#BitcoinDropsBelow$65K 🔥 بيتكوين تتراجع دون $65K — غوص عميق في فبراير 2026 🔥

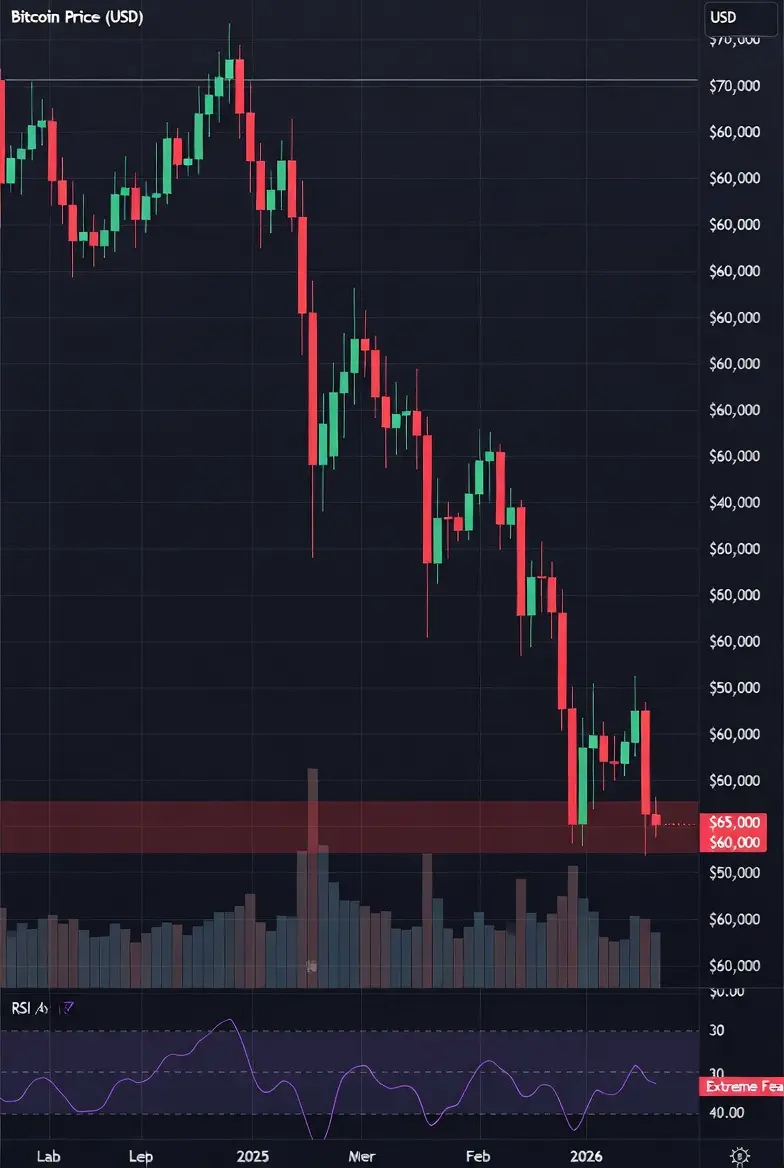

لقد كسر البيتكوين للتو مستوى الدعم الحرج عند 65,000 دولار في أوائل فبراير 2026، مما يشير إلى تصعيد كبير في الانسحاب المستمر من أعلى مستويات سوق الثور لعام 2025 بالقرب من 126,000 دولار. هذا الاختراق لا يمثل فقط ضربة نفسية للمتداولين، بل هو انهيار فني رئيسي قد يشكل سلوك السوق على المدى القصير.

حاليًا، يتداول البيتكوين حول 69,000 دولار بعد أن انخفض مؤقتًا بالقرب من 60,000 دولار في وقت سابق من الأسبوع، مع تقارير عن انخفاضات دون 61,000 دولار في 5 فبراير. يعكس ذلك انخفاضًا بنحو 45-50% من أعلى مستويات أكتوبر/نوفمبر 2025، مما يمحو معظم المكاسب التي تحققت بعد الانتخابات ويجبر السوق على مرحلة إعادة ضبط مؤلمة. حجم هذا التصحيح يذكر الجميع بأن الارتفاعات الأُرُبُعِيَّة السريعة غالبًا ما تواجه تصحيحات حادة بالمثل.

كان مستوى $65K منطقة دعم حاسمة يراقبها كل من المتداولين الأفراد والمؤسسات. كسرها أدى إلى تفعيل أوامر وقف الخسارة المتتالية وأجبر عمليات التصفية، مما زاد من ضغط البيع. المتداولون الذين كانوا يمتلكون مراكز طويلة ويعتمدون على هذا الدعم وجدوا أنفسهم مضغوطين، مما أدى إلى تسريع الهبوط وتقلبات شديدة في جلسات التداول الداخلية.

عدة عوامل رئيسية دفعت هذا الانهيار. سيطرة جني الأرباح بعد ارتفاع 2025 المفرح، المدعوم بتفاؤل بسياسات داعمة للعملات الرقمية وحماس كبير من المتداولين الأفراد. بدأ المراكز الطويلة المفرطة التمدد في التصفية بشكل عنيف بالقرب من 70-80 ألف دولار، مما خلق تأثير الدومينو الذي انتشر عبر السوق.

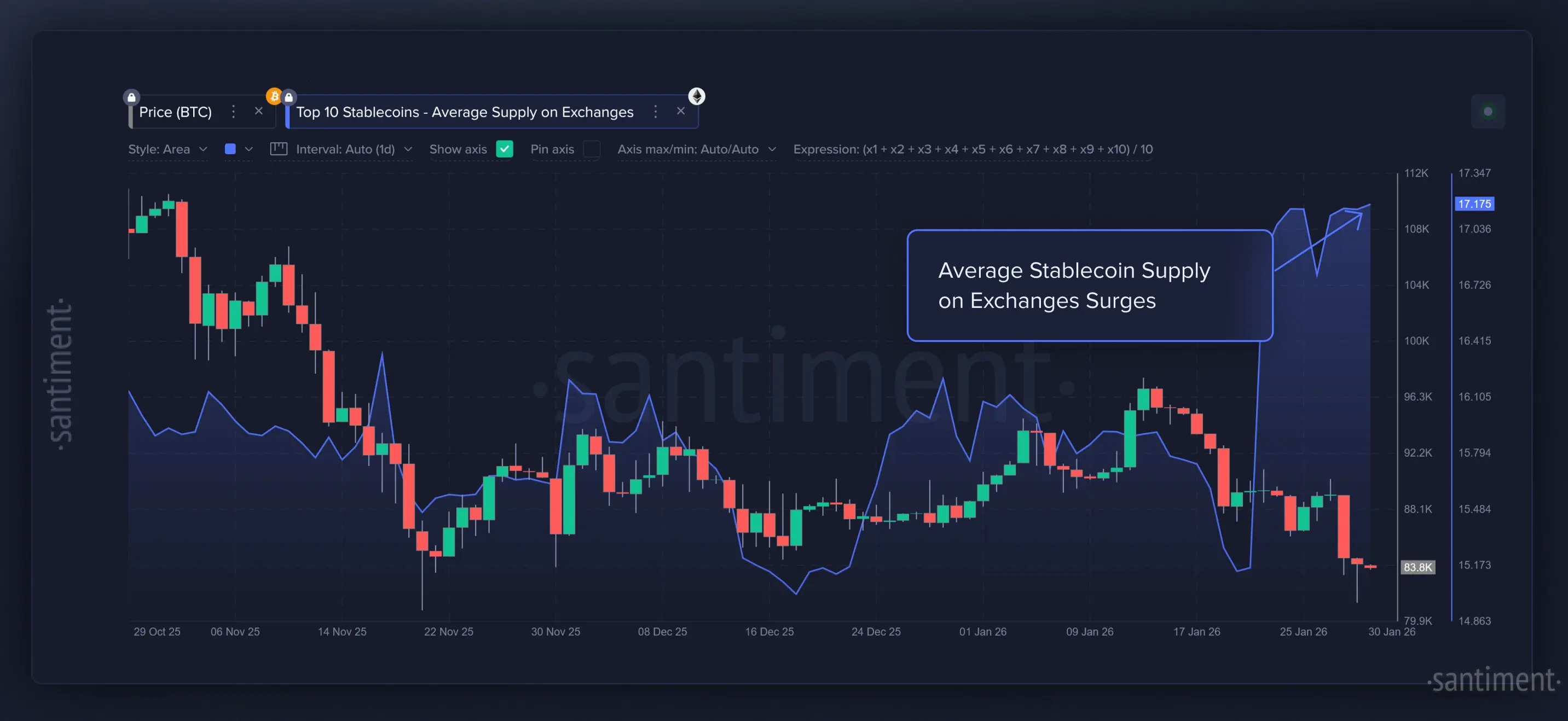

عامل رئيسي آخر كان سلسلة التصفية. بلغت الخسائر المحققة حوالي 3.2 مليار دولار في يوم واحد، مع تدمير المراكز المقترنة بالرافعة المالية بشكل جماعي. تدفقات العملات المستقرة الكبيرة أدت إلى استنزاف السيولة أكثر، مما يعني أن أوامر البيع الصغيرة كان لها تأثيرات كبيرة على السعر، مما أدى إلى تقلبات مبالغ فيها.

ديناميكيات المؤسسات أضافت ضغطًا. شهدت صناديق ETF للبيتكوين والإيثيريوم الفورية تدفقات خارجة كبيرة خلال الأسابيع والأشهر الأخيرة. بدأت الصناديق التي دخلت بشكل مكثف خلال دورة ارتفاع 2025 في الخروج أو التحوط وسط تزايد عدم اليقين الاقتصادي الكلي. هذا يمثل واحدة من أولى حلقات الضغط الهبوطي المدفوع بصناديق ETF، مما يبرز كيف تؤثر القنوات المالية التقليدية الآن على تقلبات سوق العملات الرقمية.

زادت الرياح المعاكسة الاقتصادية من وتيرة الانسحاب. الدولار الأمريكي الأقوى، التوترات الجيوسياسية، التصحيحات الحادة في الذهب والفضة، ضعف أسهم التكنولوجيا، وإشارات الاحتياطي الفيدرالي المتشددة كلها ساهمت في شعور أوسع بالمخاطر. في مثل هذا البيئة، أصبحت العملات الرقمية، كأصل مخاطرة، هدفًا رئيسيًا للتصفية وتدوير المحافظ.

سيولة التداول ضعيفة مقارنة بأوج 2025. الحجم المنخفض يعزز تقلبات السعر، مما يجعل التحركات تبدو أكثر عنفًا مما قد تكون عليه في سوق أعمق. كما أن المعنويات انقلبت بشكل حاد: مؤشر الخوف والجشع انخفض إلى مناطق الخوف الشديد (قراءات رقمية منخفضة)، مما يشير إلى أن معظم المتداولين إما يستسلمون أو يجلسون على الخطوط الجانبية.

بالنظر إلى المستقبل، هناك مساران رئيسيان للبيتكوين. في سيناريو التعافي الصاعد، قد يشير الاستقرار حول المستويات الحالية أو الارتداد فوق 70 ألف دولار–$71K إلى أن التعبئة البيعية قد انتهت، مما يهيئ قاعدة تصحيح صحية قبل الحركة الصاعدة التالية. بدلاً من ذلك، في سيناريو تصحيح أعمق، تشير مستويات الدعم المكسورة إلى 62 ألف دولار، 58-60 ألف دولار، وربما $54K إذا تسارع الذعر، يمتد شعور "شتاء العملات الرقمية" على المدى القصير.

المتداولون والمستثمرون يركزون على الحفاظ على رأس المال. يستخدم المتداولون على المدى القصير أوامر وقف محكمة، ورافعة منخفضة أو معدومة، وينتظرون إشارات انعكاس مدعومة بالحجم مثل ارتفاع القمم أو انخفاض القيعان. قد يختار حاملو المراكز طويلة الأمد التدرج في الشراء عند الانخفاضات، معتبرين ذلك تصحيحًا في منتصف الدورة وليس نهاية الدورة. الصبر والانضباط وإدارة المخاطر تظل الأدوات الأقوى في التنقل عبر هذا البيئة المتقلبة.

لقد كسر البيتكوين للتو مستوى الدعم الحرج عند 65,000 دولار في أوائل فبراير 2026، مما يشير إلى تصعيد كبير في الانسحاب المستمر من أعلى مستويات سوق الثور لعام 2025 بالقرب من 126,000 دولار. هذا الاختراق لا يمثل فقط ضربة نفسية للمتداولين، بل هو انهيار فني رئيسي قد يشكل سلوك السوق على المدى القصير.

حاليًا، يتداول البيتكوين حول 69,000 دولار بعد أن انخفض مؤقتًا بالقرب من 60,000 دولار في وقت سابق من الأسبوع، مع تقارير عن انخفاضات دون 61,000 دولار في 5 فبراير. يعكس ذلك انخفاضًا بنحو 45-50% من أعلى مستويات أكتوبر/نوفمبر 2025، مما يمحو معظم المكاسب التي تحققت بعد الانتخابات ويجبر السوق على مرحلة إعادة ضبط مؤلمة. حجم هذا التصحيح يذكر الجميع بأن الارتفاعات الأُرُبُعِيَّة السريعة غالبًا ما تواجه تصحيحات حادة بالمثل.

كان مستوى $65K منطقة دعم حاسمة يراقبها كل من المتداولين الأفراد والمؤسسات. كسرها أدى إلى تفعيل أوامر وقف الخسارة المتتالية وأجبر عمليات التصفية، مما زاد من ضغط البيع. المتداولون الذين كانوا يمتلكون مراكز طويلة ويعتمدون على هذا الدعم وجدوا أنفسهم مضغوطين، مما أدى إلى تسريع الهبوط وتقلبات شديدة في جلسات التداول الداخلية.

عدة عوامل رئيسية دفعت هذا الانهيار. سيطرة جني الأرباح بعد ارتفاع 2025 المفرح، المدعوم بتفاؤل بسياسات داعمة للعملات الرقمية وحماس كبير من المتداولين الأفراد. بدأ المراكز الطويلة المفرطة التمدد في التصفية بشكل عنيف بالقرب من 70-80 ألف دولار، مما خلق تأثير الدومينو الذي انتشر عبر السوق.

عامل رئيسي آخر كان سلسلة التصفية. بلغت الخسائر المحققة حوالي 3.2 مليار دولار في يوم واحد، مع تدمير المراكز المقترنة بالرافعة المالية بشكل جماعي. تدفقات العملات المستقرة الكبيرة أدت إلى استنزاف السيولة أكثر، مما يعني أن أوامر البيع الصغيرة كان لها تأثيرات كبيرة على السعر، مما أدى إلى تقلبات مبالغ فيها.

ديناميكيات المؤسسات أضافت ضغطًا. شهدت صناديق ETF للبيتكوين والإيثيريوم الفورية تدفقات خارجة كبيرة خلال الأسابيع والأشهر الأخيرة. بدأت الصناديق التي دخلت بشكل مكثف خلال دورة ارتفاع 2025 في الخروج أو التحوط وسط تزايد عدم اليقين الاقتصادي الكلي. هذا يمثل واحدة من أولى حلقات الضغط الهبوطي المدفوع بصناديق ETF، مما يبرز كيف تؤثر القنوات المالية التقليدية الآن على تقلبات سوق العملات الرقمية.

زادت الرياح المعاكسة الاقتصادية من وتيرة الانسحاب. الدولار الأمريكي الأقوى، التوترات الجيوسياسية، التصحيحات الحادة في الذهب والفضة، ضعف أسهم التكنولوجيا، وإشارات الاحتياطي الفيدرالي المتشددة كلها ساهمت في شعور أوسع بالمخاطر. في مثل هذا البيئة، أصبحت العملات الرقمية، كأصل مخاطرة، هدفًا رئيسيًا للتصفية وتدوير المحافظ.

سيولة التداول ضعيفة مقارنة بأوج 2025. الحجم المنخفض يعزز تقلبات السعر، مما يجعل التحركات تبدو أكثر عنفًا مما قد تكون عليه في سوق أعمق. كما أن المعنويات انقلبت بشكل حاد: مؤشر الخوف والجشع انخفض إلى مناطق الخوف الشديد (قراءات رقمية منخفضة)، مما يشير إلى أن معظم المتداولين إما يستسلمون أو يجلسون على الخطوط الجانبية.

بالنظر إلى المستقبل، هناك مساران رئيسيان للبيتكوين. في سيناريو التعافي الصاعد، قد يشير الاستقرار حول المستويات الحالية أو الارتداد فوق 70 ألف دولار–$71K إلى أن التعبئة البيعية قد انتهت، مما يهيئ قاعدة تصحيح صحية قبل الحركة الصاعدة التالية. بدلاً من ذلك، في سيناريو تصحيح أعمق، تشير مستويات الدعم المكسورة إلى 62 ألف دولار، 58-60 ألف دولار، وربما $54K إذا تسارع الذعر، يمتد شعور "شتاء العملات الرقمية" على المدى القصير.

المتداولون والمستثمرون يركزون على الحفاظ على رأس المال. يستخدم المتداولون على المدى القصير أوامر وقف محكمة، ورافعة منخفضة أو معدومة، وينتظرون إشارات انعكاس مدعومة بالحجم مثل ارتفاع القمم أو انخفاض القيعان. قد يختار حاملو المراكز طويلة الأمد التدرج في الشراء عند الانخفاضات، معتبرين ذلك تصحيحًا في منتصف الدورة وليس نهاية الدورة. الصبر والانضباط وإدارة المخاطر تظل الأدوات الأقوى في التنقل عبر هذا البيئة المتقلبة.