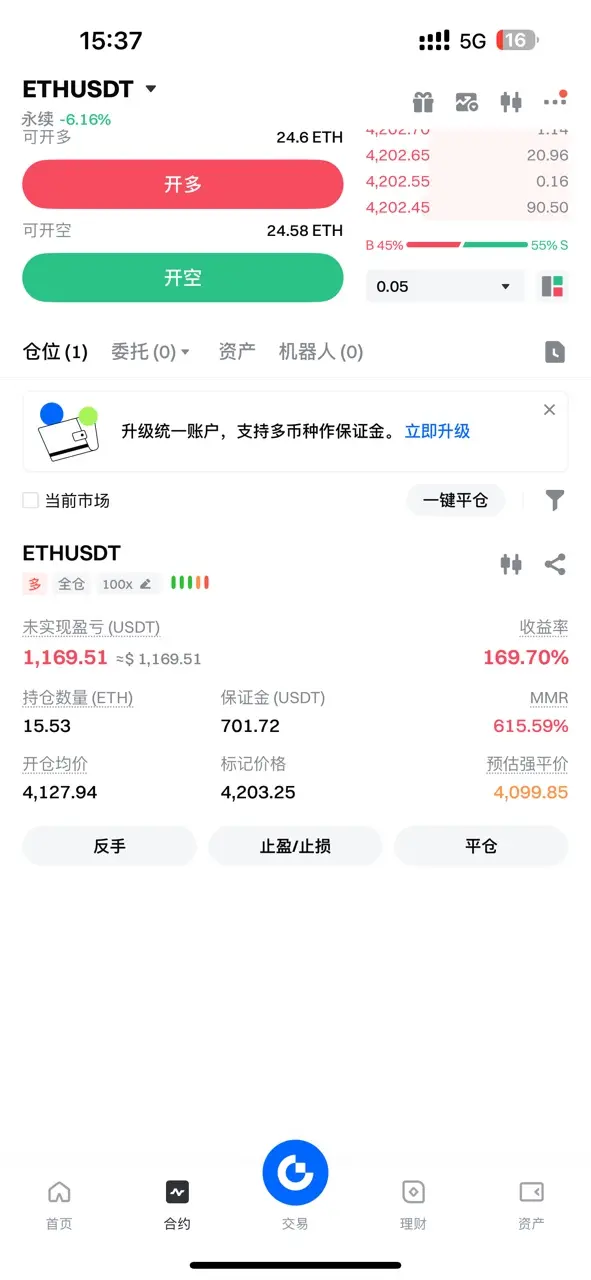

Three consecutive days of profits in December. No need to say much—just enjoy the gains. Friends in the fan group and livestream who made profits, feel free to share your position screenshots with @CryptoKing to show if you got your share.

View Original

- Reward

- 8

- 6

- Repost

- Share

You126129 :

:

666View More

- Reward

- 4

- 2

- Repost

- Share

You1216 :

:

666View More

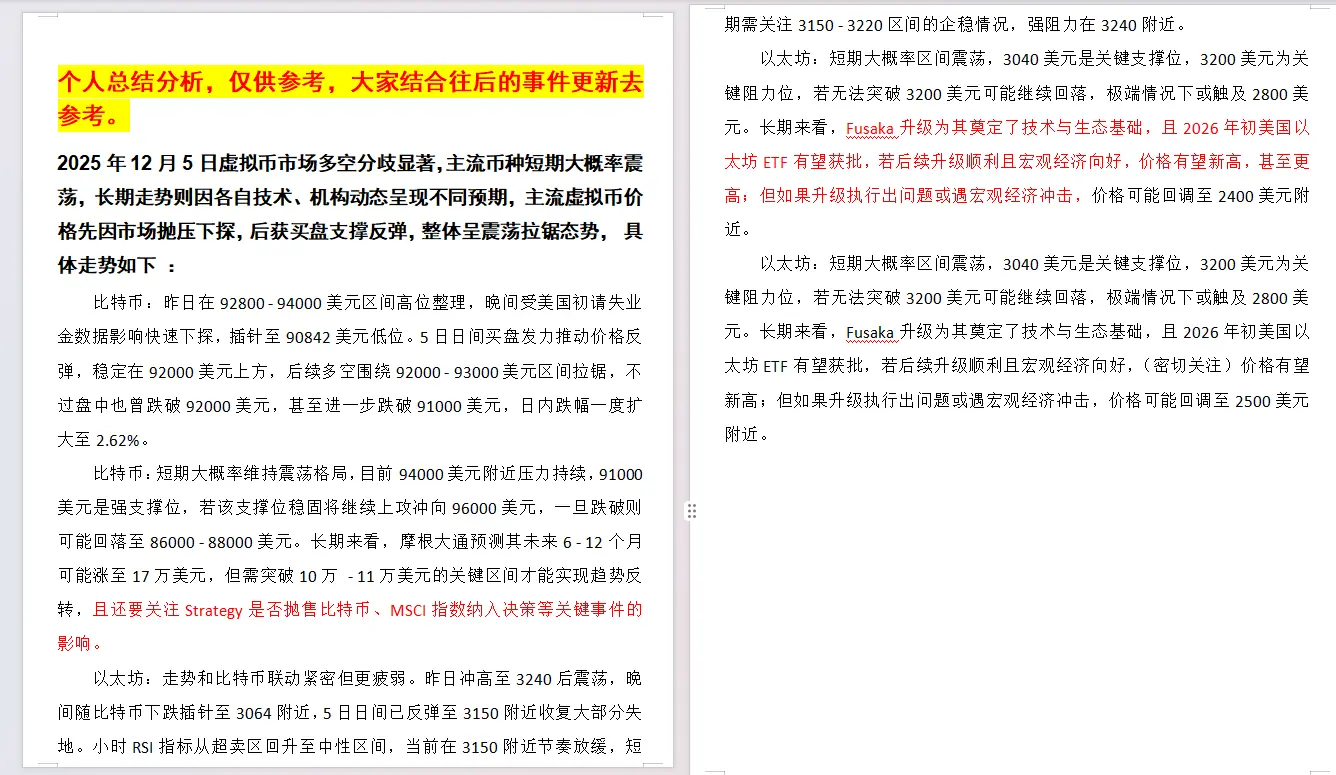

On December 2, before the US stock market opened, we positioned for a long trade based on two points of analysis. First, the support level at 2780 below the 15:59 candle did not break or stabilize, and at 16:00, the new 4-hour candle did not show continued bearish volume. The strong support at 2850 was broken with declining bearish volume, and there was a trend of increasing bullish volume. From 16:00 to 19:59, the 4-hour candle showed bullish momentum gradually increasing in volume and stabilized at the 4-hour close at 2830. The resistance level at 2830 stabilized, and at 20:00, bullish volum

View Original

- Reward

- 8

- 1

- Repost

- Share

You126129 :

:

6666On Monday, the live channel opened with the US stock market, positioning short orders in advance, because of the interest rate hike Black Swan Event during the small life. Safe-haven assets (gold, silver) broke new highs, while risk assets collectively plummeted (virtual money). In the morning, the daily chart level directly broke the strong support level at 2850 from 2998, heading towards 2800. After 9 am, the market data underwent a short volume decrease, with a sideways range until 8:00 pm when short volume began to increase slightly. At this time, a new 4-hour chart is about to show a tren

View Original

- Reward

- 48

- 16

- 2

- Share

AfterTheVirtueOfCarrying :

:

Good analysis, worth paying attention to.View More

On Friday and Saturday, I have already told many people to lay out short orders. From both on-chain data and market data, a fall is inevitable. The liquidation map on the 30th clearly shows that the market maker is in a sideways accumulation position in the middle, preparing for a decline. One should not blindly gamble on the market but should pay attention to historical trends and the behaviors of institutional market makers. We are just following behind the institutions and market makers to make money, so it depends on whether everyone can see the direction of the market maker clearly. The n

View Original

- Reward

- 18

- 7

- Repost

- Share

FloweringBlossoms :

:

Take me along, experienced driver 📈View More

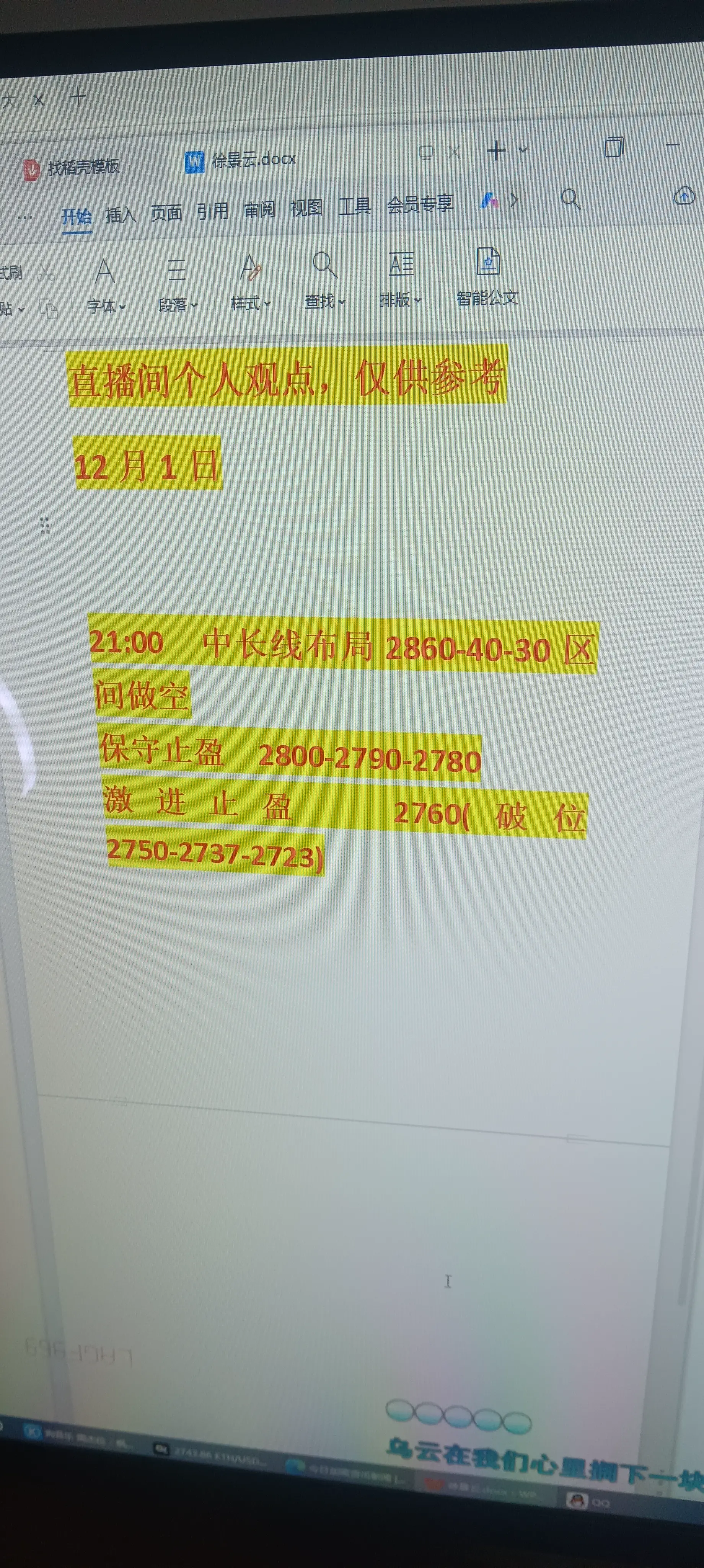

On December 1st, short order layout, continuing to profit.

View Original

- Reward

- 9

- 7

- Repost

- Share

You126129 :

:

666View More

What is the lowest point on the Ethereum monthly chart? What is the highest correction? If you want to learn more, join the live stream room, and I will guide you to make a daily profit of 300-400.

ETH0.57%

- Reward

- 5

- 3

- Repost

- Share

Zhuli998899 :

:

Buckle up, we are about to To da moon 🛫View More

#ETH

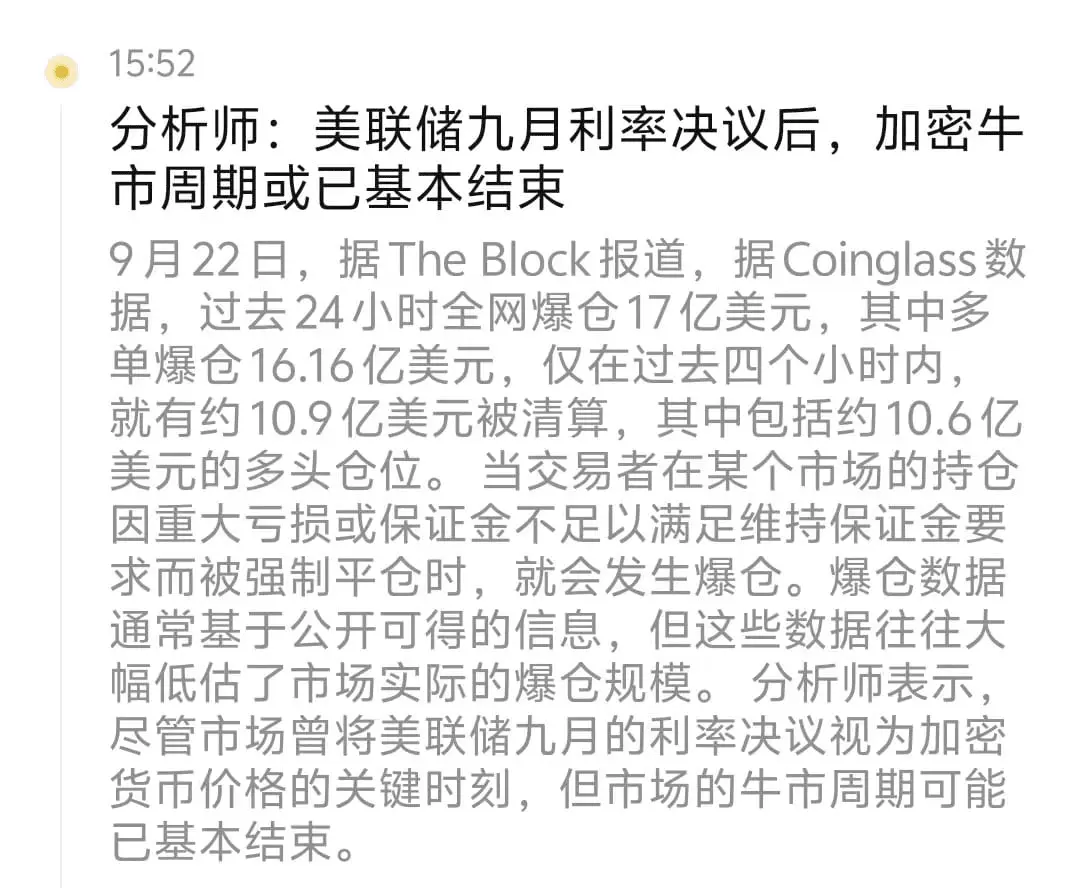

Trump is going to increase tariffs again, and then old Powell said something ambiguous, which I understand to mean that the inflation is too high for subsequent rate cuts.

Just keep falling, don’t act anymore. First of all, increasing tariffs is definitely bearish, and coupled with Powell's unwillingness to cut interest rates, it will inevitably decline.

Trump is going to increase tariffs again, and then old Powell said something ambiguous, which I understand to mean that the inflation is too high for subsequent rate cuts.

Just keep falling, don’t act anymore. First of all, increasing tariffs is definitely bearish, and coupled with Powell's unwillingness to cut interest rates, it will inevitably decline.

ETH0.57%

- Reward

- 10

- 4

- 1

- Share

ROCKSTAR33 :

:

HODL Tight 💪View More

Market maker whipsaw is never for your little chips.

Having been in the crypto space for ten years, I have seen too many retail investors cursing the market makers at the first sign of a drop, thinking that the market makers are only focused on the small amount of coins they hold. The truth is: market makers whipsaw not to seize your chips, but to be able to pump higher and sell more steadily in the future.

Let me share an operation that I have witnessed with my own eyes.

There is a small coin called METIS (an anonymous small-cap coin, not a real duplicate name), with an initial price of 1.2U

Having been in the crypto space for ten years, I have seen too many retail investors cursing the market makers at the first sign of a drop, thinking that the market makers are only focused on the small amount of coins they hold. The truth is: market makers whipsaw not to seize your chips, but to be able to pump higher and sell more steadily in the future.

Let me share an operation that I have witnessed with my own eyes.

There is a small coin called METIS (an anonymous small-cap coin, not a real duplicate name), with an initial price of 1.2U

METIS-2.62%

- Reward

- 6

- 2

- Repost

- Share

GateUser-0ec7b07b :

:

Just go for it💪View More

Our country is cracking down on Bitcoin, will the price of Bitcoin face a big dump and become less and less valuable?

China has cracked down on Bitcoin three times in history.

For the first time, in December 2013, it was clearly stated that Bitcoin is not a currency, and Bitcoin fell in response, not recovering for 3 years.

The second time, in September 2017, it was clearly stated that financial institutions were not allowed to provide settlement services for trading firms. Since then, there have been no trading firms within China, and Bitcoin fell in response. However, this only lasted for a

View OriginalChina has cracked down on Bitcoin three times in history.

For the first time, in December 2013, it was clearly stated that Bitcoin is not a currency, and Bitcoin fell in response, not recovering for 3 years.

The second time, in September 2017, it was clearly stated that financial institutions were not allowed to provide settlement services for trading firms. Since then, there have been no trading firms within China, and Bitcoin fell in response. However, this only lasted for a

- Reward

- 2

- 5

- Repost

- Share

WenwenHair :

:

Erroneous decision-making, the result of voting with one's feet.View More

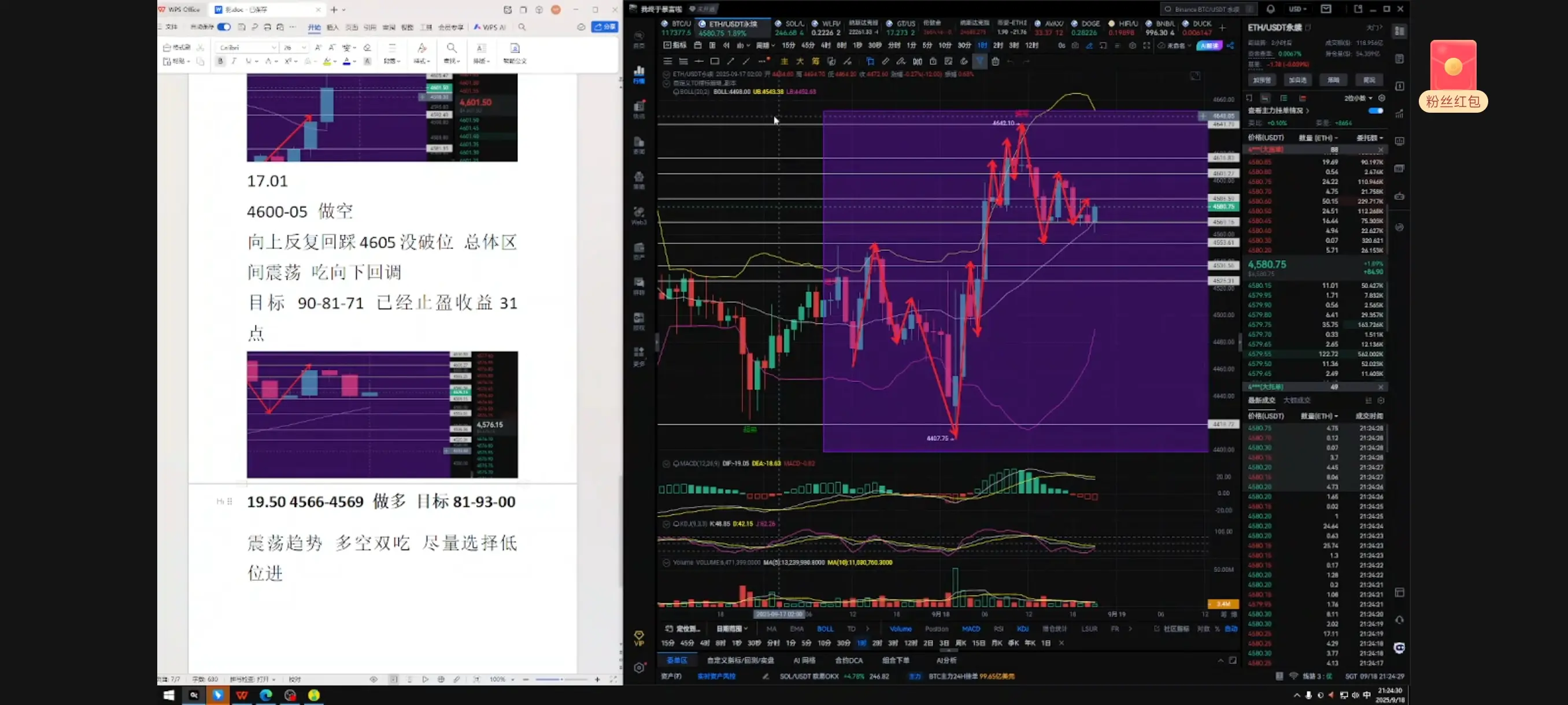

Match Record 9.18

View Original

- Reward

- like

- 1

- Repost

- Share

Why a Fed rate cut generally means a bull run

Why does everyone shout that a bull run is coming when the Fed lowers interest rates?

In fact, this logic is not complicated; to put it simply, it comes down to one sentence: when money is too cheap, it won't just lie quietly in the bank.

Think about it, what does the Fed lowering interest rates mean? It means that the interest you earn by keeping your money in the bank is less, and it might even not keep up with inflation. So large amounts of capital are reluctant to stay in the bank and must look for places with higher returns to flow into. A

View OriginalWhy does everyone shout that a bull run is coming when the Fed lowers interest rates?

In fact, this logic is not complicated; to put it simply, it comes down to one sentence: when money is too cheap, it won't just lie quietly in the bank.

Think about it, what does the Fed lowering interest rates mean? It means that the interest you earn by keeping your money in the bank is less, and it might even not keep up with inflation. So large amounts of capital are reluctant to stay in the bank and must look for places with higher returns to flow into. A

- Reward

- 1

- 2

- Repost

- Share

Azonhiph :

:

Super View More

The Federal Reserve announced on the 17th local time that it will lower the federal funds Interest Rate target range by 25 basis points to between 4.00% and 4.25%, in line with market expectations.

This is also the Federal Reserve's announcement to cut interest rates again after 9 months since December 2024.

U.S. stock futures have skyrocketed. Bitcoin and Ethereum also rebounded after a dip #美联储降息25个基点 .

View OriginalThis is also the Federal Reserve's announcement to cut interest rates again after 9 months since December 2024.

U.S. stock futures have skyrocketed. Bitcoin and Ethereum also rebounded after a dip #美联储降息25个基点 .

- Reward

- 1

- Comment

- Repost

- Share

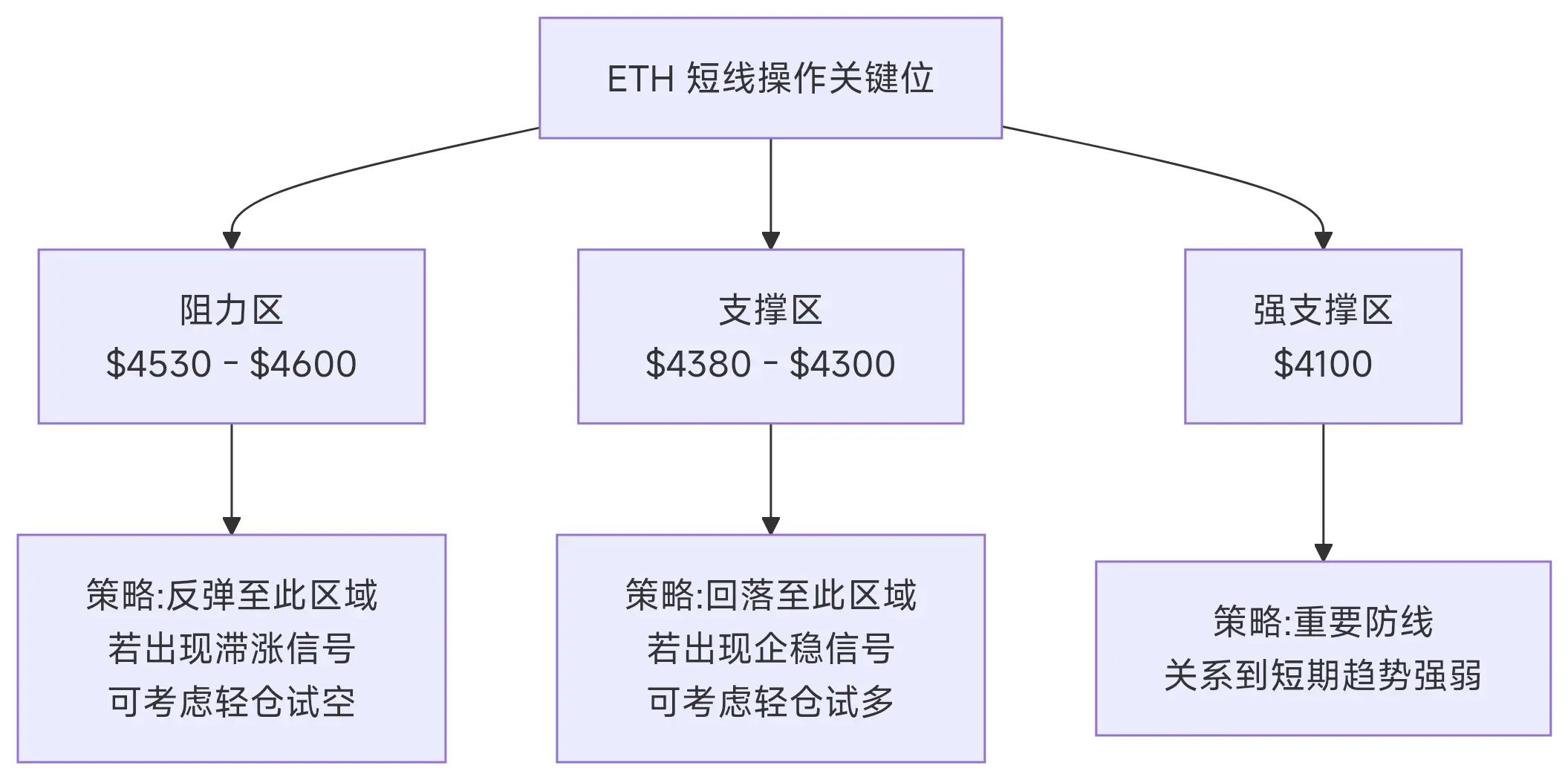

📢 [Fed decision eve: ETH Sideways consolidating, how to position at key levels?]

#ETH Fed #Gate Square

Ethereum is currently trading in a narrow range around $4505, with both bulls and bears reaching a temporary balance ahead of the Fed's decision. In the past 24 hours, the price of ETH peaked at $4538 and dipped to $4424, with volatility clearly contracting and trading volume also declining, indicating cautious market sentiment.

---

🔍 Current key signals on the technical front

1. Sideways: ETH has been continuously operating in the range of 4200-4530 USD since the beginning of Septembe

#ETH Fed #Gate Square

Ethereum is currently trading in a narrow range around $4505, with both bulls and bears reaching a temporary balance ahead of the Fed's decision. In the past 24 hours, the price of ETH peaked at $4538 and dipped to $4424, with volatility clearly contracting and trading volume also declining, indicating cautious market sentiment.

---

🔍 Current key signals on the technical front

1. Sideways: ETH has been continuously operating in the range of 4200-4530 USD since the beginning of Septembe

ETH0.57%

- Reward

- like

- Comment

- Repost

- Share

I know an old senior from the crypto world in Fujian who got on board with 100,000 yuan, and now his assets have surpassed nine figures.

His words awakened me: "Most people in the market are slaves to their emotions, stay calm, the crypto world is just an ATM."

His profit method is not complicated but efficient, especially suitable for doubling small funds. I have organized it into the "Five-Step Batch Method"; turning 10,000 into 100,000 is not difficult:

Ordinary people can profit from trading coins without "insider information" or "predictions"; discipline alone is enough to ensure profits.

View OriginalHis words awakened me: "Most people in the market are slaves to their emotions, stay calm, the crypto world is just an ATM."

His profit method is not complicated but efficient, especially suitable for doubling small funds. I have organized it into the "Five-Step Batch Method"; turning 10,000 into 100,000 is not difficult:

Ordinary people can profit from trading coins without "insider information" or "predictions"; discipline alone is enough to ensure profits.

- Reward

- like

- Comment

- Repost

- Share