USDC News Today

Latest crypto news and price forecasts for USDC: Gate News brings together the latest updates, market analysis, and in-depth insights.

Electronic Currency Revolution: How Digital Payments Will Change Investment and Consumption in 2025

In the electronic currency revolution of 2025, digital payments are leading the way in global financial innovation. The advantages of electronic currency have attracted widespread attention, with its unparalleled efficiency in cross-border transactions revealing the profound impact of digital payment trends. In addition, the security of electronic currency is highly valued, ensuring the privacy and safety of users’ funds. When faced with the choice between electronic currency and traditional currency, its future development shows unlimited potential, shaping an entirely new blueprint for the financial markets. Through this article, you will gain an in-depth understanding of the core driving forces behind this digital innovation wave.

The Rise of Electronic Currency: A Digital Revolution Disrupting Traditional Finance

A New Era of Digital Payments: A Leap in Efficiency and Convenience

2025 is becoming a pivotal turning point for the payments industry, with digital wallets and open banking services taking center stage in the payments sector. According to industry surveys, the changes brought by the electronic currency revolution have far exceeded expectations, especially with the rise of stablecoins such as Tether (USDT) and USDC.

幣圈動態·12-06 13:04

Circle increases USDC supply by 2 billion amid surging demand

Circle reported a $2 billion increase in USDC supply after issuing $8.2 billion and buying back $6.2 billion, reflecting rising demand for USDC and improving liquidity across blockchain networks. The total USDC supply now stands at $78 billion, fully backed by $78.1 billion in liquid assets. Analysts see USDC as essential for the stablecoin liquidity ecosystem and its role in fintech and blockchain platforms continues to grow.

TapChiBitcoin·12-06 06:36

Solv Foundation Integrates With Stellar To Unlock Yield For $200M In USDC

In Brief

Solv Foundation is expanding its platform to Stellar, enabling institutions and users to generate yield on $200 million in USDC while linking cross-border payments to on-chain capital market opportunities.

Solv Foundation, a prominent Bitcoin finance protocol, has announced plans to ex

MpostMediaGroup·12-05 14:40

SEI Native USDC Integration Marks a Major Step Toward Faster Blockchain Payments

The SEI ecosystem grows quickly and attracts new users who want faster performance on-chain. Developers push for stronger settlement speed, reliable liquidity, and stable transaction flow across exchanges and apps. The new SEI USDC integration now strengthens this demand and brings a fresh wave of a

SEI1.46%

Coinfomania·12-05 07:58

Taiwan stablecoins could launch as early as 2026! FSC: Banks will be given priority to issue them.

Financial Supervisory Commission Chairman Peng Jinlong revealed on December 3 that the Taiwan version of stablecoins is expected to be launched as early as the second half of 2026. The FSC has confirmed that banks will take the lead in issuing stablecoins. Currently, the draft "Virtual Asset Service Act" has entered the final stage of review by the Executive Yuan. If the three readings process is successfully completed, the FSC will finalize eight sub-laws, including the "Regulations on the Issuance and Management of Stablecoins," within six months.

MarketWhisper·12-05 05:50

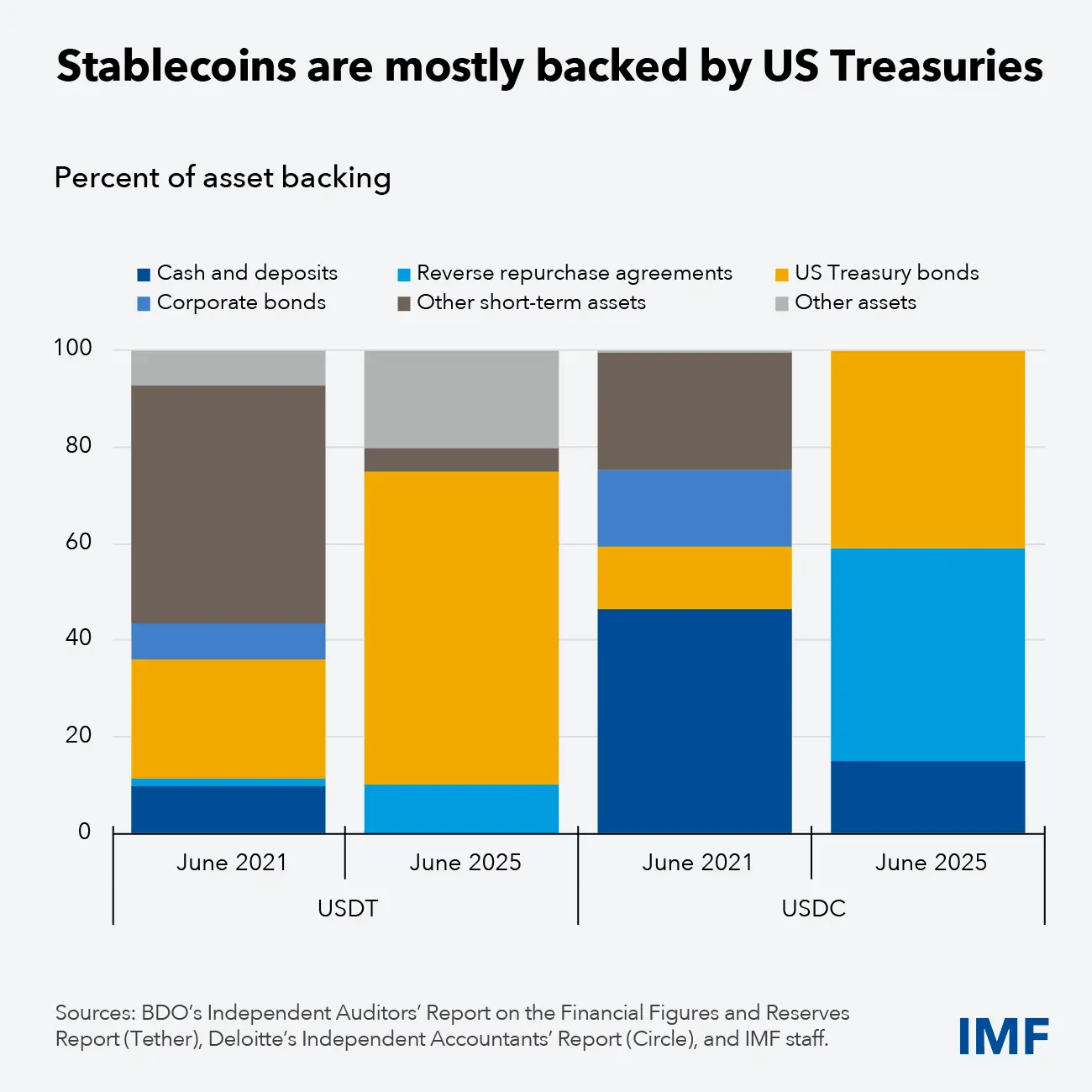

IMF Sounds the Alarm: Fragmented Stablecoin Regulation Has Become a Global Financial "Roadblock"

The International Monetary Fund (IMF) has released its latest report, issuing a stern warning about the global stablecoin market. The report points out that fragmented regulatory frameworks in major economies such as the EU and Japan have created dangerous "regulatory patchworks." This not only threatens global financial stability and undermines regulatory effectiveness but also becomes a "roadblock" for the development of efficient cross-border payments. The IMF specifically emphasized that the stablecoin market, which has already surpassed $300 billion, is moving across borders at a pace faster than regulatory oversight can keep up with, and, for the first time, published global policy guidelines aimed at reducing fragmentation. This move marks a new level of recognition among major global financial regulators regarding the systemic risks posed by stablecoins.

BTC1.4%

MarketWhisper·12-05 02:14

IMF warns of stablecoin fragmentation crisis! $300 billion market faces major regulatory hurdles

The International Monetary Fund (IMF) has released the "Understanding Stablecoins" report, warning that the fragmentation of regulatory frameworks across countries is creating structural "barriers," threatening financial stability, weakening regulation, and slowing the development of cross-border payments. The global stablecoin market capitalization has exceeded $300 billion, with Tether's USDT and Circle's USDC accounting for the majority of the supply.

MarketWhisper·12-05 00:43

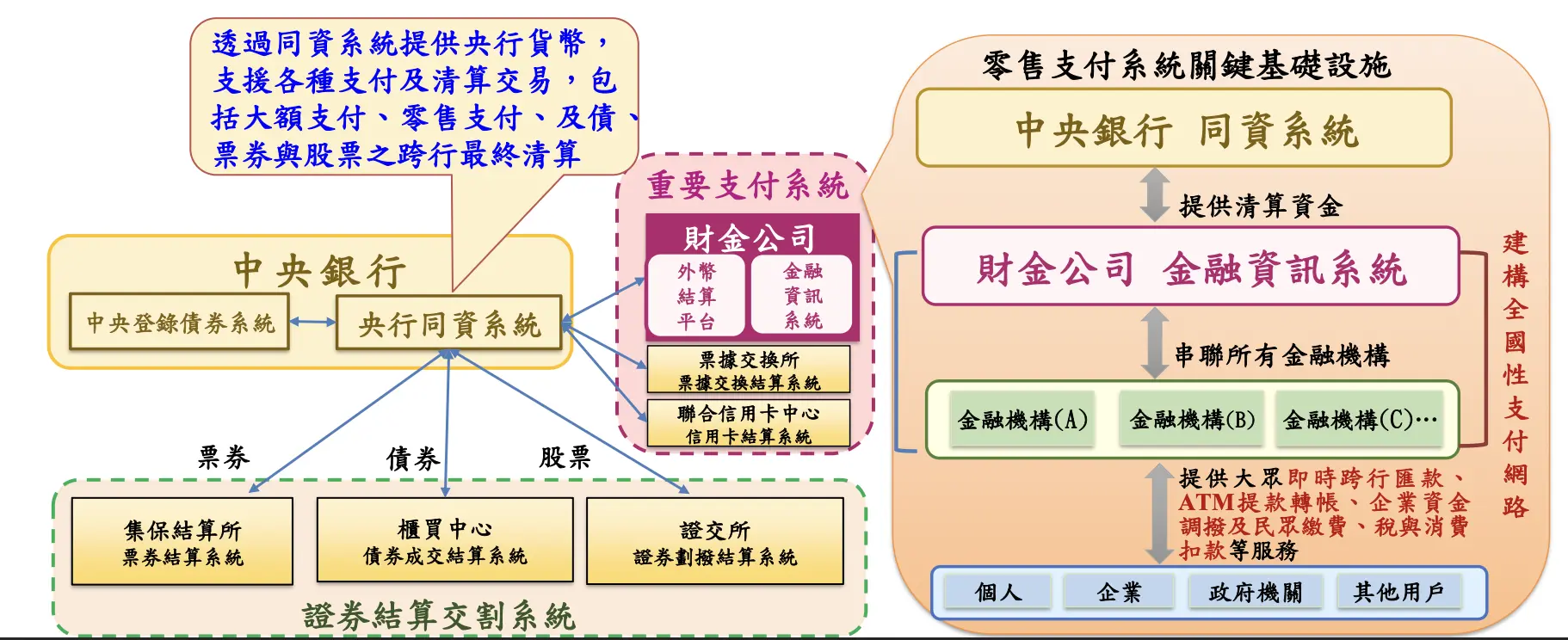

Central Bank Governor Yang Chin-long: Stablecoins are "wildcat banks," TWQR annual transactions reach 592 trillion

Taiwan Central Bank Governor Yang Chin-long stated that future payments will adopt a dual-track parallel strategy. On one hand, the bank will continue to optimize TWQR and promote cross-border interoperability; on the other hand, it will steadily advance wholesale CBDC and tokenized financial infrastructure. In 2024, TWQR's operational volume reached NT$582 trillion, 23 times the GDP for that year. Yang Chin-long warned of the risks of stablecoins, comparing them to "wildcat banks," which historically caused large-scale bank runs due to lack of regulation and insufficient reserves.

MarketWhisper·12-04 07:29

About 10 minutes ago, the USDC Treasury burned 60 million USDC on the Ethereum chain.

According to TechFlow, on December 3, Whale Alert monitoring shows that the USDC Treasury burned 60 million USDC on the Ethereum chain about 10 minutes ago.

DeepFlowTech·12-03 09:29

CRCL stock plummets 75%! Stablecoin No.2 Circle faces its "darkest moment" on the US stock market

The world’s second-largest stablecoin issuer, Circle, saw its stock price plummet from $299 to $76—a staggering 75% drop in just a few months, leaving a large number of investors trapped. Behind the CRCL stock crash lies the stablecoin business model being hit by both the interest rate cut cycle and the tokenization of RWA money market funds. Institutional estimates show that for every 1% rate cut by the Federal Reserve, Circle’s revenue declines by 27%.

BTC1.4%

MarketWhisper·12-03 06:13

x402 Protocol: The Payment Revolution and Compliance Challenges in the Era of Machine Economy

Original Authors: Mao Jiehao, Liu Fuqi

Introduction: From HTTP 402 to the Dawn of the Machine Economy

In 1996, the designers of the HTTP protocol reserved the "402 Payment Required" status code, but due to the lack of supporting payment infrastructure, it became the "ghost code" of the Internet era.

Thirty years later, the x402 protocol, initiated and promoted by Coinbase, has awakened this dormant status code into a "digital cash register" for AI autonomous transactions. When meteorological AI robots automatically purchase global weather data and self-driving cars pay road tolls in real time, the traditional payment logic of "account opening-authentication-authorization" is being dismantled—x402, through the closed loop of "HTTP request-402 response-on-chain payment-service delivery," has, for the first time, enabled atomic transactions between machines without human intervention.

Behind this transformation is the rise of the "machine economy"

PANews·12-03 04:01

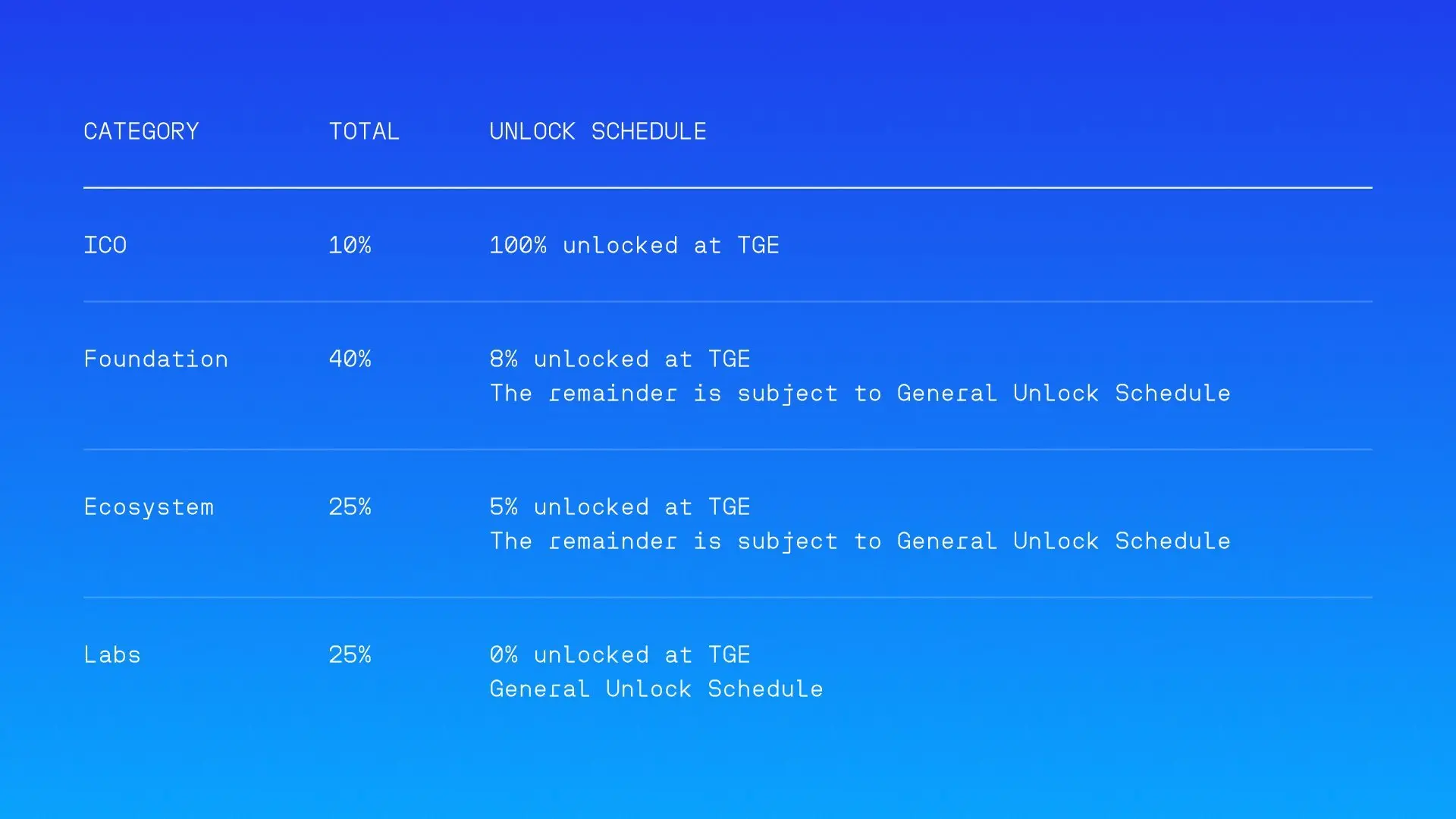

King of Solana Dark Pools HumidiFi Launches ICO—Can It Replicate Jupiter's Wealth Creation Legend?

The largest dark pool decentralized exchange (DEX) by trading volume in the Solana ecosystem, HumidiFi, has officially launched the first community sale (ICO) of its governance token WET. The sale will begin on December 3 on Jupiter’s decentralized token launch platform DTF and will be conducted in three rounds on a first-come, first-served basis. The total sale accounts for 10% of the total token supply (100 million WET), with an initial fully diluted valuation (FDV) ranging from $50 million to $69 million.

As background, HumidiFi’s 24-hour trading volume has reached as high as $1.048 billion, accounting for about 30% of the total DEX trading volume on the Solana chain. Its unique “dark pool” mechanism provides MEV protection and a trading experience with lower slippage. This ICO is not only a major milestone in HumidiFi’s own development but is also seen as the next indicator for gauging the market enthusiasm of the Solana DeFi ecosystem.

JUP-2.12%

MarketWhisper·12-03 02:45

OpenMind announced a partnership with Circle to jointly build a payment infrastructure for embodied AI.

According to Deep Tide TechFlow news, OpenMind and Circle announced a strategic partnership to jointly develop the first payment infrastructure for autonomous, real-world embodied AI trading. By combining OpenMind's Bots and agent operating system with the USDC stablecoin issued by Circle and the x402 payment protocol, both parties hope to enable Bots and AI agents to directly make payments for energy, services, and data in the physical world. Robots gradually becoming independent economic entities will participate in three core markets:

1. Task Market: Bots perform delivery, inspection, and other tasks to earn rewards.

2. Information Market: Local sensor data and environmental state summaries can be sold to agents responsible for decision-making and planning.

3. Resource Market: Bots provide resources for charging, storage, and tool usage.

DeepFlowTech·12-02 13:10

Forbes released the 2026 Finance 30 Under 30 list, with 8 founders of encryption applications selected.

According to a report by Forbes on December 2, Deep Tide TechFlow news states that Forbes has released the 2026 30 Under 30 list in the financial sector, covering the fields of financial technology, Crypto Assets, and TradFi. The list was selected from nearly 800 nominees, among which 8 founders of Crypto Assets were included.

Among them, Asta Li studied Mechanical and Aerospace Engineering and Computer Science at Cornell University, worked on autonomous driving technology at Uber, and co-founded the Crypto Assets wallet company Privy in 2021. The company provides embedded application encryption wallet services for businesses, has over 1,000 clients, including well-known Crypto Assets companies such as Hyperliquid, Lightspark, and Blackbird, and has created wallets for tens of millions of consumers. This year, it was Stri

DeepFlowTech·12-02 11:33

Countdown to South Korea's stablecoin legislation! The ruling party issues an ultimatum, submit the bill by December 10.

The ruling Democratic Party of Korea has issued an ultimatum to financial authorities, urging them to accelerate the formulation of local stablecoin market-related laws. The ruling party has notified the country's Financial Service Commission, requesting the submission of a government proposal on stablecoin regulation by December 10, referring to it as the final demand. Authorities are considering a plan that allows the Central Bank of Korea, FSC, and the banking sector to form an alliance to issue stablecoins, requiring banks to collectively hold more than 50% of the shares of the consortium.

MarketWhisper·12-02 05:13

GENIUS legislation implemented! FDIC to announce application framework by the end of the year, USDT and USDC face major challenges.

Travis Hill, acting chairman of the Federal Deposit Insurance Corporation (FDIC), testified at a House hearing that the agency is preparing to propose stablecoin application rules by the end of December, with a draft rule expected to be released later in December to establish an application framework, and a proposed rule to implement prudential requirements for federally regulated payment stablecoin issuance entities to be released early next year.

MarketWhisper·12-02 00:38

Circle has added minting of 100 million USDC on the Ethereum blockchain.

According to news from Mars Finance, Whale Alert monitored that at 22:46 Beijing time, USDC issuer Circle minted an additional 100 million USDC on the Ethereum on-chain.

MarsBitNews·12-01 15:30

Thirteen departments in China jointly crack down on "Cryptocurrency Trading"! stablecoins rarely become a regulatory target.

On November 28, the People's Bank of China held a meeting of the working coordination mechanism to combat virtual money trading speculation, attended by relevant leaders from 13 departments, including the Ministry of Public Security, the Supreme People's Court, and the Supreme People's Procuratorate. The meeting notably singled out "stablecoin," clearly stating that stablecoins are a form of virtual coins and pose risks of being used for Money Laundering, fundraising fraud, and illegal cross-border fund transfers. The meeting emphasized that activities related to virtual money business are considered illegal financial activities.

MarketWhisper·12-01 05:52

The stablecoin market bounces back thanks to USDC, reaching 306 billion USD.

After dropping to a low of $302 billion, the stablecoin economy is recovering, now reaching $306.157 billion. Tether remains dominant, while USDC has seen notable growth. Overall, recent recovery signals a resilient market, potentially boosting liquidity and confidence in crypto.

DAI0.07%

TapChiBitcoin·12-01 02:58

The People's Bank of China names stablecoins! 13 departments target Money Laundering risks, Hong Kong's layout is embarrassing.

The Central Bank of China reiterated after a multi-department meeting held last Friday that digital assets have no legal status in China, and specifically pointed out that stablecoins fail to meet AML and customer identification requirements, claiming they pose a threat to financial stability. The People's Bank of China convened representatives from 13 government departments in Beijing to discuss the "resurgence" of speculative activities related to digital assets, marking the strongest public comments the Central Bank has made on Crypto Assets issues since the comprehensive ban on trading and Mining in September 2021.

MarketWhisper·12-01 02:36

A new Address stores 3.86 million USDC to Hyperliquid, placing an order to go long 196 BTC.

According to Mars Finance, a newly created wallet 0x0c0B deposited 3.86 million USDC to Hyperliquid one hour ago and placed a limit order to go long 196 BTC in the price range of 86,500–86,750 USD, estimating the order size at approximately 16.97 million USD based on the midpoint of the range.

BTC1.4%

MarsBitNews·12-01 02:35

Circle minted an additional 1 billion USDC on the Solana network.

Circle has minted an additional 1 billion USD in USDC on the Solana network, totaling 12.25 billion since October 11. This increase reflects rising demand for USDC in DeFi and on-chain activities, highlighting Circle's efforts to enhance liquidity and strengthen its stablecoin position amid growing competition.

TapChiBitcoin·11-29 11:00

Visa Expands USDC Settlement Across Africa & Middle East Through Aquanow Partnership

Visa has officially partnered with Aquanow to expand

BitcoinInsider·11-29 00:32

What is the real profitable track for encryption payments?

Written by: Shao Jiadian

People engaged in crypto payments are all asking the same question:

Which road really can make money?

I've heard many industry stories, but those that can actually make money are really few.

Today I want to strip away all the "mysticism" outside and just talk about reality:

The real profitable directions for crypto payments now are actually only three categories: channels, compliance, and high-risk services. Other directions are basically powered by love.

By understanding these three categories, you basically know where the money flows in this industry, where the barriers are, and how you should enter the market.

Channel: The Everlasting First Source of Profit (and it will become more expensive)

If you strip down the business models of all cryptocurrency payment institutions to the bone, there is only one question left:

Who can send money to the destination the fastest, the most securely, and with the least trouble?

If you can do this, you can collect fees, take a margin, and gain traction.

(1) U ↔ fiat currency deposit / withdrawal

This is the entire industry's

DeepFlowTech·11-28 09:50

North Korean hackers strike again! The Lazarus Group steals 30.6 million, and South Korean exchanges suffer for the third time.

The notorious North Korean cybercrime group Lazarus is suspected of orchestrating a major crypto assets attack that resulted in losses of approximately $30.6 million for South Korea's largest cryptocurrency exchange. The exchange operator Dunamu confirmed that assets related to Solana worth 44.5 billion won were transferred to an unauthorized wallet on Thursday, and the company stated it would use its own reserves to fully compensate users.

MarketWhisper·11-28 06:36

2026 Crypto Assets Major Changes! Forbes: Stablecoins Are Everywhere, Four-Year Cycle Disappears

Two Prime CEO Alexander S. Blume wrote in Forbes that after fluctuations are adjusted in 2025, the Crypto Assets market will still be sluggish, but this does not mean stagnation. On the contrary, with the acceleration of institutionalization and the gradual improvement of regulatory frameworks, in 2026 DAT 2.0 will gain legitimacy, stablecoins will be ubiquitous, the Bitcoin four-year cycle will end, U.S. investors will gain offshore Liquidity, and product refinement will occur.

MarketWhisper·11-28 02:53

Pumpfun Under Pressure As Massive USDC Transfers and Falling Revenue Deepen Market Concerns

Massive USDC transfers raise concern as Pumpfun faces sharp pressure and weak market confidence.

Heavy treasury movements spark doubt as the buyback plan struggles to support PUMP price.

Pumpfun revenue drops as user activity slows and the token records a deep monthly decline.

Pumpfun is facing i

CryptoNewsLand·11-27 08:43

A newly created Wallet deposits 3 million USD into HyperLiquid and places a shorting order for HYPE.

According to Mars Finance news, Onchain Lens monitored that a newly created Wallet deposited 3 million USDC into HyperLiquid and placed an order to short HYPE in the range of 35.7-36.7 USD.

HYPE-5.78%

MarsBitNews·11-27 05:45

Pump.fun seems to have transferred an additional 75 million USDC to Kraken.

Pump.fun has transferred a total of 480 million USDC to Kraken over 12 days. While the team claims to be reinvesting, 75 million USDC was recently sent to Kraken, followed by a transfer of 69.26 million USDC to Circle.

PUMP0.65%

TapChiBitcoin·11-27 01:49

Pump.fun has transferred another 75 million USDC to Kraken, with a total of 480 million transferred in 12 days.

According to Deep Tide TechFlow news, on November 27, on-chain analyst Yu Jin (@EmberCN) monitored that Pump.fun transferred 75 million USDC to Kraken 8 hours ago. In the 12 days since November 15, Pump.fun has cumulatively transferred 480 million USDC obtained through token sales to Kraken.

According to monitoring, after 75 million USDC was transferred to Kraken, 69.26 million USDC was immediately transferred from Kraken to Circle (the issuer of USDC).

Previously, the Pump.fun team stated that the relevant fund transfer was not a withdrawal operation, but rather for the purpose of diversified fund management to reinvest in business operations.

PUMP0.65%

DeepFlowTech·11-27 00:20

What is the real profitable track for encryption payments?

People who make encryption payments all ask the same question:

"Which road can really make money?"

I've heard many industry stories, but there are really not many that can make money in practice.

Today I want to strip away all the "mysticism" outside and just talk about reality:

The real profitable directions for encryption payments now are actually only three categories: channels, compliance, and high-risk services. Other directions are basically powered by love.

Understanding these three categories, you basically know where the money flows in this industry, where the barriers are, and how you should enter the market.

Channel: The Forever First Source of Profit (and it will become more expensive)

If you strip down the business models of all encryption payment institutions to the bone, only one question remains:

Who can send money to its destination the fastest, most securely, and with the least trouble?

If you can do this, you can collect fees, take some spreads, and gain adhesion.

(1) U ↔ fiat currency deposits/withdrawals

This is the "vascular system" of the entire industry.

金色财经_·11-26 14:05

Myriad Surpasses $100M in USDC Trading Volume, Boosting Prediction Markets 10x in Just 3 Months

This is a growth of ten times in only three months, highlighting the quick adoption of Myriad and its aim to build prediction markets as a significant pillar.

Myriad launched quick Automated Markets and expanded its operations to BNB Chain before the end of the previous month.

With more

BNB0.59%

TheNewsCrypto·11-26 11:41

Crypto News: Circle Launches USDC and CCTP on Monad With Day-One DeFi Apps

Circle deploys USDC, CCTP, Wallets, and Contracts on Monad, supporting DeFi apps and secure crosschain payments from day one.

Circle has launched its USDC stablecoin, CCTP, Wallets, and Contracts on Monad, a high-performance Layer-1 blockchain. The integration allows developers to access secure,

LiveBTCNews·11-25 06:19

USDC Supply Growth on Arbitrum: Key Trends and Insights into DeFi Adoption

USDC supply on Arbitrum has seen remarkable expansion, with the stablecoin's market share on the Layer 2 network climbing from 44% to 58% in recent months.

CryptoPulseElite·11-25 06:01

A Whale spent 1.35 million USDC to purchase 37 million MON.

According to Mars Finance news, monitoring by Onchain Lens shows that about 5 hours ago, a Whale spent 1.35 million USDC to purchase 37 million MON at a unit price of 0.036 USD.

MON0.44%

MarsBitNews·11-25 01:17

The European Central Bank warns of the cross-border regulatory arbitrage risks of stablecoins, calling for a unified regulatory framework on a global scale.

According to Mars Finance, the financial stability review preview released by the European Central Bank today (the official report will be published on Wednesday) shows that by 2025, the total market capitalization of stablecoins will exceed 280 billion USD, accounting for about 8% of the entire crypto market. Among them, USDT and USDC together account for nearly 90%, with reserve assets reaching the scale of the top 20 global money market funds. The European Central Bank's report points out that if stablecoins are widely adopted, it may lead households to convert some bank deposits into stablecoin holdings, weakening banks' retail funding sources and increasing financing fluctuations. Although MiCAR has prohibited European issuers from paying interest to curb such transfers, banks are still calling for similar restrictions to be implemented in the U.S. In addition, the rapid rise of stablecoins and their connection to the banking system may also trigger a concentration of fund withdrawals during crises. The report emphasizes the risks of cross-border "multi-issuance mechanisms," warning that EU issuers may struggle to meet global redemption.

MarsBitNews·11-24 10:44

Pump.fun Hits $436M USDC After 53% Revenue Drop Post-October Crypto Crash

Memecoin Platform Pump.fun Moves Over $436 Million in Stablecoins Amid Market Turmoil

Since October’s historic crypto market decline, the Solana-based memecoin launchpad Pump.fun has liquidated more than $436 million in stablecoins, signaling significant cash-outs by its operators. The platform’s l

CryptoBreaking·11-24 10:36

Pump.fun cashed out $436.5 million USDC, PUMP down 24% weekly, sparking a community trust crisis

Since mid-October 2025, the Solana ecosystem meme coin launch platform Pump.fun has continuously extracted $436.5 million USDC stablecoins from the protocol, with $405 million transferred to major CEXs in just the past week. On-chain data shows that these funds mainly originated from the project's private sale of PUMP tokens to institutions in June. As a result, the price of PUMP tokens has plummeted 24% over the past week, now trading at $0.0026, falling below the institutional private sale price of $0.004. This has sparked strong community concerns and accusations that the team is "cashing out and running away."

MarketWhisper·11-24 05:44

A Whale deposited 1 million USDC into HyperLiquid and went long on SOL with 20x leverage.

According to Mars Finance, Onchain Lens monitored that a Whale "0x184" deposited 1 million USDC into HyperLiquid and opened a 20x leveraged long position in SOL.

SOL1.51%

MarsBitNews·11-24 01:15

A newly created Wallet deposited 1.7 million USDC into HyperLiquid and opened a 20x leverage long positions on BTC.

According to Mars Finance, monitoring by the on-chain analysis platform Onchain Lens shows that a newly created Wallet deposited 1.7 million USDC into HyperLiquid and opened a 20x leveraged long position in BTC. The Whale has already made a profit of 705,000 USD in another Wallet.

BTC1.4%

MarsBitNews·11-22 01:47

Binance has completed the integration of USDC (USDC) on the Sei network and has opened deposit and withdrawal services.

According to Mars Finance, Binance has now completed the integration of USDC (USDC) on the Sei network and has opened deposit and withdrawal services. Users can obtain their exclusive Token deposit Address through this page and check the Token's smart contracts Address on the aforementioned network.

SEI1.46%

MarsBitNews·11-21 06:46

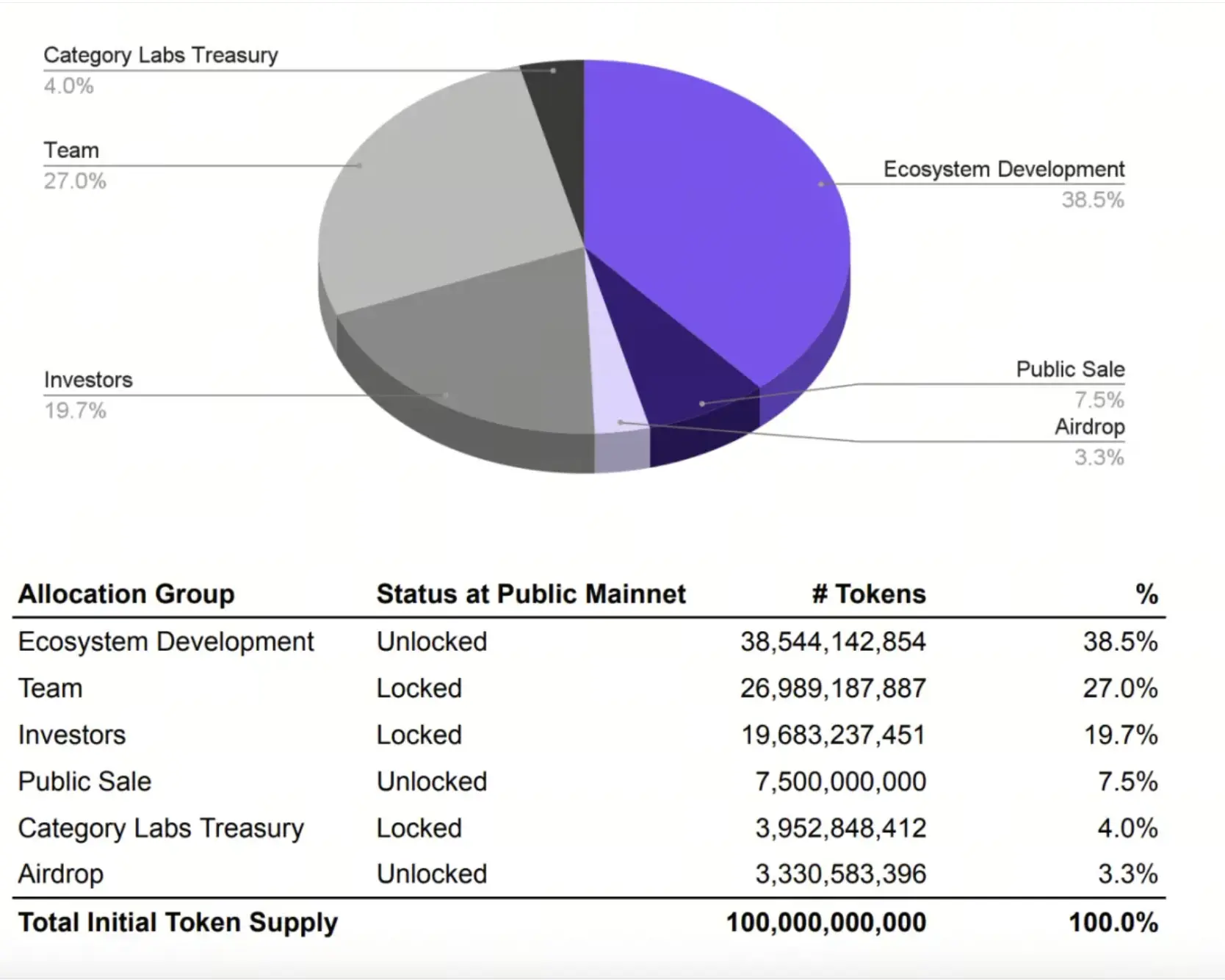

Monad public sale exceeds $140 million! Over $200 million in funding, Layer 1 new star mainnet launching soon

Monad's MON token public sale performed strongly, raising $147.1 million as of November 20, completing 78.4% of the total goal of $187 million. The sale offered 7.5 billion MON tokens at a price of 0.025 USDC each (accounting for 7.5% of the total supply), with a fully diluted valuation of $2.5 billion.

The public sale will end on November 23 at 10:00, followed by the mainnet launch scheduled for November 24. Market expectations for this public sale are positive, with Polymarket prediction platform data showing an 84% probability of reaching a total fundraising amount of $300 million, reflecting strong investor interest in high-performance EVM-compatible Layer 1 solutions.

MarketWhisper·11-21 05:31

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreAbu Dhabi Buluşması

Helium, 10 Aralık'ta Abu Dhabi'de Helium House networking etkinliğine ev sahipliği yapacak ve bu etkinlik, 11-13 Aralık tarihlerinde düzenlenecek olan Solana Breakpoint konferansının öncesi olarak konumlandırılacak. Tek günlük toplantıda, Helium ekosistemindeki profesyonel ağ kurma, fikir alışverişi ve topluluk tartışmalarına odaklanılacak.

2025-12-09

Hayabusa Yükseltmesi

VeChain, Aralık ayında planlanan Hayabusa yükseltmesini duyurdu. Bu yükseltmenin, protokol performansını ve tokenomi'yi önemli ölçüde artırmayı hedeflediği belirtiliyor ve ekip, bu güncellemeyi bugüne kadarki en çok fayda odaklı VeChain sürümü olarak nitelendiriyor.

2025-12-27

Litewallet Gün Batımları

Litecoin Vakfı, Litewallet uygulamasının 31 Aralık'ta resmi olarak sona ereceğini duyurdu. Uygulama artık aktif olarak korunmamakta olup, bu tarihe kadar yalnızca kritik hata düzeltmeleri yapılacaktır. Destek sohbeti de bu tarihten sonra sona erecektir. Kullanıcıların Nexus Cüzdan'a geçiş yapmaları teşvik edilmektedir; Litewallet içinde geçiş araçları ve adım adım bir kılavuz sağlanmıştır.

2025-12-30

OM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27