BlackRock’s Bitcoin ETF Sees $114 Million Net Outflows — Are Institutions Pulling Back?

Overview: Net Capital Outflow Summary

Chart: https://farside.co.uk/btc/

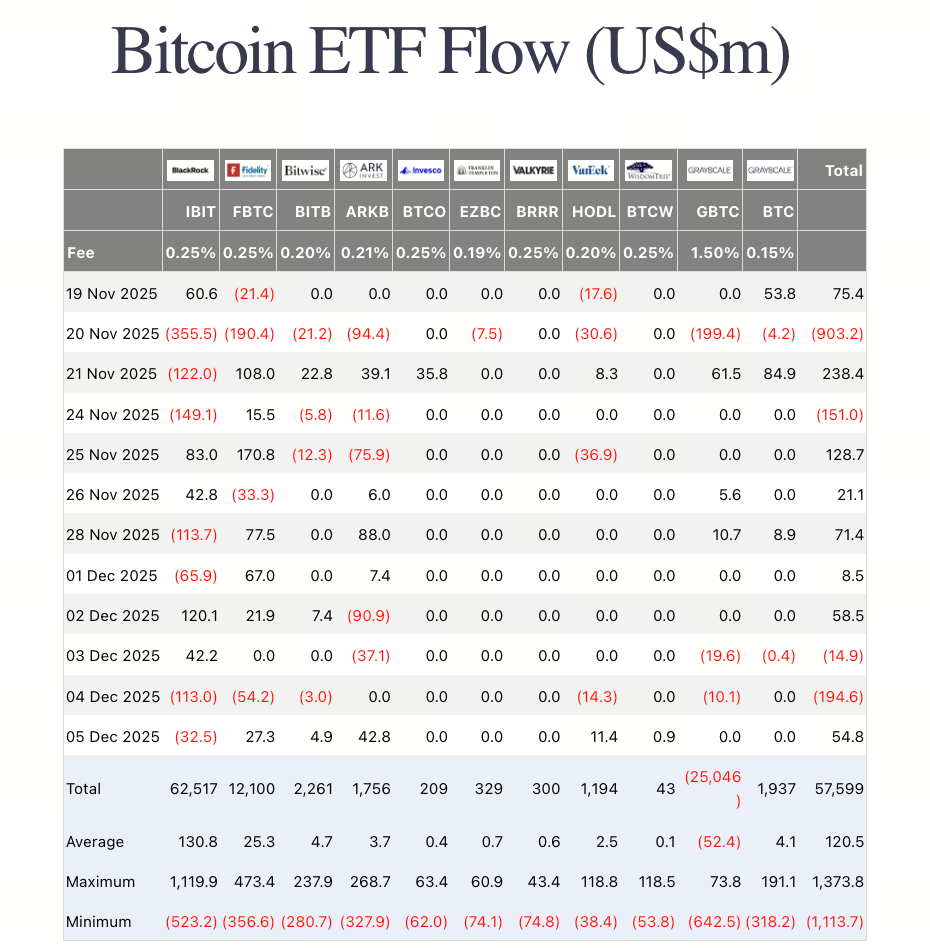

Recent data shows that BlackRock’s iShares Bitcoin ETF (IBIT) experienced a net outflow of roughly $114 million in a single trading day. This represents one of the largest single-day net redemptions in recent memory and has heightened market concerns about the outlook for digital assets. At the same time, reports indicate that the combined net outflow from all US spot Bitcoin ETFs on that day reached approximately $194.6 million.

Background: Why This ETF Was Once Highly Regarded

Since its launch in January 2024, IBIT has demonstrated strong capital inflows. In less than a year, its net asset value surpassed several billion dollars, establishing itself as a key channel for institutional investors seeking Bitcoin exposure. Many expected this product to bridge the gap between traditional finance and digital assets, making Bitcoin part of mainstream asset allocation. At its peak, IBIT was considered a trailblazer for Wall Street capital entering the Bitcoin ecosystem.

Factors Driving the Recent Net Outflows

What triggered the sudden capital outflows? Possible factors include:

- Shift in market sentiment: Significant volatility in Bitcoin and other cryptocurrencies, combined with global macroeconomic and interest rate uncertainty, has made institutional investors more cautious about high-risk, high-volatility Bitcoin exposure.

- Profit-taking and risk management: Early investors saw substantial gains as Bitcoin rallied, so some chose to redeem now to lock in profits. Some analysts describe this capital movement as “rotation, not panic.”

- Attraction of alternative assets: Media reports suggest that other crypto assets (such as Ethereum) or yield-generating investment vehicles are drawing more capital, diverting attention from Bitcoin ETFs.

Impact on the Bitcoin Market and Price

This large-scale net outflow could significantly impact both market confidence and Bitcoin’s price. First, it signals that some institutions are reducing their exposure, indicating a less optimistic short-term outlook. Second, ETF redemptions typically require selling the underlying Bitcoin, which can add selling pressure to the spot market.

This trend is evident across the broader Bitcoin ETF market. Reports show that over the past month alone, US spot Bitcoin ETFs have seen total net outflows in the billions of dollars. For investors, this could mean Bitcoin is at a critical crossroads: will the bear market persist, or is a rebound possible after a short-term correction?

How Should Investors Respond?

For those focused on Bitcoin and digital assets, consider the following strategies:

- If you already hold Bitcoin ETFs, assess your risk tolerance and investment objectives to determine if you should adjust your positions.

- If you have a long-term outlook, watch for signs that institutions are accumulating at lower prices in anticipation of a rebound.

- If you have a low risk tolerance, consider diversifying or allocating part of your portfolio to yield-generating assets.

- Most importantly, avoid following the crowd blindly. ETF outflows do not necessarily signal a prolonged bear market; they may simply reflect short-term capital rotation.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Pi Coin Transaction Guide: How to Transfer to Gate.com

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution