TradeDots

لا يوجد محتوى حتى الآن

TradeDots

$PYPL: حديث عن استحواذ ودمج Stripe

المشاعر: محايدة

'''تقول التقارير إن Stripe تستكشف صفقة لشراء بعض أو كل PayPal، على الرغم من أن المحادثات توصف بأنها في مرحلة مبكرة جدًا وقد لا تحدث (نقطة_المشاعر: 0.282). الرأي: حتى التكهنات الأولية بشأن عمليات الاستحواذ والاندماج يمكن أن تعزز المعنويات، لكنها تسلط الضوء أيضًا على الضغط التنافسي في مجال المدفوعات والعقبات المحتملة فيما يخص التقييم أو مكافحة الاحتكار.'''

شاهد النسخة الأصليةالمشاعر: محايدة

'''تقول التقارير إن Stripe تستكشف صفقة لشراء بعض أو كل PayPal، على الرغم من أن المحادثات توصف بأنها في مرحلة مبكرة جدًا وقد لا تحدث (نقطة_المشاعر: 0.282). الرأي: حتى التكهنات الأولية بشأن عمليات الاستحواذ والاندماج يمكن أن تعزز المعنويات، لكنها تسلط الضوء أيضًا على الضغط التنافسي في مجال المدفوعات والعقبات المحتملة فيما يخص التقييم أو مكافحة الاحتكار.'''

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

$AMD: ميتا AI تنفق بشكل كبير

المعطى: إيجابي

'''تخطط ميتا لإنفاق "مليارات ذات رقمين" على معدات مراكز البيانات المعتمدة على AMD، مما يشير إلى دعم الطلب على AMD في بناء بنية تحتية للذكاء الاصطناعي (تقييم المشاعر: 0.3). الرأي: الالتزامات الكبيرة والمعروفة من قبل شركات الحوسبة السحابية يمكن أن تحسن رؤية الإيرادات، لكن التسعير/الهامش وموعد النشر سيكونان أكثر أهمية من الأرقام الرئيسية.'''

شاهد النسخة الأصليةالمعطى: إيجابي

'''تخطط ميتا لإنفاق "مليارات ذات رقمين" على معدات مراكز البيانات المعتمدة على AMD، مما يشير إلى دعم الطلب على AMD في بناء بنية تحتية للذكاء الاصطناعي (تقييم المشاعر: 0.3). الرأي: الالتزامات الكبيرة والمعروفة من قبل شركات الحوسبة السحابية يمكن أن تحسن رؤية الإيرادات، لكن التسعير/الهامش وموعد النشر سيكونان أكثر أهمية من الأرقام الرئيسية.'''

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

$AVGO: مراكز شرائح BroadPeak من Broadcom للجيل الخامس المتقدم / الجيل السادس

المعطى: إيجابي

'''تستهدف شرائح BroadPeak من Broadcom الجيل الخامس المتقدم والجيل السادس مع ادعاء تقليل استهلاك الطاقة بنسبة 40%، مما يتماشى مع دورات ترقية المشغلين ومتطلبات الكفاءة. الزاوية الاستراتيجية هي الاختيارية: خرائط طريق الاتصال تضيف رافعة نمو ثانية بجانب زخم أشباه الموصلات المدفوع بالذكاء الاصطناعي.'''

شاهد النسخة الأصليةالمعطى: إيجابي

'''تستهدف شرائح BroadPeak من Broadcom الجيل الخامس المتقدم والجيل السادس مع ادعاء تقليل استهلاك الطاقة بنسبة 40%، مما يتماشى مع دورات ترقية المشغلين ومتطلبات الكفاءة. الزاوية الاستراتيجية هي الاختيارية: خرائط طريق الاتصال تضيف رافعة نمو ثانية بجانب زخم أشباه الموصلات المدفوع بالذكاء الاصطناعي.'''

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

$CRM: انتعاش في البرمجيات مرتبط بشراكات أنثروبيك

المعنويات: محايد

'''ذكرت رويترز أن أسهم البرمجيات الأمريكية انتعشت بعد أن أثار إعلان أنثروبيك انتعاشًا في السوق بين الشركاء، مما يشير إلى أن المعنويات تستقر بعد أن ضغطت مخاوف اضطراب الذكاء الاصطناعي على المجموعة. يبدو أن التحرك أكثر اعتمادًا على التمركز/المعنويات منه على إعادة تقييم أساسية من التغييرات المالية المعلنة.'''

شاهد النسخة الأصليةالمعنويات: محايد

'''ذكرت رويترز أن أسهم البرمجيات الأمريكية انتعشت بعد أن أثار إعلان أنثروبيك انتعاشًا في السوق بين الشركاء، مما يشير إلى أن المعنويات تستقر بعد أن ضغطت مخاوف اضطراب الذكاء الاصطناعي على المجموعة. يبدو أن التحرك أكثر اعتمادًا على التمركز/المعنويات منه على إعادة تقييم أساسية من التغييرات المالية المعلنة.'''

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

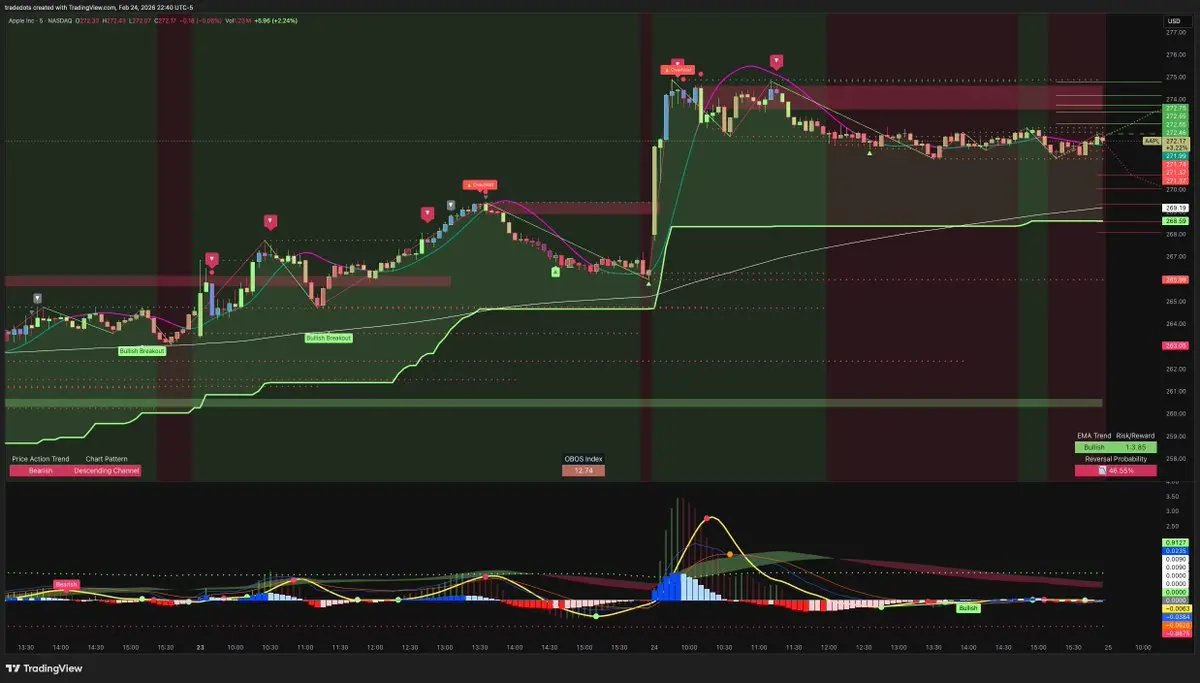

$AAPL: زخم الخدمات مقابل مناقشة تركيز الصين

المعطى: محايد

'''لا تزال رواية خدمات آبل محتوى، ألعاب، ترقيات إيجابية، لكن المساهمين رفضوا اقتراحًا يطلب تقريرًا عن الاعتماد على التصنيع في الصين، مع إبقاء التركيز على الجغرافيا السياسية وسلسلة التوريد. على نحو منفصل، تشير تقارير توسيع إنتاج ماك ميني في الولايات المتحدة إلى تنويع تدريجي، وليس فصلًا فوريًا.'''

شاهد النسخة الأصليةالمعطى: محايد

'''لا تزال رواية خدمات آبل محتوى، ألعاب، ترقيات إيجابية، لكن المساهمين رفضوا اقتراحًا يطلب تقريرًا عن الاعتماد على التصنيع في الصين، مع إبقاء التركيز على الجغرافيا السياسية وسلسلة التوريد. على نحو منفصل، تشير تقارير توسيع إنتاج ماك ميني في الولايات المتحدة إلى تنويع تدريجي، وليس فصلًا فوريًا.'''

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

$JPM: دايمون يحذر من دورة الائتمان

المعطيات: سلبية

'''قال الرئيس التنفيذي لبنك جي بي مورغان جيامي دايمون إنه يرى تشابهات مع فترة ما قبل 2008 مع دفع المنافسة إلى التسرع في إقراض، محذرًا من أن هناك "دوماً مفاجأة" في دورة الائتمان (نقطة_التقييم: -0.676). الرأي: يمكن أن يؤثر التعليق على معنويات البنوك بشكل عام من خلال الإيحاء بأن هناك تشديدًا في عمليات الإقراض المستقبلية / زيادة مخاطر الخسارة إذا تدهرت الظروف.'''

شاهد النسخة الأصليةالمعطيات: سلبية

'''قال الرئيس التنفيذي لبنك جي بي مورغان جيامي دايمون إنه يرى تشابهات مع فترة ما قبل 2008 مع دفع المنافسة إلى التسرع في إقراض، محذرًا من أن هناك "دوماً مفاجأة" في دورة الائتمان (نقطة_التقييم: -0.676). الرأي: يمكن أن يؤثر التعليق على معنويات البنوك بشكل عام من خلال الإيحاء بأن هناك تشديدًا في عمليات الإقراض المستقبلية / زيادة مخاطر الخسارة إذا تدهرت الظروف.'''

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

$MELI: ارتفاع مفاجئ في نمو الربع الرابع

المعنويات: إيجابية

'''أعلنت Mercado Libre عن إيرادات صافية ودخل مالي للربع الرابع من عام 2025 بقيمة 8.8 مليار دولار (+45% على أساس سنوي) وقالت إن إيرادات السنة الكاملة زادت بنسبة 39% على أساس سنوي، مشيرة إلى الاستثمارات الاستراتيجية التي تعزز من موقعها في السوق (sentimentScore: 0.3). الرأي: التسارع المستمر في النمو الأعلى يشير إلى مكاسب في الحصة السوقية، لكن المستثمرين سيراقبون ما إذا كانت كثافة الاستثمار ستضغط أو توسع الرافعة التشغيلية.'''

شاهد النسخة الأصليةالمعنويات: إيجابية

'''أعلنت Mercado Libre عن إيرادات صافية ودخل مالي للربع الرابع من عام 2025 بقيمة 8.8 مليار دولار (+45% على أساس سنوي) وقالت إن إيرادات السنة الكاملة زادت بنسبة 39% على أساس سنوي، مشيرة إلى الاستثمارات الاستراتيجية التي تعزز من موقعها في السوق (sentimentScore: 0.3). الرأي: التسارع المستمر في النمو الأعلى يشير إلى مكاسب في الحصة السوقية، لكن المستثمرين سيراقبون ما إذا كانت كثافة الاستثمار ستضغط أو توسع الرافعة التشغيلية.'''

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

أفضل المتحركين اليوم (التداول اليومي %)

$AMD شركة Advanced Micro Devices (+8.77%)

$GEV شركة GE Vernova (+5.77%)

$INTC شركة Intel (+5.71%)

$GLW شركة Corning (+4.36%)

$TSM شركة Taiwan Semiconductor Manufacturing (+4.25%)

$CRM شركة Salesforce (+4.07%)

$ARM شركة Arm Holdings (+3.52%)

$ORCL شركة Oracle (+3.42%)

$ETN شركة Eaton (+3.46%)

$SFTBY شركة SoftBank (−3.37%)

شاهد النسخة الأصلية$AMD شركة Advanced Micro Devices (+8.77%)

$GEV شركة GE Vernova (+5.77%)

$INTC شركة Intel (+5.71%)

$GLW شركة Corning (+4.36%)

$TSM شركة Taiwan Semiconductor Manufacturing (+4.25%)

$CRM شركة Salesforce (+4.07%)

$ARM شركة Arm Holdings (+3.52%)

$ORCL شركة Oracle (+3.42%)

$ETN شركة Eaton (+3.46%)

$SFTBY شركة SoftBank (−3.37%)

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

أفضل المتحركات بعد السوق (Post-market %)

$AXON شركة أكسون (+16.20%)

$WLK ويستليك (+7.19%)

$BBIO بريدج بايو فارما (+3.57%)

$KRMN كارمان هولدينغز (+3.22%)

$ICE بورصة إنتركونتيننتال (−3.33%)

$SMFG مجموعة سوميتومو ميتسوي المالية (−3.58%)

$ALC ألكون (−4.31%)

$TEM تيمبوس AI (−4.33%)

$HPQ إتش بي (−5.75%)

$CSGP مجموعة كوستار (−7.28%)

شاهد النسخة الأصلية$AXON شركة أكسون (+16.20%)

$WLK ويستليك (+7.19%)

$BBIO بريدج بايو فارما (+3.57%)

$KRMN كارمان هولدينغز (+3.22%)

$ICE بورصة إنتركونتيننتال (−3.33%)

$SMFG مجموعة سوميتومو ميتسوي المالية (−3.58%)

$ALC ألكون (−4.31%)

$TEM تيمبوس AI (−4.33%)

$HPQ إتش بي (−5.75%)

$CSGP مجموعة كوستار (−7.28%)

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

أفضل المتحركين اليوم (Intraday %)

$LLY إيلي ليلي (+4.86%)

$MSFT مايكروسوفت (−3.21%)

$GS غولدمان ساكس (−3.25%)

$NFLX نتفليكس (−3.37%)

$PLTR بالانتير (−3.43%)

$BAC بنك أوف أمريكا (−3.75%)

$JPM جي بي مورغان تشيس (−4.22%)

$V فيزا (−4.50%)

$MS مورغان ستانلي (−4.91%)

$MA ماستركارد (−5.77%)

شاهد النسخة الأصلية$LLY إيلي ليلي (+4.86%)

$MSFT مايكروسوفت (−3.21%)

$GS غولدمان ساكس (−3.25%)

$NFLX نتفليكس (−3.37%)

$PLTR بالانتير (−3.43%)

$BAC بنك أوف أمريكا (−3.75%)

$JPM جي بي مورغان تشيس (−4.22%)

$V فيزا (−4.50%)

$MS مورغان ستانلي (−4.91%)

$MA ماستركارد (−5.77%)

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

أفضل المتحركات بعد السوق (نسبة التغير بعد السوق )

$KEYS شركة كايزانت تكنولوجيز (+15.47%)

$TARS شركة تاروس للأدوية (+9.21%)

$TDC شركة تيراداتا (+5.58%)

$ESI شركة إليمنت سوليوشنز (+4.23%)

$KT شركة كي تي (−3.81%)

$PAY شركة بيمنتيوس (−4.01%)

$KTOS شركة كراتوس للدفاع والأمن (−3.06%)

$DRI شركة داردن للمطاعم (−6.66%)

$HIMS شركة هيمز وهيرز هيلث (−8.58%)

$UCTT شركة ألترا كلين هولدينجز (−10.44%)

شاهد النسخة الأصلية$KEYS شركة كايزانت تكنولوجيز (+15.47%)

$TARS شركة تاروس للأدوية (+9.21%)

$TDC شركة تيراداتا (+5.58%)

$ESI شركة إليمنت سوليوشنز (+4.23%)

$KT شركة كي تي (−3.81%)

$PAY شركة بيمنتيوس (−4.01%)

$KTOS شركة كراتوس للدفاع والأمن (−3.06%)

$DRI شركة داردن للمطاعم (−6.66%)

$HIMS شركة هيمز وهيرز هيلث (−8.58%)

$UCTT شركة ألترا كلين هولدينجز (−10.44%)

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

$JNJ: تقدم سريري

المعنى: إيجابي

'''أظهرت دراسة المرحلة الثانية لشركة جونسون آند جونسون لدواء مناعي جديد استجابة إجمالية بنسبة 56% في علاجات السرطان من الخط الأول.'''

رؤية: تعزز البيانات السريرية الواعدة من قوة البحث والتطوير لدى J&J، مما يحسن معنويات المستثمرين على المدى الطويل.

شاهد النسخة الأصليةالمعنى: إيجابي

'''أظهرت دراسة المرحلة الثانية لشركة جونسون آند جونسون لدواء مناعي جديد استجابة إجمالية بنسبة 56% في علاجات السرطان من الخط الأول.'''

رؤية: تعزز البيانات السريرية الواعدة من قوة البحث والتطوير لدى J&J، مما يحسن معنويات المستثمرين على المدى الطويل.

- أعجبني

- 2

- تعليق

- إعادة النشر

- مشاركة

$AAPL: الابتكار وسط التدقيق

المعنى: مختلط

'''أبل تضيف ميزات الذكاء الاصطناعي التوليدي لكنها تواجه إجراءات قانونية بسبب سوء استخدام مزعوم لـ iCloud لتخزين محتوى CSAM.'''

رؤية: التقدم في دمج الذكاء الاصطناعي يعزز التوقعات، ومع ذلك قد تحد العقبات القانونية من إمكانيات الارتفاع.

شاهد النسخة الأصليةالمعنى: مختلط

'''أبل تضيف ميزات الذكاء الاصطناعي التوليدي لكنها تواجه إجراءات قانونية بسبب سوء استخدام مزعوم لـ iCloud لتخزين محتوى CSAM.'''

رؤية: التقدم في دمج الذكاء الاصطناعي يعزز التوقعات، ومع ذلك قد تحد العقبات القانونية من إمكانيات الارتفاع.

- أعجبني

- 2

- تعليق

- إعادة النشر

- مشاركة

$NVDA: توقعات عالية في المستقبل

المعنى: محايد

'''من المتوقع أن يظهر تقرير أرباح NVIDIA للربع الرابع من عام 2026 أداءً قويًا، متأثرًا بطلب الذكاء الاصطناعي.'''

رؤية: تراجع الزخم في سعر السهم يعكس زيادة الضغط لتحقيق آمال المستثمرين العالية.

شاهد النسخة الأصليةالمعنى: محايد

'''من المتوقع أن يظهر تقرير أرباح NVIDIA للربع الرابع من عام 2026 أداءً قويًا، متأثرًا بطلب الذكاء الاصطناعي.'''

رؤية: تراجع الزخم في سعر السهم يعكس زيادة الضغط لتحقيق آمال المستثمرين العالية.

- أعجبني

- 2

- تعليق

- إعادة النشر

- مشاركة

$GPRO: انتقال القيادة

المعنى: إيجابي

'''شركة GoPro تعين بريان تراتت كمدير مالي كجزء من التحولات الاستراتيجية الداخلية.'''

رؤية: تغييرات القيادة تشير إلى التركيز على إعادة الهيكلة الداخلية وإدارة النمو على المدى الطويل.

شاهد النسخة الأصليةالمعنى: إيجابي

'''شركة GoPro تعين بريان تراتت كمدير مالي كجزء من التحولات الاستراتيجية الداخلية.'''

رؤية: تغييرات القيادة تشير إلى التركيز على إعادة الهيكلة الداخلية وإدارة النمو على المدى الطويل.

- أعجبني

- 2

- تعليق

- إعادة النشر

- مشاركة

$META: مواجهة الشكوك السوقية

المعنى: محايد

'''ميتافيس يثير ردود فعل متباينة بشأن نفقات رأس المال المركزة على الذكاء الاصطناعي دون تآزر واضح مع السحابة، مع تعويض ذلك بدمج قوي للإعلانات.'''

شاهد النسخة الأصليةالمعنى: محايد

'''ميتافيس يثير ردود فعل متباينة بشأن نفقات رأس المال المركزة على الذكاء الاصطناعي دون تآزر واضح مع السحابة، مع تعويض ذلك بدمج قوي للإعلانات.'''

- أعجبني

- 2

- تعليق

- إعادة النشر

- مشاركة

$TSLA: جدل حول الروبوتاكسي

المعنى: سلبي

'''تنتقد تسلا وايمو وسط التدقيق حول استخدام العمال عن بُعد لمراقبة روبوتاكسياتها، مع التركيز على النقاش التنظيمي في كاليفورنيا.'''

شاهد النسخة الأصليةالمعنى: سلبي

'''تنتقد تسلا وايمو وسط التدقيق حول استخدام العمال عن بُعد لمراقبة روبوتاكسياتها، مع التركيز على النقاش التنظيمي في كاليفورنيا.'''

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

$DE: أرقام قياسية في الآلات

المعنويات: إيجابية جدًا

'''تواصل شركة ديير تحقيق أعلى المستويات على الإطلاق، مما يعكس زخمًا صعوديًا مرتبطًا بقطاعات الزراعة والبناء.'''

رؤية: يعكس استمرار الطلب المتزايد إمكانات التوسع على المدى الطويل لاستثمارات الآلات.

شاهد النسخة الأصليةالمعنويات: إيجابية جدًا

'''تواصل شركة ديير تحقيق أعلى المستويات على الإطلاق، مما يعكس زخمًا صعوديًا مرتبطًا بقطاعات الزراعة والبناء.'''

رؤية: يعكس استمرار الطلب المتزايد إمكانات التوسع على المدى الطويل لاستثمارات الآلات.

- أعجبني

- 2

- تعليق

- إعادة النشر

- مشاركة

أفضل التحركات اليوم (داخل اليوم %)

$DE ديير (+11.58%)

$PWR كانت الخدمات (+6.68%)

$SO ساوثن (+4.40%)

$SNDK سانديسك (+3.45%)

$SOMN جمعة سومون (+3.28%)

$MTSUY ميتسوبيشي (+3.21%)

$PBR بتروبراس (+3.07%)

$BTI التدخين البريطاني الأمريكي (+3.60%)

$ACN أكسنتور (−3.87%)

$WDC ويسترن ديجيتال (−4.01%)

شاهد النسخة الأصلية$DE ديير (+11.58%)

$PWR كانت الخدمات (+6.68%)

$SO ساوثن (+4.40%)

$SNDK سانديسك (+3.45%)

$SOMN جمعة سومون (+3.28%)

$MTSUY ميتسوبيشي (+3.21%)

$PBR بتروبراس (+3.07%)

$BTI التدخين البريطاني الأمريكي (+3.60%)

$ACN أكسنتور (−3.87%)

$WDC ويسترن ديجيتال (−4.01%)

- أعجبني

- 2

- تعليق

- إعادة النشر

- مشاركة

$RIVN: التوسع في إنتاج السيارات الكهربائية

المعنويات: إيجابية

'''أعلنت شركة ريفيان عن خطط لزيادة الإنتاج إلى 67,000 سيارة كهربائية هذا العام مع نمو كبير في النفقات الرأسمالية، مما يثير حماس المستثمرين حول قدرتها على التوسع.'''

شاهد النسخة الأصليةالمعنويات: إيجابية

'''أعلنت شركة ريفيان عن خطط لزيادة الإنتاج إلى 67,000 سيارة كهربائية هذا العام مع نمو كبير في النفقات الرأسمالية، مما يثير حماس المستثمرين حول قدرتها على التوسع.'''

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

المواضيع الرائجة

عرض المزيد69.94K درجة الشعبية

163.64K درجة الشعبية

40.81K درجة الشعبية

7.57K درجة الشعبية

417.01K درجة الشعبية

Gate Fun الساخن

عرض المزيد- 1

🦅

宝宝

القيمة السوقية:$0.1عدد الحائزين:10.00% - القيمة السوقية:$2.37Kعدد الحائزين:20.00%

- القيمة السوقية:$2.39Kعدد الحائزين:20.00%

- القيمة السوقية:$0.1عدد الحائزين:10.00%

- القيمة السوقية:$0.1عدد الحائزين:10.00%

تثبيت