توقع سعر CC لعام 2025: تحليل الخبراء وتنبؤات السوق للسنة المقبلة

المقدمة: مكانة CC في السوق وقيمته الاستثمارية

تعد Canton Network (CC) الشبكة العامة الوحيدة والمفتوحة التي تم تصميمها خصيصًا للتمويل المؤسسي، حيث جمعت منذ تأسيسها بين الخصوصية والامتثال وقابلية التوسع بأسلوب فريد. حتى عام 2025، بلغ رأس المال السوقي لـ Canton Network نحو 2.57 مليار دولار، مع معروض متداول يقارب 36.16 مليار CC وسعر مستقر عند 0.07119 دولار. ويُنظر إلى هذا الأصل باعتباره "جسرًا بين رؤية البلوكشين والتمويل العالمي"، حيث يزداد دوره أهمية في تمكين المزامنة والتسوية الفورية والآمنة عبر فئات الأصول المتعددة في القطاع المالي المؤسسي.

يستعرض هذا المقال تحليلاً شاملاً لاتجاهات أسعار Canton Network من 2025 حتى 2030، مع مراعاة الأنماط التاريخية، والعرض والطلب، وتطور النظام البيئي، والعوامل الاقتصادية الكلية، لتزويد المستثمرين بتوقعات أسعار احترافية واستراتيجيات استثمار عملية.

I. مراجعة تاريخ أسعار CC والوضع الراهن للسوق

تطور أسعار CC التاريخي

- 2025: إطلاق Canton Network ووصول السعر إلى أعلى مستوى تاريخي عند 0.175 دولار في 10 نوفمبر

- 2025: تراجع السوق، وانخفاض السعر إلى أدنى مستوى تاريخي عند 0.05867 دولار في 6 ديسمبر

- 2025: فترة تقلبات، وتراوح السعر بين 0.05867 و0.175 دولار

الوضع الحالي لسوق CC

السعر الحالي لـ CC هو 0.07119 دولار، بانخفاض طفيف نسبته 0.18% خلال الـ24 ساعة الماضية. وبلغ حجم التداول في آخر 24 ساعة 1,714,476.03 دولار. شهدت CC تراجعات كبيرة في فترات زمنية مختلفة، حيث انخفضت بنسبة 7.47% في 7 أيام، و37.01% في 30 يومًا، و53.095% خلال عام. رأس المال السوقي الحالي يبلغ 2,573,917,962.13 دولار، مع معروض متداول يبلغ 36,155,611,211.20 رمز CC. تم تسجيل أعلى سعر تاريخي عند 0.175 دولار في 10 نوفمبر 2025، وأدنى سعر تاريخي عند 0.05867 دولار في 6 ديسمبر 2025. ويمثل السعر الحالي انخفاضًا بنسبة 59.31% عن أعلى مستوى تاريخي وارتفاعًا بنسبة 21.34% عن أدنى مستوى تاريخي.

اضغط للاطلاع على السعر الحالي لـ CC

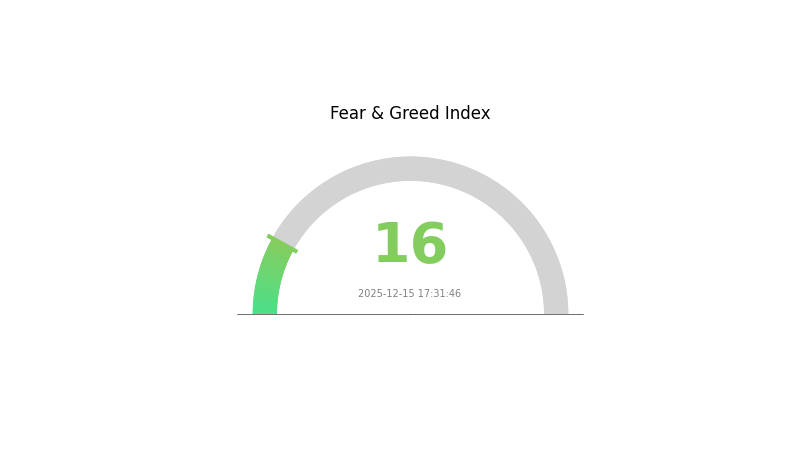

مؤشر مشاعر السوق لـ CC

مؤشر الخوف والطمع في 2025-12-15: 16 (خوف شديد)

اضغط للاطلاع على مؤشر الخوف والطمع الحالي

يسود الخوف الشديد في سوق العملات الرقمية، حيث هبط مؤشر الخوف والطمع إلى 16. ويشير ذلك إلى تشاؤم كبير لدى المستثمرين، ما قد ينشئ ظروف بيع مفرطة. تاريخيًا، غالبًا ما تسبق مستويات الخوف القصوى قيعان السوق، ما يتيح فرص شراء محتملة للمستثمرين المعاكسين للاتجاه. ومع ذلك، ينصح بتوخي الحذر نظرًا لاحتمال استمرار تقلب السوق. ينبغي للمتداولين على Gate.com تطبيق استراتيجيات لإدارة المخاطر مع متابعة مؤشرات تغير المشاعر السوقية.

توزيع حيازة CC

تشير بيانات توزيع العناوين الحائزة لـ CC إلى هيكل ملكية لامركزي بشكل نسبي، إذ لا يسيطر أي عنوان واحد على نسبة كبيرة من إجمالي المعروض، مما يقلل من مخاطر التلاعب في السوق من قبل جهات فردية كبيرة. يدعم هذا النمط من التوزيع مستوى صحيًا من اللامركزية، ويُعتبر عنصرًا إيجابيًا لاستقرار ومرونة نظام CC البيئي.

غياب الحيازات المركزة يقلل من احتمالية التقلبات المفاجئة بسبب تصرفات قلة من كبار الحائزين. ويساعد هذا التوزيع في اكتشاف السعر بشكل عضوي ويقلل من حدة التقلبات. ومع ذلك، من المهم الانتباه إلى أن توزيع الحيازات الحالي متوازن، إلا أن ديناميكيات السوق قد تتغير مع دخول أو خروج مشاركين جدد.

في المجمل، يعكس توزيع العناوين الحالي شبكة ناضجة وموزعة جيدًا لـ CC، ما يعزز الثقة لدى المستثمرين والمستخدمين، ويدعم مبادئ اللامركزية، ويمكن اعتباره مؤشرًا إيجابيًا لاستدامة نظام CC البيئي على المدى الطويل.

اضغط للاطلاع على توزيع حيازة CC الحالي

| الأعلى | العنوان | كمية الحيازة | نسبة الحيازة (%) |

|---|

II. العوامل الأساسية المؤثرة على سعر CC المستقبلي

آلية العرض

- السك التدريجي: إصدار رموز CC الجديدة تدريجيًا قد يسبب ضغطًا تضخميًا على السعر.

- التأثير الحالي: باعتبارها رمزًا مدرجًا حديثًا، قد تواجه CC سيولة محدودة، مما يؤدي إلى مخاطر تقلبات سعرية مرتفعة.

ديناميكيات المؤسسات والحيتان

- حيازات المؤسسات: مؤشر Coinbase Bitcoin Premium ظل إيجابيًا لستة أيام متتالية، مما يدل على شراء قوي من مؤسسات أو صناديق متوافقة في السوق الأمريكية.

البيئة الاقتصادية الكلية

- تأثير السياسة النقدية: تزداد توقعات السوق بخفض أسعار الفائدة، مما قد يفيد أصول العملات الرقمية.

- خصائص التحوط ضد التضخم: الترابط بين اتجاهات أسعار CC والمؤشرات التضخمية قد يؤثر في اعتبارها أداة تحوط ضد التضخم.

التطوير التقني وبناء النظام البيئي

- تحليل مشاعر السوق: معدل الصفقات الطويلة مقابل القصيرة يعد مؤشرًا أساسيًا لقياس مشاعر السوق لـ CC، ويظهر ارتباطًا إيجابيًا ملحوظًا مع حركة السعر.

- مؤشرات سوق المشتقات: العقود الآجلة المفتوحة ومعدلات التمويل مؤشرات هامة لتحركات أسعار CC، حيث يعكس إجمالي العقود المفتوحة نشاط السوق ويساعد في رصد إشارات القوة وانعكاس الاتجاه.

III. توقعات سعر CC للفترة 2025-2030

توقعات 2025

- توقع محافظ: 0.05196 - 0.07118 دولار

- توقع محايد: 0.07118 - 0.07545 دولار

- توقع متفائل: 0.07545 - 0.08000 دولار (يشترط تحسن مشاعر السوق وزيادة التبني)

توقعات 2027-2028

- المرحلة السوقية المتوقعة: نمو محتمل مع زيادة التقلب

- توقعات نطاق السعر:

- 2027: 0.05362 - 0.08937 دولار

- 2028: 0.05681 - 0.10526 دولار

- العوامل المحفزة الرئيسية: التقدم التقني، توسع القبول السوقي، واحتمالية وضوح تنظيمي أفضل

توقعات 2030 طويلة الأجل

- السيناريو الأساسي: 0.08908 - 0.10998 دولار (مع افتراض نمو السوق المستقر)

- سيناريو متفائل: 0.10998 - 0.12758 دولار (مع أداء قوي وزيادة الاستخدام)

- سيناريو تحويلي: 0.12758 - 0.15000 دولار (مع تطبيقات رائدة وتبني واسع النطاق)

- 2030-12-31: CC بسعر 0.12758 دولار (ذروة محتملة وفق التوقعات المتفائلة)

| السنة | أعلى سعر متوقع | متوسط السعر المتوقع | أدنى سعر متوقع | نسبة التغير |

|---|---|---|---|---|

| 2025 | 0.07545 | 0.07118 | 0.05196 | 0 |

| 2026 | 0.08211 | 0.07332 | 0.06892 | 2 |

| 2027 | 0.08937 | 0.07771 | 0.05362 | 9 |

| 2028 | 0.10526 | 0.08354 | 0.05681 | 17 |

| 2029 | 0.12556 | 0.0944 | 0.05853 | 32 |

| 2030 | 0.12758 | 0.10998 | 0.08908 | 54 |

IV. استراتيجيات الاستثمار المهنية وإدارة المخاطر لـ CC

منهجية الاستثمار في CC

(1) استراتيجية الاحتفاظ طويل الأجل

- مناسبة للمستثمرين المؤسسيين والأفراد ذوي تحمل المخاطرة العالي

- اقتراحات عملية:

- تجميع CC خلال انخفاضات السوق

- تحديد نقاط مراجعة دورية لإعادة تقييم فرضية الاستثمار

- تخزين الرموز في حلول تخزين باردة آمنة

(2) استراتيجية التداول النشط

- أدوات التحليل الفني:

- المتوسطات المتحركة: لتحديد الاتجاهات ونقاط الانعكاس المحتملة

- مؤشر القوة النسبية (RSI): لمراقبة حالات الإفراط في الشراء أو البيع

- نقاط أساسية لتداول السوينغ:

- متابعة تبني المؤسسات والإعلانات عن الشراكات

- مراقبة مشاعر السوق تجاه حلول البلوكشين المؤسسية

إطار إدارة المخاطر لـ CC

(1) مبادئ تخصيص الأصول

- المستثمرون المحافظون: 1-3% من محفظة العملات الرقمية

- المستثمرون النشطون: 5-10% من محفظة العملات الرقمية

- المستثمرون المحترفون: 10-15% من محفظة العملات الرقمية

(2) حلول التحوط من المخاطر

- تنويع: توزيع الاستثمارات على مشاريع بلوكشين مؤسسية مختلفة

- أوامر وقف الخسارة: تطبيقها للحد من الخسائر المحتملة

(3) حلول التخزين الآمن

- توصية بمحفظة أجهزة: Gate Web3 Wallet

- حل التخزين البارد: استخدام جهاز كمبيوتر منفصل عن الإنترنت للحيازات الكبيرة

- احتياطات أمنية: تفعيل المصادقة الثنائية، واستخدام كلمات مرور قوية، وتحديث البرمجيات بشكل منتظم

V. المخاطر والتحديات المحتملة لـ CC

مخاطر سوق CC

- التقلبات: تغيرات الأسعار الناتجة عن مشاعر السوق ومعدل التبني

- المنافسة: ظهور حلول بلوكشين مؤسسية منافسة

- السيولة: تحديات محتملة في التداول بكميات كبيرة

المخاطر التنظيمية لـ CC

- تغيرات الامتثال: تطور اللوائح في مختلف الولايات القضائية

- عوائق تبني المؤسسات: تحديات تنظيمية أمام المؤسسات المالية

- المعاملات العابرة للحدود: اختلاف الأطر القانونية بين البلدان

المخاطر التقنية لـ CC

- مشكلات قابلية التوسع: قيود محتملة في معالجة أحجام معاملات مرتفعة

- الثغرات الأمنية: نقاط ضعف غير متوقعة في بروتوكول البلوكشين

- تحديات التوافق التشغيلي: صعوبة الدمج مع الأنظمة المالية القائمة

VI. الخلاصة والتوصيات العملية

تقييم قيمة الاستثمار في CC

تطرح Canton Network (CC) قيمة فريدة كحل بلوكشين مخصص للتمويل المؤسسي. وبينما تحمل إمكانيات طويلة الأجل لتطوير البنية التحتية المالية، تبرز مخاطر قصيرة الأمد مثل تقلبات السوق وعدم وضوح التنظيمات.

توصيات الاستثمار في CC

✅ للمبتدئين: ابدأ بمراكز صغيرة وطويلة الأجل بعد دراسة مستفيضة

✅ للمستثمرين ذوي الخبرة: اعتمد استراتيجية متوسط تكلفة الشراء مع مراجعة دورية للمحفظة

✅ للمؤسسات: استكشف الشراكات الاستراتيجية وبرامج الاختبار مع Canton Network

طرق المشاركة في تداول CC

- التداول الفوري: شراء CC عبر Gate.com

- تداول OTC: للصفقات الكبيرة، التواصل مع مكتب OTC في Gate.com

- الاستيكينغ: المشاركة في التحقق من الشبكة عند توفره للحصول على مكافآت إضافية

ينطوي الاستثمار في العملات الرقمية على مخاطر عالية جدًا، ولا يُعد هذا المقال نصيحة استثمارية. يجب على المستثمرين اتخاذ القرارات بحذر وفقًا لتحملهم للمخاطر، وينصح بمراجعة مستشارين ماليين محترفين. لا تستثمر أبدًا أكثر مما يمكنك تحمل خسارته.

الأسئلة الشائعة

هل سهم CC خيار جيد للشراء؟

نعم، سهم CC يُعتبر خيارًا جيدًا للشراء. غالبية المحللين إيجابيون، حيث يوصي 40% منهم بالشراء القوي، والإجماع العام يميل نحو الشراء.

هل سيصل سهم Costco إلى 1000 دولار؟

نعم، من المتوقع أن يصل سهم Costco إلى 1000 دولار في عام 2026. يشعر المحللون بالتفاؤل، حيث أن 60% منهم لديهم توجهات إيجابية تجاه السهم.

كم ستكون قيمة سهم Coca-Cola خلال 5 سنوات؟

وفقًا للاتجاهات الحالية، قد يصل سهم Coca-Cola إلى حوالي 90 دولارًا خلال 5 سنوات، بافتراض نمو سنوي بنسبة 5% من سعره الحالي 71 دولارًا.

ما هو توقع سهم Caterpillar لعام 2025؟

من المتوقع أن يتراوح سعر سهم Caterpillar بين 598.70 و630.29 دولارًا في عام 2025، بناءً على تحليلات السوق والاتجاهات الحالية.

XZXX: دليل شامل لعملة BRC-20 الميمية في 2025

مؤشر الخوف والطمع في بيتكوين: تحليل مشاعر السوق لعام 2025

أفضل صناديق الاستثمار المتداولة للعملات الرقمية لمراقبتها في عام 2025: التنقل في زيادة الأصول الرقمية

5 طرق للحصول على بيتكوين مجانًا في عام 2025: دليل المبتدئين

القيمة السوقية للبيتكوين في عام 2025: تحليل واتجاهات للمستثمرين

توقعات سعر بيتكوين لعام 2025: تأثير رسوم ترامب على بيتكوين

أفضل 10 عملات رقمية واعدة تستحق النظر للاستثمار في عام 2024

أفضل خيارات المحافظ لـ Avalanche AVAX: الدليل الكامل

فهم KYC: التحقق الضروري لمنصات العملات الرقمية في الهند

العملات الرقمية في أمريكا اللاتينية: الاتجاهات وفرص التبني

تحول Worldcoin إلى World: استكشف سلسلة Worldchain Layer 2 ومشروع بقيمة مليار دولار!